What types of interests can you have in property?

Real property (eg land and buildings) in England and Wales can be owned in different ways – ie there are multiple types of ‘interest’ a person can have in a property. Property can be owned either by:

-

legal ownership – representing a legal interest in the property, and

-

beneficial ownership – representing a beneficial interest in the property

The legal owner of a property is the person who owns the legal title of the land. The beneficial owner is the person who is entitled to the benefits of the property. A property can have one or more of each type of owner. One individual can be both a legal and a beneficial owner of a property or only one of these.

Which types of interests different parties have in a property help determine how the property can be sold or given in a Will, and has implications for who is entitled to any income earnt by the property (eg rental income).

What is a legal interest in a property?

A legal interest in a property refers to the right to possess or use property. It belongs to a legal owner, ie a person who is named as the property’s owner on the title register at the Land Registry and/or on the property’s title deeds). A legal interest gives the holder a right of control over the property, which means they have the power to sell or transfer (eg gift) the property.

What is the beneficial interest in a property?

A beneficial interest (or ‘equitable interest’) belongs to a beneficial owner (or ‘real owner). It is an interest in (ie entitlement to) the economic benefit of a property. For example, a beneficial owner of a property has rights to:

-

use the property (eg to live in)

-

a share of any rental income

-

a share of the proceeds of sale if the property is sold

A beneficial owner is entitled to the financial value of a property regardless of who the land’s legal owners are (eg regardless of who is listed as the owner on title entries at the Land Registry).

How do legal and beneficial ownership relate to each other?

If somebody has a beneficial interest in a property, the property’s legal owner(s) will hold that property ‘on trust’ for the beneficial owner. This means that they hold and must manage the property for the benefit of the beneficial owner.

This applies whether the legal and beneficial owners are the same or different people. For example, legal ownership and beneficial ownership will be separated when two people decide to manage property through a trust. The legal owner – whose name is registered at the Land Registry – holds the property 'on trust' for the benefit of the beneficial owner. We say that the legal owner is the 'bare trustee', whereas the beneficial owner is the 'beneficiary'.

What's the advantage of differentiating legal ownership and beneficial ownership?

This complexity regarding property ownership can be useful for property owners. For example:

When the property is held jointly

If multiple people purchase property together (eg a house), they will always own the legal interest as ‘joint tenants’. This means that they will always own the legal interest jointly (ie all together) and equally. All legal owners will be registered as such at the Land Registry. In England and Wales, a property can only have a maximum of four legal owners.

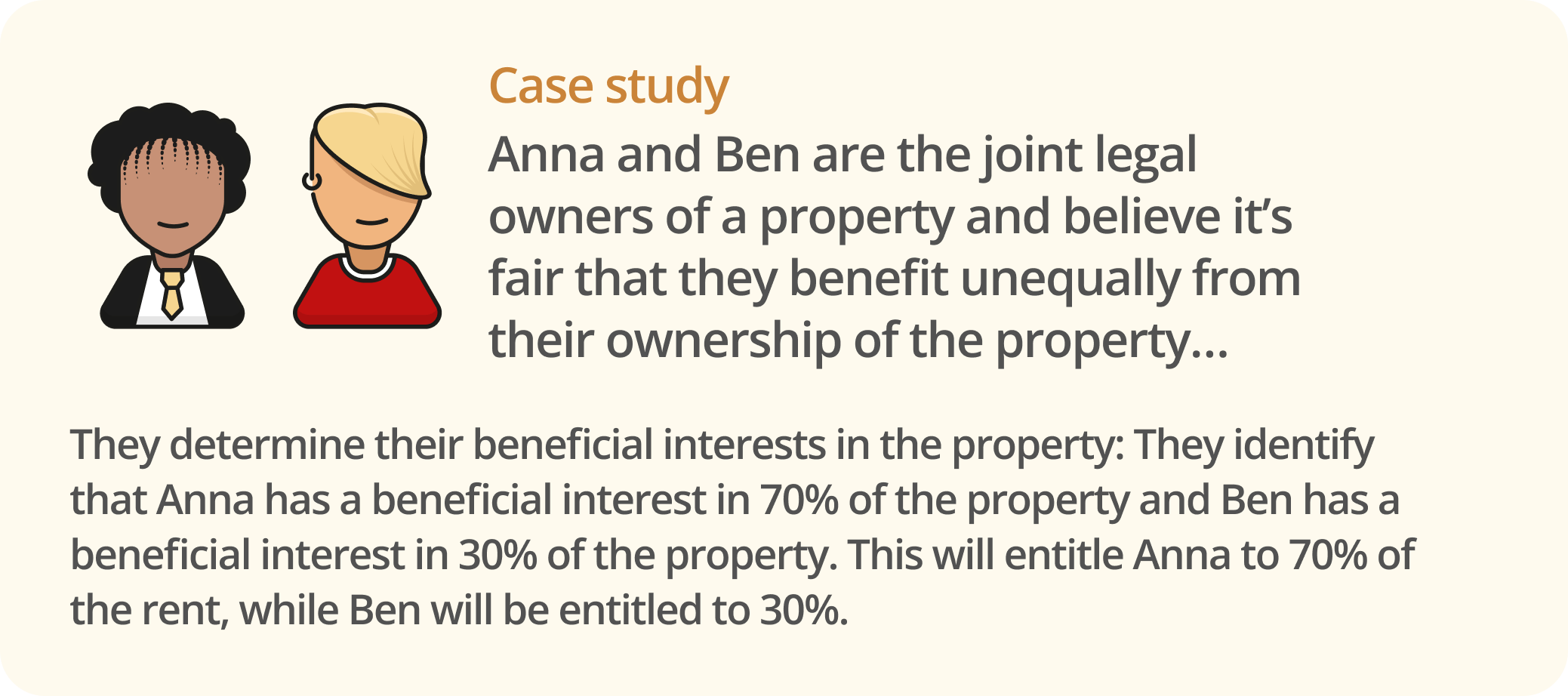

The beneficial interest can be held as joint tenants or as ‘tenants in common’. Tenants in common hold property in distinct shares, which can be equal or unequal.

Note that the use of the word ‘tenant’ here has nothing to do with tenancy agreements or leases. Joint tenants and tenants in common can be the owners of a freehold property (ie when there is no tenancy/lease).

Having beneficial ownership of a property that’s different to its legal ownership is often useful because beneficial owners can own the property in different proportions. If, for example, the owners want one of two partners to be entitled to a higher share of rental income, that owner could be given a larger beneficial interest in the property to make this happen.

Allocating beneficial interests in this way can provide tax efficiencies, as taxation of income is generally based on beneficial ownership rather than legal ownership. For example, transferring beneficial ownership to a partner who falls within a lower tax bracket can allow a larger share of a couple’s rental income to be assigned to that partner, and their overall tax liabilities can be minimised. For more information, read Buy to let tax implications.

Ask a lawyer if you have any questions regarding beneficial interest splits and how to set up different beneficial interests.

When there is only one legal owner

A sole legal owner of a property may want their partner or a family member (eg a spouse, civil partner, or cohabitee) to have a share in the benefits of the property even though they have no legal interest in it. Giving a beneficial interest to a partner who is not a legal owner enables that partner to receive a share of the financial value of the property, such as rental income or sale proceeds.

How can beneficial interests be established or changed?

The legal and beneficial ownership of property can be separated and set out using a Declaration of trust.

A declaration of trust is a formal legal document that confirms who holds beneficial ownership of a property and sets out the respective beneficial interests of each beneficial owner.

For more information, read Declarations of trust for property.

How do you find out who the legal owner of a property is?

For properties that are registered (this includes most properties), the legal owners are identified on the property’s title register at the Land Registry (for England and Wales) or the Registers of Scotland. You can search for a property online and, for a fee, download a copy of its title register.

Can you have legal and beneficial interests in Scotland?

In Scotland, property is generally held in outright ownership (often referred to as ‘heritable title’). Heritable title is similar to the concept of freehold titles in England and Wales. The laws of Scotland do not normally recognise the concept of separate beneficial ownership (or interests) of such heritable titles. For more information, read Property ownership in Scotland.