What is a guarantor?

The person whose financial obligations a guarantor is taking on is referred to as the ‘primary party’ throughout this guide. A guarantor will pay the primary party’s obligations (eg mortgage or rent payments) if the primary party is unable to do so.

Guarantors provide an extra layer of security for the creditor (ie the party the primary party contracts with, such as a lender or landlord), as they ensure that any money owed by the primary party will be paid.

When is a guarantor needed?

There are many situations where a guarantor may be required. This is normally the case when there is uncertainty about a person's ability to meet their financial obligations. For example, because they:

-

lack a stable employment history or do not work regularly (eg because they’re a student)

-

have a low credit score or no credit history (eg because they are young or have just moved to the UK)

-

have County Court Judgments (CCJs) (in England and Wales) or decrees (in Scotland)

-

have previously gone bankrupt

-

have low income or claim benefits

Common circumstances that may require a guarantor include:

-

residential tenancies - under Tenancy agreements, landlords may request guarantors if they are worried about a prospective tenant’s ability to pay their rent for the reasons listed above, or because they have never rented before (so don’t have landlord references), or have just moved to the UK from overseas. Guarantors are particularly common when letting to students

-

business contracts - small businesses or startups may require guarantors when entering into contracts, especially if they don’t have strong credit histories or financial backing

-

mortgage applications - in some cases, a guarantor is required for a mortgage, especially for first-time homebuyers or anyone with poor credit history. This type of mortgage, often called a ‘guarantor mortgage’, allows buyers who might not qualify on their own to secure a loan with the support of a guarantor. The guarantor agrees to cover any missed mortgage payments, providing the creditor with additional security (often their home). This is particularly useful for younger buyers who may not have a substantial deposit or those with unstable incomes

-

loan and credit applications - when a person has a limited credit history, low credit score, or insufficient income to qualify for a loan or credit card on their own, a guarantor might be required to provide assurance to the creditor

Who can be a guarantor?

Generally speaking, anyone can be a guarantor provided they:

-

have a solid financial standing

-

have a reliable credit history

-

meet the age requirements (which vary depending on the situation, but often require guarantors to be between the ages of 18 to 75 or 21 to 75)

Those who own property (eg a house) are often preferred as guarantors, as this indicates financial stability and provides a tangible asset (ie the property they own) that may be leveraged if needed.

In many cases, the guarantor must be based in the same country as the agreement is entered into. For example, if the agreement is entered into in the UK, the guarantor may be required to be based in the UK. This ensures that they fall under the same jurisdiction so the creditor can easily start legal proceedings, if necessary.

Guarantors may be required to meet further requirements, depending on the specifics of the situation. If you have any questions about this, Ask a lawyer.

Guarantors are often parents or spouses (provided they have separate bank accounts), but they may also be close friends or relatives.

Guarantor companies also exist, which provide guarantor services in exchange for a fee. These companies act as guarantors for individuals who may not have a personal guarantor who meets the necessary criteria. Guarantor companies are commonly used for tenancy agreements, especially by tenants who are unable to secure a traditional guarantor.

Guarantor checks

Prospective guarantors will be subject to various background checks to ensure their ability to cover the primary party’s financial obligations. These checks will usually include:

-

credit checks verifying the prospective guarantor’s credit history and credit score

-

employment and income checks verifying that the prospective guarantor has a stable and sufficient source of income to cover the potential financial obligations they are guaranteeing

-

affordability checks evaluating whether the prospective guarantor has sufficient disposable income to cover the potential costs they may have to pay

-

identity checks confirming that the prospective guarantor is who they say they are

Rent guarantors (ie those acting as guarantors on behalf of tenants) will typically be subject to the same background checks as tenants in England, Wales and Scotland.

What is a guarantor agreement?

A guarantor agreement is a legally binding agreement between a guarantor and a creditor, landlord, or service provider in which the guarantor agrees to take on the financial responsibilities of the primary party if that party fails to meet their obligations under the terms of a primary agreement (eg a tenancy agreement, business contract, or Loan agreement).

The guarantor agreement should clearly set out the details of the agreement, including what the guarantor will be responsible for paying if the primary party defaults on (ie fails to meet) their obligations and for how long the agreement is binding.

Depending on the details of the situation, guarantor agreements are either formed as contracts or deeds.

