MAKE YOUR FREE Loan Agreement

What we’ll cover

What is a Loan Agreement?

When can you use a Loan Agreement?

- You are loaning money to someone and want to set out the terms.

- You are borrowing money from a private party and want to outline the terms.

- You wish to prepare an amortization table if the loan will include interest.

- You wish to determine the monthly payment amount on the loan agreement.

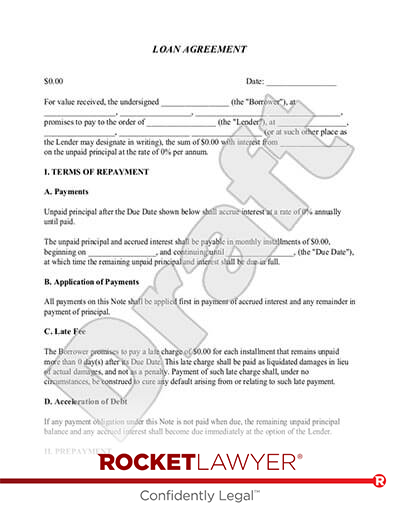

Sample Loan Agreement

The terms in your document will update based on the information you provide

| Date: |

For value received, the undersigned (the "Borrower"), at , , , promises and (collectively, the "Borrower"), at , , , each as principal, jointly and severally, promise to pay to the order of (the "Lender"), and (collectively, the "Lender"), (or at such other place as the Lender may designate in writing), the sum of with

. TERMS OF REPAYMENT

. Payments

THE BORROWER UNDERSTANDS THAT THE PAYMENT OF THE ABOVE INSTALLMENT PAYMENTS MAY NOT FULLY AMORTIZE THE PRINCIPAL BALANCE OF THE NOTE, AND THEREFORE, A BALLOON PAYMENT MAY BE DUE ON THE DUE DATE.

. Application of Payments

All payments on this Note shall be applied first in payment of accrued interest and any remainder in payment of principal.

This Note is secured by personal property in a . This Note shall be secured by a to real property commonly known as , , . Any such prepayment shall be applied against the installments of principal due under this note in the inverse order of their maturity and shall be accompanied by payment of accrued interest on the amount prepaid to the date of prepayment.

. COLLECTION COSTS

If any payment obligation under this Note is not paid when due, the Borrower promises to pay all costs of collection, including reasonable attorney fees, whether or not a lawsuit is commenced as part of the collection process.

. DEFAULT

If any of the following events of default occur, this Note and any other obligations of the Borrower to the Lender, shall become due immediately, without demand or notice:

1) the failure of the Borrower to pay the principal and any accrued interest when due;

2) the liquidation, dissolution, incompetency or death of the Borrower;

3) the filing of bankruptcy proceedings involving the Borrower as a debtor;

4) the application for the appointment of a receiver for the Borrower;

5) the making of a general assignment for the benefit of the Borrower's creditors;

6) the insolvency of the Borrower;

7) a misrepresentation by the Borrower to the Lender for the purpose of obtaining or extending credit; or

8) the sale of a material portion of the business or assets of the Borrower.

assets pledged as security real estate pledged as collateral

. SEVERABILITY OF PROVISIONS

If any one or more of the provisions of this Note are determined to be unenforceable, in whole or in part, for any reason, the remaining provisions shall remain fully operative.

. MISCELLANEOUS

All payments of principal and interest on this Note shall be paid in the legal currency of the United States. The Borrower waives presentment for payment, protest, and notice of protest and demand of this Note.

No delay in enforcing any right of the Lender under this Note, or assignment by Lender of this Note, or failure to accelerate the debt evidenced hereby by reason of default in the payment of a monthly installment or the acceptance of a past-due installment shall be construed as a waiver of the right of Lender to thereafter insist upon strict compliance with the terms of this Note without notice being given to Borrower. All rights of the Lender under this Note are cumulative and may be exercised concurrently or consecutively at the Lender's option.

This note may not be amended without the written approval of the holder.

. GOVERNING LAW

This Note shall be construed in accordance with the laws of the

. SIGNATURES

This Note shall be signed by and and by . , on behalf of

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, this Agreement has been executed and delivered in the manner prescribed by law as of the date first written above.

Signed this _____ day of _______________, _____, at ___________________________, _________________________ .

