MAKE YOUR FREE LLP Agreement

What we'll cover

What is an LLP Agreement?

When should I use an LLP Agreement?

Use this LLP Agreement:

-

to clarify the partners' contributions to and their capital shares in the LLP

-

to set out the partners' profit shares

-

to set out how decisions are to be made within the partnership

-

only for LLPs registered in England, Wales, or Scotland

Sample LLP Agreement

The terms in your document will update based on the information you provide

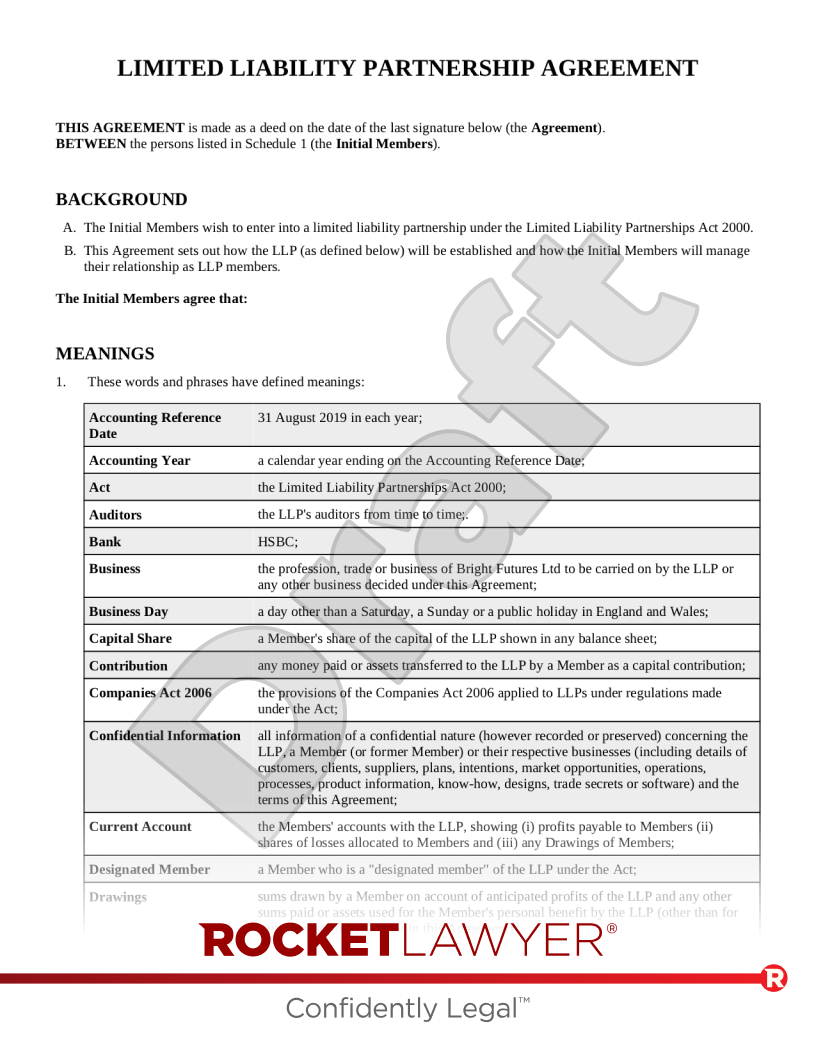

LIMITED LIABILITY PARTNERSHIP AGREEMENT

THIS AGREEMENT is made as a deed on the date of the last signature below (the "Agreement").

BETWEEN the persons listed in Schedule 1 (the "Initial Members").

BACKGROUND

- The Initial Members wish to enter into a limited liability partnership under the Limited Liability Partnerships Act 2000.

- This Agreement sets out how the LLP (as defined below) will be established and how the Initial Members will manage their relationship as LLP members.

The Initial Members agree that:

MEANINGS

- These words and phrases have defined meanings:

Accounting Reference Date in each year; Accounting Year a calendar year ending on the Accounting Reference Date;

Accounts

means the profit and loss account and balance sheet of the LLP drawn up in accordance with clauses below;

Act the Limited Liability Partnerships Act 2000; Auditors the LLP's auditors from time to time; Bank ; Business the profession, trade or business of to be carried on by the LLP or any other business decided under this Agreement; Business Day a day other than a Saturday, a Sunday or a public holiday in England and Wales; Capital Share a Member's share of the capital of the LLP shown in any balance sheet; Contribution any money paid or assets transferred to the LLP by a Member as a capital contribution; Companies Act 2006 the provisions of the Companies Act 2006 applied to LLPs under regulations made under the Act; Confidential Information all information of a confidential nature (however recorded or preserved) concerning the LLP, a Member (or former Member) or their respective businesses (including details of customers, clients, suppliers, plans, intentions, market opportunities, operations, processes, product information, know-how, designs, trade secrets or software) and the terms of this Agreement; Current Account the Members' accounts with the LLP, showing (i) profits payable to Members (ii) shares of losses allocated to Members and (iii) any Drawings of Members; Designated Member a Member who is a "designated member" of the LLP under the Act; Drawings sums drawn by a Member on account of anticipated profits of the LLP and any other sums paid or assets used for the Member's personal benefit by the LLP (other than for any expenses provided for in this Agreement) . Exit Date the date a Member retires, is deemed to retire or is expelled from the LLP; Expenditure Limit £; Initial Members

means the parties to this agreement (other than the LLP) as listed in Schedule 1;

Intellectual Property all patents, rights to inventions, copyright and neighbouring and related rights, moral rights, trademarks, service marks, business names and domain names, goodwill, rights in designs, rights in computer software, database rights, confidential information (including trade secrets and know-how) and all other intellectual and industrial property and similar rights, whether registered or unregistered, and including (a) all renewals or extensions of these rights and (b) all applications and rights to apply for and be granted these rights which subsist in any part of the world; Leaving Member a Member who has retired, been deemed to retire or been expelled from the LLP; LLP the limited liability partnership incorporated under the Name and registered at Companies House with number ; Members the Initial Members and any other additional persons admitted as Members of the LLP in accordance with this Agreement at any time;

Members' Resolution a decision taken by Members the value of whose Capital Shares together exceed 50% of the overall Capital when the decision is taken; Name or another name from time to time registered by the LLP at Companies House; Payment Date the day of each calendar month or, if not a Business Day, the Business Day immediately following; Profit Share a Member's agreed proportion of any profits or losses of the LLP; Start Date the date of incorporation of the LLP; Tax any income tax, capital gains tax or National Insurance contribution payable by any Member arising from their status as a member of the LLP, their share of the profits of the LLP or the proceeds from the sale of any LLP assets.

