What is a limitation of liability clause?

All contracts, in particular contracts for commercial transactions, carry a risk of liability. When a party is liable for something, this generally means that they must cover costs associated with that thing.

Legal liability can arise from occurrences such as:

-

breaches of contract – ie when one party fails to deliver on their obligations under a contract (eg by not delivering goods or by withholding payment)

-

negligence – if one party is considered to have a duty of care towards a second party, then their conduct fails to meet a reasonable standard of care, and this failure causes harm, the party whose conduct was lacking may be considered negligent. For example, if a car manufacturer makes a mistake in designing a car and the design defect results in a car accident that causes harminjures the driver, the manufacturer may be considered negligent and liable for the harm

-

misrepresentation – when one party makes a false statement of fact that causes a second party to enter into a contract, this can be considered misrepresentation. If the second party suffers losses due to the misrepresentation, the party that made the mispresentation may be liable for these losses. For example, if a party represents equipment as high quality and suitable for a particular purpose but, after somebody purchases it the equipment it causes them harm by being unfit for such use, the seller may be liable for this harm

-

infringement of intellectual property (IP) rights – if a party infringes another party's intellectual property rights (eg by using without permission their creations protected by copyright, trade mark, patent, or design rights), they may be liable for losses suffered in relation to this use

A limitation of liability clause serves to limit the amount and/or types of liability one party has to another party under a contract. It will generally:

-

completely exclude certain types of loss from being recoverable (eg by stating that the costs of certain types of losses will not be covered), or

-

limit the amount of compensation that can be recovered in relation to losses

Limitation of liability clauses essentially cap the liability that may be incurred by one party and reduce the risk of a claim by the other party.

For example, imagine that a website user suffers loss because they relied on information provided on a website. A limitation of liability clause in the Website's terms and conditions could limit the liability of the website owner by stating, for example, that the owner will only cover the costs of the user’s losses up to a certain amount.

Why do I need a limitation of liability clause?

Limitation of liability clauses are used to manage the risks attached to a contract. When these clauses are not included in a contract, there is usually no financial limit on the damages (eg compensation) that a party can ask for if they suffer a loss in relation to that contract.

Parties wishing to reduce exposure to the risks of a contract should include an express limitation of liability clause. Negotiating how liability is limited can be a key aspect of negotiating a functional contractual relationship that’s fair to both parties in terms of who holds what financial risks.

When can you limit liability?

The law imposes restrictions on the use of limitation of liability clauses. This helps protect parties from not having fair access to remedies if they suffer losses in relation to a contract.

The extent to which liability can be limited largely depends on whether a contract involves a consumer (ie a private individual) or not.

Limiting liability in business-to-business contracts

When a contract is between two businesses (ie ‘B2B’), the Unfair Contract Terms Act 1977 (UCTA) prohibits limitation of liability clauses in certain circumstances. In others, limitation is only allowed when it is ‘reasonable’. For example, a party:

-

cannot limit or exclude (ie absolutely limit) liability for death or personal injury caused by negligence

-

can only limit liability for its own breach of contract or misrepresentation when doing so is reasonable

can only limit liability for breaches of certain ‘implied contractual terms’ when doing so is reasonable. These implied terms are those held to be included in a contract by law, but which are not expressly written into in the contract, eg terms stating the quality or fitness for purpose of goods or their conformity with any descriptions or samples used to form the contract

What’s considered a ‘reasonable’ limitation of liability in B2B contracts?

A limitation of liability clause is considered to be ‘reasonable’ if the clause is considered to be a fair and reasonable one to include in that contract, having regard to the circumstances that were (or ought reasonably to have been) known to or in the contemplation of the parties at the time the contract was made. This is referred to as the ‘reasonableness test’. In practice, in determining reasonableness the courts will take into account factors such as the degree to which the clause limits liability, the parties' relative bargaining position, and the information available to the parties when the contract was made. For example, a limitation clause that caps liability to the value of the sales made under the contract is more likely to be reasonable than one that excludes liability altogether.

Limiting liability in consumer contracts

Contracts between businesses and consumers (ie ‘B2C’ contracts) are not covered by UCTA – instead, the Consumer Rights Act 2015 (CRA) restricts how liability can be limited in these contracts.

The CRA requires that, to be enforceable, a limitation of liability clause in a business-to-consumer contract must be ‘fair’. If the court considers that the restriction of liability is unfair, it won’t be binding on the consumer. This means that the consumer can treat it as struck out of the contract, while the rest of the contract will stand and remain enforceable.

A limitation of liability clause will generally be considered unfair (therefore, unenforceable) if it causes a significant imbalance in the parties’ rights and obligations under the contract to the consumer’s detriment. This is a lower threshold than the ‘unreasonableness’ test applied to B2B contracts, so limitation of liability clauses in B2C contracts are less likely to be enforceable than those in business contracts.

