What is an invoice?

An Invoice is a formal financial document issued by a seller of goods or services and sent to business customers to request payment. It is also known as a bill, although not to be confused with a receipt, which is an acknowledgement of a payment that has already been made.

Are invoices legally required?

Invoices help to protect your business’ cash flow, maintain records, and fulfil your tax obligations. You should issue invoices promptly after you have provided goods or service to a customer to avoid delays in the customer making payment.

If both you and your customer are registered for VAT, you are required by law to send them an invoice. Your business must register for VAT if your annual turnover is higher than a certain threshold, and you can choose to register if you are below the threshold.

If you’re not registered for VAT, issuing invoices generally isn’t compulsory but it is a good habit to form for small to medium businesses that often manage their own finances. Issuing invoices after each sale can help keep records throughout the year for tax and accounting purposes.

There is no prescribed statutory template for an invoice, although there are prescribed standards to which you must adhere (eg information to include) to make your invoices legally binding.

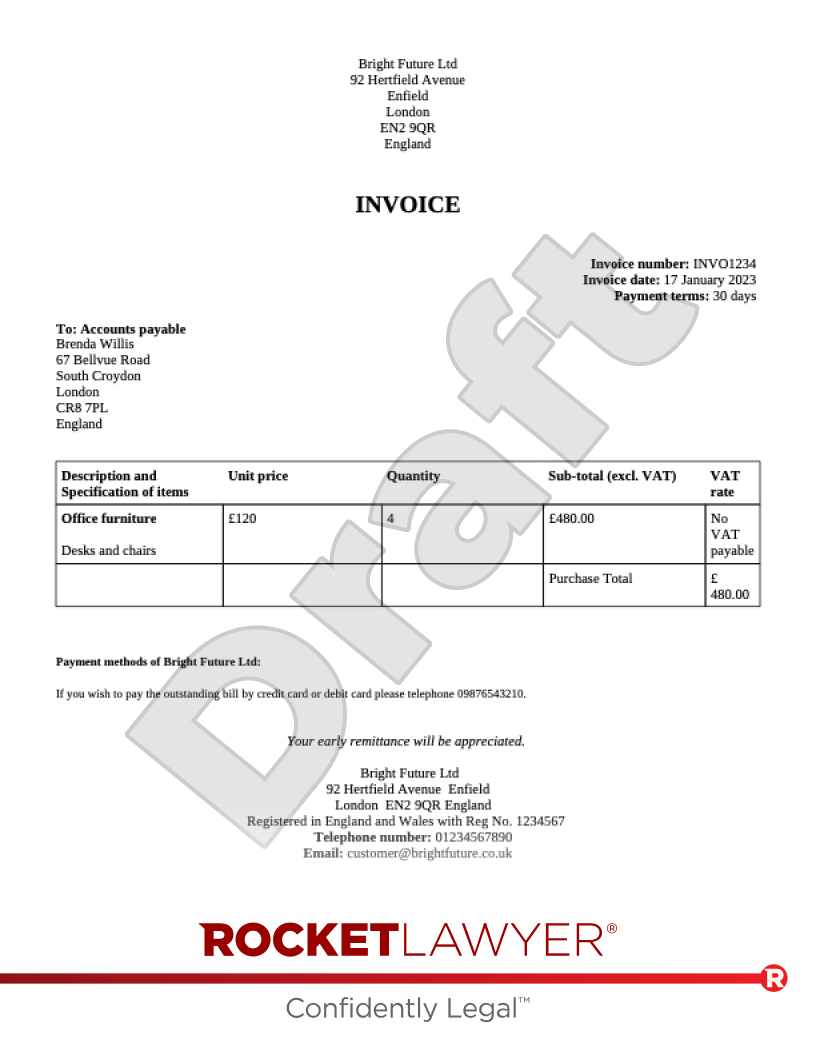

What details should be included in an invoice?

To comply with the law, you must make sure that your invoice is easy to understand, accurate, and contains the following information:

-

use of the word ‘invoice’ at the top of the document

-

a separate and unique identification number (eg INV001)

-

the seller's details. There are differing requirements for different business structures, such as:

-

companies must provide their full company name as registered on the certificate of incorporation and the company registration number

-

sole traders must provide their full name and any business (ie trading) name being used

-

-

contact and business address details of the seller

-

details of the purchaser

-

the description of goods sold or services provided

-

price and method of payment

-

date of purchase

-

date of the invoice and payment

-

the total amount owed

-

VAT amount and details, if applicable

All directors must be named if a company chooses to name directors on the invoice.

If your business and the customer are both registered for VAT, it is important that your VAT is paid on time. Failure to comply can leave your business liable to a fine. Read the government’s guidance on VAT payment penalties for more information.

When must the customer pay?

Although there are several legal requirements you must comply with when writing an invoice, you can set your own payment terms (eg discounts and upfront payments).

The customer must pay you by the due date mentioned on the invoice. If there is no due date specified, the customer must pay within 30 days of receiving the invoice for the goods or services.

What if the customer does not pay?

If the customer does not pay, you can formally request payment using a statutory demand. A statutory demand can be served as soon as the debt is due, and it is not necessary to obtain a court judgment first.

If you plan to take enforcement action by applying for a winding up or bankruptcy petition if your statutory demand doesn’t prompt payment, then it's best to ensure your statutory demand is above a certain amount. A winding up or bankruptcy petition requires a minimum of debt to be owed.

Alternatively, you can always send the customer a Debt recovery letter once payment becomes overdue.

Can I charge the interest for late payment?

You usually have the right to charge interest for late payments, but you can choose not to.

Under the Late Payment of Commercial Debts (Interest) Act 1998, you are entitled to charge interest on the late payment of debts by other businesses (ie as opposed to consumers) even if your contract with the customer does not have applicable specific provisions covering interest payments. This is called charging ’statutory interest’. Statutory interest can currently be charged at a rate 8% above the Bank of England Base Rate.

You should specify in your invoices and letters requesting payment that you intend to exercise these statutory rights. You should also send a new invoice when you have added interest onto a total amount already owed. For more information, read Calculating interest on commercial debts.

You can also charge business customers a fixed sum to cover the costs of the recovery of any debts on top of the interest that’s accrued. To learn more, read the government’s guidance on the fixed sum amount you can collect for different levels of debt.

If you have any concerns about invoicing, Ask a lawyer.