- In this Agreement, unless the context means a different interpretation is needed:

- including means "including without limitation";

- words denoting the singular include the plural and vice versa, and words denoting any gender include all genders;

- a person includes firms, companies, government entities, trusts and partnerships;

- a party means a party to this Agreement and includes its assignees and successors in title and, in the case of an individual, to their estate and personal representatives;

- reference to a paragraph or Schedule is to a paragraph or Schedule of or to this Agreement (and the Schedules form part of this Agreement);

- reference to a statute or statutory provision includes any modification of or amendment to it, and all statutory instruments or orders made under it; and

- reference to writing or written includes faxes and email but not any other type of electronic communication.

- The headings in this document are for convenience only and do not affect the interpretation of this Agreement.

PRELIMINARIES

Registration

- The LLP was incorporated under the Act on .

- The LLP's certificate of incorporation issued under the Act will be kept at the registered office of the LLP.

Commencement and Duration

- This Agreement shall take effect on the Start Date.

- The LLP will carry on the Business.

- The LLP will continue until wound up in line with the provisions of the Act.

- The LLP will on registration be deemed to ratify and assume responsibility for any contract entered into by a Member prior to the registration of the LLP for the benefit of the LLP and with the express or implied consent of the other Members. The LLP will indemnify Members against all claims, liabilities and costs of such contracts.

Name and Registered Office

- The LLP's registered office will be , , .

- The Members can change the Name and/or the registered office of the LLP by unanimous agreement and must notify Companies House if they do so.

Place of Business

- The Business will initially be carried on from the registered office.

Designated Members

- Each Member will be a Designated Member.

- A Designated Member can resign as a "designated member" (but will remain a member of the LLP) on notice to the LLP and the other Members. Any notification which means the number of Designated Members falls below two will not take effect until the Members have appointed a new Designated Member to fill the vacancy.

Members' Initial Contributions and Shares

- On the Start Date, or as otherwise agreed, each Initial Member must make an initial Contribution as set out in Schedule 1. The Contribution must be:

- paid in cash, and/or

- with the agreement of all the other Members, a contribution of assets.

- On the Start Date, each Initial Member's Profit Share is the proportion against their name in Schedule 1.

ACCOUNTING AND FINANCIAL MATTERS

Property and Assets

- The LLP owns absolutely all property and equipment (including computers and ancillary equipment, office equipment, furniture, books and stationery) and all Intellectual Property held or created by the LLP to carry on the Business which has been paid for by the LLP, contributed to the LLP by a Member or otherwise accrued to the LLP.

- The Members have no individual rights in the property and assets of the LLP other than by virtue of their entitlement to such capital distribution as may be due to them under this Agreement or following liquidation of the LLP.

- Members must record the LLP's interest in any property held by them on its behalf using a declaration of trust or other acknowledgement. The LLP will indemnify the relevant Member(s) against all liability relating to that property after the Start Date.

- Members must promptly notify the LLP of all Intellectual Property which they have created (or partly created) and which relates to the Business or can be used in the Business. All this Intellectual Property will vest in the LLP automatically on creation (and if it does not, the relevant Member(s) will hold it on trust for the LLP). Members must, at the LLP's sole expense, promptly do everything and sign all documents necessary to transfer ownership of this Intellectual Property to the LLP and enable the LLP to enforce its Intellectual Property.

Accounts

- The Members must maintain accounting records giving a true and fair view of the Business, the state of affairs and profit and loss of the LLP.

- The accounting records must be kept at the LLP's registered office (or any other place the Members agree) and must be open to inspection by the Members during normal business hours on Business Days in accordance with the Companies Act 2006.

- The LLP's annual Accounts must be:

- accompanied by the Auditors' report (unless the LLP is exempt from audit);

- sent to and approved by the Members;

- signed by a Designated Member on behalf of all the Members; and

- filed at Companies House.

- Unless the LLP is exempt from audit under the Companies Act 2006:

- the Designated Members can appoint and reappoint the Auditors under the Companies Act 2006, fix their remuneration and remove them from office; and

- the LLP's annual Accounts will be audited and settled by the Auditors.

- The Members can by unanimous agreement change the LLP's Accounting Reference Date and the Designated Members must notify any change to Companies House.

Banking Arrangements

- The LLP will open a bank account with the Bank.

- All money and payments received by or on behalf of the LLP will be paid promptly into the LLP's bank account and all securities for money will be promptly deposited in the LLP's name with the Bank.

- All cheques or instructions for the electronic transfer of money from any account of the LLP with the Bank will be in the LLP's name and can be drawn or given:

- for amounts up to and including the Expenditure Limit, by any Designated Member; and

- for amounts in excess of the Expenditure Limit, by two Designated Members.

In the case of instructions for electronic transfer, written confirmation of those instructions will be signed by the authorising Designated Member(s).

Capital

- The Members can from time to time require some or all of the Members to make a further Contribution needed for the Business but cannot require Members to contribute any additional capital on the LLP's insolvency

- If a Member makes a Contribution after the Start Date they will acquire a new Capital Share or increase their existing Capital Share by an amount equal to the amount or value of that Contribution and their Profit Share will be set or adjusted as agreed by the Members.

- A Member can make a Contribution by payment to the LLP or by transfer from their Current Account.

- The Members will share any profits of a capital nature in proportion to their Contributions.

- No Member is entitled to any interest on the amount of their Capital Share unless agreed by the Members.

