MAKE YOUR FREE Quitclaim Deed

What we’ll cover

What is a Quitclaim Deed?

It offers little protection to the person receiving the interest, so it is most often used between family members who have already established trust (such as gifting a house to a close relative).

When can you use a Quitclaim Deed?

- You are passing your rights in a piece of property to a spouse or ex-spouse.

- You are gifting your property to another person or family member.

- You are transferring ownership in a property to a trust.

- You are correcting the spelling of a name in a previous deed.

- You are changing tenancy (how the property is owned) between owners.

- You are clarifying if the property is community or separate property after marriage.

- You own a business and you want to buy or sell real property.

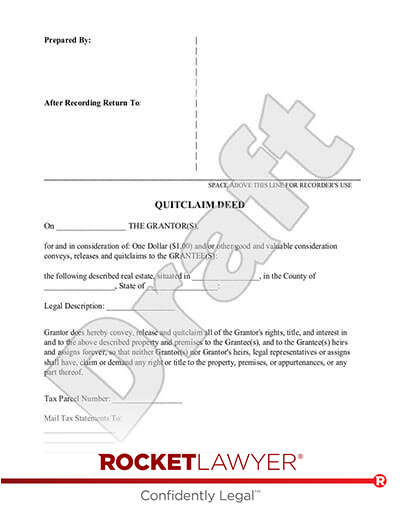

Sample Quitclaim Deed

The terms in your document will update based on the information you provide

| Prepared By: | | |

| Recording Requested By: | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

________________________________________________________________________________________

QUITCLAIM DEED

,

EXEMPT pursuant to A.R.S. § 11-1134(A)1.

[SIGNATURE PAGE FOLLOWS]

| DATED:___________________________ |

,

On this _____ day of ____________________, _____, before me, the undersigned, personally appeared, personally known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the instrument, the individual(s) or the person upon behalf of which the individual(s) acted, executed this instrument.

, COUNTY OF PARISH OF

On this _____ day of ____________________, _____, before me, ______________________________, the undersigned officer, personally appeared

Before me, a Notary Public (or justice of the peace) in and for said county, personally appeared the above named , who acknowledged that they did sign the foregoing instrument, and that the same is their free act and deed. In testimony whereof, I have hereunto subscribed my name at ________________________________, this _____ day of ____________________, _____.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by

The foregoing instrument was acknowledged before me, by means of ☐ physical presence or ☐ online notarization, this _____ day of ____________________, _____ by , who are personally known to me or who have produced ________________________________ as identification.

This instrument was acknowledged before me on this _____ day of ____________________, _____ by , proved on the basis of satisfactory evidence to be the person(s) whose name(s) subscribed to this instrument and acknowledged (he/she/they) executed the same. Witness my hand and official seal, proved on the basis of satisfactory evidence to be the person(s) whose name(s) subscribed to this instrument and acknowledged (he/she/they) executed the same. Witness my hand and official seal, proved on the basis of satisfactory evidence to be the person(s) whose name(s) subscribed to this instrument and acknowledged (he/she/they) executed the same. Witness my hand and official seal

I affirm, under the penalties for perjury, that I have taken reasonable care to redact each social security number in this document, unless required by law.

On this _____ day of ____________________, _____, before me personally appeared , to me known to be the persons described in and who executed the foregoing instrument, and acknowledged that they executed same as their free act and deed.

On this _____ day of ____________________, _____, before me, the undersigned, a notary public in and for said state, personally appeared , personally known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the instrument, the individual(s) or the person upon behalf of which the individual(s) acted, executed this instrument.

On this _____ day of ____________________, _____, before me, ________________________________, personally appeared , known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same as for the purposes therein contained.

On this _____ day of ____________________, _____, before me, the undersigned, Notary Public for the State of Vermont, personally appeared , to me known (or to me proved) to be the identical persons named in and who executed the above Quitclaim Deed, and acknowledged that such persons executed it as such persons' voluntary act and deed.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by

In witness whereof I hereunto set my hand and official seal.

_________________________________

Notary Public

Signature of person taking acknowledgment

_________________________________

Name typed, printed, or stamped

Title (and Rank)

_________________________________

Title or rank

My commission expires _____________

_________________________________

Serial number (if applicable)

Serial number, if any

Notary Address:

_________________________________

_________________________________

_________________________________

| _________________________________ |

________________________________________

Printed Name of Notary Public

Notary Public for the State of

Residing at: ______________________________

My Commission Expires: ____________________

(Notary Seal)

Signature and Notary for Quitclaim Deed regarding

, COUNTY OF PARISH OF

.

