Do I need to set up as a business to sell on Etsy?

You can sell on Etsy as an individual rather than as a business. If you do decide to set up as a business, there are various business structures to choose from. However, operating as a sole trader (ie running a business as an individual) is likely the best fit for an Etsy shop. There are benefits and obligations that come with setting up as a business. For operating as a sole trader, examples include:

-

paying income tax (note that income tax is different in Scotland)

-

carrying out a yearly self-assessment tax return

-

registering for VAT and National Insurance

-

deducting business expenses from your taxable income

Even if you don’t formally set up as a business, HMRC may consider you to be one. If you only sell products as a hobby, your shop is unlikely to be seen as a business. However, your shop is likely to be considered a business (or a ‘business for profit’) if some of the following are true:

-

you buy wholesale goods from elsewhere to make your items

-

you make your items for the purpose of selling them at a profit

-

you make regular sales for a profit

-

your shop has its own brand that you promote (eg on social media)

-

your shop is actually registered as a business on Etsy (a huge clue, but you can be considered a business even if you are not registered as such)

Can I hire employees to help with my Etsy shop?

You can hire employees to help you run your Etsy shop – even if you are a sole trader. If you decide to hire somebody, you should ensure that you create an Employment contract. If any issues arise during the course of employment, having a formalised employment contract can help to resolve conflicts by setting out the rights and obligations that you and your employee agreed to at the start of the relationship.

Health and safety considerations

As a seller, you may be responsible for any harm that your products cause to your buyers. Therefore, you need to carefully consider the safety of your products. Etsy has its own list of prohibited items (including dangerous items like flammable goods, gases and weapons). However, even seemingly benign items can make you liable under product liability laws. This could happen if they cause harm due to, for example, being negligently made.

Certain products carry additional risks. For example, making and selling food or cosmetics requires extra care due to these products’ chemical nature and their potential to cause harm by being ingested or used on sensitive parts of the body.

You should also ensure that you make your products in a manner that is safe for yourself (and any employees). Common crafting materials, such as resin, can be dangerous and safety precautions should be taken.

Complying with health and safety rules can be complicated and mistakes can happen. It is good practice to consider obtaining business insurance, such as public liability insurance, to protect yourself if legal action is taken against you.

Can I run my business from my home?

Running a business from home is increasingly common, but in some situations doing so might not be allowed. Your residential property may be subject to a restriction that prohibits the use of your property for commercial purposes. If you are unsure if this is the case, you should speak to your landlord. As most Etsy businesses are unlikely to be particularly disruptive, your landlord may give you permission to run your shop from home.

What about income tax?

Sole traders running an Etsy shop will generally need to pay income tax.

If you make less than £1,000 from self-employment in a tax year (which runs from 6 April one year to 5 April the following year) you can rely on the ‘trading allowance‘ and do not have to pay income tax on the first £1,000 of income from self-employment. If you make more than £1,000, you will need to register a self-employed business and pay taxes depending on your income.

For more information, read Personal tax in England and Wales and Personal tax in Scotland.

Intellectual property

We’ve all heard of Colin the Caterpillar, a legal rigmarole that involved large supermarket chains, but intellectual property (IP) laws affect smaller businesses too. IP laws protect intellectual property (ie intangible assets that arise out of creativity or innovation), like artistic works and inventions.

If you use somebody else’s IP without their permission, they can take legal action against you. Etsy takes allegations of IP infringement very seriously and removes any infringing items. Etsy usually engages with shops first, to attempt to resolve the situation. In serious or repeat cases, they can close a shop.

To ensure you are not breaking IP laws, it is good practice to consider the origins of your ideas to make sure they truly are your own. Even calling your items ‘similar to’ or ‘inspired by’ other brands, or making items the same shape (‘design’) as a famous product can potentially create an issue. You should also acknowledge any contributions that others have made to your products.

It is important to protect your own IP too. If you think someone is infringing your IP rights, you can report the issue to Etsy.

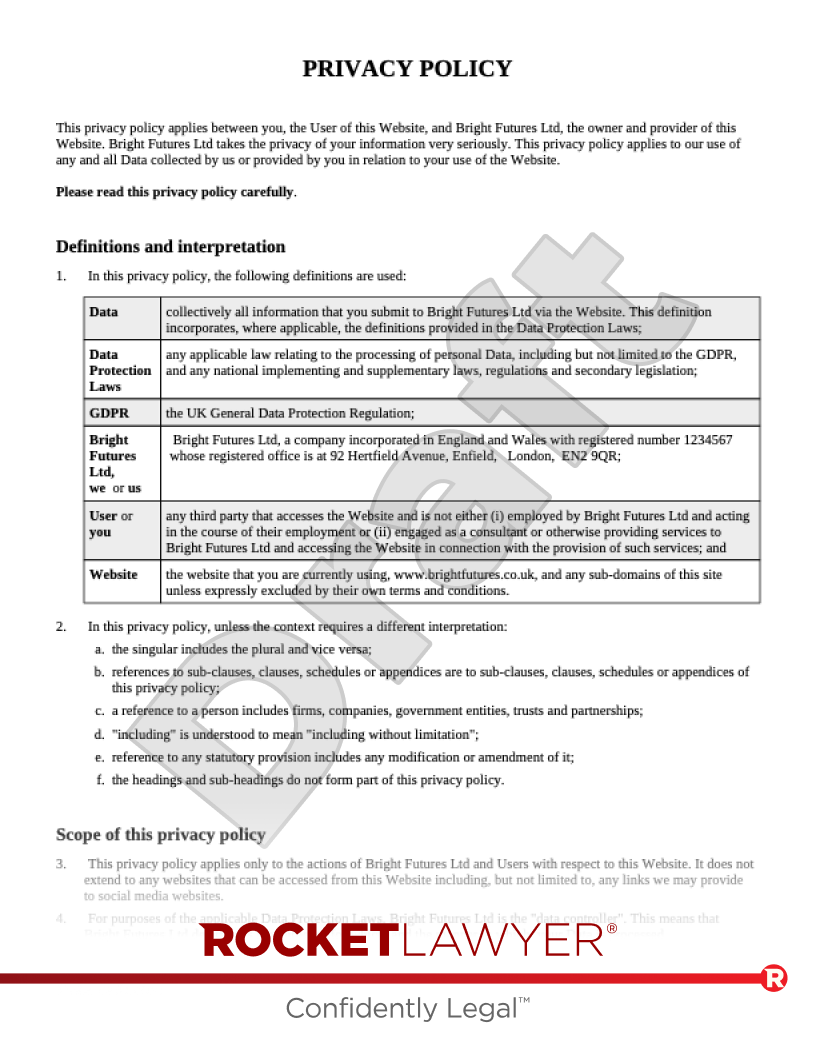

Do I need to consider data protection?

As running an Etsy shop requires you to collect and use your customers’ personal data, such as their addresses, you must consider how to protect their data and privacy.

Etsy has its own privacy rules, but you are ultimately responsible for your own privacy and data protection practices. It is good practice to make your own Privacy policy so you can ensure that you are doing everything necessary to protect your customers’ privacy.

If your business expands or you hire employees, additional data protection considerations may be relevant.

For more information, read E-commerce, Running a micro-business and Run an online business and follow our Run a business online checklist. If you don’t know where to start or if you have any questions, do not hesitate to Ask a lawyer.