What is a dividend?

Dividends are a type of distribution of company assets paid to company shareholders. Dividends normally take the form of cash payments which reflect a certain proportion of annual profits. Each shareholder generally receives a portion of the overall dividend which corresponds to their level of shareholding.

In the UK, company directors sometimes take dividends instead of drawing a salary, for tax efficiency purposes.

How does a dividend differ from a director's loan?

Dividends paid to director shareholders are subject to tax (although the rates are different to taxation on salary payments). A director's loan, on the other hand, is not considered to be a payment in the same way as a dividend. As a result, and depending on the arrangements, tax may not need to be paid. For further information, read Director's loans.

What are the rules for the payment of dividends?

Rules relating to the payment of dividends are set out in the Company Taxation Manual. The manual states that dividend payments are unlawful if there are insufficient company profits to cover the amounts paid. This means that company directors should establish that there have been sufficient profits before agreeing on any dividend payments.

Further, any dividend payments must follow the correct procedure (see below).

What is the procedure for making a dividend payment?

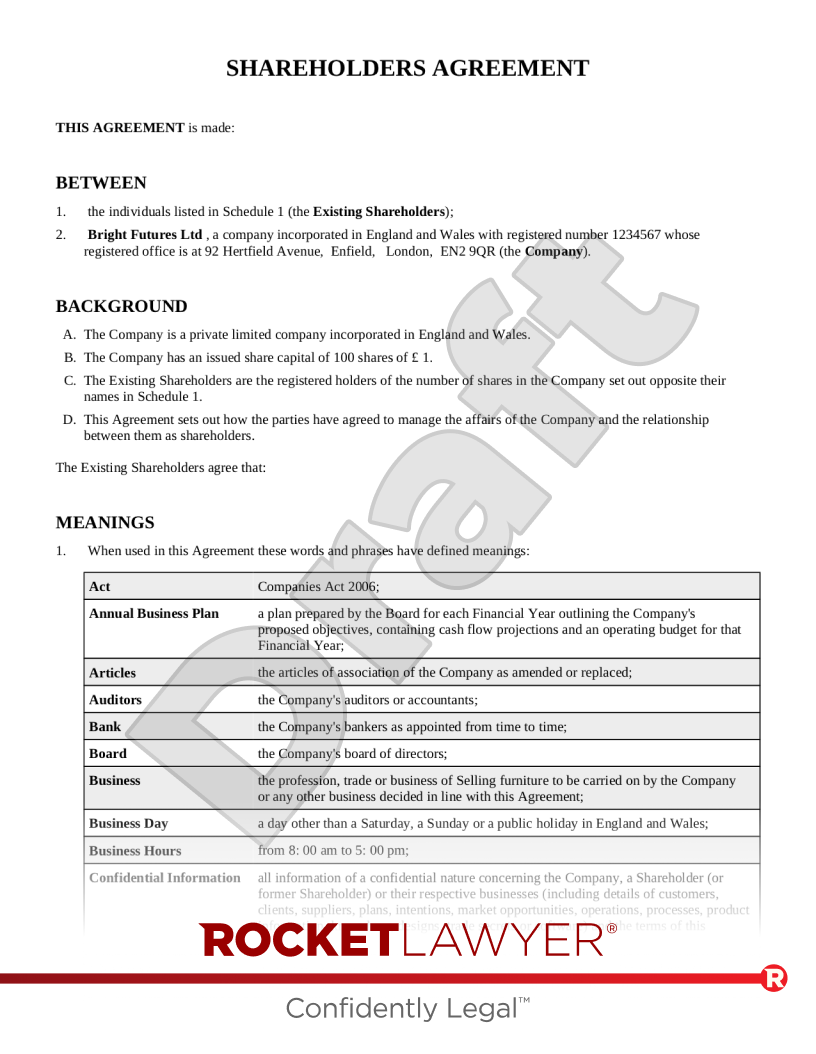

The procedure for paying dividends is normally set out in the company's Articles of association. Reference should also be made to any relevant provisions contained in a Shareholders' agreement.

As a general rule, interim dividends (ie those paid during the course of the financial year) may be approved by the board of directors. A final dividend (ie those paid at the end of a financial year) normally requires approval by shareholders in the form of an ordinary resolution (ie a majority of shareholders need to agree on a decision).

Dividend vouchers must be issued to all shareholders who receive a dividend. Public companies must also properly prepare interim accounts and file these with Companies House prior to the distribution of any interim dividends.

How are dividends taxed?

There is a dividend allowance of £500 (for the tax year 2025/26) which means that dividends paid up to this amount in any tax year are tax-free. Any dividends received above this allowance are taxed according to the shareholder’s income tax bracket. Dividends above the allowance will be taxed at:

-

8.75% for basic rate taxpayers

-

33.75% for higher rate taxpayers

-

39.35% for additional rate taxpayers

Dividends that fall within the income tax personal allowance do not count towards the dividend allowance.

To work out your tax band, add your total dividend income to your other income. You may pay tax at more than one rate.

How do you calculate how much dividend to pay?

Unless stated otherwise in the articles of association or shareholders' agreement, there is no minimum level of dividend which must be paid. However, the maximum amount of dividends paid must not exceed the profits available.

For more information on dividends, see the Company Taxation Manual.