How often should I update my estate planning documents?

You should review your estate planning documents any time you experience a major life change, regardless of whether you move to another state. Below are a few examples of life changes that warrant a review of your current estate plan.

- Marriage

- Divorce

- Having a child

- Children are no longer minors

- Need to change agent or guardian

You might also want to periodically review your documents just in case you need to make changes. The laws may have changed or you might need to address a new tax situation. It is a good rule of thumb to ensure that your documents are updated every three to five years, even if you don't experience any major life changes.

You should also consider whether you need to change beneficiary information. While updating a child's address every time they move likely is not necessary, changing names after children get married or clarifying whether you want their spouses to take an inheritance might be something you will want to add.

Of course, making a move to a new state is also a good time to review your documents, given the different laws and procedures among states.

Can I just amend my existing Will, Trust, or Power of Attorney?

Maybe. You might be able to amend your estate planning document in some circumstances if you just want to make a minor change. However, other situations may also warrant the need to make a completely new document.

For example, to have a valid Will in one state, you might be required to have one witness watch you sign the document. In another state, they might need two witnesses for the same type of document to be valid. In that case, an amendment to an already invalid Will is not going to be helpful. Instead, you will need a completely new document to ensure that your wishes contained in both the original document and the amendment are valid.

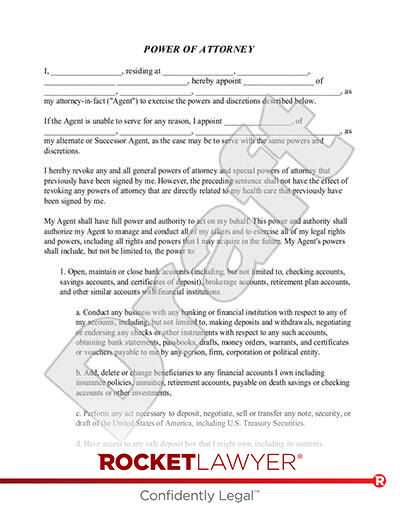

Most states have specific forms that you should use for a Power of Attorney. They all contain slightly different information, and simply amending that document to include the missing information isn't always an option. Thankfully, creating a Power of Attorney in your new state is straightforward, and you can easily create a customizable Power of Attorney that is valid in your state with Rocket Lawyer.

Will a new Will, Trust, or Power of Attorney override my old one?

You must follow very specific rules, which are different in each state, if you want to cancel a previous document. For example, destroying the old Will in some states is enough to cancel it. Other states require you to include a notation in your new Will that this new document should completely replace the old Will. If you do not have this type of statement, there is some risk that both Wills (at least the conflicting provisions) are set aside.

As you work through creating a new Will, you should speak with a lawyer about the proper procedure to cancel or destroy your old Will. Getting this process wrong could mean that the Will you intended to apply will not be used.

The same type of confusion might also arise if you are creating a new Trust or Power of Attorney. Specifically stating that you intend to cancel the old document is sometimes enough to set it aside, but that might not be the case in every state.

How long does a Power of Attorney last?

Generally, a Power of Attorney lasts as long as you say it will last. In most circumstances, a General Power of Attorney will not have an expiration date. If that is the case, then the Power of Attorney will be effective indefinitely. If you created a Specific Power of Attorney that is only supposed to be in use for a short period of time, such as when you are out of the country, you should specifically state that provision in the document.

In some states, your Power of Attorney can be invalidated if you named a spouse as your Power of Attorney agent but you're now divorced. The law assumes that you likely did not want that person making decisions for you, even though you did not change your Power of Attorney. However, this rule is not in place in every state, so it's a good idea to create a new Power of Attorney after a divorce.

Get help with your estate planning documents

When you move, redrafting estate planning documents can be a hassle, but Rocket Lawyer makes it easy with forms that are designed to meet the requirements in your new state. You can also consult with a Rocket Legal Pro™ if you want advice about your specific situation.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.