Profits and Losses

- The Members will allocate the profits and losses of the LLP between themselves:

- as soon as they have approved the annual Accounts for the relevant Accounting Year; and

- in proportion to the Profit Shares set out in Schedule 1 or as otherwise unanimously agreed, with the appropriate proportionate reduction for any Member who joined the LLP during the relevant Accounting Year.

- All Members are responsible for calculating and accounting for their own Tax and shall, within any time requested by the LLP or Auditors, supply the information requested for the purposes of such calculation and shall promptly submit all returns required by the HM Revenue & Customs.

- If any losses to be debited to a Member are greater than the value of their Current Account, the balance must be deducted from their Capital Share. If any sums are to be debited against a Member when their Current Account and their Capital Share are both exhausted, then the sum must be set-off against any other monies owed to them by the LLP or, if none or insufficient for that set-off, the balance can be set off against any future credits due from the LLP to the Member.

- For the avoidance of doubt, any losses allocated to a Member cannot exceed the amount of their aggregate Contributions and Members do not have to pay any sums to the LLP in respect of any unsatisfied element of these debits.

Drawings

- On each Payment Date, each Member can draw a sum on account of their share of the LLP's profits as the Members reasonably calculate, having allowed for the LLP's ongoing working capital needs.

- Any further payments or any transfer of assets to or on behalf of any Member will only be made or transferred if agreed by the Members.

- If the annual Accounts show that in the relevant Accounting Year any Member drew more than their share of the LLP's profits for that Accounting Year, that Member must repay the excess immediately, together with interest on the excess at a rate of % above the Bank's base rate at the time.

DUTIES AND ENTITLEMENTS

Members' Obligations and Duties

- Each Member must at all times:

- devote all their time and attention to the Business except when on holiday, on leave as described in the paragraph below (Maternity, parental and family leave), or when incapacitated because of illness, injury or another serious cause;

- not engage in any business other than the Business or accept (other than in a voluntary or honorary capacity) any office or appointment unless the engagement is agreed by the Members;

- not benefit from the use of the Name, the property, or the Business connection of the LLP unless agreed by the Members;

- conduct themself in a proper and responsible manner and use their best skill and all reasonable endeavours to promote the Business;

- comply with all statutes, regulations, professional standards and other provisions applying to the conduct of the Business;

- show the utmost good faith to the LLP;

- promote the interests of the LLP for the benefit of the Members; and

- account to the LLP for any profit derived from any business, office or appointment accepted by them in breach of this Agreement, or any personal benefit derived by them from the use of the Name, the property or the business connection of the LLP in breach of this Agreement.

Confidentiality

- Except as set out in the following paragraphs, the Members must not at any time disclose any Confidential Information to any other person or use for it any purpose other than the performance of their obligations as Members. This obligation will continue to bind a Member after they stop being a Member.

- The obligation of confidentiality in the previous paragraph does not apply to information that is or becomes generally available to the public (other than as a result of its disclosure by a Member in breach of this Agreement).

- A Member can disclose Confidential Information to:

- a governmental, regulatory or other authority if disclosure is required by law, court order or a duty imposed by a regulatory authority;

- his professional advisors; or

- the professional advisers of the LLP.

Holiday

- In each calendar year, each Member is entitled to days' holiday on Business Days, to be taken at times agreed with the other Members and having regard to the needs of the Business at that time.

Maternity, Parental and Family Leave

- Members are permitted the maternity, parental leave and family leave to which they would have been entitled under the Employment Rights Act 1996 if they were employees of the LLP with more than one year's continuous service.

Expenses

- Each Member is entitled to claim back out-of-pocket expenses properly incurred by them in connection with the Business on provision of a receipt and VAT invoice where appropriate.

- The Members can decide to place upper limits on any category or categories of expenses which can be claimed.

MANAGEMENT

Meetings

- The Business will be managed by the Members.

- Meetings of the Members will be held at least times a year and Members must use all reasonable efforts to attend.

- Meetings of the Members can be called by not less than Members.

- Not less than days' notice of the meeting must be given to all those entitled to attend, but a meeting can be convened at shorter notice if all the Members agree in writing.

- Each meeting notice must specify the time, date and venue of the meeting and outline the matters to be discussed.

- Meetings will be held at the LLP's registered office unless another venue is agreed by all the Members in writing.

- Members may attend a meeting by telephone or video conferencing if all the Members agree in writing.

- At the beginning of the meeting the Members present will appoint a Designated Member to be chairman for that meeting who will have a casting vote.

- The quorum for a meeting of the Members is Members.

- No business will be conducted at a meeting unless a quorum is present in person or, if agreed by all the Members, by telephone or video conferencing. If a quorum is not present within 30 minutes of the time appointed, or if during a meeting a quorum ceases to be present, the meeting will be adjourned until a time and date agreed by the Members unanimously in writing.

- Minutes of each meeting will be prepared, approved by the Members at the next meeting and signed by the chairman as evidence of the proceedings.

- A Member who has an interest in any business to be transacted at a meeting will count towards the quorum but can only vote on such business after declaring their interest.

Decision Making

- Other than the matters set out in the following paragraphs, all decisions of the Members are made by a Members' Resolution.

- Proxy voting is permitted.

- A decision on any of the following matters must be taken with the agreement of all the Members:

- a change in the nature of the Business;

- the opening or closing of any place of business of the LLP;

- a change to the Name;

- a change of the LLP's registered office;

- a change in the Profit Shares;

- a change in the location where the LLP's accounting records are kept;

- the admission of any Member;

- authorising the service or revocation of any notice from the LLP requiring a Member to retire because they have been unable to perform their duties as a Member for certain reasons as set out in the paragraph (Leaving Members) and sub-paragraph (Retirement) below;

- the appointment of any Member as a Designated Member or the revocation of any such appointment;

- the appointment of all Members for the time being as Designated Members or any reversal of such a decision;

- the purchase of any capital item or connected items exceeding the Expenditure Limit;

- the borrowing or lending by the LLP of a sum exceeding the Expenditure Limit;

- the giving of any guarantee or undertaking by the LLP for a sum exceeding the Expenditure Limit;

- an increase in or the repayment of any Member's Capital Share;

- the commencement of any legal proceedings by the LLP;

- the voluntary winding-up of the LLP;

- any amendment to this Agreement; and

- placing the LLP into administration or voluntary liquidation, appointing a liquidator, making a proposal for a voluntary arrangement, scheme of compromise or arrangement with its creditors, or applying to the court to wind up the LLP.