A notary public or other officer completing this certificate verifies only the identity of the individual(s) who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF

On ____________________ before me, ________________________________, personally appeared , who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

________________________________________ (Notary Seal)

Signature of Notary Public

STATE OF WEST VIRGINIA

COUNTY OF

I, ____________________________, a notary public in and for said state, do hereby certify that , whose name is signed to the writing above, has this day acknowledged the same before me.

Given under my hand this ____ day of ___________, 20___.

My commission expires: __________________

_____________________________________

Notary Public Signature

_____________________________________

Notary Printed Name (Stamp)

Signature and Notary for Quitclaim Deed regarding

, COUNTY OF PARISH OF

On this _____ day of ____________________, _____, before me, ______________________________, the undersigned officer, personally appeared, known to me (or proved to me on the oath of ______________________________) to be the persons who are described in and who executed the within and foregoing instrument, and acknowledged to me that they executed the same.

Before me, a Notary Public (or justice of the peace) in and for said county, personally appeared the above named , who acknowledged that they did sign the foregoing instrument, and that the same is their free act and deed. In testimony whereof, I have hereunto subscribed my name at ________________________________, this _____ day of ____________________, _____.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by .

The foregoing instrument was acknowledged before me, by means of ☐ physical presence or ☐ online notarization, this _____ day of ____________________, _____ by , who are personally known to me or who have produced ________________________________ as identification.

This instrument was acknowledged before me on this _____ day of ____________________, _____ by .

I affirm, under the penalties for perjury, that I have taken reasonable care to redact each social security number in this document, unless required by law.

On this _____ day of ____________________, _____, before me personally appeared , to me known to be the persons described in and who executed the foregoing instrument, and acknowledged that they executed same as their free act and deed.

On this _____ day of ____________________, _____, before me, the undersigned, a notary public in and for said state, personally appeared , personally known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the instrument, the individual(s) or the person upon behalf of which the individual(s) acted, executed this instrument.

On this _____ day of ____________________, _____, before me, ________________________________, personally appeared , known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same as for the purposes therein contained.

On this _____ day of ____________________, _____, before me, the undersigned, Notary Public for the State of Vermont, personally appeared , to me known (or to me proved) to be the identical persons named in and who executed the above Quitclaim Deed Agreement, and acknowledged that such persons executed it as such persons' voluntary act and deed.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by .

In witness whereof I hereunto set my hand and official seal.

_________________________________

Notary Public

Signature of person taking acknowledgment

_________________________________

Name typed, printed, or stamped

Title (and Rank)

_________________________________

Title or rank

My commission expires _____________

_________________________________

Serial number (if applicable)

Serial number, if any

Notary Address:

_________________________________

_________________________________

_________________________________

_________________________________

A notary public or other officer completing this certificate verifies only the identity of the individual(s) who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF

On ____________________ before me, ________________________________, personally appeared , who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

________________________________________ (Notary Seal)

Signature of Notary Public

, COUNTY OF PARISH OF

On this _____ day of ____________________, _____, before me, ______________________________, the undersigned officer, personally appeared, known to me (or proved to me on the oath of ______________________________) to be the persons who are described in and who executed the within and foregoing instrument, and acknowledged to me that they executed the same.

Before me, a Notary Public (or justice of the peace) in and for said county, personally appeared the above named , who acknowledged that they did sign the foregoing instrument, and that the same is their free act and deed. In testimony whereof, I have hereunto subscribed my name at ________________________________, this _____ day of ____________________, _____.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by .

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by .

The foregoing instrument was acknowledged before me, by means of ☐ physical presence or ☐ online notarization, this _____ day of ____________________, _____ by , who are personally known to me or who have produced ________________________________ as identification.

This instrument was acknowledged before me on this _____ day of ____________________, _____ by .

I affirm, under the penalties for perjury, that I have taken reasonable care to redact each social security number in this document, unless required by law.

On this _____ day of ____________________, _____, before me personally appeared , to me known to be the persons described in and who executed the foregoing instrument, and acknowledged that they executed same as their free act and deed.

On this _____ day of ____________________, _____, before me, the undersigned, a notary public in and for said state, personally appeared , personally known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the instrument, the individual(s) or the person upon behalf of which the individual(s) acted, executed this instrument.

