What is a general meeting?

A general meeting is a meeting of a company’s shareholders. This is different to a board meeting, which is a meeting of the company’s directors. General meetings are used to consider company matters and to make decisions (ie to vote on company resolutions) on these matters.

A general meeting can be either a non-routine meeting called for a specific purpose (eg to consider the appointment of a new director) or an annual general meeting (AGM).

A general meeting for a specific purpose is generally called in relation to important company matters. For example:

-

the appointment or removal of a company director

-

amending the company’s articles of association

-

approving significant loans

As an alternative to holding a general meeting, shareholders may make decisions using written resolutions.

What is an annual general meeting?

An annual general meeting (AGM) is a general meeting that certain companies must hold annually (ie once per year) to discuss key issues, company performance, and company plans.

Which companies have to hold AGMs?

AGMs must be held by:

-

all public companies - they must call an AGM within 6 months of the day following their accounting reference date

-

private companies that are traded companies (ie where shares with the right to vote at a general meeting are being traded on a UK regulated market by or with the consent of the company) - they must call an AGM within 9 months of the day following their accounting reference date

If a company does not sit within the above categories it does not need to hold an AGM. For example, most private companies don’t need to hold AGMs unless their articles of association require them to.

If a private company is not required to hold an AGM, it may still decide to do so.

When is a general meeting called, and who calls it?

A general meeting can be called (ie initiated) either by the company directors or requested by the company shareholders. Different periods of notice are required depending on how a general meeting is being called, the type of company calling it, and whether or not the meeting is an AGM.

When can directors call a general meeting?

Directors can generally call a general meeting at any time. If the directors of a private company call an AGM, they must give at least 14 days’ notice. For directors of a public company, at least 21 days’ notice is required.

For general meetings that are not AGMs, if the company directors of a private company or an unlisted public company (eg a public company that does not have shares listed on any stock exchanges) want to call a general meeting, they need to give the shareholders a minimum of 14 clear days’ notice. If the directors of a listed public company call a general meeting, they should give at least 21 days’ notice except in certain situations.

These notice periods may, in some instances, be different. For example, if a company’s articles of association require a longer notice period. Articles of association generally cannot allow shorter notice periods.

Notice periods are often measured in 'clear days', meaning that, when calculating a specified notice period, the day of the meeting and the day that notice of the meeting is given are excluded.

When can a general meeting be requested by the shareholders?

A company’s shareholders (ie members) can make a request to the directors that a general meeting be held. Directors must call a general meeting if they receive such a request from:

-

shareholders who hold at least 5% of the company’s paid-up share capital that carries voting rights (or, if the company has no paid-up share capital, 5% of the company’s voting rights), or

-

guarantors (ie the members of a private company limited by guarantee) representing at least 5% of the total voting rights of all members

When directors receive a valid request, they must call a general meeting within 21 days of receiving the request. The general meeting should be scheduled for a date no later than 28 days after the date of the notice calling the meeting.

Can a general meeting be called on short notice?

Typically, unless the minimum notice period is given, a general meeting will be void. However, a general meeting for a private company or non-traded public company may be called on short notice if a majority of the shareholders, who together hold at least 90% of voting rights in the company, agree.

Note that a company's articles of association may specify that a percentage of voting rights greater than 90% is required. Before calling a meeting on short notice, the company’s articles should be checked to ensure the necessary requirements are met.

How should notice of a general meeting be given?

There is no single prescribed format in which notice for a general meeting should be given.

Notice of a general meeting can generally be given either:

-

in hard copy (eg handed to shareholders personally or sent by post)

-

by electronic means (eg by email or fax), provided that the shareholders have consented to notice being given electronically

-

via a website, subject to the requirements below

-

partly by one of the above means and partly by another

When can notice be given via a website?

For notice to be given via a website, the shareholders have to consent to notice being given in this way. Once consent has been sought, the shareholders have 28 days to respond. If no response is given, the law permits companies to treat this lack of response as consent to notices of general meetings being communicated via the relevant website.

Where notice is given via a website, all parties must receive notification that the notice is available on the website. This notification must specify that the notice concerns a company general meeting and the date, time, and location of the general meeting. Further, the notice must remain on the website from the date of the notification until the conclusion of the general meeting. If the notification concerns a public company, it should also state whether the meeting is an AGM.

Note that a company’s articles of association may include provisions requiring a certain method of service, which should be adhered to. The articles should be checked before a notice is given.

What should notice of a general meeting include?

A notice of a general meeting must be clearly written and must generally include the following:

-

the date, time, and location of the meeting

-

the general nature of the business to be discussed and dealt with at the meeting (note that this can be varied in a company’s articles)

-

the full text of any special resolutions (ie shareholder resolutions that generally require at least 75% of the shareholders to agree to pass) to be discussed at the meeting and notice of the intention that such resolutions will be proposed as special resolutions

-

a reasonably prominent statement informing the shareholders of their right to appoint a proxy (ie a third party appointed to exercise the shareholder’s rights to attend, speak, and vote at the meeting on the shareholder’s behalf)

It is also considered best practice to:

-

set out the day of the week on which the general meeting is to be held

-

set out the full text of any ordinary resolutions (ie shareholder resolutions that require at least 50% of the shareholders to agree to pass) to be discussed at the meeting

A company’s articles may set out additional requirements for notices. They should be checked before the notice is given.

You can use a Shareholder resolution to give notice of a general meeting.

Who should receive notice of a general meeting?

Notice of a general meeting should be given to all parties who are entitled to receive notice.