- Any decision or action to be taken by the Members can be taken without a meeting if all the Members concerned unanimously consent to it in writing.

RISK MANAGEMENT

Limitations on Members' Powers as Agents

- Members can only do the following with all Members' agreement:

- engage or dismiss any employee of the LLP;

- pledge the credit of the LLP or incur any liability or lend any money on behalf of the LLP, but agreement is not required if this is (i) in the ordinary course of business (ii) for the benefit of the LLP and (iii) the amount is less than or equal to the Expenditure Limit;

- pledge the credit of the LLP or incur any liability or lend any money on behalf of the LLP above the Expenditure Limit;

- give any guarantee or undertaking on behalf of the LLP for any sum or connected sums above the Expenditure Limit;

- compromise or compound or (except on payment in full) release or discharge any debt or connected debts due to the LLP if these are above the Expenditure Limit.

- Members must not:

- have any dealings with any person the Members have previously resolved not to deal with;

- allow the LLP to enter into any bond or become bail or surety for any person;

- knowingly cause or permit anything to be done where the property of the LLP could be taken in execution or otherwise jeopardised;

- assign, mortgage or charge their interest in the LLP; or

- make an application to the Court under section 994 of the Companies Act 2006.

Member Indemnity

- The LLP will indemnify each Member from and against all payments made and personal liabilities incurred by them in the performance of their duties as a Member in the ordinary course of the Business or in respect of anything necessarily done by them for the preservation of the Business or the property of the LLP.

Insurance

- The LLP will obtain and maintain policies of insurance (for its benefit or its Members' benefit) against risks and for amounts as the Members agree for:

- any property of the LLP;

- employers' liability;

- public liability;

- professional negligence;

- loss of profits resulting from the destruction of or damage to premises used to carry out the Business;

- loss of profits resulting from the destruction of or damage to or theft of any plant equipment, chattels, cars and other vehicles, including in the case of any computers or ancillary equipment any virus or corruption or loss of any software or data; and/or

- private health insurance for the Members and employees of the LLP,

and any other insurance policies the Members consider appropriate.

- The Members agree to provide any information and undergo any medical examination(s) reasonably required to obtain any of these policies.

Guarantees and Indemnities

- If a Member gives a guarantee on behalf of the LLP after obtaining the Members' consent by Members' Resolution:

- if the guarantee is called on and the Member makes a payment due under that guarantee, the Member in question is entitled to be indemnified immediately by the other Members, so that the amount or aggregate amounts payable under the guarantee will be borne by the Members in the same proportions as the Members share profits and losses of the LLP; and

- on the death, dissolution, retirement, deemed retirement or expulsion of that Member the other Members must:

- use their best endeavours to make the person having the benefit of the guarantee release that Member (or their estate) from the guarantee;

- provide a substitute guarantor if required by that person as a condition of release;

- jointly and severally indemnify the Member in question (or their estate) against any liability under the guarantee arising after that Member's Exit Date.

- For the avoidance of doubt, nothing in the above paragraph requires any Member to indemnify any other Member against a claim or liability resulting from the negligent act or omission of that other Member.

NEW MEMBERS

- If the Members want to admit an additional Member they will negotiate in good faith any amendments to this Agreement and/or ensure the prospective Member signs a deed of adherence under which they agree to be bound by this Agreement.

- The Designated Members must notify Companies House of the appointment of the new Member.

LEAVING MEMBERS

Retirement

- A Member can retire from the LLP by giving not less than months' written notice to the LLP. Their Exit Date will be the date that notice expires.

- A Member will be deemed to retire from the LLP:

- immediately on their death and their Exit Date will be the date of their death;

- on expiry of at least three months' written notice from the LLP requiring them to retire as a Member because they have been unable to perform their duties as a Member for either:

- a continuous period of 12 months or more; or

- an aggregate period of 12 months or more during the previous 24-month period.

Any period of holiday or leave described in the paragraph above (Maternity, parental and family leave) is excluded from this calculation. A notice under this paragraph is of no effect if the Member who has been served the notice satisfactorily resumes their duties as a Member before the notice expires and the LLP decides to withdraw the notice; or

- immediately if the LLP serves them written notice requiring them to retire as a Member after they have become a patient under the Mental Health Act 1983 and their Exit Date will be the date of that notice.

Expulsion

- The other Members may by written notice (signed by all of them) to the Member concerned expel that person immediately from membership of the LLP if that person:

- commits a serious breach of this Agreement which is either incapable of remedy or is not remedied within Business Days after it occurs;

- commits persistent breaches of this Agreement;

- has a bankruptcy order made against them;

- fails to pay any money owed by them to the LLP within 10 Business Days of a written request for payment from the LLP or any Designated Member;

- is guilty of any conduct likely to have a serious negative effect upon the Business; or

- no longer holds a professional qualification or certification required for the normal performance of their duties as a Member.

- If the Members are not already aware, a Member must inform the other Members as soon as possible after the occurrence of an event mentioned in the above paragraph.

- The expulsion notice must give sufficient details of the alleged breach or breaches.

- The expelled Member's Exit Date is the date of expiration of the expulsion notice.

Provisions Relating to Leaving Members

- If a Member retires, is deemed to retire or is expelled on a date other than an Accounting Reference Date:

- he is not entitled to receive any share of the profits of the LLP from their Exit Date;

- the LLP is not obliged to prepare any accounts other than the Accounts which would normally be prepared for the next Accounting Reference Date; and

- the profits of the LLP shown in those Accounts will be apportioned on a time basis for the periods before and after the Member's retirement, deemed retirement or expulsion in order to calculate the amount of their Capital Share.

