Why make a will?

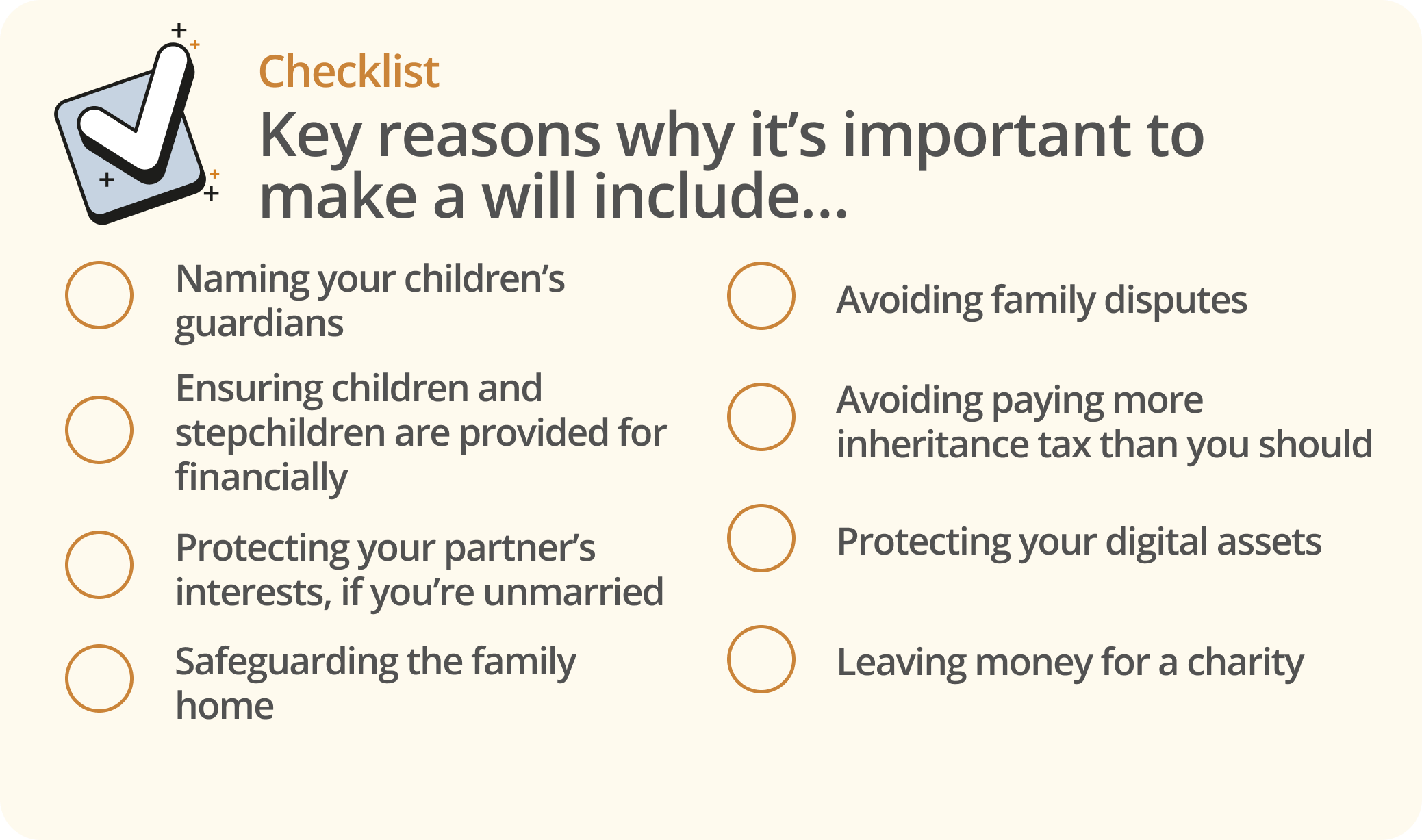

There are many important reasons to make a will that might apply at various stages of your life.

I’m married, so why do I need to make a will?

You might think that when you die and you are married or in a civil partnership, your surviving spouse or civil partner will automatically receive all of your estate. However, this is not the case.

If you die without leaving a will there are legal rules, called the intestacy rules, that formulaically dictate which members of your family will receive your estate (ie the money and other assets you own at the time of your death). For more information, read Intestacy rules and Intestacy rules in Scotland.

What happens if I have a partner but I am not married or in a civil partnership?

In England and Wales

If you do not have a will on your death, your partner will not be automatically entitled to anything under the intestacy rules.

Even if you have joint bank accounts with your partner, or you jointly own your home, any jointly held property will not necessarily pass to your surviving partner. Whether it does or not depends on how you own these assets.

If you don’t have a will that makes your intentions clear, your partner may not be entitled to any jointly owned property or money in a joint bank account, even if this is what you intended.

Failing to make a will can also have unintended tax consequences. So it makes good sense to always make a will.

In Scotland

If you do not have a will on your death, your partner will not be automatically entitled to anything under the intestacy rules, even if, for example, you co-owned your home.

However, a surviving cohabitant can ask the courts for a share of the deceased’s estate under the Family Law (Scotland) Act 2006. The court, in deciding whether to give a share of the estate to a former cohabitant, will take into account the couple’s relationship. In deciding whether to grant a former cohabitant a portion of the estate the courts will, for example, consider:

-

how long the couple cohabited for

-

the nature of their relationship (eg whether it was similar to a marriage or civil partnership)

-

the type of arrangement the couple made regarding money (eg whether they had a joint bank account and whether they supported each other financially)

As in England and Wales, failing to make a will can also have unintended tax consequences.

For more information on cohabitation laws in the UK, read Cohabitation.

Do I need to review my will?

You need to review your will regularly and amend it to reflect changes in your life, such as:

-

changes in your financial circumstances

-

the birth of a child, which brings new responsibilities and changes in your partner’s circumstances

-

entering a marriage or civil partnership

-

the death of a beneficiary (ie someone who was to inherit something under the will)

-

changes to tax legislation (ie income tax)

Trying to apply an old will to new circumstances can have harmful results, so it makes sense to evaluate your estate and review your decisions from time to time.

If you know something major is going to happen in your life (eg if you are getting married or entering into a civil partnership, or getting divorced or separated), it is advisable to review your will in contemplation of the new circumstances.

If you wish to make one or a few minor amendments to your will without making a new will, you can add a Codicil. For more information, read our guide on Codicils.

Making a will while you have mental capacity

Someone who wishes to make a will must have the requisite mental capacity and understanding to make a valid will. Therefore, it’s important that you make a will if you think that, for any reason, you may soon lose capacity to do so.

People are presumed to have mental capacity unless proven otherwise. Generally, someone will be considered to lack capacity to make a specific decision at a specific point in time if they cannot:

-

understand information relevant to that decision

-

retain and remember the information

-

use (eg evaluate) the information as part of the decision-making process, and

-

communicate their decision in any way

When someone lacks mental capacity, a statutory will can be made on their behalf through an application to the Court of Protection.

For more information on the Mental Capacity Act 2005 and establishing who has capacity to make decisions (like changing a will), read Mental capacity and medical consent.