Who pays income tax?

The following may be responsible for paying income tax:

-

individuals

-

partnerships - partners are individually responsible for the tax due on their shares of partnership profits

-

personal representatives - these are individuals who manage administration of the estate of someone who has died. They often need to pay the deceased's outstanding income tax during the administration of the estate

-

trustees (ie those who hold property on trust for others) - they will be responsible for paying income tax on the income produced by a trust’s assets

Companies pay corporation tax rather than income tax.

What is the tax year?

Income tax is paid by reference to the 'tax year', which runs from 6 April until 5 April each year. It is referred to by the calendar years that it straddles. For example, the tax year beginning on 6 April 2025 is referred to as the 2025/26 tax year.

How much income tax do I pay?

When calculating income tax, you will need to work through the following steps:

1. Calculate your total income

Add together all of your before-tax taxable income.

What constitutes taxable income?

Taxable income is any type of income you pay tax on. It includes, but is not limited to:

-

money you earn from employment (including bonuses and commissions)

-

profits you make if you are self-employed (ie from goods or services that you sell)

-

taxable state benefits

-

income from renting out property

-

pensions (including most state and company pensions)

-

interest from bank and building society accounts

-

income from trusts

What does not constitute taxable income?

Certain types of income are not taxable and can, therefore, be ignored for tax purposes. Some types of income are only taxable once they’re over a certain threshold. You usually do not have to tell HM Revenue and Customs (HMRC) about income that is not taxable. Income that is not taxable includes, but is not limited to:

-

income from tax-exempt accounts, like Individual Savings Accounts (ISAs)

-

income from dividends from company shares that’s under the dividend allowance (£500 for the 2025/26 tax year)

-

the first £1,000 of income from self-employment (ie the trading allowance)

-

premium bonds or National Lottery wins

-

rent you receive from a lodger that is below the Rent a Room threshold (currently £7,500)

For more information on which income is and isn’t taxable, read the Government’s guidance on income tax. If you're unsure as to whether income is taxable or not, you can Ask a lawyer for assistance.

2. Deduct any allowable tax relief

Check whether you can claim tax relief for any payments made during the year. Allowable reliefs remove sums of money from the income tax calculation and apply to:

-

pension contributions - you can get tax relief on private pension contributions if certain conditions are met

-

charity donations - donations to charity from individuals are often tax-free (ie if they are made using Gift Aid)

-

maintenance payments - the Maintenance Payments Relief reduces your income tax if you make maintenance payments to an ex-spouse or civil partner

-

work expenses - you can claim tax relief if you are employed and use your own money for travel or things you have to buy for your job. If you are self-employed (ie if you are a sole trader or a partner in a partnership), you can get tax relief on what you spend running your business

Different types of tax relief are applied in different ways. Some tax reliefs reduce your overall tax bill by a certain amount. Others affect the amount of income that you pay tax on.

For more information, read the Government’s guidance on income tax reliefs.

