What is a stock transfer form?

A Stock transfer form (or ‘STF’) is a legal document commonly used as a key component in the process of transferring ownership of shares in a company from one person (or company) to another. Stock transfer forms are usually used to transfer shares in private limited companies for which share certificates (ie legal documents attesting to shares’ ownership) exist. This is different to the process used for companies whose shares are transferred using an electronic system like ‘CREST’.

What are the key components of a stock transfer form?

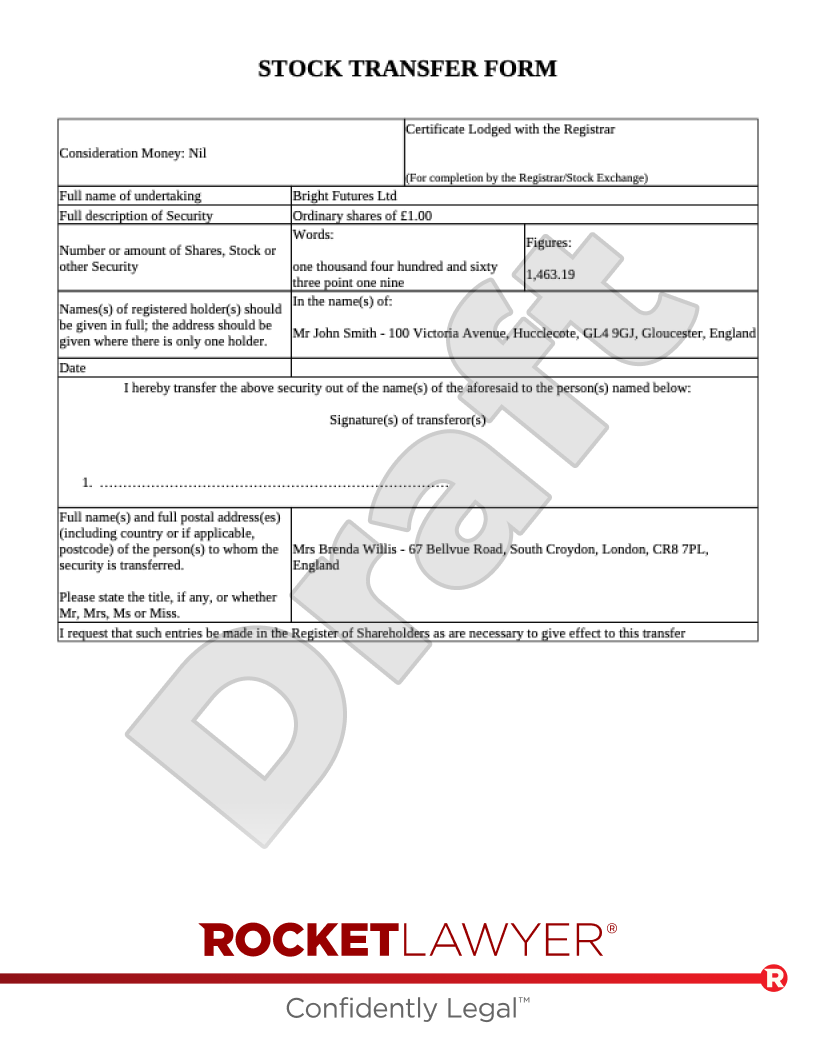

Parties to the transfer

The form identifies the registered holder (ie the current shareholder, or for a joint shareholding, all joint shareholders) and the recipient of the shares (or recipients for proposed joint shareholdings), which is the person(s) in whose name(s) the shares are now to be registered. These parties are sometimes referred to as the ‘transferor’ and the ‘transferee’ respectively.

Undertaking company

The undertaking company is the company whose shares are being transferred.

Description of the shares being transferred

Stock transfer forms must clearly identify which shares are being transferred (eg of which share class) and how many shares are being transferred.

Consideration

Consideration is the value exchanged for the shares. Consideration can be money or other things of value, including other shares, assets like property, or even things like the issuance of a life insurance policy.

