MAKE YOUR FREE Invoice

What we'll cover

What is an Invoice?

When should I use an Invoice?

Make and send Invoices as a seller to:

- send a bill or fee note to a buyer

- sell goods or services to a buyer

- sell within the UK only, and only in GBP (£)

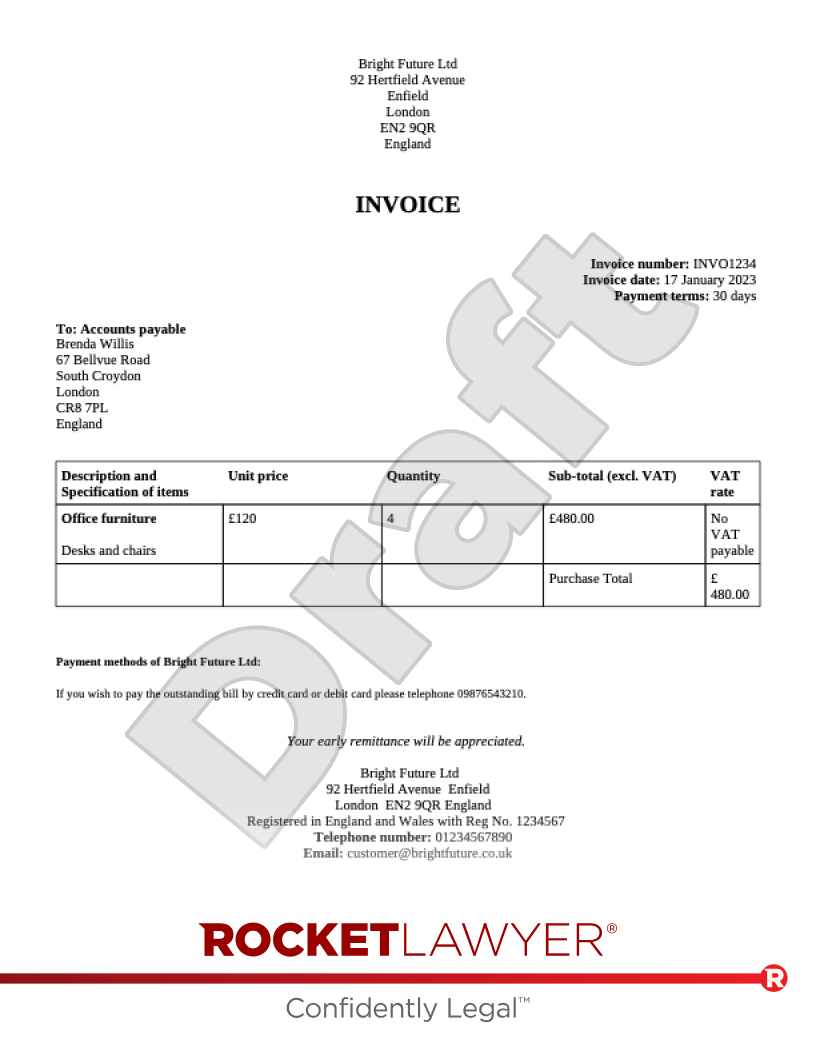

Sample Invoice

The terms in your document will update based on the information you provide

Invoice

Invoice number:

Invoice date:

Payment terms: days

To: Accounts payable

VAT payable at %

£

Payment methods of:

Your early remittance will be appreciated.

VAT Reg No.

Telephone number:

About Invoices

Learn more about making your Invoice

-

How to make an Invoice

Making an Invoice online is simple. Just answer a few questions and Rocket Lawyer will build your document for you. When you have all of the details prepared in advance, making your document is a quick and easy process.

To make your Invoice you will need the following information:

Seller details

-

What is the seller’s legal structure?

-

Will the Invoice be printed on headed paper including the business’ name and address?

-

If not, what is the seller’s name and their address?

-

If so, what is the seller’s name?

-

-

What is the seller’s telephone number?

-

Will the Invoice include the seller’s email address? If so, what is it?

-

Will the Invoice include the seller’s website address? If so, what is it?

Buyer details

-

The buyer’s details (eg legal structure, name and address).

Invoice details

-

What is the Invoice number?

-

What is the Invoice date?

-

How many days does the buyer have to pay the Invoice?

-

What are the details of the items or services being sold (including a description, quantity and price)?

-

Does a discount apply to the total price? If so, what is the discount percentage?

-

Is VAT applicable to the goods or services being sold? If so:

-

What percentage of VAT applies?

-

What is the seller’s VAT number?

-

Purchase order

-

Was a purchase order created for this Invoice? If so:

-

What is the purchase order number?

-

What is the purchase order date?

-

Payment

-

Does the seller accept payments made using:

-

Credit cards? If so, what is the seller’s phone number for credit card payments?

-

Debit cards? If so, what is the seller’s phone number for debit card payments?

-

Bank transfers? If so, what are the seller’s bank account details?

-

Cheques?

-

-

-

Common terms in an Invoice

By making an Invoice you provide a record of goods sold and/or services provided, and the amount payable in exchange for them. As a result, this sample Invoice covers:

Seller details

The Invoice starts by setting out the seller’s name and address. This will only be displayed if the Invoice will not be printed on headed paper that includes the seller’s name and address.