On this _____ day of ____________________, _____, before me, ________________________________, personally appeared , known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same as for the purposes therein contained.

On this _____ day of ____________________, _____, before me, the undersigned, Notary Public for the State of Vermont, personally appeared , to me known (or to me proved) to be the identical persons named in and who executed the above Quitclaim Deed Agreement, and acknowledged that such persons executed it as such persons' voluntary act and deed.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by .

In witness whereof I hereunto set my hand and official seal.

_________________________________

Notary Public

Signature of person taking acknowledgment

_________________________________

Name typed, printed, or stamped

Title (and Rank)

_________________________________

Title or rank

My commission expires _____________

_________________________________

Serial number (if applicable)

Serial number, if any

Notary Address:

_________________________________

_________________________________

_________________________________

_________________________________

_________________________________

A notary public or other officer completing this certificate verifies only the identity of the individual(s) who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF

On ____________________ before me, ________________________________, personally appeared , who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

________________________________________ (Notary Seal)

Signature of Notary Public

CountyParish

Write the total number of pages on the first page of this Quitclaim Deed.

Oregon state law requires that all deeds be recorded no more than 15 days after being signed.As a number of counties in Arkansas have two county seats you should make certain you are recording the deed in the correct office.

Most counties will not accept your deed for recording until proof all transfer taxes have been paid. Some towns will affix a town stamp to the deed when you have paid the required taxes.

A cover sheet must be created through ACRIS (Automated City Register Information System) www. nyc.gov before the deed can be recorded if you are filing in New York City. For all other New York counties contact your county clerk to see if a cover sheet is required for recording.

Cattaraugus County and Chautaugua County require a carbon copy of the information contained in the deed, not the deed, for each of the townships affected by the deed. The information needed in this information sheet includes: Date of conveyance, Consideration given, Name of Grantor(s) and Grantee(s), Mailing Address of the Grantee(s) and the Legal Description of the property conveyed.

If you are a resident of Cook County and this Quitclaim Deed is for a transfer of residential real estate:

Grantor must sign the deed in front a notary. The notary is required by law to get the Grantor's right thumb print on their Notary Report.

Unless your notary is an employee of a principal, employee or agent of a Title Insurance Company, Title Insurance Agent, Financial Institution or attorney, the notary must deliver an original Notarial Record within 14 days of notarizing the document to the Recorder of Deeds of Cook County along with a filing fee of $5.00. If your notary is one of the above they may retain the record at their place of employment

Ask the Registry Employee prior to recording your deed to verify if you deed should be recorded or registered. The deed will be invalid if it is recorded or registered in the wrong place.

Even though only one witness needs to sign in New Jersey, including a second witness signature may be beneficial. This second witness signature may be left blank if a second witness is not available.

Additional Documents Required to File with Your Quitclaim Deed:

A Property Transfer Tax Return must be filed with a town clerk whenever a deed transferring title to real property is delivered to a town clerk for recording. A town clerk cannot record a deed unless it is accompanied by a completed Property Transfer Tax Return. For more information on how and where to file this tax return, please see: http://tax.vermont.gov/property-owners/real-estate-transaction-taxes/property-transfer-tax

A Illinois Declaration of Value form must be filed with your deed. You will need to obtain this form from your County Recorder.

The Grantor must fill out a Declaration of Value, Ground Water Hazard Statement and pay transfer taxes on the property before the deed will be accepted for recording.

The Ground Water Hazard Statement form can be obtained from your County Recorder or online at:

https://www.iowadnr.gov/Portals/idnr/uploads/forms/5420960.pdf

The Declaration of Value form can be found here:

https://tax.iowa.gov/sites/files/idr/forms1/57006andInstructions_fillable.pdf

A Nevada Declaration of Value form must be filed with your deed. You will need to obtain this form from your County Recorder.

Real Estate Transfer Statement Form 521 will need to be completed and filed with your deed. You can obtain this form from your County Recorder or online at http://www.co.cheyenne.ne.us/Form521.pdf.

Within 30 days of recording your deed you will need to file a Declaration of Consideration statement with the Department of Revenue Administration. This form can be found on the New Hampshire Department of Revenue Administration Website.

Each County has its own transfer tax and property ownership forms, which must be filed and recorded with your deed. You can obtain these forms by contacting the County Registrar's Office where the property being transferred is located.

A Certificate of Real Estate Value must be filed with your deed. You will need to contact your County Recorder's Office to obtain this form.