The parties who are entitled to receive notice of general meetings are:

-

all shareholders listed on the register of members (subject to the company’s articles)

-

all company directors

-

any auditors

The company’s articles of association may set out other rules on who is entitled to receive notification - these should be followed.

Different general meeting formats

General meetings (including AGMs) can be held in different formats. They can be:

-

face-to-face (ie physical) meetings - this is the conventional format, in which a meeting is held either at one location or at a central site linked to several satellite locations via an integrated communication network

-

hybrid meetings - meetings held both in person and virtually (ie a certain number of participants attend in person while and the remaining participants join remotely meeting via a virtual platform

-

physical plus webcast - meetings where, in contrast to a hybrid meeting, virtual participants are only able to listen to what's being stated; if they want to ask questions or cast votes, they must use traditional procedures (eg proxies)

The legal status of entirely virtual meetings is not completely clear. As such, these aren’t generally approved by large companies. It is still considered safest to have a physical location for a general meeting that at least some people attend.

Is it safe to hold a hybrid or virtual general meeting?

The popularity of virtual general meetings increased during the Coronavirus (Covid-19) pandemic and has remained.

To ensure that general meetings with virtual elements are safe, companies must make sure that the technology used is trustworthy enough to ensure that meetings and voting procedures are secure, fair, and transparent.

Setting out how shareholders can vote in certain cases, for example during hybrid meetings, is becoming more and more common.

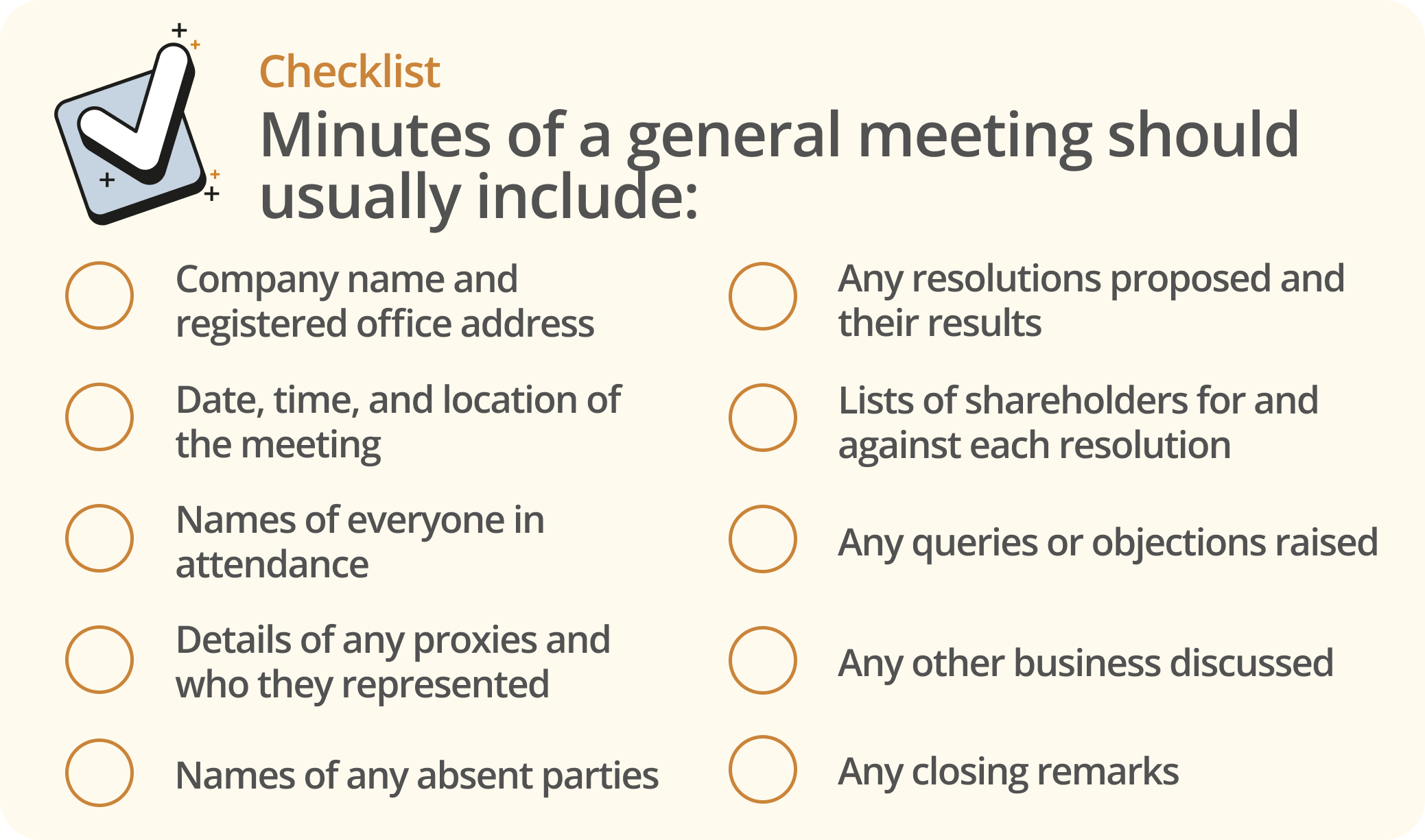

Keeping minutes

Minutes (ie formal records) of a general meeting and copies of all ordinary and special resolutions passed at the general meeting should be kept. This is the case even where there is only one company shareholder.

The minutes must be kept at the company’s inspection location for at least 10 years from the date of the meeting.