Estate planning

Family is everything. Let us help you protect your loved ones.

- Guillermo V.

- Rocket Lawyer member since 2012

Estate planning FAQs

-

What's the difference between a Will and an Estate Plan?

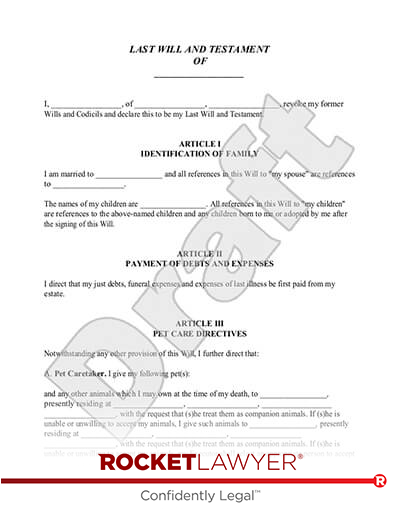

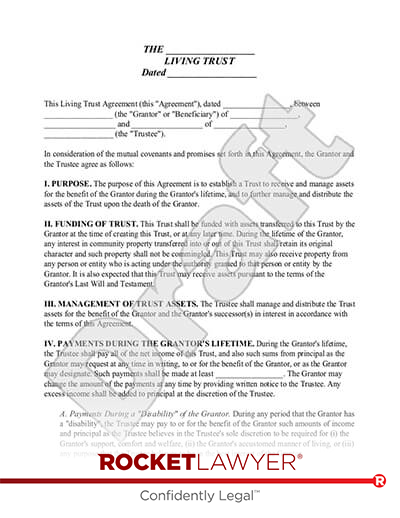

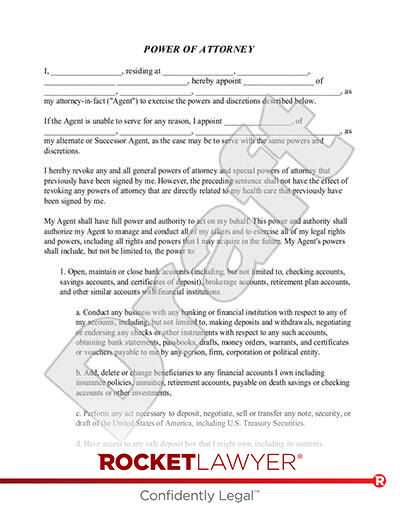

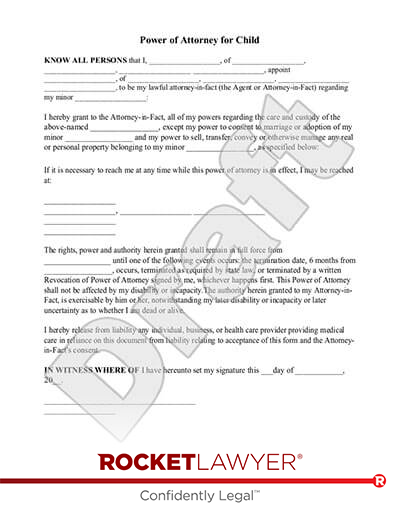

A Last Will and Testament is the cornerstone of every estate plan. It allows you to distribute your assets, appoint guardians for your children, and provide for a favorite charity. But an estate plan doesn't end there. A Power of Attorney, for example, lets you appoint a trusted family member or other individuals to make financial and medical decisions on your behalf, while a Living Trust can help you provide for your children without the hassles of probate court.

-

How often should I update my Will?

It's a good idea to consider updating your Will whenever you have a big change in your life. A marriage, the birth of a child, a new business venture, or the purchase of a home are great reasons to take a look at your Will. You can either start from scratch and create a brand new Last Will and Testament or just use a Codicil to Will to make changes to your existing one.

-

Why should you create a complete Estate Plan?

A full estate plan is the smartest way to make sure your assets are distributed the way you want them to be. Without a Will, your property will be divided based on the rules in your state, which are the same for everyone. If you want to leave money to a charity, appoint a guardian for your children, or protect your business after you're gone, an estate plan is the only way to make sure your wishes are known.

-

What's the difference between a Living Will and a Power of Attorney?

Both these estate planning documents can help you make tough healthcare decisions now that might affect you and your family in the future. With a Power of Attorney, you appoint an agent who you trust to make these decisions for you, while with a Living Will, you can expressly lay out the sorts of treatment you do and do not want to receive. For example, people who may not want to be kept in a vegetative state can note that explicitly in their Living Will.

Ask a lawyer

Legal guides

-

- Estate Planning for Property Owners

- 3 min read

-

- Help Loved Ones With Estate Planning Over the Holidays

- 3 min read

-

- Estate Planning 2.0: What Can You Do Online?

- 3 min read

-

- Estate Planning Is for Everyone

- 3 min read

-

- What Can Go Wrong? 5 Pitfalls of Not Planning Your Estate

- 5 min read

-

- How To Include Crypto in Your Estate Plan

- 3 min read

-

- What Can Be Done When a Conservatorship Is Not Working Out?

- 2 min read

-

- What Term Life Insurance Covers and Why You May Want It

- 4 min read

-

- Three New Year's Resolutions to Jumpstart 2023

- 4 min read

-

- Royal Family Estate Planning for Everyone

- 3 min read

-

- Living Will vs. Durable Healthcare Power of Attorney

- 3 min read

-

- Living Will vs. Last Will and Testament

- 1 min read

-

- Simplify Probate Using a Will and Living Trust

- 4 min read

-

- What is Conservatorship?

- 2 min read

-

- How to Create a Testamentary Trust

- 3 min read

-

- Do I Need an Estate Planning Attorney?

- 2 min read

-

- Understanding Life Insurance Policies

- 4 min read

-

- Types of Estate Planning Documents: Know Your Options

- 4 min read

-

- Using a Pour-Over Will with a Living Trust

- 1 min read

-

- How To Simplify or Avoid the Probate Process

- 3 min read

-

- 3 Estate Planning Essentials To Protect Your Family

- 1 min read

-

- How To Choose the Right Executor for Your Will

- 4 min read

-

- Legal Issues at Different Life Stages

- 4 min read

-

- Estate Planning Checklist: Essential Documents To Get Your Affairs in Order

- 7 min read

-

- Estate Planning for Heroes: Honoring Our Military on Memorial Day

- 4 min read

-

- Key Legal Documents for Your Pet

- 3 min read

-

- What Is an NFT and What Are the Tax Implications?

- 3 min read

-

- How To Pass Your Home to Your Heirs With Just a Deed

- 3 min read

-

- What Happens if my Loved One Dies without a Will?

- 4 min read

-

- How To Include Children in Your Estate Plan

- 3 min read