Transfer ownership of property upon your death: Transfer on Death Deed

What we’ll cover

What is a Transfer on Death Deed?

A Transfer on Death Deed can be an easy way to transfer the ownership of property when you pass. By naming one or more new owners and going into effect automatically upon death, Transfer on Death Deeds can help simplify end-of-life planning and make sure your wishes are carried out.

It's important to know that a Transfer on Death Deed, or TOD Deed, trumps anything else you have in place – such as a Trust, Will, or any other estate planning legal document. Therefore, it can be an excellent tool to ensure that your property goes to the right person or people, but you have to keep it updated. Make sure you keep it with the rest of your estate plan and update it accordingly.

In addition, a Transfer on Death Deed overrides any existing claim to the property which may be in a Will or Trust. For example, a TOD overrides any statement in your Will leaving the property to other beneficiaries. In a way, they can help you etch your wishes in stone. Get started on yours with Rocket Lawyer now!

Important Note: A Transfer on Death Deed may be called a Ladybird Deed in Florida, Michigan, Texas, Vermont, and West Virginia.

When to use a Transfer on Death Deed:

- You would like to transfer ownership of your property to a beneficiary, but not until your death.

- You want that piece of property to avoid probate court.

- You would like to retain ownership, responsibility, and control of your property while you are alive.

Sample Transfer on Death Deed

The terms in your document will update based on the information you provide

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

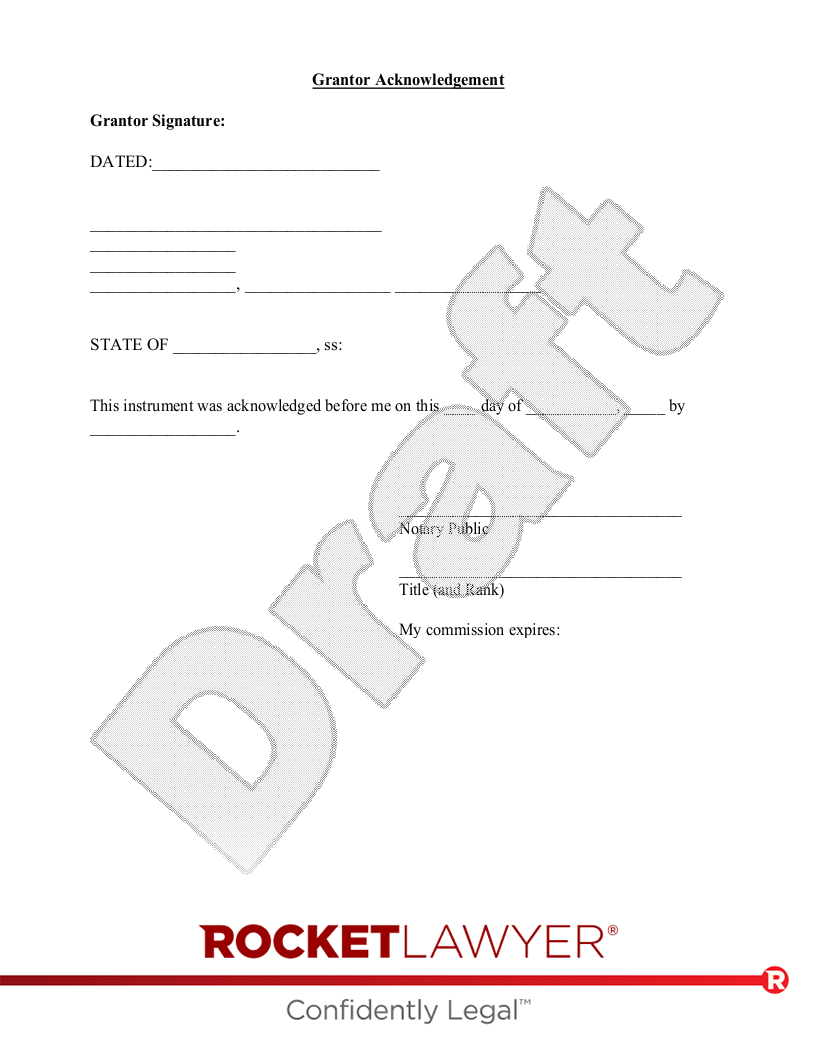

STATE OF , ss:

, ss:

This instrument was acknowledged before me on this ____ day of ___________, _____ by .

I certify that I know or have satisfactory evidence that is the person who appeared before me, and said person acknowledged that s/he signed this instrument and acknowledged it to be his/her free and voluntary act for the uses and purposes mentioned in the instrument.

We, the undersigned witnesses, hereby certify that the above Transfer on Death Instrument was on the date thereof signed and declared by the Grantor as his/her Transfer on Death instrument in our presence and that we, at his/her request in his/her presence in the presence of each other, have signed our names as witnesses thereto, believing to the best of our knowledge that the Grantor was/were at the time of signing of sound mind and memory, and under no influence.

NOTICE: This Notice of Death Affidavit and Acceptance form or equivalent form must be recorded by the beneficiary within 30 days of the death of the owner to make the transfer on death instrument effective. You should consult a lawyer before using this form.

