1. Use a Promissory Note

We can't stress this enough: if you're going to loan a business or other individual any substantial sum of money, put it in writing. Understandably, asking a friend or loved one to enter into a contract can feel impolite, but if you're worried that you may not get paid and that you'll miss the amount of money you've loaned in the first place, it's essential.

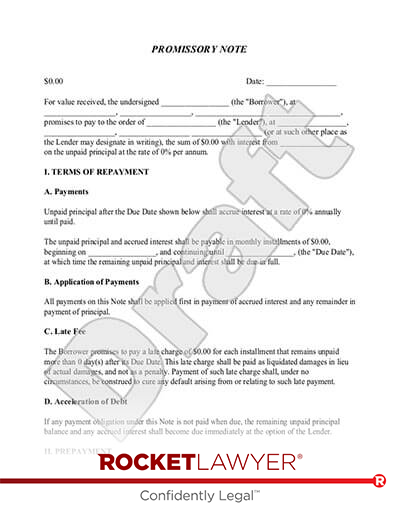

A Promissory Note simply lays out the sum of money loaned and the conditions of repayment. You can set these as you see fit. Perhaps you'd like to acrue interest on loan or demand it repaid within a month or a year. These options are certainly available to you. Promissory notes are fairly simply contracts, but they are binding documents. Securing repayment without one is always much more difficult.

2. Be respectful and polite

Even though the debtor has broken their word, collecting on a debt tends to go more smoothly if you're polite. Contact the debtor and ask if they remember the debt and when they plan to pay. Sometimes, they may have just forgotten. But no matter what, being combative is the surest way to stall the process. Debtors can get combative and react to your negativity. Especially on your first contact, approach them with respect and politeness.

3. Put your requests for payment in writing

If your first entreaties are ignored, it's time to send letters. 30-Day, 60-Day, and 90-Day Past Due Notices can be used for this purpose. They'll create a paper trail and show your debtor that you're serious about getting repaid. Keep copies of these letters in case you end up in small claims court down the line.

4. Think about a Debt Settlement Agreement

If your debtor has fallen on hard times, if you're worried about recouping your loan, or if the amount you loaned is simply not worth the hassle, think about using a Debt Settlement Agreement. With this, you can amend the original agreement, changing the amount owed or the timeframe in which the debtor must pay you. Sometimes, avoiding protracted court room battles or the worry about losing a friend over a debt can spur people to use these agreements. You'll have to consider whether it's right for your particular case, but it's good to know that the option is available.

5. Call in the big guns

Hopefully, it never comes to this, but if your personal attempts to collect your debt go ignored or otherwise fail, it may be time to call a lawyer.

If you were a business, a collections agency might be your best option. But, generally, in personal matters, it's smarter to enlist the help of an attorney first. Have the attorney write a letter to the debtor. The appearance of a demand letter on legal stationary can show your debtor you're serious about getting what you're owed.

If your debtor still won't pay up? Then you may want to consider small claims court. Of course, once you have a seasoned attorney on your side, it's a good idea to ask their advice as to how to proceed. After all, every loan, every debt, and every situation is different. A good lawyer can advise you how best to navigate your unique situation.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.