- On retirement, deemed retirement or expulsion of a Member the LLP will owe them the amount of their Capital Share as shown in the Accounts of the LLP as at either the Accounting Reference Date following his Exit Date or the Accounting Reference Date that is their Exit Date. For the avoidance of doubt, there will be no goodwill payable to them.

Payments to Leaving Members

- On the death of a Member the LLP must:

- on the first day of the next three months, pay an amount equal to their normal monthly Drawings then applicable. These payments will be made to the deceased Member's personal representatives, widow or another person as the LLP decides in its absolute discretion (but the LLP is not concerned whether or not the recipient(s) of these payments will prove to be entitled at law to the deceased Member's estate); and

- pay the Member's Capital Share (after allowing for the payments referred to in the above paragraph to the deceased Member's personal representatives as soon as reasonably practical but in any case within one year of their death (together with interest at the Interest Rate on the amount payable).

- On the retirement, deemed retirement (other than on a death) or expulsion of a Member, the LLP will pay to the retiring or expelled Member the amount of that Member's Capital Share (together with interest at the Interest Rate on any part of it outstanding). The payment will be made by four equal six-monthly instalments. The date of the first instalment will be either the Accounting Reference Date following their Exit Date or the Accounting Reference Date that is their Exit Date. Instalments can be paid earlier by the LLP at its discretion.

Leaving Members' Obligations

- Each Leaving Member must pay into the LLP's bank account immediately all sums due from them to the LLP and any of these sums which are not paid will be recoverable from them by the LLP as a debt.

- Each Leaving Member must return to the LLP all accounting records, letters and other documents in their possession relating to the LLP which are needed for the continuing conduct of the Business. While the Leaving Member is owed money by the LLP, they or their duly authorised agents are permitted to inspect by appointment the LLP's accounting records, letters and other documents to the extent they relate to any period preceding the Exit Date.

- Each Leaving Member must promptly do all things and sign all documents reasonably requested by the LLP (and at the LLP's sole expense) to assign or transfer to it any property or assets which immediately prior to the Exit Date were owned by or vested in the Leaving Member as nominee for or in trust for the LLP.

GENERAL

Winding Up

- No Member has agreed with the other Members or the LLP that they will contribute in any way to the LLP's assets on the winding up of the LLP.

- Any surplus assets of the LLP at the conclusion of the LLP's winding up (and after payment of all money due to the LLP's creditors and all expenses of the winding up) will be distributed to the Members in proportion to their respective Profit Shares at the time.

- If a court makes any declaration requiring any Member to make a Contribution to the assets of the LLP then the other Member(s) will indemnify that Member so that the overall amount payable is borne by the Members in proportion to their respective Profit Shares at the time.

Entire Agreement

- This Agreement contains the whole agreement between the parties relating to its subject matter and supersedes all prior discussions, arrangements or agreements that might have taken place in relation to the Agreement. Nothing in this paragraph limits or excludes any liability for fraud or fraudulent misrepresentation.

Assignment

- No party may assign, transfer, sub-contract, or in any other manner make over to any third party the benefit and/or burden of this Agreement without the prior written consent of the other party or parties, such consent not to be unreasonably withheld.

Variation

- No variation to this Agreement will be valid or binding unless it is recorded in writing and signed by or on behalf of the parties.

Notices

- Any notice (other than in legal proceedings) to be given to a Member under this Agreement must be in writing and delivered by handing such notice to the Member in question personally, by sending it pre-paid first class post to or leaving it by hand delivery at the last known address of the Member in question or, being addressed to such Member, by sending it pre-paid first class post to or leaving it by hand delivery at the registered address of the LLP or by sending it by email to an address notified by the Member in question as being an address at which such Member is prepared to accept service of notices.

- Notices which are:

- sent by post will be deemed to have been received, where posted from and to addresses in the United Kingdom, on the second Business Day after the date of posting, and where posted from or to addresses outside the United Kingdom, on the tenth Business Day after the date of posting;

- delivered by hand will be deemed to have been received at the time the notice is left at the proper address; and

- sent by email will be deemed to have been received on the next Business Day after sending.

Miscellaneous

- The Contracts (Rights of Third Parties) Act 1999 shall not apply to this Agreement and no third party will have any right to enforce or rely on any provision of this Agreement.

- Unless otherwise agreed, no delay, act or omission by a party in exercising any right or remedy will be deemed a waiver of that, or any other, right or remedy.

- Provisions which by their intent or terms are meant to survive the termination of this Agreement will do so.

- If any court or competent authority finds that any provision of this Agreement (or part of any provision) is invalid, illegal or unenforceable, that provision or part-provision will, to the extent required, be deemed to be deleted, and the validity and enforceability of the other provisions of this Agreement will not be affected.

Governing Law and Jurisdiction

- This Agreement will be governed by and interpreted according to the law of England and Wales. All disputes arising under the Agreement will be subject to the exclusive jurisdiction of the English and Welsh courts.

SCHEDULE 1

Details of Initial Members

This Agreement has been executed as a deed on the date(s) below.

| Executed as a deed by acting by | |

| , Member | |

| in the presence of: | |

| Witness signature | |

| Name of witness | |

| Address | |

| Occupation | |

| Date | |

About LLP Agreements

Learn more about making your LLP Agreements

-

How to make an LLP Agreement

Making your LLP Agreement online is simple. Just answer a few questions and Rocket Lawyer will build your document for you. When you have all the information about the partnership prepared in advance, creating your document is a quick and easy process.

You’ll need the following information:

The LLP

-

What is the LLP’s name, registered address, registered number, and date of incorporation?

-

Does the LLP have an address for its place of business that is different to its registered address?

-

What type of business will the LLP undertake?

Accounting and finances

-

Which date is the end of the LLP’s accounting year?

-

On which day each month can members draw down (ie take) money from the LLP in advance of their expected share of profits?

-

If a member withdraws more than they are actually entitled to in a year, what interest rate will be charged on the amount to be repaid?

-

What is the name of the LLP’s bank?

-

What is the monetary threshold above which payments or purchases must be authorised by at least two designated members, and above which borrowing or lending carried out, guarantees given, or capital item purchases must be agreed to by all members?