Preliminary Change in Ownership Form must be completed and filed with your deed. You can complete this form at the County Assessor's Office when you file your Quitclaim Deed.

Affidavit of Consideration: Must be completed and filed with your deed if:

a) If the full consideration is not stated in the deed

b) When an exemption to Realty Transfer Fee is claimed

c) If the transfer involves Class 4 property (commercial, industrial or apartments)

d) If the transfer involves "new construction"

Click here if you would like to print this form:

www.state.nj.us/treasury/taxation/pdf/other_forms/lpt/rtf1ee.pdf

Statement of Value must be filed with your deed in duplicate-

http://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/Documents/Realty%20Transfer%20Tax/rev-183.pdf

Real Estate Transfer Tax (From PT-61) form must be filed prior to recording your deed (This form should be completed and submitted online at http://www.gsccca.org/efiling/pt61/)

A cover sheet and Real Estate Excise Tax Affidavit must be filed with your deed.

Refer to https://dor.wa.gov/get-form-or-publication/forms-subject/real-estate-excise-tax-forms and https://apps.leg.wa.gov/rcw/default.aspx?cite=65.04.047 for more information.

If you are in Asotin, Clark, Pacific, Skamania or Whatcom County you will need to contact your County Treasurer or Recorder to get the correct Affidavit.

Real Estate Excise Tax Supplemental Affidavit must be filed in addition to the Real Estate Excise Tax Affidavit with your deed if you are claiming an exemption to the tax

http://dor.wa.gov/content/getaformorpublication/formbysubject/forms_reet.aspx

Affidavit of Property Value will be provided by your County Recorder if it is required

State of Maryland Land Instrument Intake Sheet must be filed with your deed

http://www.courts.state.md.us/courtforms/circuit/intakesheet.html

Well Disclosure Statement must be filed with your deed if wells are on the property being transferred and the number of wells has changed since the last Well Disclosure Statement was filed.

www.health.state.mn.us/divs/eh/wells/disclosures/certificateform.pdf

It will be necessary for either a Grantor or Grantee to execute the consideration statement at the end of this deed verifying the amount of the consideration paid.

Indiana state law requires that a Sales Disclosure be completed when real property is sold. The Sales Disclosure must be completed by the Seller or their agent. Most counties use either the state Sales Disclosure website (gatewaysdf.ifionline.org/) or the following third-party website (www.salesdisclosuresonline.com/). A few counties require that you use the paper form, available at forms.in.gov/download.aspx?id=7477.

The use of a Quitclaim Deed for the sale of real property in Texas may cause issues with obtaining title insurance. In many instances, it may be preferable to use a different type of deed, for example, a Warranty Deed. Talk to a lawyer about which type of deed is right for your situation before you execute it.

The state of Wisconsin requires a Real Estate Transfer Return form be filed along with the Quitclaim Deed. You can find this form on the Wisconsin Department of Revenue Website (https://www.revenue.wi.gov/Pages/RETr/Home.aspx).

The state of Maine requires a Real Estate Transfer Tax form be filed and paid along with the Quitclaim Deed. You can file this tax online (https://www1.maine.gov/cgi-bin/online/mrs/rettd/index.pl) or fill out a form (https://www.maine.gov/revenue/sites/maine.gov.revenue/files/inline-files/rett.pdf).

Along with your Quitclaim Deed, a Form TP-584 must be submitted. In addition, if the property is in a county outside of New York City, a Form RP-5217 is required. Otherwise, a Form RP-5217NYC is required for property located in New York City.

The state of Montana requires a Realty Transfer Certificate (https://mtrevenue.gov/property/realty-transfer-certificates/) to be filed along with the Quitclaim Deed.

About Quitclaim Deeds

Learn how to transfer legal rights to real property

-

How To Write a Quitclaim Deed

A Quitclaim Deed (also known as a Quit Claim Deed) is a type of real property (i.e. land or a building, like a house or apartment) deed where the grantor or owner of the property transfers (grants) their portion of interest in the property in which the grantor has title. A Quitclaim Deed is often used to change who is listed as the owner on the title to the property. For example, the Quitclaim Deed is often made by family members, divorcing spouses, or in other exchanges of property between people well-known to each other.

Although the Quitclaim Deed transfers rights to the title of the property, it does not transfer obligation for the mortgage of the property. The Quitclaim Deed does not guarantee that the property is free of debt and it does not guarantee that no one else claims to own the property.