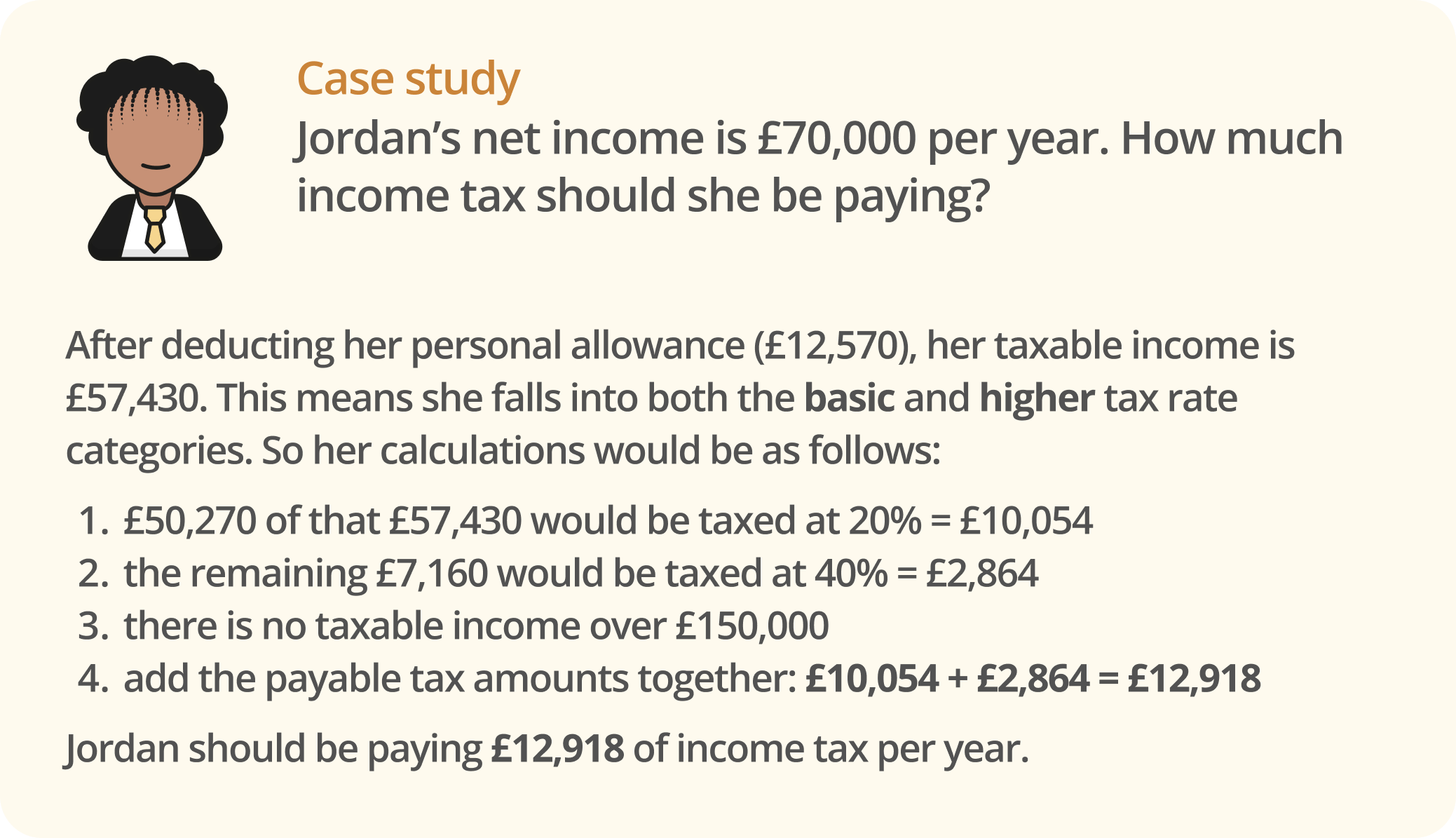

3. Deduct any personal tax allowances

Once you’ve worked out your total amount of taxable income, work out what Personal Allowance you can apply to this amount.

Most people get a Personal Allowance, ie an amount of income they can receive and not pay tax on. Once your income is above your Personal Allowance, you will need to pay tax on it at specified rates.

The standard Personal Allowance for the 2025/26 tax year is £12,570.

If your income is over £100,000, your Personal Allowance goes down by £1 for every £2 that your adjusted net income is above £100,000. This means your allowance is zero if your income is £125,140 or above.

Deduct your Personal Allowances from your total taxable income before you calculate your tax payments.

4. Calculate the tax

The income tax rates are subject to change. For the 2025/26tax year:

-

income between £12,571 and £50,270 is taxable at 20%. This is the basic rate

-

income between £50,271 and £125,140 is taxable at 40%. This is the higher rate

-

if you have income over £125,140, this is taxed at 45%. This is the additional rate

Note that your rates and calculations will be different if your Personal Allowance is reduced. You may also have to fill in a Self Assessment tax return. For more information, read the Government’s guidance on Personal Allowances and higher rates of income.

Estimate your income tax for the current year using the Government's income tax calculator.