-

Will the LLP pay members their gross profit share, or will the LLP retain the amount of tax likely to be due from members and pay it on their behalf?

Assets

-

Will you include a schedule listing the property owned by the LLP at its beginning?

Members

-

What is each member’s name and address?

-

How much has each member contributed to the LLP? This may be a monetary amount established based on assets that a member has contributed.

-

What is each member’s percentage share of the profits (this may be in proportion to their contributions or different)?

Entitlements under the LLP

-

What is members’ annual leave entitlement?

-

Do members receive any benefits besides annual leave, family leave, and repayment of expenses?

Meetings and management

-

What is the minimum number of days’ notice required to hold a members’ meeting?

-

If there is a deadlock situation when voting (ie a tie vote), does the chairperson have a casting (ie deciding) vote?

-

What’s the minimum number of members required (ie the quorum) for the business conducted at a members meeting (eg the passing of resolutions) to be valid?

-

Can members vote by proxy (ie via a person authorised to vote on their behalf)?

-

Is a specified number of members required to call a meeting? If so, how many?

-

What’s the minimum number of members’ meetings that must be held each year?

Retirements, expulsions and appointments

-

How many months’ notice is required before a member can retire from the LLP?

-

How many days after committing a serious breach of the LLP Agreement does a member have to remedy the breach before they may be expelled from the LLP?

-

Will obligations (eg restrictive covenants) be imposed on members once they leave the LLP (eg by retirement or expulsion)?

-

If so, within a radius of how many miles is a leaving member prohibited from competing with the LLP’s business for 12 months after the member’s exit?

-

The LLP Agreement

If the LLP is based in Scotland, will the Agreement be governed by the laws of England and Wales or the laws of Scotland?

-

-

Common terms in an LLP Agreement

LLP Agreements set out the terms for the running of a new LLP. To do this, this LLP Agreement template includes the following terms and sections:

This Agreement is made as a deed…

This section identifies the parties to the Agreement (ie the members/partners, referred to as ‘Initial Members’) by reference to Schedule 1 of the Agreement. It also identifies that this Agreement is made as a deed, a special type of legal document subject to additional formalities when executed (eg signed).

Background

The purpose of the Agreement is identified as facilitating and setting out the terms for the members’ entering into and managing an LLP as governed by the Limited Liability Partnerships Act 2000.

Meanings

This definition table assigns specific meanings to key terms used throughout the Agreement. When these terms (eg 'Capital Share’, ‘Designated Member’ or ‘Drawings’) are used capitalised throughout the Agreement, they carry the meaning they’re given in this table.

Registration

This section sets out the LLP’s incorporation date and states that its certificate of incorporation will be kept at its registered office.

Commencement and duration

By reference to details set out in the Meanings table, this section identifies when the Agreement starts, what the LLP will do (ie its business), and how long it will continue for (ie until wound up).

It also explains that any contracts entered into by members for the LLP’s benefit before the LLP’s registration will be deemed to have been ratified by the LLP. This essentially means that the LLP assumes responsibility for any such contracts and will indemnify the members against the costs of any relevant claims related to these contracts.

Name and registered office

This section sets out the LLP’s registered office address and states that the members can change the LLP’s name if they all agree to do so.

Place of business

The LLP’s primary place of business is set out here, whether the same as or different to the registered address.

Designated members

Here all members are appointed as designated members. This section also explains how members may resign as designated members but not from the LLP itself.

Members’ initial contributions and shares

This section explains how much each member is contributing to the LLP at its start, either in cash or in assets assigned cash value. The section identifies these initial contributions and members’ profit shares by reference to Schedule 1 of the Agreement.

Property and assets

This section explains how various assets, including intellectual property, are owned and held by the LLP and its members. For example, if a member holds property for the LLP’s benefit, they should set this out in a declaration of trust or a similar document. Intellectual property created in relation to the business should be notified to the LLP and will be the property of the LLP.

Accounts

Obligations regarding accounts are set out here. For example, accurate accounting records should be maintained and kept at the LLP’s registered office or similar and must be available for inspection. The annual accounts must generally be accompanied by an auditor’s report, signed by a designated member, and filed at Companies House.

The section also notes how the accounting reference date can be changed.

Banking arrangements

This section explains how the LLP’s members should deal with payments received (ie by depositing them with the LLP’s bank) and how electronic transfers of money or cheques can be used for transactions with, depending on the amount, different numbers of designated members’ authorisation.

Capital

This section explains when and how members might make additional contributions to the LLP’s capital and makes provisions for how any such added capital is to be managed (eg by the contributing member’s profit share increasing).

Profits and losses

This section explains that the LLP’s profits and losses will be allocated between members in the shares specified in Schedule 1 of the Agreement. It sets out whether or not the members or the LLP are responsible for paying tax on income and explains what happens if the losses allocated to a member are greater than their current account (ie their account with the LLP of profits minus any losses and drawings).

Drawings

Members’ entitlement to draw money in advance from their anticipated profit share for a year is set out here. The section explains when members’ agreement is needed during this process and specifies the interest rate to be paid on any excess owed if a member draws more than they are eventually allocated as a profit share.

Members’ obligations and duties

This section sets out various obligations imposed on members. For example, each member should:

-

give time and attention to the business except when, for example, on leave or incapacitated

-

not engage in any other businesses without the other members’ agreement

-

comply with laws and professional standards applicable to the business’ conduct

-

promote the LLP’s interests for the benefit of all members

Confidentiality

This section sets out members’ obligations to protect and not disclose the LLP’s confidential information, except in specified rare circumstances.

Holiday

The members’ annual leave entitlement and when it may be used are set out here.

Maternity, parental and family leave

This section states that members are to receive the statutory maternity leave, parental leave, and other family leave rights (ie those they’re entitled to under the law) that they would be entitled to if they were employees with at least one year’s service with an employer.

Expenses

The members’ entitlement to reclaim expenses incurred by their activities in connection with the business is set out here.

Other entitlements

If members of your LLP are to receive any additional entitlements (eg paid volunteering days or annual travel stipends), these will be set out here.