Consideration provided in exchange for shares can be either chargeable (ie cash, debt, or other securities), ‘not chargeable’ (anything else of value), or a mixture of the two. How much consideration is provided and how much of it is chargeable or not chargeable has implications for how much (if any) stamp duty must be paid on the transaction (ie the share transfer). For more information on how to deal with consideration in STFs, read the guidance for our Stock transfer form template.

Stamp duty

Stamp duty is a statutory tax that must be paid when you transfer shares using a stock transfer form, unless an exception applies. It needs not to be paid if an exemption applies, no consideration at all has been provided, or no chargeable consideration has been provided.

As of April 2022, stamp duty is chargeable at a rate of 0.5% of the shares’ sale price.

Exemptions

If an exemption applies, stamp duty need not be paid. Some of the key exemptions are when the shares are being transferred:

-

in exchange for chargeable consideration (ie a purchase price) of £1,000 or less

-

as a gift (ie not in exchange for any money or other consideration)

-

between spouses or civil partners when marrying or entering into a civil partnership

-

on divorce or the dissolution of a civil partnership

-

while they’re held on trust and they’re being transferred between two trustees

-

following the provisions of a will or the intestacy rules

-

by a liquidator as part of the winding-up of a company

-

to a trust’s beneficiaries when a trust is being wound up

-

as certain types of loan capital

-

which are traded on a recognised growth market and not on any listed market

For more information on the exemptions, read HMRC’s stamp duty manual.

Certificates

If the transfer is exempt from stamp duty, or if no chargeable consideration is given for the transfer, you won’t need to pay stamp duty. In this situation, you must complete one of the certificates on the back of the stock transfer form - Certificate 1 or Certificate 2. If no consideration at all has been provided (chargeable or not chargeable), neither certificate needs to be filled in, nor does stamp duty need to be paid. Which certificate needs to be completed will depend on the consideration being paid for the shares:

-

Certificate 1 - should be completed if the chargeable consideration being paid for the shares is £1,000 or less

-

Certificate 2 - should be completed if the consideration being charged for the shares is not chargeable or if an exemption other than the under £1,000 exemption applies

Relief

There are some share transfers that qualify for relief to reduce the amount of stamp duty due (sometimes to nothing or 'nil'). Neither Certificate 1 nor Certificate 2 will need to be completed in these instances. However, you’ll still need to send the stock transfer form, along with an explanation of which relief you’re entitled to and why, to HMRC, so that they can consider your relief claim. Examples of situations in which relief may be claimed are when shares are transferred between companies in the same group or to a charity. For more information on claiming relief, read the Government’s guidance.

Enquiries

If you’re making a share transfer and you're not sure whether your transaction is exempt from stamp duty, or you’re unsure whether you’re entitled to relief from stamp duty, you can contact the HMRC Stamp Taxes Helpline.

Stamping by HMRC

Execution

It’s important to ensure that your stock transfer form is correctly signed. Usually, this will only involve signing ‘under hand’ (ie using a normal cursive signature). However, there may be more precise requirements if, for example, a company that’s transferring the shares or the company whose shares you’re transferring has more complex provisions set out in their company documents. If you create a stock transfer form using our Stock transfer form template, the ‘Make it legal’ checklist will provide more information about signing requirements.

Stamping

After it’s been signed, within 30 days of the form being signed and dated you must:

-

pay any stamp duty that’s payable. You can pay stamp duty online. Stamp duty must be paid before HMRC can process a stock transfer form

-

email your STF to the HMRC (along with any necessary supporting documents). You can email it as a scanned PDF to stampdutymailbox@hmrc.gov.uk. You do not need to send your form to HMRC for stamping if either:

-

the shares have been purchased for less than £1,000 or chargeable consideration (and they’re not part of a series of transactions or a larger transaction of more than £1,000) and Certificate 1 has been filled in

-

the transaction is subject to another exemption or there is no chargeable consideration and Certificate 2 has been filled in

-

Once they’ve processed your form, HMRC will send you a letter confirming that they’ve received your stamp duty and have ‘stamped’ your form. The stock transfer form should then be sent (usually by the transferee) to the registrar of the company whose shares are being purchased, along with the letter from HMRC (if the STF was sent for stamping) and the share certificate. The registrar will then register the purchaser as the new owner of the shares and will issue them with their own share certificate.