What is a declaration of trust?

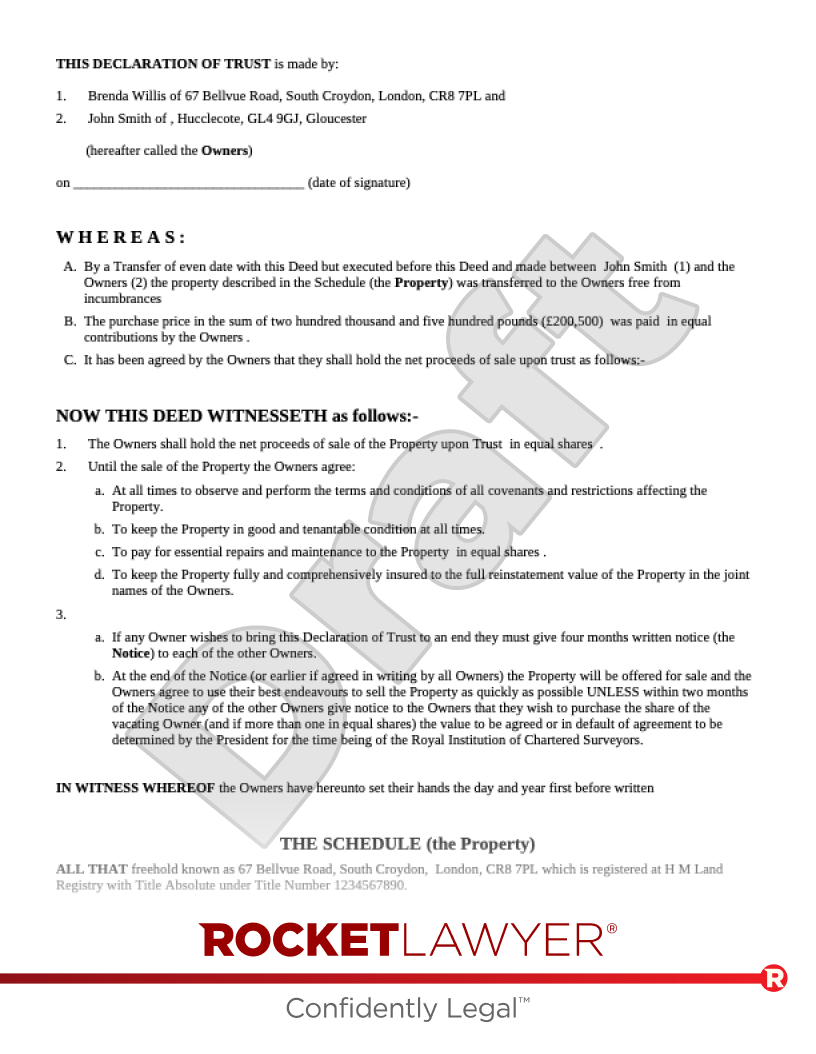

A declaration of trust is an important document in which ‘trustees’ are appointed to hold property for ‘beneficiaries’. It appoints people as trustees who are ‘trusted’ to act in an appropriate manner and always in the interests of the beneficiaries. Declarations of trusts are governed by The Trustee Act 2000.

What is a trustee?

A trustee is somebody who manages property that is held in a trust. As a trustee, you're responsible for using the money or assets in a trust to benefit somebody else.

What does a declaration of trust do?

A declaration of trust confirms the true ownership of a property in the proportions contributed by each party regardless of the title entries at the Land Registry. It can allow an owner not protected by being a registered owner of a property at the Land Registry to actually be an owner and be protected as such. The declaration of trust can be noted at the Land Registry, alerting future purchasers that the registered owner is not alone in owning the property.

When is the true ownership of property not registered?

Miss A is purchasing her first home with the benefit of a mortgage. Her parents are putting up some (or even all where there is no mortgage) of the purchase price on the basis that they will share any ‘profit’ made on the property. The registered owner on the title deeds of the property will be Miss A but her parents can register their beneficial interest on a trust deed. Completing a Declaration of trust - beneficial interest protects the parents interests without the parents having to be named on the mortgage deed themselves. It states the percentage contribution made by the beneficiaries and the percentage of proceeds of sale due to them.

Mr B and Mrs C are both contributing to buying a home together but Mrs C is still an owner of a different property with an existing mortgage. She cannot be party to another mortgage because of that. A Declaration of trust - beneficial interest states the true position and protects Mrs C’s interest as an actual owner of the property with Mr B as the legal owner and the sole mortgagee. A declaration of trust of beneficial interest states the percentage contribution made by Mrs C, and the percentage of proceeds of sale due to Mrs C.

Mr D and Mrs E are buying a property together, but are providing different contributions to the purchase price. They wish their contributions to be reflected in a legal document. Mr E is to own 60% and Mrs E is own 40%. Upon sale, they will get a respective share of the net proceeds. A Declaration of trust for tenants in common records each person's contribution and therefore the proportions of the property they own.

For more information on the different types of property interests, read Legal interest and beneficial interest in property. For more information on owning property with someone else, read Co-ownership of property.

Steps to take when making a declaration of trust

Be absolutely certain of the decision that you are making to share the ownership of a property. The trust deed changes the legal ownership. It can (and should) be protected at the Land Registry and can be enforced in court. The purchase of a property is a long term commitment, longer than some marriages and a trust deed reflecting the true ownership must be just that: the true ownership.

Work out very carefully the proportions in which you will own the property, and don’t forget to include the costs of the purchase in your calculations. If only one party is paying for the stamp duty (in England) or land transaction tax (in Wales), that should be taken into consideration when you work out the percentages. The proportions that you set out in the trust deed are the proportions that will be used to distribute the sale proceeds when the property is sold (or possibly the amounts that each party has to pay for the property to be sold if the property loses value).

The registered and true owner(s) must complete the declaration of trust together. If the declaration of trust is completed without all parties' knowledge and consent, then registration of the declaration of trust could be considered fraudulent. Once the declaration of trust is complete, make sure it is dated on the date of completion of the property purchase.

Register the deed against the title at the Land Registry when you register your purchase. If it is not registered, future purchasers will not be aware that someone else may have an interest in the property. To register your interest, complete the declaration of trust panel in Form TR1 or Form JO (which allows for a declaration of trust to be made in the absence of a transfer, assent or lease) and send it to the Land Registry.