Who do I need to employ?

As a new business, in order to decide what type of employees you need to hire you should consider the overall goals of the business and the specific activities which need to happen to reach those goals.

Figuring these things out will help you to determine the level of knowledge and skills you need from your future hires. You should also consider the skill set of the founders and what they can take on, which will help you realise where help is needed.

Examine the depth of knowledge required to achieve business goals and the length of time they can be achieved in. It may be that a marketing graduate can handle your immediate marketing needs part-time, or you require a more in-depth marketing strategy and need the proficiency of a senior marketing manager. You may need the expertise of someone for a specific project, in which case a contractor or consultant may be more appropriate.

How do I hire someone?

Recruiting your new employee is the first step in the hiring process. The most important legal issue when recruiting is to avoid unlawful discrimination. Take care when writing the job specification and during the hiring process.

There are some practical steps to think about when making your first hire. These include appointing a payroll provider, purchasing employer’s liability insurance, making tax arrangements, preparing employment policies and conducting a health and safety assessment. You should also consider pay and benefits such as employee pensions, holiday entitlement and salaries.

For more information, read Hiring and Recruitment and follow our Checklist for new employers.

Types of employees and workers

The three main types of employment status are:

-

workers (usually agency workers or some freelancers)

-

self-employed (contractors or consultants)

-

employees

For more information, see below and read Consultants, workers and employees.

Employees

Most people are employed as employees and work under a contract of employment. Employees generally have more employment rights than workers and the self-employed. Employers deduct tax and national insurance contributions directly from employees’ salaries.

Employees can usually be divided into levels of seniority.

Executive directors

The most senior employees will normally be executive directors. An executive director holds the statutory office of director but is also an employee of the company. They have day-to-day responsibility for running the business and often are in charge of an area (eg finance) and can sit on the board of directors, who answer to the company's shareholders. A managing director is sometimes appointed to lead the implementation of the Board’s strategy. Executive directors are appointed using a type of employment contract that covers their employment status, office as director and the relationship between these. You can use a Senior employment contract to appoint an executive company director.

Senior employees

Senior employees will usually be departmental heads (eg 'Head of operations'). Sometimes departmental heads are also called directors (eg ‘Director of Sales’), even though they do not hold a position on the board. Senior personnel will have access to confidential business information and therefore you should consider using a Senior employment contract when hiring them. This should include clauses on garden leave and post-employment restrictions, which can help to protect your business secrets, and prevent employees from working for your competitors for a certain period of time once they leave the company.

Regular employees

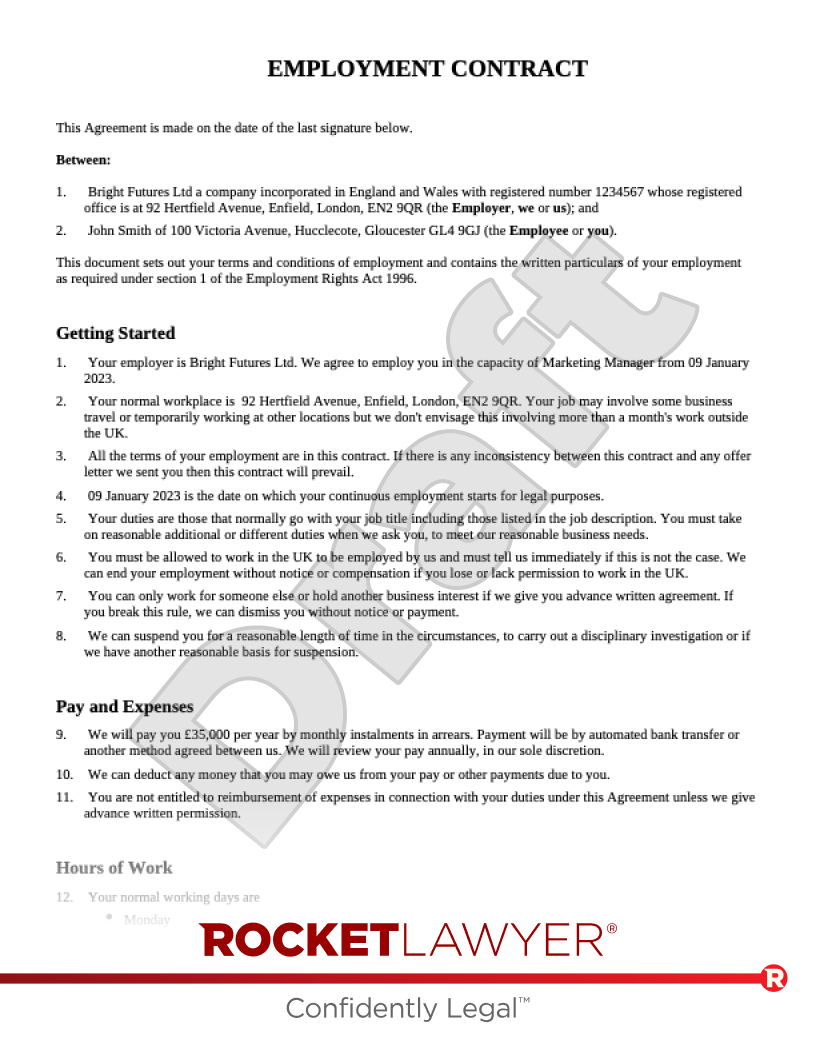

Regular employees should sign a written employment statement - normally in the form of a standard Employment contract to formalise the employment relationship. Putting the employee-employer relationship into a contract makes the employee obligations clear and avoids any potential disputes. For more guidance on employment contracts, read Employment documents.

Non-executive directors

Non-executive directors are independent advisors to the company, which may specialise in a specific area. A non-executive director is required to attend board meetings to provide advice to the executive directors. Non-executive directors can be appointed using a Letter of appointment, which is similar to a consultancy agreement. However, for tax purposes, individual non-executive directors are treated as employees by HMRC. This is because the role is a statutory appointment at Companies House as a director, and hence the post is an ‘office’. HMRC views an individual ‘office holder’ as an ‘employee’. For more information, read Different types of company director.

Workers

Workers are individuals who, while not working under a contract of employment, do generally work under some type of contract or fixed working arrangement. While workers are entitled to many of the core employment law rights, such as minimum wage and holiday pay, they are not entitled to other employment law rights, such as unfair dismissal protection and minimum notice periods.

If you wish to hire a casual worker, you may consider using a Zero hours contract. This is a casual agreement between a business and an individual, generally where the individual works for the business, but the business does not guarantee any set hours or future work. For more information, read Zero-hours contracts and zero-hours workers.

Self-employed individuals

People who are self-employed are often referred to as consultants, contractors or freelancers. These terms are generally interchangeable, although a consultant is ostensibly selling their advice as opposed to a contractor who will normally carry out the actual (often physical) work. Self-employed workers are generally not covered by employment law and are not paid through Pay As You Earn (PAYE). Instead, they are sole traders or run their own businesses and they need to arrange their own tax affairs.

It may be that you only need someone for a period of time for a specific project, in which case you can hire them for a period of time using a Consultancy agreement. Read Using consultants for more information.

Ask a lawyer if you have any questions about hiring for your startup.