Borrower:

| By: | Date: |

Lender:

| By: | Date: |

Dated: _________________________

By:____________________________________________________

The is secured by collateral pledged by . Therefore, a Security Agreement should be signed by the parties in addition to the .

and fail fails or and and

About Loan Agreements

Learn how to state loan terms and protect against default

-

What to include in a Loan Agreement

Our Loan Agreement Form can be used to create a legally-binding agreement suitable for any state. It is simple to use, and it only takes a few minutes to make. Even though it is easy to make the document, you'll need to gather a bit of information to make the process go faster.

- Contact information - Legal name and address of the borrower and the lender.

- Repayment options - You'll need to decide when payments are due or if you want the loan to be repaid in one lump sum. You can also configure the Loan Agreement to include monthly payments with a large balloon payment if you want.

- Interest - Not everyone charges interest on a personal loan, but you can if you want to get paid back more than you loaned. You'll also need to decide how you want the interest paid and if there will be any benefits to the borrower if they pay the loan balance early.

- Late fees and consequences of defaulting - You'll need to decide when payments are considered late and the amount of the late fee if any. If the borrower violates the terms of the agreement, you can define what happens if they default (such as transferring the ownership of collateral to you.)

- Collateral - If someone is looking to borrow money from an individual, they likely do not qualify for a traditional bank loan, so collateral may be used to secure the loan. Typical collateral items include vehicles or real estate.

- Cosigner - A cosigner is someone with good credit who is willing to take over payment responsibility for the loan if the borrower defaults or is unable to pay. A cosigner is often used to secure loans to young people who have not yet established their credit history.

- Loan sales - You can include a provision in the agreement that allows the lender to sell the loan. This option is not extremely common in personal loans, but it is a possibility that you can include.

-

Loan Agreement Terms and Conditions

A Loan Agreement, also known as a Loan Contract or Personal Loan Agreement, is used to loan or borrow money with or without interest included. It typically covers the amount of the loan, the interest rate, the repayment terms, and other specific provisions and terms that will be explained in more detail below.

Payback Options

A Loan Agreement, or Note, usually includes one or more provisions that detail how the loan will be paid back. Options for paying back a loan may include:

- "In installments of interest and principal" - interest and principal will be due in regular payments similar to monthly mortgage payments.

- "In installments of interest only" - interest will be due in regular payments, but the principal will not be due until a future date that is specified in the Note.

- "In full on a specific date" - no monthly payments; rather, all of the principal and interest will be due on a future date that is specified in the Note.

- "On Demand" - in other words, payable immediately at the request of the Lender.

Acceleration

An "acceleration" provision allows the Lender to demand immediate payment of an entire loan balance, including payments otherwise due at a future time, if a Borrower defaults under a Loan Agreement. For example, if Scott (the Borrower) has paid two required monthly payments under a Note that will run for 5 years, and if he then stops making payments when due, Mary (the Lender) can then "accelerate" payment of the Note by demanding payment of the remaining principal balance plus accrued interest. ("Accrued interest" is interest that has accumulated but has not been paid.)

Amortization

An amortization schedule is a schedule of principal and interest payments over time for a Loan Agreement (or Loan Contract), mortgage, or other type of debt using a mathematical formula. The term "amortization" means to repay a loan in equal installments over a period of time. Each periodic payment (usually a monthly payment) includes both "principal" (a portion of the initial loan or debt) and "interest" (a charge for borrowing the money), with the payment applied first to the interest and the balance applied to the principal. The initial payments within the schedule will include a higher amount of interest because of the higher principal amount, but as the principal amount is gradually reduced, the monthly payments will be made up of less interest and more principal amount.

Assignment

The "assignment" option can be included to allow the Lender to transfer (e.g., sell) their right to receive the loan payments from the Borrower. For example, the Lender may assign their right to collect the Note payments to a bank. The bank probably would not pay full value to the Lender because of the usual risk that the Borrower may not make all of the Note payments.

Balloon Payment

To lower monthly payments for the Borrower, the Lender may configure the loan to include a “balloon payment” at the end. This is a large payment that makes up for the decreased monthly payments during the payback period.

Costs

Notes (or Loans) usually include a "costs" provision which obligates the Borrower to pay the Lender's collection costs if the Borrower defaults in paying the Note. For example, if Gary (the Borrower) fails to pay a $10,000 Note to Carroll (the Lender) on the due date and Carroll has to hire a lawyer to start a lawsuit to collect the Note, Gary can be required to pay the cost of the lawsuit, including Carroll's attorney's fees.

Default Rate

If the Borrower fails to pay off the Note on or before the due date, it is common to assess a higher rate of interest that becomes effective as of the due date. This higher "default rate" provides an incentive for the Borrower to pay the Note when due, and if the Borrower fails to do so, provides some additional compensation to the Lender. The following example provides an illustration.

