What is a consultant?

A consultant (also referred to as a ‘contractor’ or ‘freelancer’) is someone who provides professional services or advice. A consultant acts as an individual or through a service company and provides services to your business on a self-employed basis.

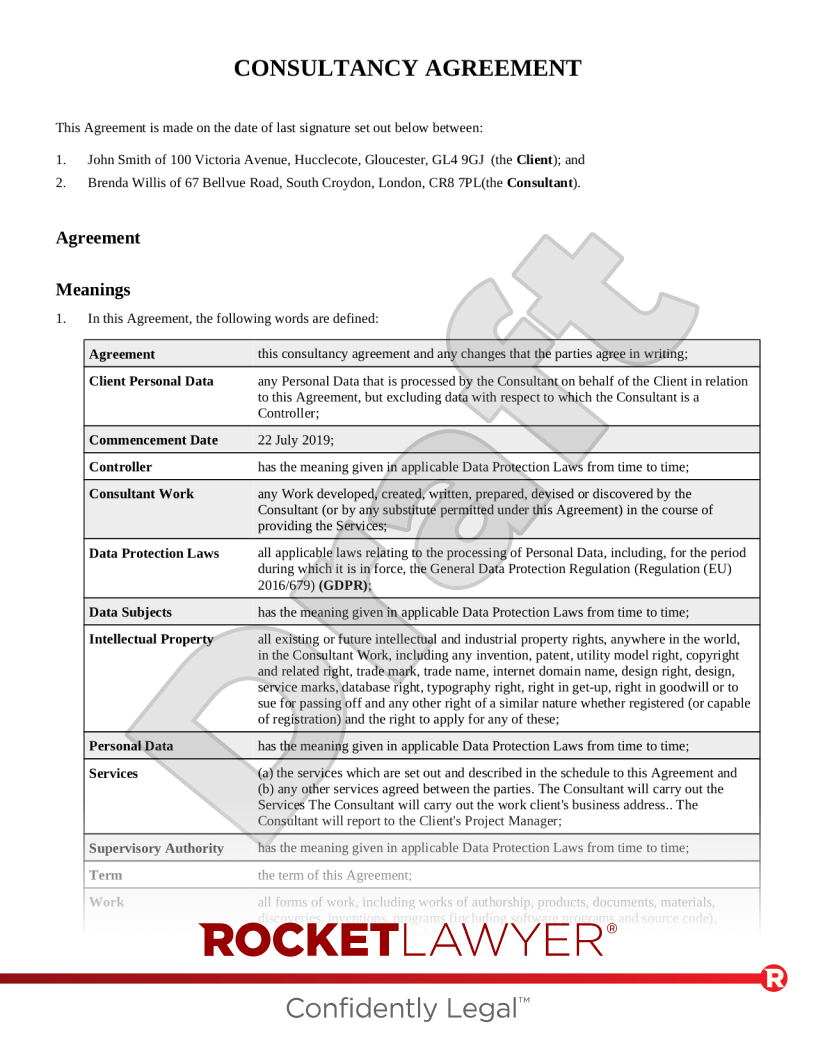

A consultant is not your employee and therefore does not have an Employment contract. Instead, the consultant provides consultancy services to your business under a Consultancy agreement. This is essentially a Services agreement between the consultant and your business, which sets out the services to be provided and the agreed payment.

Why use a consultant?

Using a consultant, rather than an employee, to provide services to your business can be an attractive option. It offers flexibility by allowing the business to use the consultant for specific projects, as and when the occasion demands, to meet the requirements of the business. Other potential advantages of consultants include:

-

financial savings because the business using the consultant should not have to pay national insurance contributions (NICs)

-

fewer obligations compared to an employee

-

in-depth knowledge and expertise which the business does not possess in-house

Things to be aware of

Simply labelling someone as a 'consultant' won't mean that they are genuinely providing services as a self-employed person if in fact they are behaving and being treated like an employee.

If the tax authorities or an Employment Tribunal decides that the 'consultant' is really your employee, they will ignore the label and treat the consultant as an employee. This may cause you to lose any advantages of a consultant relationship, such as having to pay tax under a normal employment relationship.

To avoid this situation, you need to be very careful about what's included in the consultancy agreement, particularly around issues such as:

-

how much work you have to provide

-

how much you control/supervise the provision of the services

-

the length of the appointment

-

whether the consultant is integrated into your workforce and if the consultant can work for anyone else

Consider using Rocket Lawyer's Consultancy agreement to help ensure you keep to the rules.

What about IR35?

You should be especially aware of the IR35 tax law and the changes from 6 April 2021.

IR35 was introduced to tackle tax avoidance by consultants supplying their services to clients via an 'intermediary' (ie a party who makes arrangements for or pays an individual for providing services to the client) who would otherwise be an employee.

Since 6 April 2021, all public authorities (ie third sector organisations, such as some charities) and medium and large-sized clients will be responsible for deciding the employment status of consultants. This means that the responsibility for deciding consultants’ employment statuses (and statuses for tax purposes) will therefore shift from the consultant to the client. If this tax status is incorrect, the client will be responsible for any fees and penalties, making it very important to get it right.

For more information, read IR35 and IR35 status determination. If you need legal advice on determining a consultant’s IR35 status, seek IR35 status determination advice.

Confidential information

You also need to be aware of confidentiality and intellectual property (IP) created by the consultant.

Generally, you will want to ensure that any confidential information a consultant has access to during their engagement remains confidential even after they stop working for you. Similarly, you will want to ensure that any IP created by the consultant over the course of the engagement belongs to you and not the consultant.

Rocket Lawyer's Consultancy agreement covers both confidentiality and intellectual property.

Data protection considerations

The process of engaging a consultant will result in you collecting and handling the consultant's personal data (ie information which relates to the consultant who can be personally identified from the data, like their name and address). As part of their engagement, the consultant is also likely to process personal data belonging to you as the client. As such, you should be aware of the UK General Data Protection Regulations (GDPR) and the Data Protection Act 2018.

For more information, read Data protection and Processing personal data.

Can you ask for a retainer fee?

A consultant retainer involves a fixed, guaranteed payment made by a client which effectively puts the consultant on 'stand-by', to be called upon as and when the client requires them.

The retainer may be paid for a set period of time but enables the client to access the consultant’s services when the need arises. However, whether or not to accept a retainer fee will need to be a commercial decision for the consultant to make.

Consultants will need to be aware of the implications of accepting a retainer fee, including how it affects their contractor status. This is because the very nature of the arrangement attaches to its obligations (ie for you to pay the freelancer an ongoing fee in return for the expectation for the contractor to make themselves available, normally at short notice).

Before deciding whether to offer a consultant a retainer, you should consider how the retainer may affect their employment status for IR35 purposes.