Meetings

This section sets out rules for how the LLP’s meetings will be held. For example, it specifies the minimum number of members needed to hold and to call a meeting and how meetings can be joined (eg by video conference if the members agree in writing). The requirement for a quorum to be present in order for business to be carried out is explained.

Decision making

This section explains how decisions about the LLP can be made. Certain decisions are identified as requiring the agreement of all members. For example, changes to the name or nature of the business, changes to members’ profit shares, admission of a new member, or changes to this LLP Agreement. Decisions not set out in the list may be made by a members’ resolution (ie with the assent of members whose collective capital shares’ value exceeds 50% of the overall capital share value).

If your LLP allows proxy voting this will be set out here, as will the alternative decision-making method of consent by writing.

Limitations on members’ powers as agents

The members of an LLP are automatically considered agents of the LLP (ie they may act on its behalf to, for example, enter into contracts on the LLP’s behalf during commercial transactions). This section sets out limitations on members’ agency powers. For example, members cannot without the other members’ agreement hire or dismiss any employees or lend money or release any debts above the LLP’s expenditure threshold.

This section also sets out things that members must not do regardless of other members’ consent. For example, they must not assign their interest in the LLP to another party or deal with any persons that the members previously resolved not to deal with.

Member indemnity

The LLP provides an indemnity to the members, covering them for payments made and personal liabilities (eg debts or losses) incurred by the members’ acting in the course of the LLP’s business.

Insurance

This section sets out which types of insurance the LLP should maintain, at amounts and of a scope agreed to by the members. These include, for example, public liability insurance, professional negligence insurance, private health insurance for the members, and insurance for loss of profits due to certain occurrences.

Guarantees and indemnities

This section explains how a guarantee (eg a promise to repay a debt) given by a member (with the other members’ consent) to another party on the LLP’s behalf is managed. For example, if the member makes a payment under such a guarantee, the other members will indemnify the member (ie share the costs). What happens when a member holding such a guarantee leaves the LLP is also explained.

New members

This section explains how, if a new member is admitted to the LLP, they will be required to abide by the LLP Agreement (ie by signing a ‘deed of adherence’ promising to adhere to the Agreement). Amendments to the Agreement may also be negotiated.

Retirement

This section sets out the amount of notice a member must give to leave the LLP and sets out various instances in which a member will be deemed to have retired (eg if they die, have been unable to perform their duties as a member for an extended period of time, or if they have become a patient under mental health legislation for certain reasons and the LLP requires them to retire).

Expulsion

One member may be expelled (ie removed) from the LLP by the other members giving written notice in certain situations. For example, if the member commits a serious breach of the LLP Agreement and doesn’t remedy it within a specified number of days, has a bankruptcy order made against them, or doesn’t pay money they owe to the LLP when requested within a specified timeframe.

Provisions relating to leaving members

This section explains what happens when a member retires or is expelled from the LLP. For example, they will stop receiving a profit share and their remaining allocated profits will be calculated in a specified way (eg based on divisions of time). The member will also receive the amount of their capital share.

Payments to leaving members

This section explains how the capital share and any regular monthly drawings will be paid to a member’s personal representatives or similar if they die. It also explains how a capital share will be paid out if a member leaves the LLP for a reason other than death.

Leaving members’ obligations

Obligations imposed on members when they leave the LLP include:

-

paying the LLP any sums that the member owes it

-

returning any documents (eg accounting records) of the LLP that the member has in their possession

-

signing documents and taking other required actions to assign or transfer to the LLP any assets held by the member for the LLP

-

if you’ve chosen to include them, non-solicitation and non-compete clauses preventing the leaving member from engaging in competing business with the LLP within a specified geographical radius, from attempting to deal with the LLP’s clients, and from attempting to hire the LLP’s members and employees

Winding up

If the LLP is winding up (ie stopping trading whilst being in debt), this section sets out what will happen. For example, members will receive portions of the money from any surplus assets (ie those left after settling the LLP’s debts). If any member has to contribute to assets during the winding up process the other members will indemnify them against this (ie the costs will be paid in proportion to the members’ profit shares).

Entire agreement

This section states that this Agreement is the whole agreement between the parties (ie there are no additional terms). This helps avoid confusion if, for instance, other terms were in contemplation during negotiations.

Assignment

Parties are prevented by this section from assigning or otherwise transferring (eg by subcontracting) their benefits or obligations under the LLP Agreement to another party without the members’ written consent.

Variation

This section prevents any changes to this Agreement from being legally binding unless they’re made in writing and signed by all members.

Notices

This section sets out how any notices or other similar communications that are given under the Agreement should be delivered.

Miscellaneous

This section deals with various other points of law that govern how this Agreement operates. For example:

-

excluding the Contracts (Rights of Third Parties) Act 1999 or the Contract (Third Party Rights) (Scotland) Act 2017. This essentially means that third parties (ie not the members) that would otherwise be able to enforce obligations under this Agreement under the Act cannot do so

-

stating that, if part of the Agreement is found to be void or illegal or similar, the rest should remain valid and enforceable

Governing law and jurisdiction

This section sets out which country’s legal system must be used to resolve any disputes (ie the Agreement’s ‘jurisdiction’). This is necessary as the legal systems of England and Wales and of Scotland are different.

Schedule 1 - Details of initial members

This is where the names, addresses, capital contributions, and profit shares of each initial member of the LLP are set out.

Schedule 2 - Property

This schedule, if included, contains details of the assets the members have each contributed to the LLP.

This Agreement has been executed as a deed…

The Agreement ends by providing spaces for all founding members to sign the LLP Agreement. It’s highlighted that the document is signed as a deed, as one of the legal requirements for the valid execution of a deed.

If you want your LLP Agreement to include further or more detailed provisions, you can edit your document. However, if you do this, you may want a lawyer to review the document for you (or to make the changes for you) to make sure that your modified LLP Agreement complies with all relevant laws and meets your specific needs. Use Rocket Lawyer’s Ask a lawyer service for assistance.

