Incorporating a company in the UK as a non-UK resident

Fundamentals

Whether you’re a UK resident or not, if you decide to set up your business in the UK as a company, you must follow certain steps to incorporate (ie form) it. For example, you must decide what type of company you will form and who its directors will be, and you must register it with Companies House. For more information, read How to register a company in 5 steps.

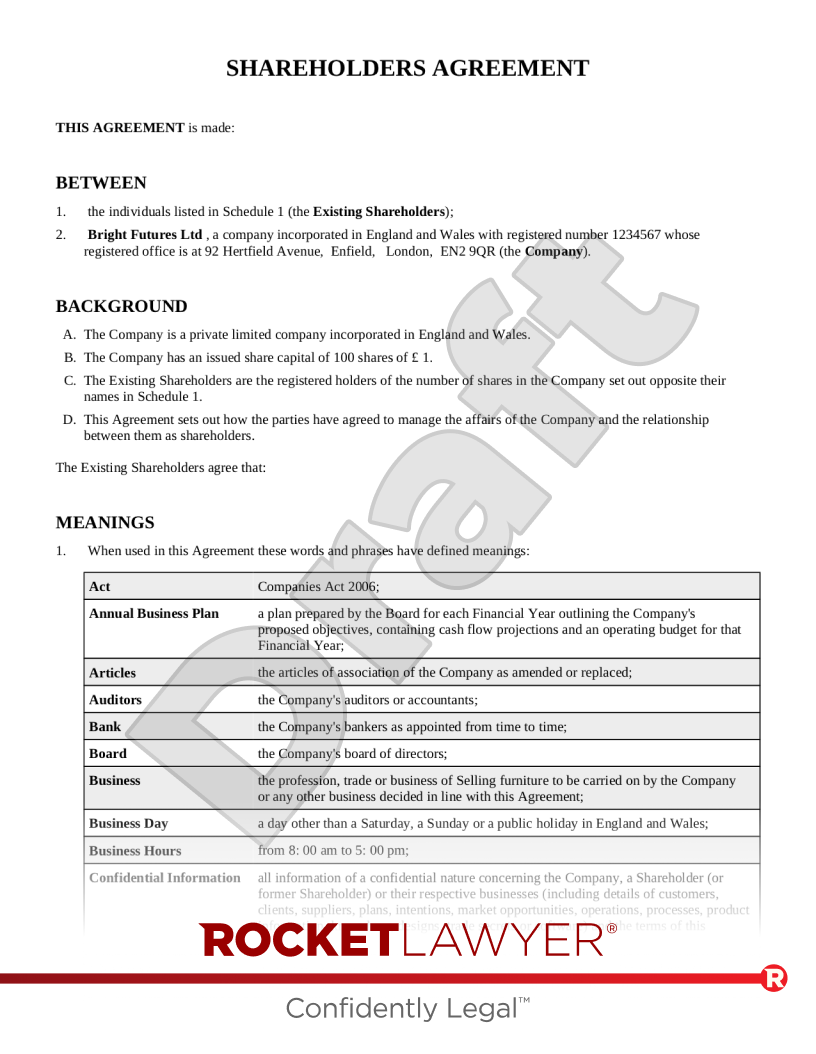

You’ll also have to create certain legal documents when you set up your company, such as Articles of association and a Shareholder’s agreement. For more information, read Run a private limited company.

Do non-resident company owners need to have a UK bank account?

It is not necessary to have a UK bank account to trade in the UK. However, having a UK business account or personal bank account will help transactions to be processed more smoothly and without exorbitant fees.

It’s not necessary to live permanently in the UK to open a UK bank account. However, UK residency rights and a UK home address are often required (a registered office address isn't usually sufficient). Alternatively, various international bank account services are available with major banks.

Can a UK company be run by an agent on behalf of a non-resident?

It is possible for non-residents to set up and run a UK company entirely or partly via a UK business agent (eg a registered incorporation agent who submits your registration for you). An agent will charge a fee for their services, the level of which will depend on the level of services required. You should use a formal contract to create your agency agreement, which will usually be governed by the UK’s agency laws.

Operating your overseas-incorporated company in the UK

Businesses that have been incorporated abroad may operate in the UK.

If your company is ‘established’ in the UK, the Companies Act 2006 requires that you register its particulars with Companies House. If your company’s presence in the UK is not permanent enough to be considered established, you need not register.

Is my company ‘established’ in the UK?

A company will be considered as having an establishment in the UK if it has a physical presence, for instance:

-

a branch, or

-

another place of business in the UK, which is either somewhat permanent or which is recognised as a location of the company’s business. For example:

-

a place of management

-

an office

-

a factory

-

a workshop

-

a site or installation for the exploration or extraction of natural resources, or

-

a building site or construction or installation project

-

It’s not necessary for establishment that the activities the company carries out at this site are its core business activities - they may only be supporting activities.

If your company does business in the UK via an agent, it may or may not be considered established in the UK. If your agent is independent (eg they act in the ordinary course of their business when acting for you), their presence in the UK will usually not mean that your company is established in the UK. If you have an agent acting for you who is not independent of your company (eg they’re always doing business in the UK on your behalf), this may constitute your company being established in the UK.

Registering particulars

Registering particulars means submitting certain details about your company and its UK establishment to Companies House. These details include, but are not limited to:

-

the company’s name and legal structure in the country in which it is incorporated

-

which jurisdiction it’s incorporated in

-

who its directors and secretary are

-

the address and functions of its UK establishment

-

who is authorised to represent the company in the UK, and the extent of their authority

Overseas companies must register with Companies House within one month of opening a UK establishment. They can do so by filing Form OS IN01, ‘Register a UK establishment of an overseas company’, along with a registration fee (£20 as of August 2022) and other required documents. If a company is registering its first UK establishment, these documents include:

-

a certified copy of the company's constitution documents (including a certified English translation if required)

-

the latest set of company accounts (including a certified English translation if required), if the company is legally required to prepare and disclose these in its own country

For more details, read the Government’s guidance.

Does an overseas business need to pay corporation tax in the UK?

A non-resident company is generally only subject to UK corporation tax if it does business in the UK via a permanent establishment. So, if you register your company in the UK, you will most likely need to register for and pay UK corporation tax.

Do overseas company directors need to pay income tax in the UK?

UK non-residents who earn income in the UK must usually pay income tax in the UK. They may be able to take advantage of the Personal Allowance (ie the yearly amount of income on which income tax doesn’t need to be paid) if they’re a European Economic Area (EEA) citizen or they are a citizen of a country that has a double-taxation agreement with the UK (ie a bilateral international agreement that prevents people from having to pay tax in both countries). Otherwise, the full tax is usually due in respect of any income earned by non-residents. People may also need to pay further income tax in their resident country. Bear in mind, however, that double taxation agreements may not always apply to certain categories of people, such as company directors.