Rose (the Borrower) signs a Loan Agreement with Ed (the Lender) which includes the following terms: a principal amount of $5,000, an interest rate of 7%, and a due date of February 23, 2028. The Note also includes a default rate of 10%. The higher interest rate provides an incentive for Rose to pay off the Note by the due date. If she does not, Ed is entitled to interest at 10% on the unpaid balance, with the higher rate going into effect on February 23, 2028, the original due date.

Please note that the default rate will apply to the outstanding balance (the amount that remains unpaid) at the time of the due date. For any concerns of late payments prior to the due date, the late charge provisions of the document can provide for a late fee to be charged when a payment (such as a monthly installment payment) is missed prior to the due date.

Discount

A "discount" provision can be used as a "positive" incentive to encourage the Borrower to pay off the loan early. By discounting the Note, the Borrower benefits by having to pay back a smaller amount to the Lender than would otherwise be required by the loan. Thus, the discount is a bonus to the Borrower who is able to pay off the Note in full early. This option is not a commonly used provision because the discount has the effect of reducing the amount of interest earned.

Events of Default

A "default" is the failure to do something required by the Loan Agreement. Often a Loan Agreement lists "events of default," which usually are events that may impair the Borrower's ability to repay the loan. Because these events threaten the Borrower's repayment ability, the Lender is allowed to demand immediate payment of the entire Note if an "event of default" occurs.

General Provisions

The "general provisions" for the Loan Contract include standard provisions that assist the Lender in enforcing payment of the Note by the Borrower.

Guaranty

A "guaranty" provision may be included so that a co-signer becomes obligated to repay the Loan Agreement for the Borrower if the Borrower defaults by not making payment of the Note. The co-signer, perhaps a third party friend or relative of the Borrower, does not become liable unless the co-signer signs the "guaranty" section of the Note.

Interest

Repayments are applied to the interest due first, and to the principal (original amount borrowed) second.

Most states have usury laws that limit the amount of interest that can be charged. Therefore, if an interest rate is unusually high, it is advisable to check with a lawyer or local bank to make sure that state usury laws will not be violated.

The Internal Revenue Service has special "imputed interest" rules that apply if no interest is charged or if the interest rate charged is lower than the statutory federal rate of interest. The IRS treats such loans as having a higher interest rate than the rate stated in the Loan Agreement. Exceptions apply to most loans of $10,000 or less. Consult a tax advisor or lawyer if no interest or low interest will be charged. The statutory federal rate of interest changes each month. This information may be obtained from a local bank.

Late Charge

The "late fee" provision requires the Borrower to pay a fixed dollar amount if an installment is not paid by its due date. It acts as a negative incentive to encourage the Borrower to make required payments when due. This term is designed to be used if the Note will require installment payments of principal and interest or installment payments of interest only. It is not intended to be used in Notes that are "due on demand" or payable in full on a specific date.

Prepayment

A "prepayment" provision allows the Borrower to pay the Note in advance of the due date without penalty. "Without penalty" provides that the Lender cannot charge the Borrower a fee or try to collect additional funds from the Borrower who is trying to reduce his interest costs. This provision is beneficial to the Borrower who may wish to reduce interest charges by paying off the Note early. Compare this provision with the "discount" provision.

Securing your Loan Agreement

A Loan Agreement may be secured with personal property, using a Security Agreement; it can also be secured through real estate using a Deed of Trust or a Mortgage Deed depending on what state the parties reside in. By securing a promissory note with personal property or real estate (both, "collateral"), the Borrower of the loan promises to give up ownership or title of the property to the Lender in the event that the Borrower fails to pay back the loan. The Security Agreement or Deed of Trust allows the Lender to use or sell the collateral to recover the money loaned to the Borrower.

A Real Estate lawyer in your state can assist you with any questions and help you draft a Security Agreement or Deed of Trust in connection with your Loan Agreement.

Mortgages and Deeds of Trust

When a loan is taken out to purchase real property, the promissory note is usually accompanied by a Mortgage or a Deed of Trust, depending on the state that the parties reside in. The promissory note is essentially the "I.O.U." that details the money lent and the terms for repayment, while the mortgage or the deed of trust is the collateral offered to ensure the performance of the loan. The mortgage or deed of trust is then recorded to evidence and give public notice of the lien created by the promissory note. The lender holds the promissory note while the loan is outstanding and when the loan is paid off, the promissory note is considered paid in full and then returned to the borrower.