-

-

Legal tips for members

Consider the implications of entering into an LLP

An LLP is a formal legal entity, membership of which comes with numerous obligations. Some of these are related to general business performance (eg acting in the business’ best interests and maintaining accounts), while others are less well known (eg the possibility of indemnifying other members for certain guarantees or debts they make or hold on the LLP’s behalf). These obligations do come with benefits, for example, the ability to run a business with limited liability.

It’s important that, if you want to enter into an LLP, you truly understand what this means and your responsibilities regarding the LLP. For more information, read Setting up a partnership, Running your business, and Running a partnership. Make sure that you properly read your LLP Agreement before signing and that you understand all of its provisions. Ask a lawyer if you need help understanding anything.

Understand when to seek advice from a lawyer

In some circumstances, it’s good practice to Ask a lawyer for advice to ensure that you’re complying with the law and that you are well protected from risks. You should consider asking for advice if:

-

your business is a general partnership (rather than an LLP) or another type of organisation

-

you want to convert an existing partnership into an LLP

-

the LLP is registered outside England, Wales and Scotland

-

some of the LLP’s partners are not individuals

-

you want to make different provisions for your LLP and its members (eg enhanced leave rights or different voting procedures)

-

LLP Agreement FAQs

-

What is included in an LLP Agreement?

This LLP Agreement template covers:

-

who the members (ie the partners) are

-

initial set-up considerations and general administration matters

-

members' capital interests and profit shares

-

members' duties and entitlements

-

management and decision-making

-

risk management

-

what happens when members leave

For more information, read Setting up a partnership and Running a business partnership.

-

-

Why do I need an LLP Agreement?

If you want to form an LLP, to run a business with limited liability and yet the flexibility of a partnership, make sure you do so using a formal written document. This ensures that all provisions for the LLP’s running are clearly set out.

This straightforward LLP Agreement is ideal for businesses run by several owner-managers. Not only does it limit liability, it also sets clear rules for sharing power and profits. It provides a sound basis for the operation of a partnership and deals with a variety of matters from incorporation and decision-making through to members leaving.

-

How do I register an LLP?

You must register your LLP at Companies House. You will then receive a certificate of incorporation, which will include the registered number of the LLP and its date of registration.

When choosing a name for your LLP, make sure that the name is not already being used by someone else. For more information, read Setting up a partnership.

-

What is the registered address of an LLP?

A registered address is an LLP's official 'home' on record at Companies House. All official correspondence addressed to the LLP is sent to its registered address. The LLP may operate on a day-to-day basis from a different address to its registered address.

-

What is the date of incorporation?

The date of incorporation is the date on which an LLP is registered at Companies House. This date can be found on the certificate of incorporation.

-

What is the end of an accounting year and can it be changed?

An accounting year (or 'financial year') is usually a 12-month period for which an LLP has to prepare accounts. For new LLPs, the year-end date will automatically be set as the last day of the month during which the first anniversary of the LLP's incorporation occurs. You can agree to change this to a more convenient date, which must be notified to Companies House using Form LL AA01.

-

What are the LLP designated members?

Designated members of an LLP are members who are responsible for making sure the LLP complies with its legal obligations. Designated members also have authority for money transfers.

This LLP agreement makes all members designated members, meaning that all members are equally responsible for these matters. The law requires that an LLP has at least 2 designated members.

For more information, read Running a partnership.

-

How do I control finances in an LLP?

Under this LLP Agreement, cheques and electronic money transfers above a certain specified threshold need to be authorised by at least 2 designated members. Transfers for amounts below the threshold can be authorised by one designated member.

Any borrowing or lending carried out, guarantees given, or purchases of capital items made by the LLP above the same specified threshold will need the consent of all of the members.

The threshold an LLP sets will depend on the type of business it carries out and the sorts of amounts typically involved in its activities on a day-to-day basis.

-

When can members draw money in advance of their expected share of profits?

On a specified day of each month, members can draw down (ie take) some of their profit shares for a year, rather than having to wait until annual accounts have been drawn up after the end of the accounting year. However, members must be careful to ensure that any amount they draw from the LLP on account of expected profits is based on realistic predictions informed by profits actually made.

-

What happens if a member has withdrawn too much money?

If a member has withdrawn more money than they are actually entitled to in a year they can repay the excess with interest, added at a rate a stated percentage above the base rate of the bank where the LLP has its account.

-

How do I decide what each member will contribute to the LLP?

When setting up an LLP, you can include a schedule listing the property owned by the LLP at the start of the partnership. This provides a record of what each member contributed to the LLP (ie cash or non-cash assets). It can also show which assets the individual members did not intend to be owned by the LLP but instead lent or licensed to the LLP.

If a member contributes assets rather than money, the amount that the members agree makes up the value of those assets must be determined.

-

What are the members’ tax options?

Rather than distribute to the members their gross profit share (ie profits before any tax deductions), you can choose to make the LLP responsible for holding back the tax that the auditors expect will be due from the members. This approach helps ensure that members pay their taxes on time and avoids the risk of a member becoming bankrupt and jeopardising the LLP and its assets.

-

What other matters should be decided in an LLP agreement?

There are many other matters which can be decided when creating this LLP agreement, to ensure clarity of entitlements and decision-making. These include:

-

annual leave entitlements, family leave provisions, and provisions for repayment of expenses

-

other entitlements (eg car allowances, private health insurance, and pension schemes)

-

the minimum number of days' notice required to hold a members’ meeting

-

whether, when a members' vote is tied, the chairperson has a casting (ie tiebreaking) vote

-

how many members need to be present at a meeting to ensure it is quorate (ie can validly make business decisions)

-

whether members can vote by proxy (ie appoint someone to vote on their behalf)

-

the minimum number of months’ notice that should be given by a member wanting to retire from the LLP

-

the number of days a member has to remedy a serious breach of the LLP Agreement before the other members can expel them from the LLP

-

restrictive covenants and geographical non-compete provisions imposed on leaving members

-

Our quality guarantee

We guarantee our service is safe and secure, and that properly signed Rocket Lawyer documents are legally enforceable under UK laws.

Need help? No problem!

Ask a question for free or get affordable legal advice from our lawyer.