Initial considerations

If you are setting up a business or looking to expand to larger premises, you will need to find the best property available to suit your needs. Before approaching a commercial agent you will need to decide:

-

how much space you need

-

what the use of the property will be

-

your financial position

Once you have answered these questions, you will be able to decide whether or not you want to purchase or lease a property.

Lease of a property

Once you have decided to rent a property, you will need to sign the appropriate agreement. A lease of part, a lease of whole, an agreement to share space and a sublease are all ways in which the property can be rented.

Some lettings will be needed on a short-term basis whilst others will be required for a longer, more permanent time.

There are various advantages of renting such as flexibility. The term of a lease can vary between 2 and 25 years but usually runs between 3 and 5 years. Scottish commercial leases can run for up to 175 years, however, the average lease lasts between 5 and 15 years.

A short lease with options to renew may be more suitable than a longer lease with break clauses. Upfront costs for a lease can be relatively low compared to purchasing a property. Under a short-term lease, you will usually only be responsible for the interior with the landlord remaining responsible for the exterior of the property. However, in Scotland, a landlord can contract out of their obligations regarding the outside of the property. Furthermore, you will be able to negotiate with the landlord over any aspect of the lease; the Code for Leasing Business Premises aims to provide fairness between a landlord and tenant in negotiating the terms of a lease. Note that a short-term let licence may be needed for certain types of short commercial lease in Scotland.

Heads of terms

Once the basic terms of the letting have been negotiated, the landlord or the landlord’s agent will draw up the heads of terms. The heads of terms are the main details of the proposed letting arrangement. They form the framework of the documentation.

Proposed use of the property

Don’t always assume that because a landlord is granting a lease for office use this use is authorised. Ask for a copy of the planning permission to check that the proposed use is permitted.

Check whether there are any restrictions on the use of the property (eg for loading and unloading) which may be vital for operating your business.

For retail leases in Scotland, you may also be restricted in relation to opening hours, business signage and other aspects because of the location of the premises.

Condition of the property

You may need to carry out a survey if you are taking a lease of the whole property and are responsible for the interior and exterior of the building, in order to highlight any defects or areas of disrepair. When the lease comes to an end, it will be your responsibility to make good any defects and leave the property in good repair and condition.

If the property is in a poor state of repair, you may want to consider agreeing on a schedule of condition with the landlord. This limits your obligations to repair the property to the standard contained in the schedule.

In Scotland, leases will often include a provision that on signing you have accepted that the premises are in good condition and fit for purpose. You will then be responsible for repairs, maintenance and decoration of the premises. Under Scottish common law, the landlord must keep the property wind and watertight.

For more information, read Commercial property repair obligations.

Costs involved

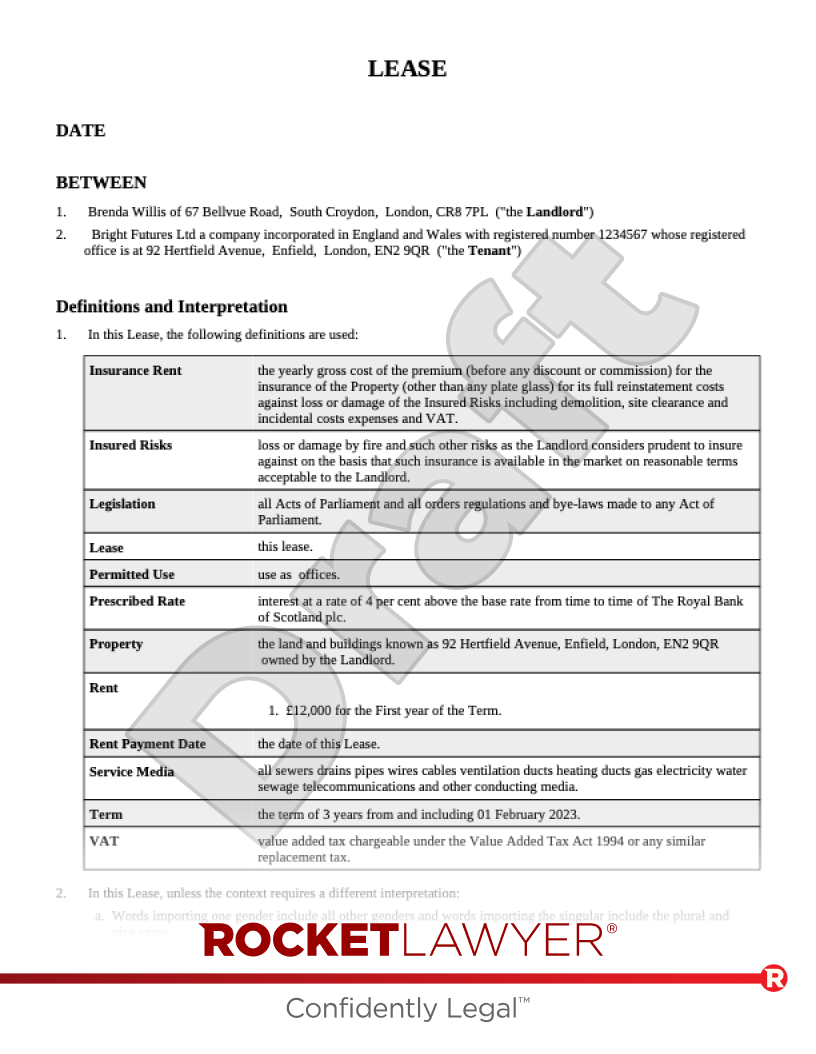

You will pay rent under the lease but Value Added Tax (VAT) may be payable on top and the lease may contain a rent review. Rent reviews are usual in leases of 3 years or more and an upwards-only rent review means that you will not benefit from any decrease in market rent levels.

In Scotland, rent for retail leases is often worked out as a percentage of the tenant’s business turnover.

Deposit or guarantee

A tenant may be asked to enter into a Rent deposit deed. The landlord has the right to withdraw sums from the rent deposit to cover any costs, should the tenant default any of the lease covenants for example any damages or late payments of rent. Should this occur the landlord may insist that the tenant then tops up the deposit. The tenant will usually get the deposit back when the lease ends provided the tenant has fulfilled all its obligations under the lease. A landlord should use a rent deposit deed to protect their commercial property and to ensure payment if the tenant defaults.

The tenant may also have to provide a guarantor for the lease, especially if the lease is taken in the name of a new or young business. It is most common if a landlord is unsure that the tenant can pay rent (usually due to the fact the tenant is young and may have an insufficient credit history in the case of a student or if the prospective tenant has a poor tenant credit history). The guarantor's application form is similar to the tenancy application. Credit searches and references will be checked. For more information, Ask a lawyer.

Service charge & insurance

If you are taking a lease of part of a building, you may be required to pay a service charge. Make sure you ask for an estimate of what this will be and if it is a significant amount, ask whether the landlord will agree to cap your contribution.

It is usual for a landlord to insure the property but you will be responsible for paying the whole (or a proportion) of the premium and for loss of rent if the property is destroyed or damaged and unfit for occupation and use.

You will also need to take additional insurance for your contents which are not covered by the buildings insurance.

Stamp Duty Land Tax (SDLT)

Depending on the amount of rent, premium and VAT payable, you may have to pay SDLT. It may also be appropriate to register or note the lease at the Land Registry, in which case additional fees will be incurred. For more information, see the Government’s guidance.

In Scotland, SDLT was replaced by Land and Buildings Transaction Tax (LBTT) in 2015. LBTT must be paid by the tenant on any rent between £150,001 and £2,000,000 at a rate of 1%. LBTT must be paid on any rent above £2,000,000 at a rate of 5%. For more information, see Revenue Scotland.

Security of tenure

If the lease is ‘excluded’ from Part II provisions of the Landlord and Tenant Act 1954, you will have no automatic right to stay at the end of the lease. A lease with protection means that you have a right to request a new lease and the landlord can only refuse on certain grounds. For more information, read about Security of tenure.

In Scotland, there is no statutory provision that provides you with an automatic right to stay, with the exception of the Tenancy of Shops (Scotland) Act 1949 and Tenancy of Shops (Scotland) Act 1964. If notice of termination is not given by either landlord or tenant at the end of the lease, the lease will continue under the same terms on a yearly basis (this is known as ‘tacit relocation’) until valid notice is provided.