Additional steps may be needed, so we recommend you consult with a Rocket Lawyer network attorney in this situation.

Security Agreements

A Security Agreement is a document that is often used in a business setting under which the Borrower pledges personal property to assure payment of the Loan Agreement. If the Borrower fails to make payments on the Note, the security agreement usually gives the Lender the right to have the pledged personal property sold to pay off the Note. It is very important to note that the Lender may be required to take additional steps under local law to make sure that the Lender's claim against the pledged personal property has priority in the case of default. These additional steps may be complicated and it is advisable to consult a lawyer if a security agreement will be used.

-

Definitions of Loan Agreement Terms

Term

Definition

Accrued interest

The amount of interest that a borrower has incurred, but has not yet paid. A loan agreement will identify an accrual period, which could be annual, monthly, daily, or some other period of time. To calculate accrued interest, multiply the principal balance by the interest rate, and then divide that number by the number of accrual periods in a year. For example, monthly accrued interest would use the formula (principal x interest) / 12.

Actual damages

Damages that compensate the nonbreaching party for their out-of-pocket losses caused by a breach of contract, also known as “compensatory damages.” This type of damages replaces the ordinary and reasonable expenses incurred by the nonbreaching party for their performance of the contract, as well as other losses that resulted directly from the breach.

Amortize

The process of scheduling regular, equal payments on a loan with a fixed interest rate and set repayment term. An amortization schedule identifies the amount of each payment that goes towards principal and interest. For a 30-year mortgage, for example, the amortization table will divide the loan into 360 equal monthly payments.

Balloon payment

A one-time payment at the end of a loan term that is larger than the other regular payments. A lender may agree to accept relatively small monthly payments in exchange for a shorter loan term with a final balloon payment. Most residential mortgages cannot have balloon payments, but they are common in many other loan agreements.

Guaranty

A binding promise by a third party to pay a debt if the borrower is unable to pay, also known as “co-signing.” A common example involves parents who guarantee a mortgage, lease, car loan, or other debt for a young adult child who has not established their own credit history. If the borrower defaults on the debt, the lender can pursue the guarantor(s) for collection.

Installment payments

Regular payments in a fixed amount to repay a loan over a defined period of time. Each payment partially consists of interest, with the remaining amount going toward the principal of the loan. An amortization table shows how much of each payment goes to principal and interest.

Liquidated damages

A defined amount of money that a party to a contract must pay to the other party in the event that they fail to meet specific contractual obligations. The amount of damages and the circumstances that would lead to liability for damages must be included in the contract. In a lawsuit for breach of contract, the nonbreaching party only needs to prove that the breach occurred, and that it meets the contract’s requirements for liquidated damages.

Loan Agreement FAQs

-

How do I write a Loan Agreement?

It's easy to make a Loan Agreement on Rocket Lawyer. Just answer a few critical questions, and we'll generate the proper legal language for your contract. Before you write your own Loan Agreement, you should know some of the basic details that are included. For example, you'll need to identify who the lender and borrower are, and you should know the general terms and conditions of your loan, such as, how much money you are lending, and what your expectations are for being paid back.

-

What are the types of loan structures I can agree to?

With a Rocket Lawyer Loan Agreement, you can agree to various types of loan repayment structures including installment payments or a lump sum. Ultimately, the best payment schedule is one that the borrower can manage. With Rocket Lawyer, you have the flexibility to decide which payment schedule will work best for your loan.

If this loan document doesn't fit your needs, we offer other types of loan contracts including:- Promissory Note: A Promissory Note is similar to a Loan Agreement. However, it is a simpler form and doesn't usually include as many provisions as a Loan Agreement.

- IOU Form: An IOU agreement is a step above a handshake agreement. It is suitable for small personal loans.

If you have questions about making your Loan Agreement, ask a lawyer.

-

What is the difference between a Loan Agreement and a Promissory Note?

Essentially, a Loan Agreement and Promissory Note serve the same purpose as both being written agreements for loans, but a Loan Agreement typically contains more formalities and is more detailed than a Promissory Note.

-

Can I write a personal Loan Agreement between family members?

Yes, you can write a personal Loan Agreement between family members. It is important to follow contract formalities to hold both parties accountable. If there is a dispute, it will be difficult to prove the terms of your arrangement without a formal contract. If you've already loaned money and are having a difficult time collecting payments, see How to Collect Personal Debt from a Friend, Family Member or a Business.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.