What are Minimum Energy Efficiency Standards?

Minimum Energy Efficiency Standards (MEES) are the minimum levels of energy efficiency required for privately rented property in England and Wales. The Regulations set out the legal requirement for privately rented properties in England and Wales to have a minimum energy performance certificate (EPC) rating of E or above.

When do the MEES apply?

England and Wales

Since 1 April 2018, landlords have been prohibited from granting new tenancies for properties with an EPC rating below E. This includes extensions and renewals of existing tenancies, or a tenancy becoming a statutory periodic tenancy following the end of a fixed term. This means that landlords must not let out any substandard property to new tenants or renew or extend existing arrangements with existing tenants.

On 1 April 2020, the minimum requirement for EPC ratings of band E or higher was extended to also cover existing tenancies within the scope of the Regulations. This means that since 1 April 2020 landlords have been prohibited from renting out property that has a substandard energy rating (ie F or G). This includes periodic tenancies and existing tenancies still in their fixed term.

Scotland

Residential property in Scotland is subject to different EPC rating requirements. The Scottish band E standard requirement was removed due to challenges facing the residential private rented sector during the Coronavirus (COVID-19) pandemic. Amended plans require that properties have a band C rating as a minimum by 2025, where this is technically feasible and cost-effective. The requirement will apply regardless of technical feasibility and cost-effectiveness from 2028.

For more information, see the Scottish Government website.

What types of tenancies are covered by the Regulations?

The Regulations apply to most privately rented property in England and Wales. It covers the following tenancy types:

-

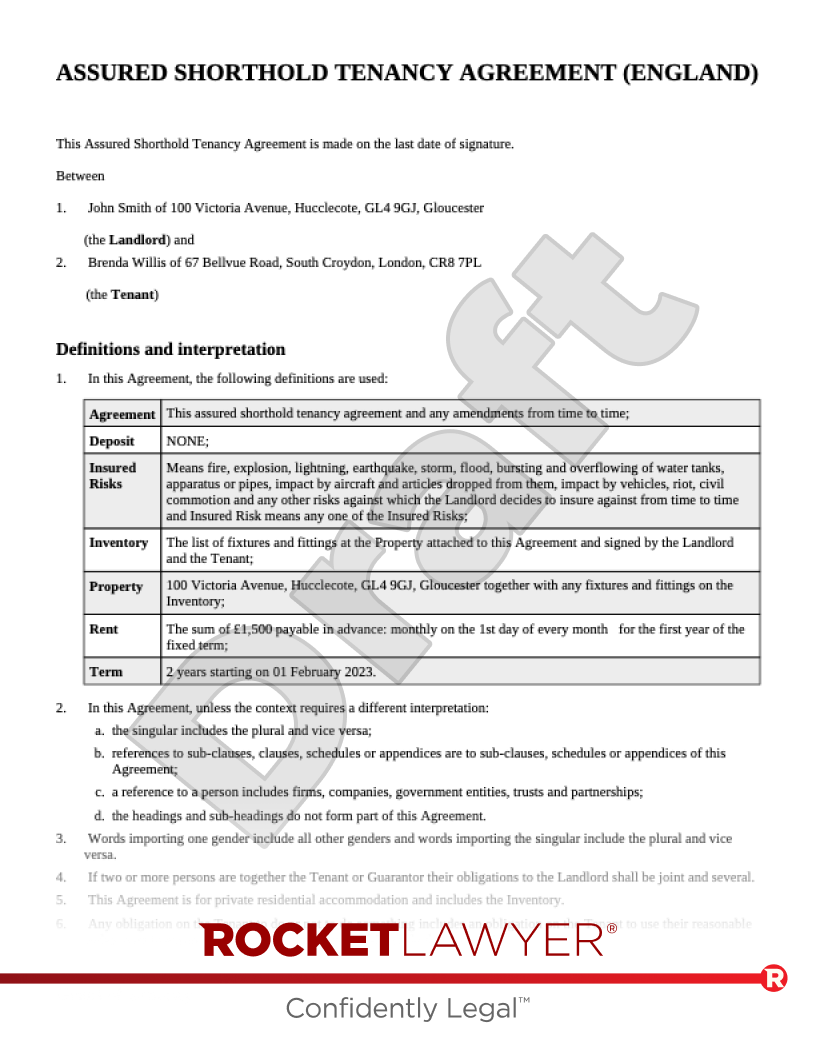

an assured shorthold tenancy

-

a regulated tenancy

-

an agricultural tenancy

Do all properties need to be band E?

The Regulations only apply to domestic properties which are legally required to have an EPC. This means that a 'trigger point' for an EPC (ie the sale or letting of a property) will bring a property within the scope of the Regulations. If a property doesn't need to have an EPC then the Regulations do not apply. For more information, read Energy Performance Certificates (EPCs).

How can landlords comply with the Regulations?

