What legal issues are commonly faced before or following marriage or divorce?

A wedding is a joyful time, but planning for one can be difficult. Thankfully, a wedding planner can handle much of the leg work for you.

Planning for a marriage, however, can be even more onerous than planning for a wedding, and it is likely more important. Attention to various legal issues before getting married can help a couple avoid difficult legal issues in the future, both during the marriage and in the event of a divorce, severe illness, or death.

Planning for a marriage

A Prenuptial Agreement, or prenup, is a contract between two people who plan on getting married. It can address a wide range of issues, although the specific terms may vary depending on the laws of the state where the couple lives.

Property ownership is a major part of many prenups. Most property obtained during a marriage is known as marital property or community property, depending on the state. Property that a spouse owned before the marriage is their separate property.

A prenup may contain terms like:

- Confirmation that certain property will remain one spouse's separate property.

- Turning separate property to community or marital property.

- A plan for dividing the community or marital property in a divorce.

- Provisions for, or a waiver of, alimony or spousal maintenance.

- Protection from a spouse's pre-marriage debts.

By definition, prenups are signed before the parties get married. Married couples also have the option to agree to a contract with similar terms after the wedding. These are known as Postnuptial Agreements.

Going through a divorce

Nearly every divorce involves a division of marital or community property. Many divorces require figuring out child custody and child support, in addition to separating the shared assets and debts. Courts generally must approve any agreements affecting children, to confirm the parents are acting in their children's best interests.

Common legal issues in divorce include:

- Alimony or spousal maintenance: One spouse might be entitled to support payments from the other.

- Child custody: Parents may work out a Parenting Plan that addresses where the children will live, draft visitation rights with each parent via a Child Visitation Letter, and decide how they will make decisions regarding education and welfare.

- Child support: One parent may issue a Demand for Child Support Payment to the other parent. Usually, the parent with whom the child lives most of the time receives support from the other parent.

What are common legal issues that parents or guardians encounter?

A parent or guardian of a child has the duty to provide shelter, food, and clothing. They are also responsible for decisions about the child's best interests when it comes to healthcare and education. When minors get in legal trouble, parents or guardians may be able to help by getting them legal assistance, or by making assurances to a court.

A parent or guardian is responsible for the child's well-being even if they have entrusted the child to someone else's care. A Child Care Authorization agreement can enable a caregiver to perform certain tasks, such as picking a child up from school. Child Care Instructions can outline the caregiver's responsibilities. A Consent for Medical Treatment of a Minor can ensure that your child can receive necessary care even if you are not available to be there.

Additionally, parents may want to think about their estate plan, and how they can protect their children in case something happens unexpectedly.

How can I prepare for the worst, for myself and my family?

Estate planning is the process of deciding what you want to happen to your property when you die. It can also include, however, other decisions about what you want to happen if you become incapacitated or unable to make decisions for yourself. It may involve financial planning that can keep your affairs in order should anything happen to you or your spouse.

Financial planning for married couples addresses what one spouse should do if the other spouse has an accident, gets sick, or dies Financial planning for individuals asks you to choose someone who can make decisions for you if you are not able to do so.

It can be difficult to talk about estate planning with your spouse, parents, children, or other family, but doing so may also prove very helpful. For example, an Advance Directive can help make sure your wishes, or your loved one's wishes, are carried out in dire medical circumstances.

Some important estate planning documents to consider preparing include:

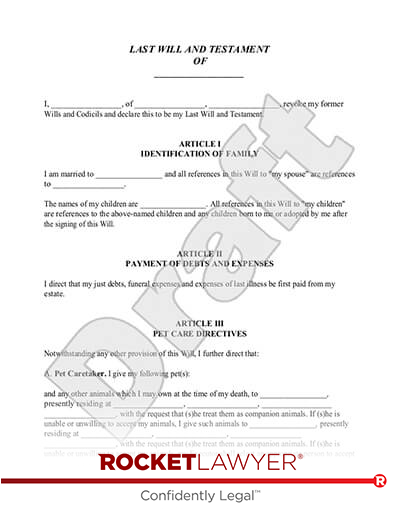

- A Last Will and Testament names an administrator or executor who will handle your estate after you die. It also directs that person to distribute your property in a certain way.

- A Power of Attorney gives a person, known as your agent, legal authority to act on your behalf. You can specify certain powers that they have, and others that they don't. A Power of Attorney can become effective immediately or upon your incapacitation. You may be able to revoke it at any time, as long as you are not incapacitated. If something happens to you and you do not have a Power of Attorney, your loved ones might have difficulty handling your affairs for you. Parents may grant Power of Attorney to their children to represent them if they become ill.

- A Power of Attorney for a Child gives a person authority to act on behalf of a minor child if their parents die or are incapacitated.

- Living Trusts create a new legal entity to hold property for a person. When that person dies, the living trust can distribute the property to their heirs, or beneficiaries, more quickly than the probate system.

While estate planning may require some difficult conversations, those conversations may prove essential down the road.

Which legal issues arise when buying, selling, or renting housing?

Everyone needs a place to live. Unless you live with family, you almost certainly have to deal with either renting or owning a home. Each option has its own set of rights and responsibilities.

Renting a home

Whether it is your first time renting, or your fifteenth, different landlords have different rules and different rental agreements. As a tenant, generally, your main obligations are to:

- Pay rent to a landlord or property manager.

- Keep the property in reasonably good condition for the next tenant.

- Not disturb or interfere with the rights of fellow tenants.

The landlord is likely to be responsible for repairs to most parts of the property, such as plumbing and electrical. You might want to submit a Complaint to Landlord form to create a written record when you request repairs.

Most Lease Agreements are for a term of one year. You may have the opportunity to renew the lease for another year, but in most jurisdictions, the landlord may have the right to not renew or to raise the rent. If you decide not to renew, you may have to submit a Notice to Terminate Tenancy. If you violate the terms of the Lease Agreement, you may be evicted, or could lose a portion of your security deposit.

Buying and selling a home

When you buy a home, you are responsible for the mortgage, taxes, repairs, and maintenance. The buying process typically involves finding properties through various listing services or websites, then visiting those properties in person. You may have a real estate agent help you, but this is not legally required. A Home Evaluation Worksheet can help you keep track of all the houses you see and pick the best one.

Once you have found the perfect property and you have approval for a mortgage, a Real Estate Purchase Agreement can confirm that you intend to buy the property from the seller. Obtaining a mortgage or financing from a bank or lender can be complicated. Getting the best rates may require shopping around, repairing a damaged credit score, saving up a larger down payment, or other steps.

When you close the sale, several documents are particularly important:

- The seller may be required to sign a Warranty Deed, which conveys the title to the property to the buyer.

- The buyer may be required to sign a Deed of Trust, giving the lender the right to foreclose on the property if you stop making payments on the mortgage.

When selling a home, there are several legal considerations. From federal and state required disclosures, to agreements with your real estate agent, offers from buyers, and more, the process can be legally complicated, and the laws may depend heavily on where a property is located.

If you have questions about legal issues at any stage of life, contact a Rocket Legal Pro for affordable legal advice.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.