Details of the Invoice

The Invoice is addressed to the accounts payable department at the buyer. The body of the Invoice sets out the details that all Invoices should include, such as their number, date and payment period. It also provides:

-

a description and specification of the items and/or services being sold

-

the unit price

-

the quantity

-

the sub-total (excluding VAT)

-

the applicable VAT rate

-

the discount percentage and the discount amount (if applicable)

-

the sub-total and the amount of VAT payable (if applicable)

-

the purchase total

Payment methods

This section sets out what payment method(s) the seller accepts and provides details of how the buyer can make payments under the Invoice.

If you want your Invoice to include further or more detailed provisions, you can edit your document. However, if you do this, you may want a lawyer to review or change the Invoice for you, to make sure it complies with all relevant laws and meets your specific needs. Ask a lawyer for assistance.

-

-

Legal tips for making an Invoice

Make sure you charge the correct rate of VAT

The standard rate of VAT payable on most goods and services is 20%. However, for some goods and services (eg children’s car seats and home energy), the VAT rate is 5% (this is known as the ‘reduced rate’). For other goods and services (eg children’s clothes and most foods) the VAT rate is 0% (this is known as the ‘zero rate’). Before making your Invoice, you should check the Government’s guidance on different goods and services. For more information, read VAT.

Consider how long the buyer has to pay your Invoice

In your Invoice, you can set out how long the buyer has to pay the Invoice. Generally, Invoices should be paid within 30 calendar days of receiving the goods or services. You can, however, choose a shorter or longer payment term. It’s recommended that you Ask a lawyer if you are seeking a longer-term repayment period (eg a period of more than 60 days). For more information, read Invoicing.

Understand when you can charge interest on late payments

Under the Late Payment of Commercial Debts (Interest) Act 1998, you can choose to charge interest if a commercial buyer is late paying your Invoice. Check your contract with the buyer to see what it says about claiming interest and consider sending a Debt recovery letter to remind the buyer to make payment.

For more information, read Calculating interest on commercial debts and How to avoid problems with debtors.

Understand when to seek advice from a lawyer

Ask a lawyer if:

-

you need advice on setting up a business

-

you want to find out about international sales (including web sales)

-

you charge different rates of VAT or different discounts across different items/services

-

this document doesn’t meet your needs

-

Invoice FAQs

-

What is included in an Invoice?

This Invoice template covers:

-

a description of the goods or services that are being purchased

-

the price and payment terms

-

the details and contact information of the seller and the buyer

-

how payment may be made

-

VAT details (if relevant)

-

any discount applicable

-

-

Why do I need an Invoice?

All VAT-registered businesses are legally required to submit Invoices to any clients who are also VAT registered. However, it is good practice for all businesses to generate Invoices as part of the overall transaction process, irrespective of their VAT status.

As most businesses will only pay for goods or services once they have received an Invoice, ensure all Invoices are processed in a timely fashion. This will facilitate quick payments and avoid discrepancies and delays.

Keeping an accurate record of Invoices is also crucial for annual tax returns, and for calculating business turnover, profit and expenses.

Read Invoicing to find out more.

-

How do I write an Invoice?

Use this Invoice template to learn how to write an Invoice.

As a minimum, Invoices (like this sample Invoice) should include:

-

the word ‘invoice’ (this should be clearly displayed at the top of the document)

-

a number that uniquely identifies this Invoice

-

the date of the Invoice

-

the business’ name (for companies, this should be the full company name as it appears on the certificate of incorporation)

-

the business’ address

-

contact information, including an email address and phone number

-

the name of the client that is being invoiced

-

a brief description of the services provided or goods supplied and individual costs/fees

-

the total amount being invoiced

-

payment methods and details (eg a bank account number and sort code)

-

a Purchase order number (if required by your client)

VAT-registered businesses must also include:

-

their VAT-registration number

-

details of VAT charges

VAT Invoices should be used where both businesses involved in the transaction are VAT registered. See the Government website for information on VAT Invoices.

-

-

What is an appropriate payment period?

You should negotiate payment terms with your client before sending an Invoice. However, an Invoice can include a reminder of the payment period, or a preferred payment due date if one was not discussed.

Many small businesses require payment within 14 calendar days but larger organisations may agree to up to 60 days (or longer, if reasonable for both businesses). If there is no specific payment period, clients must pay within 30 calendar days of receipt of the Invoice. 30 days is generally considered to be the standard payment period amongst businesses.

-

What payment methods can I set out in an Invoice?

As most businesses pay by direct bank transfer, make sure to include your bank account name, sort code and account number on all Invoices. Alternatively, you can ask to be paid by cheque - in which case you should specify the best postal address. Some businesses also offer the option of card payment. However, this will often incur a processing charge and there are rules on passing on these processing fees.

-

What if I charge different rates of VAT or discounts on my products or services?

This sample Invoice only allows you to charge one rate of VAT and one rate of discount applicable to all of the products and/or services. If you wish to charge different rates of VAT or different discounts for different items, create multiple Invoices or Ask a lawyer for help drafting a bespoke Invoice.

Our quality guarantee

We guarantee our service is safe and secure, and that properly signed Rocket Lawyer documents are legally enforceable under UK laws.

Need help? No problem!

Ask a question for free or get affordable legal advice from our lawyer.