There are no specific improvement measures landlords must take. Landlords are free to do whatever they like as long as they improve the EPC rating to meet the MEES. The EPC is the most accessible source of advice as the EPC will set out recommendations for improving the energy efficiency of the property.

Landlords will never be required to spend more than £3,500 (including VAT) on energy efficiency improvements. If a property cannot be improved to the required EPC rating for £3,500 or less, all improvements possible should be made. An ‘all improvements made’ exemption should then be registered (see ‘Exemptions’ below for more information).

Funding options for property improvements include (but are not limited to):

Green Deal Finance

The Green Deal enables property owners to take out loans to pay for energy efficiency improvements in their homes or rental properties, with repayments made through the electricity bill for the improved property. Repayments are made on a 'Pay As You Save' (PAYS) basis. After the improvements have been made, the household begins to save energy and the energy bills are less than they would have been without the improvements. These savings are used to repay the loan. The finance mechanism also includes a 'Golden Rule' principle which states that the first year's repayments must not exceed the estimated first-year saving, and the overall repayment period must not exceed the lifetime of the measures installed. This is one way that landlords can meet their legal obligations with no up-front costs to them. Search for a local Green Deal Provider on the Green Deal Approved website.

Exemptions

There are a few exemptions to the Regulations available for landlords to use. If an exemption applies, landlords do not need to ensure their property meets the band E (in England and Wales) minimum. Landlords seeking to make use of one of the following exemptions must ensure it is registered on the PRS Exemptions Register, operated by the Government.

The ‘high cost’ exemption

If a landlord has undertaken all 'relevant energy efficiency improvements' (ie the cheapest recommended improvements) up to a cost cap of £3,500 including VAT, but the property remains below an energy rating of E, then the landlord would be eligible for an exemption. A 'relevant energy efficiency improvement' is one which has been identified as a recommended improvement for the property either in the EPC or a report prepared by a surveyor.

The third-party consent exemption

In some circumstances, another party’s consent may be required to make required improvements. For example, if a tenancy agreement requires the landlord to seek their tenants’ consent to undertake certain works, or if a neighbour’s consent is required to make external improvements which may impact their neighbouring property. Planning permission or consent from a mortgage lender may also be required. There is no general requirement for a landlord to seek permission from a tenant to install energy efficiency measures. If consent is refused when it is required, this exemption may apply. The exemption generally lasts 5 years, although if it is caused by a tenant’s withheld consent it will lapse at the end of that tenant’s tenancy.

Other exemptions

Other exemptions may apply in certain circumstances, including the:

-

7 year payback exemption - if making the improvements would cost more than the energy bill savings they would be expected facilitate over 7 years

-

all improvements made exemption - if all relevant energy efficiency improvements for the property have already been made and it’s rating is still sub-standard

-

wall insulation exemption - if installing wall insulation is unsuitable, ie it would negatively impact the building’s structure or fabric

-

devaluation exemption - if a report by an expert and independent surveyor shows that the property’s market value would decrease by more than 5% if the recommended improvements were made

-

new landlord exemption - if the landlord has only recently become the landlord of the property (this exemption only lasts for 6 months)

Ensure that you register any valid exemptions on the PRS Exemptions Register. You will need to submit evidence and details of your exemption to the Register. Examples of supporting evidence include letters from a local authority or an independent surveyor. The government may use this information to assist local authorities in targeting their enforcement activity.

More information on the exemptions is available on the Government’s website.

Enforcement of the Regulations and penalties for non-compliance

Every local authority will be an 'enforcement authority' for their area. Each local authority is responsible for enforcing compliance with the minimum level of energy efficiency. Where a local authority suspects that a landlord with a property in scope of the Regulations is not compliant, or that an exemption has not been proved sufficiently, the local authority can serve a compliance notice on the landlord requesting further information that it considers necessary to confirm compliance. If this is not provided, or it is provided and it is not sufficient to evidence compliance, the local authority may proceed to issue a penalty notice.

Where a local authority decides that a financial penalty is necessary, they have the discretion to decide on the amount.

The maximum penalty for a single offence is a fine of up to £5,000. Further penalties may be awarded for non-compliance with the original penalty notice where a landlord continues to rent out a non-compliant property. However, penalties would be cumulative up to a maximum of £5,000. The financial penalty can be issued in relation to each property. Therefore, if a landlord has multiple properties, they can be fined for each non-compliant property.

The local authority may also issue a publication penalty. This means that the enforcement authority will publish some of the details of the landlord's breach on a publicly accessible part of the PRS Exemptions Register. The information in the publication penalty can contain:

-

the landlord's name (except where the landlord is an individual)

-

details of the breach

-

the address of the property which is non-compliant

-

the amount of any financial penalty imposed

Appealing decisions

Landlords may appeal any penalty notice on the basis that the penalty notice was issued in error, the penalty does not comply with the Regulations, or that it was inappropriate in the circumstances for the penalty notice to have been served. The appeal would be heard at the First-Tier Tribunal (General Regulatory Chamber).

More information about enforcement is available on the Government’s website.