Following are some common provisions in a Quitclaim Deed form, along with additional information and a brief explanation.

Document Preparer

Some states require the name and address of the preparer of the Quitclaim Deed to be listed in the document. Failure to provide this information can result in additional recording fees or rejection of your deed by the Recorder's or Registrar's Office.

Quitclaim Deed Grantee

The Grantee is the person, persons, or entity (such as a trust or business) that is being granted rights to the property transferred by the Quitclaim Deed. All those being granted the property must be listed as the grantee.

Quitclaim Deed Grantor

The Grantor is the owner (all or partial) of the property being transferred by the Quitclaim Deed. The Grantor could be a single person or persons or an entity like a trust or business. For example, if a husband and wife own property together, both must be listed as the Grantor of the property. Be certain that all Grantor names are entered EXACTLY how they appear on the original deed. Even if a party has been remarried or divorced, the names should still match the original deed.

Note: The Grantor only gives up their share of ownership in the property, but not their obligation to mortgage payments for the property. The property must be refinanced if the loan is to be transferred to the Grantee.

Tenancy

Tenancy determines how the property will be held and transferred upon the death of a Grantee (the person or persons who are receiving the property) when dealing with multiple grantees. If the tenancy of the property is unclear, there will be problems or difficulties upon the death of a grantee. Many states assume that unless specified, the property is held as tenants-in-common, but the following are other possible scenarios:

- Tenants-in-Common: Allows each grantee's interest in the property to pass to his or her estate and prospective heirs upon death. This works well when friends, siblings, or business partners own land together but wish for the land to pass to their own individual families upon death. The grantees do not need to own equal shares in the property. One grantee, for example, could own 70% of the property while another owned 30%. All owners of a property held "in common" have the right to access every part of the property.

- Joint-Tenants with Rights of Survivorship: Provides for the deceased grantee's interest to automatically pass to the remaining grantee(s), usually with the recording of a death certificate.

- Tenancy by the Entirety: This option is for married couples who desire to own the property together in such a way that each holds full ownership of the property and neither spouse can sell the property without both spouses selling their interest.

Consideration

The consideration for the transfer is the amount of money given in exchange for the property. If you are only clarifying a previously filed deed, transferring property to an ex-spouse, gifting property to a family member or moving property into a trust, your transfer may not involve an exchange of money. For these and other similar situations most states will accept the general language "One Dollar ($1.00) and other good and valuable consideration" as a substitute for a specific dollar amount since your transaction did not involve the sale of the property.

Legal Property Description

The legal description is a formal description of the location of the property. The legal description requirement in Quitclaim Deeds can vary from state to state. In urban and suburban areas, the legal description implies which lot the property occupies. If you are in a rural area, the property description includes the boundaries and property lines with respect to the landmarks. The description often includes a tax parcel or tax assessor's number.

You can find the legal description in the title of the property. If you don't have a copy of the title, you can find a copy or obtain the legal description from the office in your city or county where taxes are paid on the property or where property deeds are registered.

If the legal description is too long or if it includes drawings or lines on a map, you may make a photocopy of the legal description to include with your deed when you file.

Parcel Number

The Parcel Number, or Assessor's Parcel Number (APN) is assigned by the tax assessor, or equivalent, in the property's jurisdiction (typically at the county level, although some cities will have an assessor's office). These are used to identify the properties owing property tax to the county or city.

The Parcel Number is also known as:

- Assessor's Identification Number (AIN)

- Property Identification Number (PIN)

- Property account number

- Tax account number

- Sidwell number

Recorded Deed

Once a deed is recorded, the document information is kept on record in the County Recorder's or Registrar's Office. The information is filed under a specific volume, book or plat and page number. This recording information can be found on the first or last page of the previously recorded deed or by contacting your County's Recorder or Registrar's Office.

Reserving Mineral Rights

If you currently own an interest in mineral rights on the property being transferred, you may wish to reserve this interest. Unless stated otherwise, the transfer of mineral rights with the property may be assumed. A mineral reservation clause should be considered if you believe you may own an interest in oil, gas or other mineral rights that you do not desire to transfer as a part of this deed.

Life Estate

This is a clause which should be included if the Grantor wishes to grant property to a child or other person upon their death. With the life estate, the Grantor remains in control of the property (as well as any mineral rights) during their lifetime, receives any proceeds from leases involving the property, and remains financially responsible for the property. In the case of multiple Grantors, the life estate expires upon the death of the last surviving Grantor.