Deed Instrument

Deed Instrument If a witness is required, a witness signature section will be included in the Deed.Deed Instrument prior to the Grantor's deathDeed Instrument

About Transfer on Death Deeds

Learn about how to transfer ownership of property upon your death

-

What are the advantages and disadvantages of a Transfer on Death Deed?

A Transfer on Death (TOD) Deed, also known as a Beneficiary Deed, is like any other real estate transfer deed except for one very important difference: It does not take effect until your death. It is used to leave real estate to a beneficiary or beneficiaries who will receive the property without having to go through probate court proceedings. Read on to learn about both the advantages and disadvantages to using a TOD Deed.

Advantages of a Transfer on Death Deed

A Transfer on Death Deed permits you to select the beneficiary or beneficiaries who will inherit your property when you pass away. The beneficiary you choose does not have any rights to your property while you are alive. Your beneficiary automatically becomes the owner at your death without going through the probate process, like they would if the property was left to them in your Last Will and Testament. If you and your spouse own your home jointly, the transfer on death will not take place until both owners have died. When making a deed, you can name alternate beneficiaries in case your beneficiary refuses the bequest or predeceases you.

Even if the property is listed in your Last Will And Testament, a separate Transfer on Death Deed takes precedence. Still, the named beneficiary in both documents may be updated to match one another. The deed is only valid if filed with your local Property Records office. While different states and localities have different rules, having your document reviewed by a Rocket Lawyer network attorney can help you be confident that your transfer will go through.

Deeds can be revoked, either by requesting a revocation form at your County Recorder’s office or by making a new deed that replaces the most recent version. Also, if you still owe money on the mortgage, or to a contractor, or another party has a lien, the beneficiary will inherit this debt along with the property.

Disadvantages of a Transfer on Death Deed

Unlike naming a beneficiary in your Last Will and Testament, a Transfer on Death Deed becomes part of the public record when it is filed. This means that anyone can see who you plan to inherit your property when you pass. Also, if you name more than one beneficiary in the deed, they can only inherit the property in equal shares. Additionally, while the transfer may avoid the probate process, the property will generally be considered part of your estate when you pass, and creditors may still be able to make a claim against it.

During your lifetime, you continue to pay taxes on any property for which you have a Transfer on Death Deed. When you pass away, the property is exposed to the federal and state estate tax threshold on your estate. For most people, the federal estate tax exemption is high enough that it will not affect them, but some states impose an estate tax with a lower threshold and the beneficiary will have to pay that tax.

There is a potential capital gains benefit to property inherited through a Transfer on Death Deed because the beneficiary will receive a stepped-up basis when it is inherited.

If you need more guidance before getting started on your Transfer on Death Deed, reach out to a Rocket Lawyer network attorney for affordable legal advice.

Transfer on Death Deed FAQs

-

How do I make a Transfer on Death Deed?

With Rocket Lawyer, all you have to do is answer a few simple questions and we build the document for you – so you can focus on spending time with your family or enjoying your life.

It is an easy process: You name the beneficiary, sign the deed, get it notarized, and file or record the deed with your county or local property records office.

-

Where can I make a Transfer on Death Deed?

A Transfer on Death Deed is not available in every state. They are permitted in the following states and Washington, D.C.:

- Alaska.

- Arizona.

- Arkansas.

- California.

- Colorado.

- Hawaii.

- Illinois.

- Indiana.

- Kansas.

- Maine

- Michigan.

- Minnesota.

- Missouri.

- Montana.

- Nebraska.

- Nevada.

- New Mexico.

- North Dakota.

- Ohio.

- Oklahoma.

- Oregon.

- South Dakota.

- Texas.

- Virginia.

- Washington.

- West Virginia.

- Wisconsin.

- Wyoming.

Transfer on Death Deeds may be called a Ladybird Deed in Florida, Michigan, Texas, Vermont, and West Virginia.

In states where a Transfer on Death Deed is not permitted, property owners might put their property into a Living Trust or a pour-over Trust by including instructions in their Last Will and Testament for certain property assets to go into a Trust when they pass. The latter type of trust is called a “pour-over” Trust because assets are “poured” into the trust when you pass away. The assets poured into the Trust can avoid going through probate.

-

How do I revoke, change, or update a Transfer on Death Deed?

It is fairly simple. In order to revoke a deed without replacing it, you can request a revocation form from the local office where you filed the initial deed. To change or update a deed, you can simply file a new deed that supersedes the old one.

It is common to make changes if your beneficiary is no longer in a position to inherit the property, you have another child, or you get divorced. Updating a Transfer on Death Deed can be a much simpler process than updating a Last Will and Testament or Living Trust. Generally speaking, it is good practice to review your estate plan after major life events or at regular timely intervals.

-

What are some alternatives to Transfer on Death Deeds?

You may have decided this isn’t exactly what you’re searching for – or maybe it’s not an option in your state. Don’t worry, there are alternatives. A Living Trust is often used to transfer property between family members and other beneficiaries, and has the added benefit of keeping your heirs out of probate. You may opt for a Simple Will, though Wills do undergo probate after your death. Life estate deeds are also an option: they keep your property out of probate, but they do require your beneficiaries’ permission to make any changes.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.