Additionally, certain types of limitations on liability will always be prohibited in B2C contracts, including terms that:

-

exclude or limit certain statutory rights (eg implied terms similar to those banned in B2B contracts, above)

-

limit liability for death or personal injury resulting from negligence

Drafting your limitation of liability clause

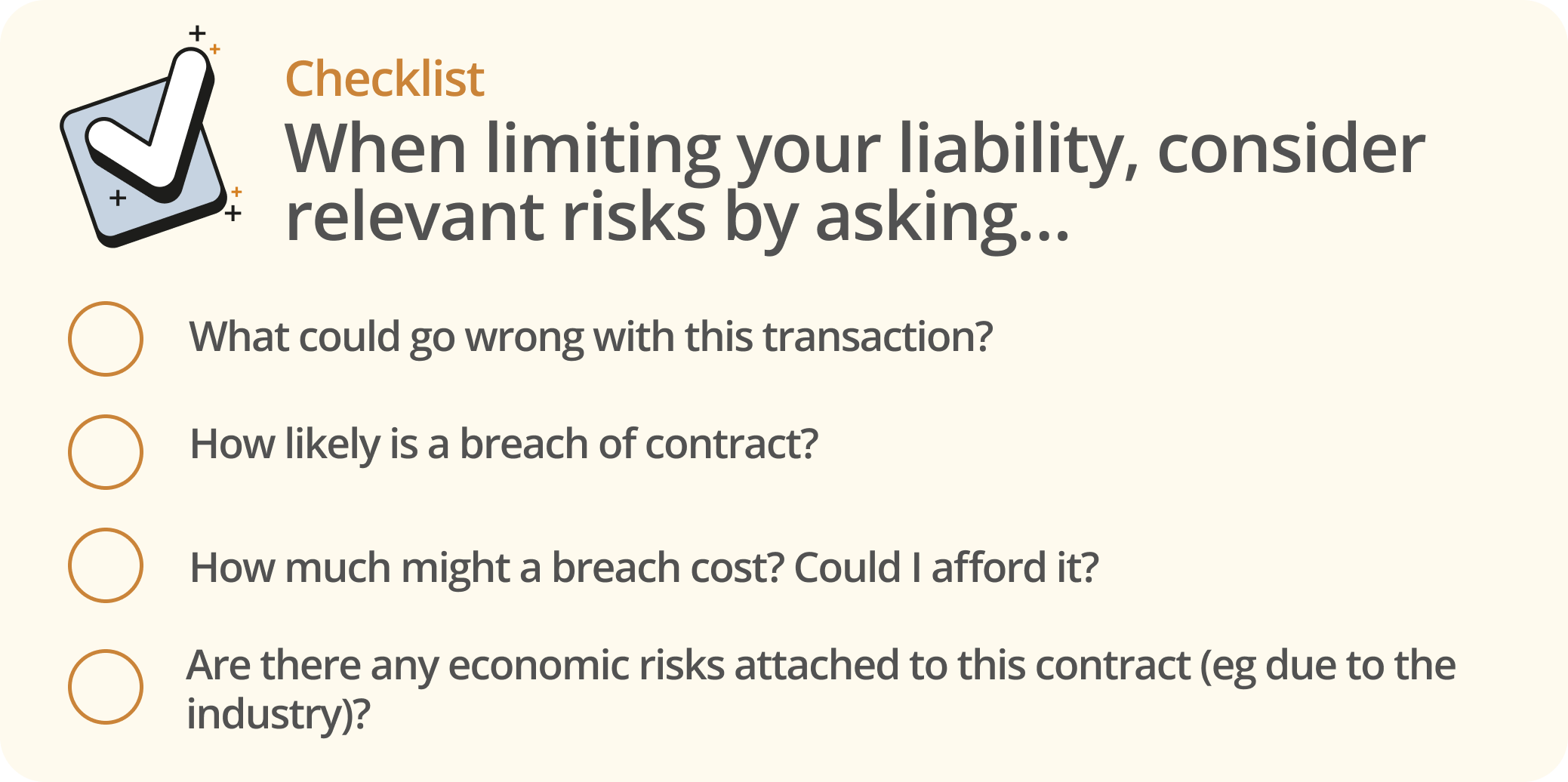

To draft a limitation clause properly, it is important to precisely identify the risks attached to the contract and the losses that may arise from such risks.

Once you've assessed the level of risk, make sure that your limitation clause is written in clear and unambiguous wording. In particular, the limitation clause should set out:

-

the types losses each party accepts they will be liable for without limit (eg fraud, death, or personal injury)

-

the losses each party accepts will be liable for up to a certain cap (ie amount) and what that cap is – the clause should list precisely which losses will be capped and what the cap(s) should be (the caps can be different for different types of loss). Caps may be determined according to the parties' level of insurance, the value of the contract, and/or the potential amount of damage a breach of contract may cause

-

the losses each party excludes completely – ie specific types of losses that a party will not be liable for, such as a loss of profit or revenue. However, remember that death and personal injury caused by negligence can never be excluded from liability

As a general rule, a party’s liability should always be capped to a reasonable amount and you should make sure that a meaningful remedy is still available for the recovering party if they suffer any losses.

If you need help amending limitation of liability clauses or adding them to a contract in a way that protects you and your business, you can use our Bespoke drafting service. If you have any questions, you can Ask a lawyer.