State Differences in Quitclaim Deeds

Although the Quitclaim Deed is fairly universal, there can be many subtle and important differences from state to state. Make sure you indicate the correct state and county in which the property is located to avoid any problems with your deed.

Transfer Tax Exemption

While many states impose a tax on land transfers, many states also recognize exemptions to the tax for common transactions. Your transaction MAY be exempt from the transfer tax if the transfer involves any of the following:

- A gift among family members where no money is exchanged.

- A transfer among family members where only nominal consideration is given.

- A transfer as part of the division of property in a divorce.

- A corrective deed that does not affect ownership rights.

- A transfer between LLC and its members.

- A transfer as part of a foreclosure.

- A transfer releasing property held as collateral for a debt.

If any of the above apply to this deed, contact your County Recorder or Registrar of Deeds to verify if your transfer is exempt from any state transfer tax. If your transaction is exempt, include the reason for the exemption in the deed.

Unincorporated Area

If a property is located outside the city limits or in a rural area, it may not be incorporated. The property likely does not have a physical street address as it is not attached to a particular city, town, or municipality. The property is only referenced by its legal description. While in most cases real property is incorporated, many rural areas have large plots of pasture or farm land that lie in unincorporated areas. You know your property is in an unincorporated area if your property was never assigned a physical street address.

Additional Documents that may be required to file your Quitclaim Deed

Each County has its own transfer tax and property ownership forms, which must be filed and recorded with your deed. Some commonly required forms include:

- A cover sheet (sometimes called a Land Instrument Intake Sheet).

- Preliminary Change in Ownership Form.

- A Realty Transfer Certificate or Sales Disclosure.

- A Real Estate Transfer Tax form (which might also be called a Real Estate Transfer Return form, a Real Estate Transfer Tax form, Real Estate Transfer Statement Form, or a Property Transfer Tax Return).

- Real Estate Excise Tax Affidavit or a Real Estate Excise Tax Supplemental Affidavit.

- An Affidavit of Property Value (sometimes called a Certificate of Real Estate Value or Declaration of Value form).

- A Groundwater Hazard Statement.

- A Well Disclosure Statement (if wells are on the property being transferred and the number of wells has changed since the last Well Disclosure Statement was filed).

- An Affidavit of Consideration (sometimes called a Declaration of Consideration statement).

After you make your Quitclaim Deed and before you record this document, check with the County Registrar's Office where the property being transferred is located to understand what will be required in your state and county and to obtain any required forms.

Quitclaim Deed FAQs

-

Why would you use a Quitclaim Deed?

You should use a Quitclaim Deed if you:

- Are giving up your interest in real property to a spouse or ex-spouse.

- Are gifting your property to another person or family member.

- Need to transfer property to a trust.

- Want to show a name change that affects an existing deed.

- Want to transfer property to a business or other entity.

- Have been asked by a title company to resolve a "cloud" on the title.

Since this document offers little protection for the grantee (the person being granted the real property) it is not recommended to be used between those who do not know each other well. If you have questions about whether or not this document is right for you, ask a lawyer.

-

Does a Quitclaim Deed transfer ownership?

Yes, a Quitclaim Deed transfers ownership of real property from one party to another, and it is most often used for transfers that do not involve a sale or purchase of the property.

The person giving up interest, called the grantor, may not even have their name on the title (for example, if the property is in their spouse's name), but may be transferring their acquired or assumed interest to show that they have no interest in the property.

-

How long is a Quitclaim Deed good for?

It varies by state, but some states will only honor the Quitclaim Deed for a certain amount of time (five years in California, for example). You'll need to talk to a lawyer or check with your county recorder's office to see if a statute of limitations applies.

-

How do I file a Quitclaim Deed?

After you complete your Quitclaim Deed and have it signed and notarized, in most cases you will file the document with your local county clerk or office of the assessor or recorder. Some states may also require witness signatures and/or grantee signatures, as well.

-

Do I need a lawyer for a Quitclaim Deed?

No, you do not need a lawyer for a Quitclaim Deed. With Rocket Lawyer, you can make a Quitclaim Deed for free.

However if you have questions, you can rely on Rocket Lawyer to get the legal advice you need. Ask a lawyer.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.

Quitclaim Deed checklist

Complete your free Quitclaim Deed with our Make it Legal™ checklist

Learn more about states with more specific Quitclaim Deeds requirements

Learn about states with different laws regarding Quitclaim Deeds.

Pick a state: