What is a buy to let property?

A buy to let property is when you buy a property in order to rent it out to tenants.

What are the tax rules for buy to let properties?

Buy to let landlords used to be able to deduct 100% of the cost of financing their rental property (eg mortgages, loans and overdrafts) from their total rental income, eg if their rental income was £10,000 over the year and they repaid £10,000 of the mortgage, there would be no tax to pay.

However, these tax rules were gradually changed. From 6 April 2020, there is no allowable deduction (eg the full £10,000 in the example above would be taxable). Instead, the entire sum of interest payments will now qualify for a 20% tax credit. This means that basic rate taxpayers will get all the tax back on their mortgage payments, while higher and additional rate taxpayers will not get all the tax back on their mortgage repayments, as the credit only refunds tax at the basic 20% rate, rather than the top rate of tax paid.

Between 2017 and 2020, the following could be offset:

-

from 6 April 2017 - 5 April 2018: 75% of the financing cost could be deducted

-

from 6 April 2018 - 5 April 2019: 50% of the financing cost could be deducted

-

from 6 April 2019 - 5 April 2020: 25% of the financing cost could be deducted

How is rental income taxed?

Rental income may be taxed in different ways depending on how the property is held between the co-owners. There are two different ways to hold property: as joint tenants or as tenants in common.

What is the difference between joint tenants and tenants in common?

Joint tenants

In the case of a joint tenancy, both partners have equal rights to the whole property, eg they both act as a single owner. If one of the partners dies, their part of the property automatically passes to the other. Married couples and civil partners may be inclined to purchase a buy to let property as joint tenants, however, there are potential tax advantages to opting for a tenancy in common.

Tenants in common

In the case of tenants in common, each partner will own individual shares of the property. The shares don’t have to be equal shares. If one of the partners dies, their share in the property passes to someone named in their Will or a next of kin.

For more information, read Co-ownership of property.

Joint ownership in Scotland

While the terms ‘joint tenants’ and ‘tenants in common’ aren’t used in Scotland, the law is similar. The extent of your share of the property will depend on what is agreed when buying the property. You may agree to equal shares or individual shares, and the details of this should be stated in the title deeds.

If you include a survivorship clause in the title deed this will mean that your share of the property will automatically pass to the other owner(s) if you die. However, if you’d prefer your share to go to someone else, this can be written into your will.

What are the tax advantages of owning property as tenants in common?

Tenants in common who are not married or in a civil partnership

If tenants in common rent out a buy to let property and are not married or in a civil partnership, they’ll pay tax on the relevant proportion of their rental income (ie reflecting their share). This is because the income from rent has to be split as per the ownership of the property.

Tenants in common who are married or in a civil partnership

Married couples and civil partners will generally be deemed by HMRC to be liable for 50% each of the total rental income, even if they own different shares (eg 10% and 90%).

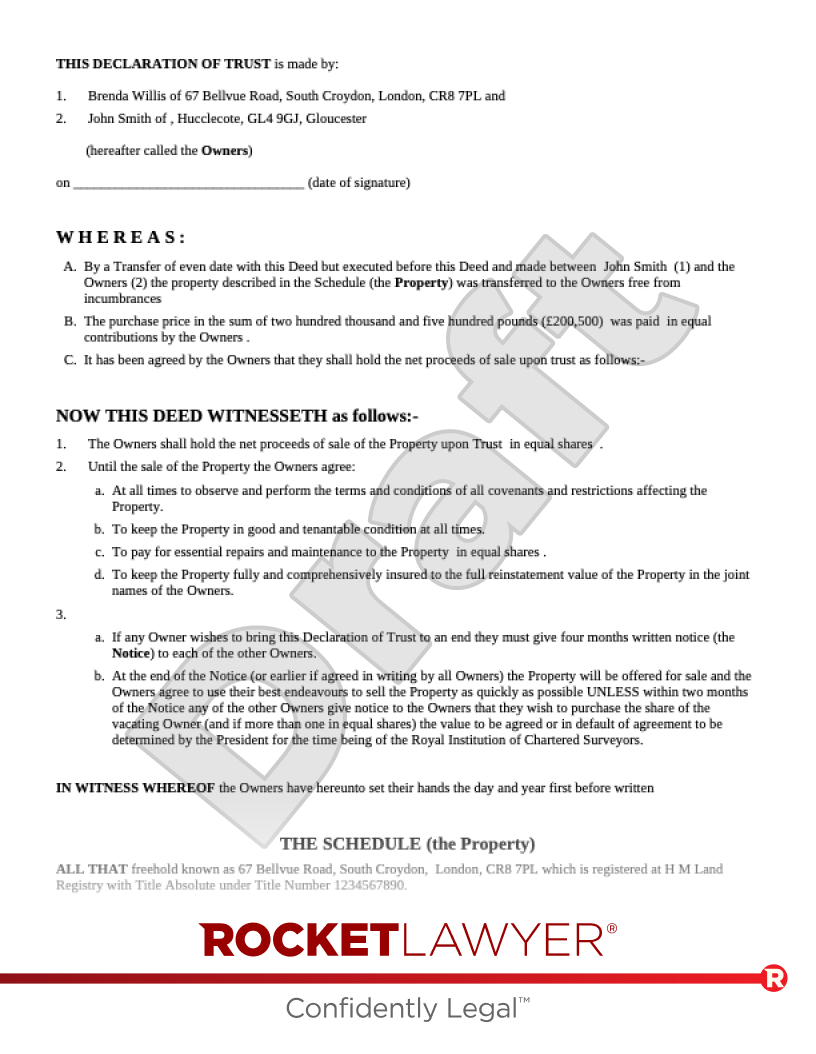

In order to avoid this assumption and to pay tax on rental income reflected by their shares, they’ll need to register a Declaration of trust with the Land Registry, which will record the proportions in which they own the property. They’ll also need to submit Form 17 to HMRC to provide evidence of the property being held jointly in unequal shares.

Doing so can provide tax efficiencies if one spouse falls into a lower tax threshold than their partner (ie a larger share of the rental income can be assigned to the spouse who falls within the lower tax threshold, so that overall tax is minimised).

Example:

Mr and Mrs B purchase a buy to let property as tenants in common

They create a declaration of trust which states that Mr B owns 70% of the beneficial interest and Mrs B owns 30% of the beneficial interest. This is because Mr B is paying 70% of the mortgage and put in 70% of the deposit (for more information, read Declaration of trust).

Their rental income is £18,000.

HMRC generally deem that married couples (provided they are living together) are liable for 50% each of the tax, therefore if they do not submit Form 17 they will each be taxed on £9,000.

Mrs B is a higher rate taxpayer and therefore they wish to tell HMRC that the rental income will be split according to their unequal beneficial interests in the property. They fill in Form 17 and Mrs B is only taxed on 30% of £18,000 and Mr B is taxed on 70% of £18,000.

Exceptions

You do not have to fill in and file Form 17:

- if the income is from the commercial letting of furnished holiday accommodation

- if you are married but do not live together

- if you are not married or civil partners with your co-owners

- if you have equal shares in the property

- you wish to be taxed 50:50 on a buy to let property

Form 17 must be given to HMRC within a period of 60 days from the date of the declaration.

Establishing the size of beneficial interests in property can be difficult. For more information on this complex area of law, seek advice to a lawyer.