How can I settle or waive employment claims?

There are only two ways to settle statutory employment claims. The first is to use a qualifying Settlement agreement. The other method involves a conciliation agreement (COT3 agreement).

What are settlement agreements?

A settlement agreement (previously called a ‘compromise agreement’) is a legally binding contract between an employer and an employee which settles potential employment claims. In exchange for a settlement payment, the employee agrees to waive their right to bring specific claims against the employer in an employment tribunal. A lawyer must be involved in the process, providing legal advice to the employee.

What is a COT3 agreement?

A COT3 or conciliation agreement is another legally binding agreement to settle employment claims. It can only be used when the conciliation service Acas is involved in a dispute. This usually happens during the ‘early conciliation’ process before a tribunal claim is formally lodged.

The key difference is that because an impartial Acas conciliator helps broker the agreement, the employee does not need separate independent legal advice for a COT3 to be valid.

For more information, read Conciliation.

When do I use a settlement agreement?

Settlement agreements are flexible and can be used in various situations where an employment relationship is ending, whether or not a formal legal claim has been started. They can be used whenever an employer and employee wish to resolve known potential statutory claims without litigation. Common scenarios include:

-

to manage an employee’s exit by mutual consent

-

as part of a redundancy process

-

to resolve an ongoing disciplinary or performance issue

-

to settle a specific workplace dispute or grievance

For situations where the employment is not ending, you should Ask a lawyer for advice.

How can I get the employee to sign a settlement agreement?

The employer will typically make a payment in return for the employee’s waiver of claims, reflecting the likely value of those claims and the likelihood of their success.

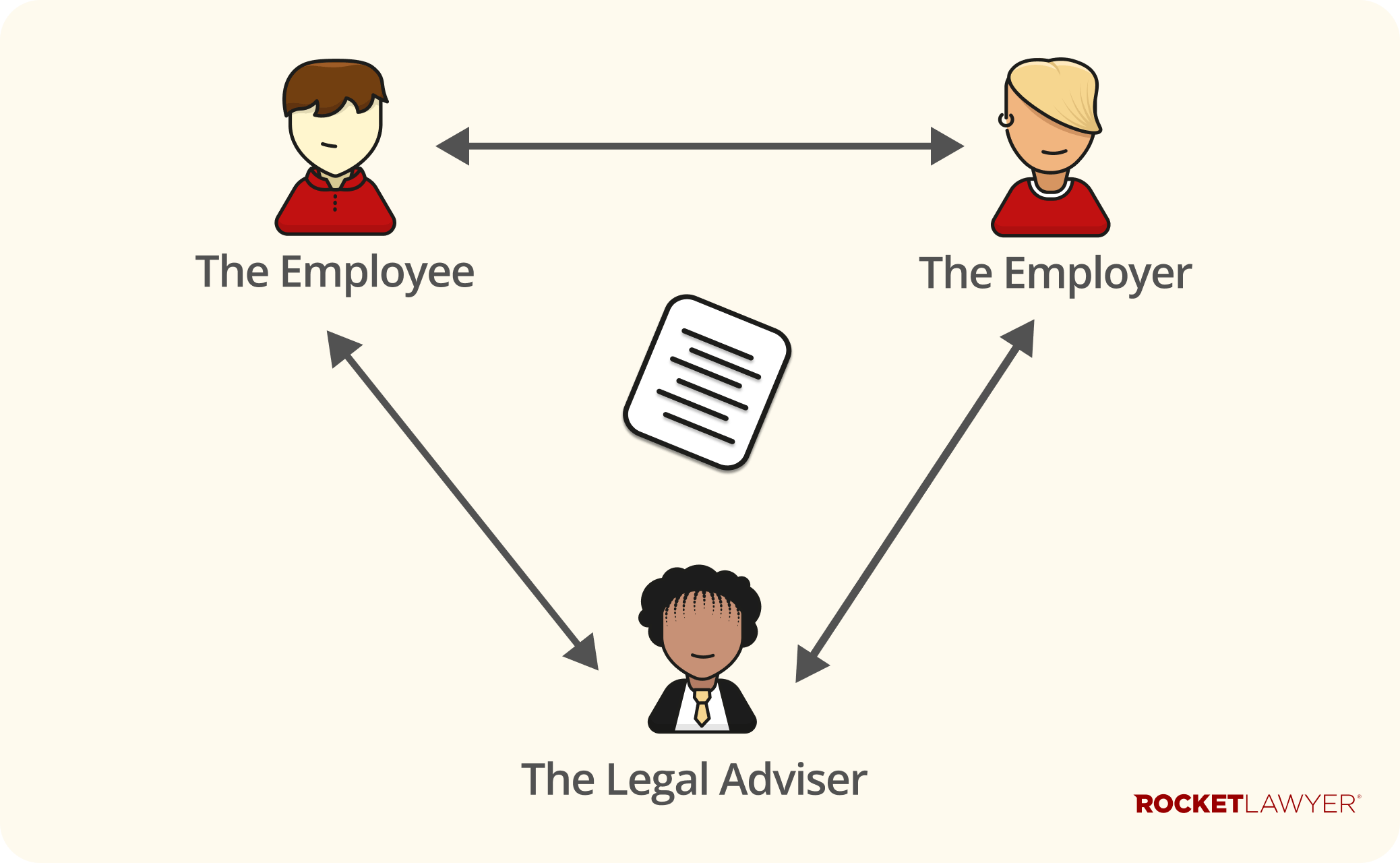

Settlement agreements are normally concluded after negotiation between the parties. Since the employee must receive independent legal advice before signing the agreement, the employer will normally also instruct a lawyer or HR expert in connection with the overall settlement process, ensuring that the parties are on an equal footing. Where an employee is seeking independent legal advice on a settlement agreement, they can submit their details to our Settlement agreement service.

Be very careful when talking to employees about settlement agreements or departure, as you risk constructive dismissal.

Never threaten to dismiss an employee if they don’t agree to leave. Raising the prospect of a departure 'out of the blue' (ie where there is no previous dispute, grievance, claim or formal disciplinary/performance procedure ongoing) or where the suggestion of departure might be said to be discrimination is particularly tricky. We recommend in this case that you Ask a lawyer.

The 'without prejudice' conversation

Approaching an employee about a settlement agreement is a sensitive process. These discussions are typically held on a ‘without prejudice’ basis.

This means that if you cannot reach an agreement and the employee later brings a tribunal claim, your settlement offer cannot be used as evidence against you. To ensure this protection applies, you should:

-

clearly state both in writing (eg in an email subject line) and verbally that the conversation is 'without prejudice and subject to contract'

-

keep settlement communications that are to be without prejudice separate from those that aren’t. For example, a Dismissal letter should be made separately from a without prejudice communication about a settlement. If this is not possible, the two types of communication can be combined within one communication, but they should ideally be distinct within it, and the employer should be aware that this method is more prone to complications.

-

never threaten to dismiss an employee if they do not sign the agreement, as this could lead to a claim for constructive dismissal

What are the legal rules on settlement agreements?

It is essential that the settlement agreement records all the specific relevant claims or complaints that the employee is waiving (eg specific claims relating to unfair dismissal or sex discrimination). Settlement agreements often state that they waive every employment claim that exists at law, but without specifics. This is unlikely to be valid.

Further, a settlement agreement:

-

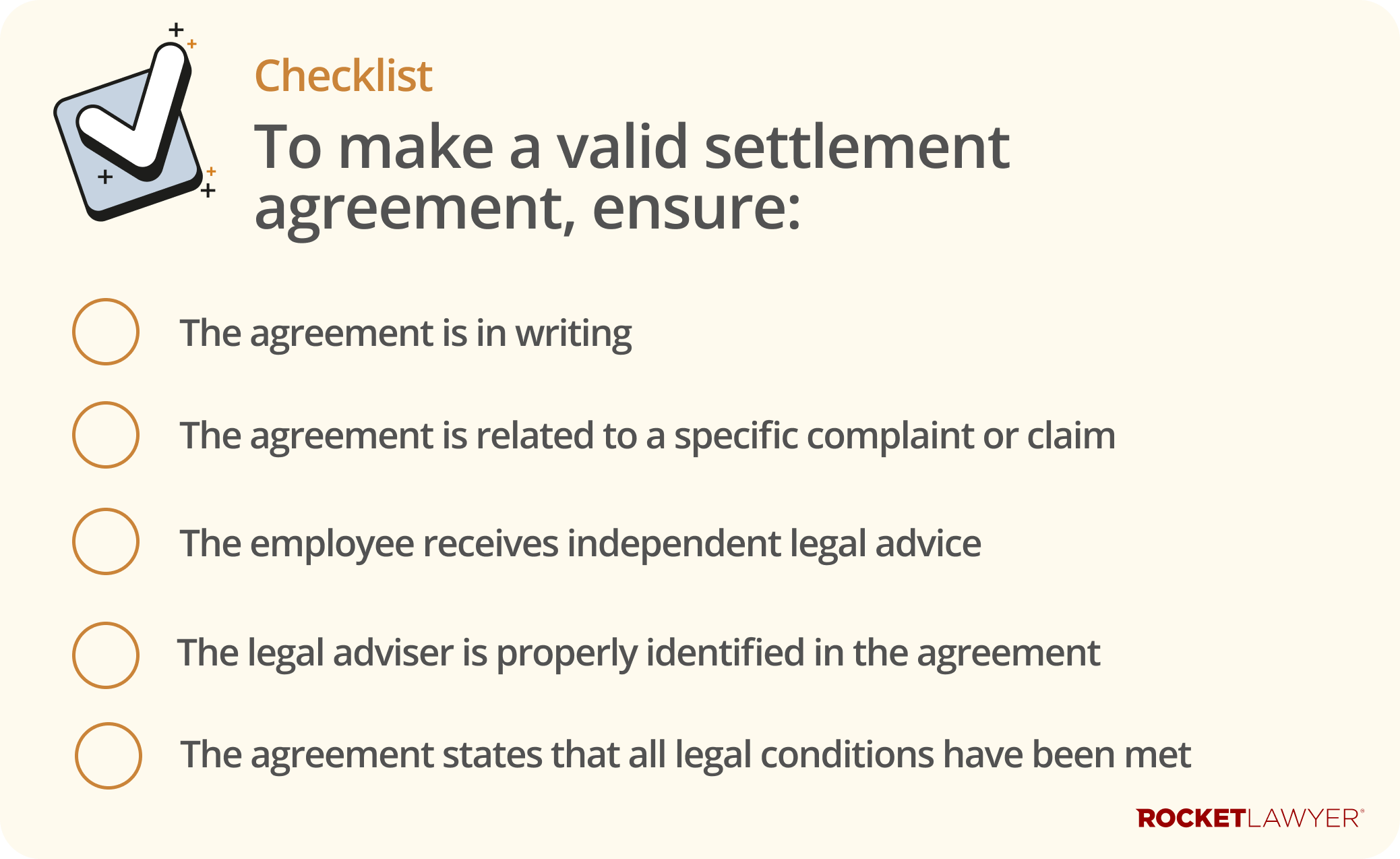

must be in writing

-

can only be executed after the employee has received independent legal advice on the terms and effect of the agreement. Such advice is offered as part of our Settlement agreement service

-

must have the legal adviser clearly identified in the agreement

-

states that the conditions regulating settlement agreements have been satisfied

Note that some claims just cannot be legally waived (eg failure to inform and consult under TUPE (Transfer of Undertakings (Protection of Employment)).

Remember that settlement agreements cannot be used to bypass standard procedures. For example, you cannot offer a settlement agreement to an employee on long-term sick leave without first considering reasonable adjustments (ie a period of long-term sickness is a strong indicator that an employee may be disabled). Proceeding directly with an offer to terminate a contract alongside a settlement agreement could provide evidence of an employer's failure to consider and make those adjustments.

Can settlement agreements settle future claims?

Settlement agreements should be used with extreme caution to settle claims that have not yet become known. For example, even if an agreement specifically states that sex discrimination claims are settled, a sex discrimination claim that arises later (ie the actions or discussions that give rise to the complaint have not occurred at the time the settlement agreement is made) will not be settled under the agreement, and the employee may later pursue this claim.

This type of ‘future claim’, described above, is different from situations where the cause of a claim is known (eg if the relevant discrimination has already occurred but the employee has not yet pursued any legal action), such claims can be covered by a settlement agreement.

The law dictating whether future claims can be settled is not crystal clear. A 2022 Employment Appeal Tribunal (EAT) case suggested that future claims that have not yet become known cannot be settled using a settlement agreement. However, the EAT’s position has since been overturned by the more powerful Scottish Court of Session, where it was suggested that future claims that have not yet become known may be settled, so long as the type of claim is specifically identified and the agreement expresses an explicit intent to settle such future claims. A 2024 EAT case in England took a similar approach. However, it’s possible that either of these cases will be appealed (ie further changes to the law may occur) and that other sitting EATs may take various, nuanced views on whether future claims can be settled. As the issue is not yet definitively resolved, it’s best to be cautious when making a settlement agreement that covers future claims, and to avoid doing so if possible. Consider Asking a lawyer for advice before making such a settlement agreement.

What else should I think about?

Including an agreed form of reference in the agreement can avoid future disputes, but you must not mislead the reference recipient.

Make sure that any agreements that need to stay in force are preserved as valid in the settlement agreement (for example, agreements governing share option rights, pensions, or other benefits).

The rules on taxation of termination payments are also tricky. Make sure that you deal with the payments correctly and in accordance with HMRC guidance.

A settlement agreement provides a formal and legally secure way to end an employment relationship, offering certainty for both you and your employee. However, the legal requirements are strict and must be followed precisely for the agreement to be valid.

If in doubt about any of these issues, Ask a lawyer.