What if I do not have major assets?

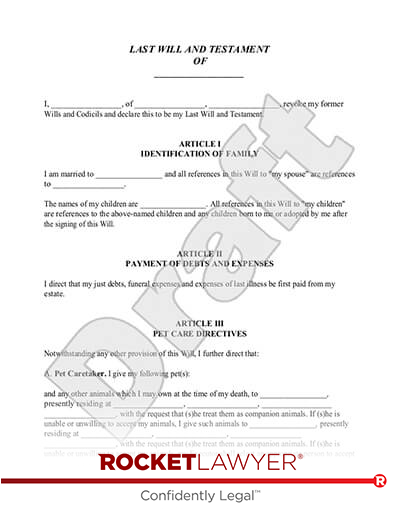

Even if you do not have any major assets, such as a home or business, it might make sense to draft an estate plan. The process consists of more than just making a Last Will and Testament to distribute your assets after your death. For example, it may involve deciding who may make decisions on your behalf or provide instructions directly to doctors if you are incapacitated. This can also be accomplished in an Advance Directive.

Planning for accidents or illnesses

Suppose you are involved in an accident and are in a coma. You may want someone to have the authority to pay your bills and manage your assets. A Power of Attorney can grant this authority. A Power of Attorney for Child designates someone to care for your children when you are unable.

You might own more assets than you think

If you spend a fair amount of time online, your estate plan can also make arrangements for your digital assets. These may include email and social media accounts, blogs, cloud storage, music and ebook collections, and online retail accounts. Some digital assets, such as gamer accounts, cryptocurrency, and NFTs, can have substantial value. You might consider appointing a digital executor to handle this part of your estate.

An estate plan lets you decide where your assets go

An estate plan allows you to decide what happens to the assets that you own. It might also save time and expense for your family or friends in the event that something happens to you. Remember, your estate might have to go through the probate process. If you have a Last Will and Testament, and a robust estate plan, probate can be a much simpler process. In most U.S. states, someone will have to apply to a probate court for authorization to manage your estate. Without a Will, state law determines how to distribute your assets to your surviving family members.

What happens if assets listed in my Will are sold before I die?

Sometimes, a person (the "testator") will leave a specific item, such as a car, to someone (the "beneficiary") in their Will. By the time the testator dies, however, they may no longer own the car. They might have sold it, given it away, or lost it because of an accident. This is known as "ademption." If the Will does not say anything about what to do if the testator no longer owns the asset, the beneficiary is out of luck.

If you want to leave a specific item to a beneficiary, but also want to make sure they still get something if that item is adeemed by the time you die, you can clarify that in your Will. For example, you could say something like "To [Beneficiary], I leave my 2018 Toyota Camry or a sum of money equal to the fair market value of a 2018 Toyota Camry at the time of my death."

How do I make an estate plan as a young adult?

If you are 18-30 years old, you might benefit from having a Will even if you do not own much property. A Will allows you to decide who will manage your estate, also known as your executor or administrator. It allows you to decide what will happen to your assets. If you die without a will, the law generally only allows your property to go to family members.

Estate planning for a young adult also allows you to appoint someone to have Power of Attorney for you if you are incapacitated. This could be a friend, family member, or professional, such as an attorney. If you have children, the children's other parent would still have parental authority. If no other parent is around, you can make a Power of Attorney For Child to designate someone who will care for them. You can even designate someone to take care of your pets. A Memorial Plan allows you to state your wishes for your funeral or memorial.

Your executor is typically responsible for paying off unsecured debts, such as credit card or medical bills, from the assets in your estate. Secured debts, such as a mortgage or car loan, might be a different story. If you want to leave someone a car that still has a loan balance, you might be able to state in your Will that the debt should pass along with the asset. Hopefully the value of the asset is greater than the balance of the loan. If the beneficiary does not want to make loan payments, they might sell the asset, pay off the loan, and keep the difference.

How do I make an estate plan as an adult?

When you are between the ages of 30 and 55, estate planning priorities change. You may have more assets than you had when you were younger, you might be thinking about what you will leave behind for your children or other loved ones, and you might be gaining greater awareness of your own mortality.

Your estate plan can reflect the complexity of your assets. Your Will might include assets like your home, your vehicle, and various financial accounts. Some investment and retirement accounts may allow you to designate one or more beneficiaries, so you may not need to include those in your Will.

An estate plan at this stage of life might also include more serious provisions for what will happen if you become ill and cannot make decisions for yourself. A Power of Attorney appoints someone to handle matters like your finances. You can make a Special Power of Attorney, or an Advance Directive, that focuses on medical decisions, so that doctors and hospitals know want you want or who has the authority to make decisions when you are unable.

How do I make an estate plan as an older adult?

Adults who are 55 or older might have different concerns than younger adults. At least for now, seniors tend to have fewer digital assets than their children or grandchildren. They might have more complicated estates, though, with real estate, financial accounts, a lifetime of personal property, and retirement benefits. A Last Will and Testament may account for anything that does not have built-in clauses regarding beneficiary or survivorship rights. Your spouse, for example, might have the right to continue receiving benefits from a retirement account after you are gone, if they are designated as the beneficiary. If you have life insurance, you can designate who you want to receive those benefits.

You might also be thinking about finding the most efficient and effective way for family members to get the estate through probate. A Living Trust allows you to transfer title to various assets from yourself to a trust. The trust includes instructions on who should take over as trustee if you die, and what that trustee should do with the trust's assets. A probate court generally has jurisdiction over assets that belong to you. Property that belongs to the trust can skip the probate process altogether, saving time and expense for your executor and your family.

You can also set up trusts and other funds to provide benefits for your spouse, children, grandchildren, charities, or anyone you choose. For example, if you want to set money aside for your grandchild's college education, you can make a College Education Trust or invest in a 529 plan. If you have a family member who needs long-term care or assistance, you might make a Special Needs Trust to provide for them. You might even create a Pet Trust to make sure funds are available to care for a beloved pet after you are gone.

Can I leave everything to charity?

Depending on your marital status and the laws in your state, you might be able to leave everything to charity, either in your Will or through a trust. If you are married, your spouse may have a claim to half of the property that you acquired during the marriage. In that case, you may still be able to leave your share to charity. It might be best, however, to discuss this with your spouse first.

An estate plan may require regular updates, especially if you move, marry, have children, grandchildren, get divorced, remarry, or experience other major life events. If you have questions about estate planning at any stage of life, from your teenage to your twilight years, reach out to a Rocket Lawyer network attorney for affordable legal advice.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.