What is shareholder deadlock?

Companies with two directors who each own 50% of the shares, often run into difficulties when these joint owners disagree on certain decisions. If negotiation fails, and in the absence of any explicit agreement (such as a shareholders' agreement) which specifies a method to resolve such a dispute, it may be impossible to make any decision. This situation is known as shareholder deadlock. As well as affecting joint owners, it can cause problems whenever there is a split decision with equal amounts of shares on either side.

How can shareholder deadlock be resolved?

Mediation/arbitration

An independent mediator or arbitrator can be brought in to help the shareholders come to an amicable decision (or to impose one). For more information, read Mediation and Arbitration.

Appointment of a non-executive director or expert

Bringing in a third party to handle certain business decisions can help to break a deadlock.

New shareholder

In the case of two equal shareholders who cannot find a way forward, inviting a third shareholder will ensure that a majority decision can be reached.

What are the options if no resolution is reached?

Company buyback/shareholder buy out

If one shareholder wants to exit the company, and the company has the funds to buy their shares, this can solve the deadlock. This is known as a share buyback.

Alternatively, the other shareholder can buy them out in a shareholder buy out.

Third-party buyer

Subject to any agreement to the contrary, a shareholder can sell their shares to a third-party investor (although the other shareholder/director can refuse to register the share transfer if there is a good reason).

Company sale

If neither party is able (or willing) to sell their shares, they may decide to sell the entire company rather than trying to dispose of shares individually.

Court action

Applying to the court to resolve a shareholder deadlock is the option of last resort. This will normally result in either the court ordering an independent valuation of shares (ie so the other party can buy them) or making a winding-up order.

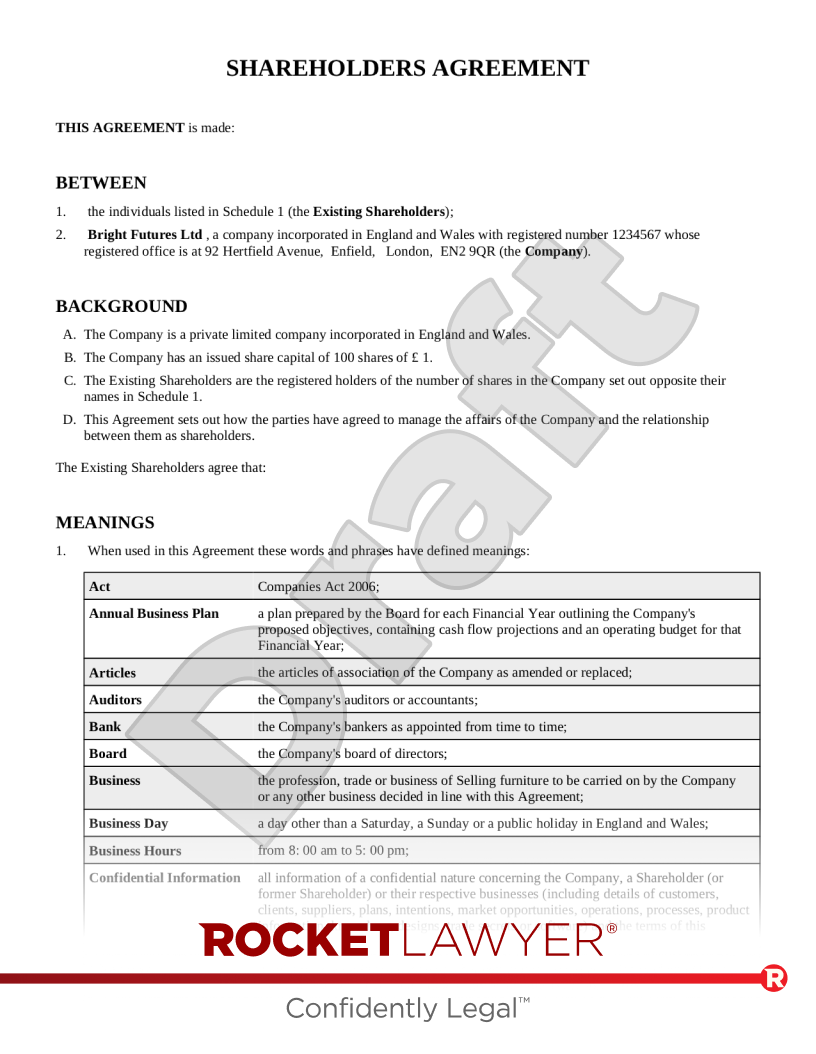

How can a shareholders' agreement help to prevent deadlock?

Shareholders' agreements protect the interests of each individual shareholder in a company and also create rules which determine how a business will deal with any disputes which arise between its shareholders. Although this may not be enough to prevent all disputes, an effective agreement can go a long way to avoiding disputes getting to the stage of deadlock. Some shareholders' agreements also specifically provide deadlock provisions but these generally focus on issues of shareholder buy out.