A guarantor agreement is a separate document that supplements a primary agreement when the primary agreement doesn’t already contain a term appointing a guarantor. Often, a term within a primary agreement will simply appoint a guarantor (eg a clause in a tenancy agreement).

Ask a lawyer if you have any questions about guarantor agreements, and consider using our Bespoke drafting service if you need one.

What are a guarantor’s responsibilities?

The specific responsibilities of a guarantor vary depending on the terms of the agreement they are supporting and the terms of the guarantor agreement they sign. A guarantor may be responsible for:

-

covering financial obligations - if the primary party fails to make payments (whether for a loan; rent, or damage to a rental property; a mortgage; or another financial commitment) the guarantor must cover these unpaid amounts

-

providing additional security - in some instances, a guarantor may be asked to provide additional security or collateral to support the agreement

-

fulfilling contractual terms - a guarantor may be required to ensure that all terms of a contract are met. This is more common in business or service contracts

-

maintaining liability over time - a guarantor’s responsibilities may extend over the duration of the agreement and, in some cases, even beyond, until all obligations are fully satisfied. For example, in the case of a mortgage, the guarantor's liability may last until the mortgage is fully repaid

What consequences can acting as a guarantor have?

When someone agrees to be a guarantor, they are essentially promising to cover someone else's obligations if they fail to meet them. While this can be a supportive gesture, it also comes with risks and implications that must be considered carefully. These include:

Financial liabilities

The most immediate and significant consequence of acting as a guarantor is the potential financial liability. If the primary party defaults on their payments or fails to fulfil their obligations, the guarantor will be required to cover these costs. Depending on the terms of the guarantor agreement, this may include:

-

repaying the debt in full - in the case of a loan or mortgage, the guarantor may be required to repay the entire outstanding amount, including any accrued interest and late fees

-

paying all unpaid rent or property damages - for tenancies, guarantors may have to pay unpaid rent, cover damages beyond normal wear and tear, or pay legal fees incurred by the landlord in pursuing the debt

-

covering legal and administrative costs - in addition to paying the primary party’s financial obligations, the guarantor may also be responsible for any legal or administrative costs incurred by the creditor in enforcing the guarantee

Impact on credit scores

If the primary party fails to meet their obligations and the guarantor is unable to cover these financial obligations, this can negatively impact their credit score. Missed payments, defaults, or involvement in legal proceedings related to the guarantee can be reported to credit reference agencies, leading to a reduction in the guarantor’s credit score. A lower credit score can affect the guarantor’s ability to obtain credit in the future or secure a mortgage.

Reduced borrowing capacity

Acting as a guarantor may be considered a liability by financial institutions (eg banks). This means that even if the primary party has not defaulted, the fact that someone is acting as a guarantor could affect their own borrowing capacity. Lenders may view the guarantor’s potential liability as a risk factor when considering applications for loans, credit cards, or mortgages, possibly leading to higher interest rates, reduced borrowing limits, or rejections.

Legal consequences

Guarantors are legally bound to fulfil the terms of their guarantor agreements. If they fail to meet these obligations, creditors can take legal action against them. This can result in:

-

court judgements - if the matter is taken to court and the guarantor is found liable, a CCJ, decree, or similar legal judgment could be issued against them. This could further impact the guarantor’s credit score and result in additional legal costs

-

seizure of assets - in some cases, particularly with secured loans or high-value agreements, creditors may seek to seize the guarantor’s assets (such as property or vehicles) to recover the outstanding amount

-

bankruptcy - in extreme cases, if the guarantor is unable to meet the financial demands, acting as a guarantor could lead to bankruptcy proceedings being brought against them

Strain on personal relationships

Acting as a guarantor for a friend or family member who defaults on their obligations can strain personal relationships. Financial disputes and the pressure of covering someone else's debts can lead to misunderstandings, resentment, and damaged relationships. As a result, before agreeing to act as a guarantor, it is important to consider the potential impact it may have on personal relationships.

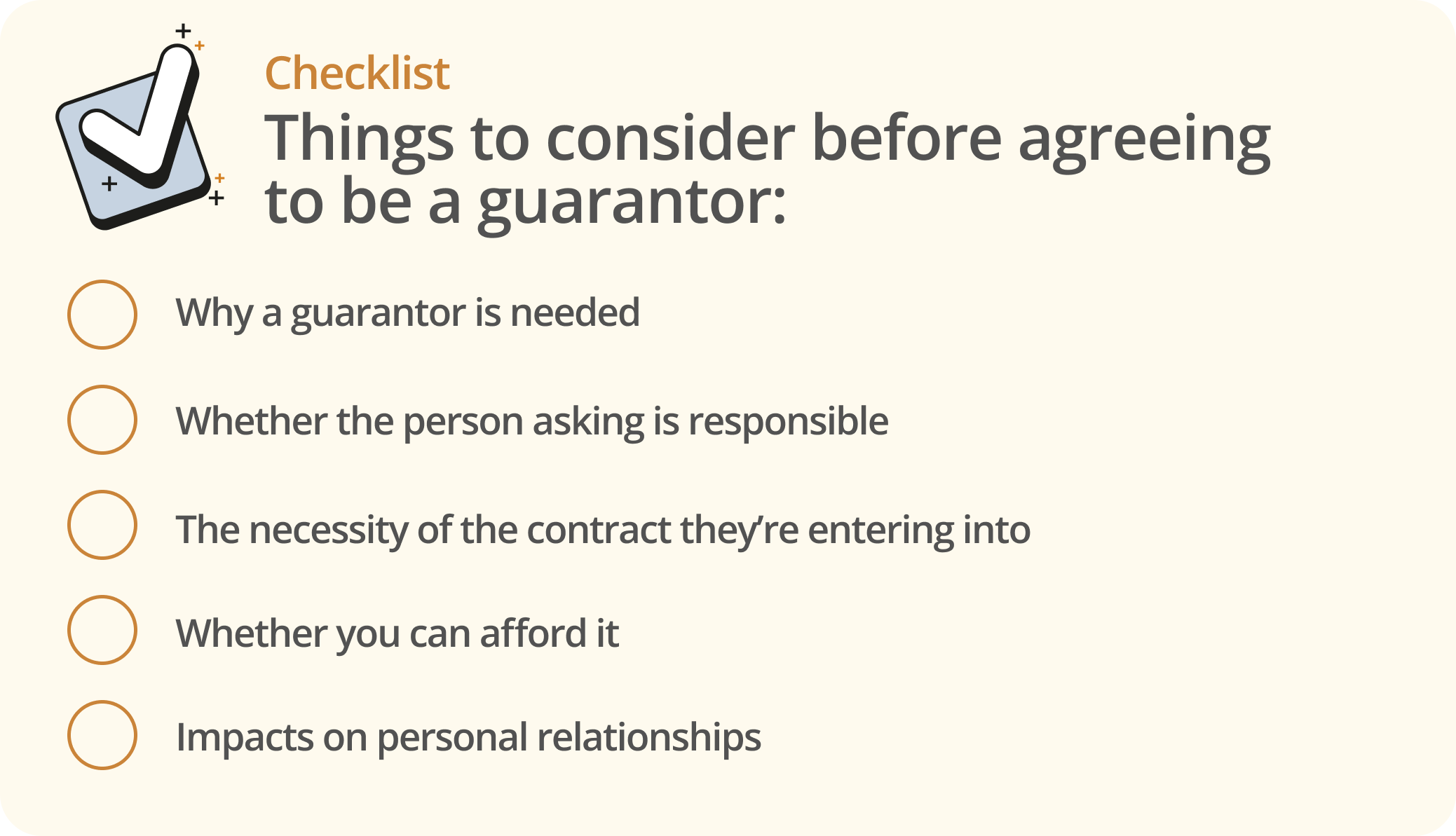

Considerations for guarantors

Acting as guarantor for anyone is always a difficult decision to make.

Before agreeing to act as guarantor on someone’s behalf, consider:

-

why they need a guarantor - do they have a bad credit history? If so, do you believe they will be able to make the necessary payments?

-

responsibility - are they likely to meet their obligations?

-

necessity - is the contract for something they need, like a home, or is it something they merely want, like a newer car?

-

affordability - consider whether you can truly afford to cover their obligations if the primary party can’t or won’t

-

personal relationships - consider whether having to cover their repayments will affect your relationship

Being a guarantor can provide valuable support to someone in need, but weighing this decision against the possible risks and impacts on your own life is crucial. Clear communication with the primary party, thorough preparation, and careful consideration of all factors will help ensure that you fully understand and are prepared for the responsibilities you are taking on.

If you have any questions or concerns about acting as a guarantor or requiring someone to provide a guarantor, do not hesitate to Ask a lawyer.