Am I hiring employees or independent contractors?

Generally, an employee is a person who is hired by another person or business (an employer) for a wage or fixed payment in exchange for services to help operate the employer's business. An independent contractor is a person who runs an independent business and agrees to provide services to other businesses for a price. For example, an expert in cybersecurity might provide services to several businesses as an independent contractor.

The difference between employees and independent contractors, for employers, can be rather significant. Misclassifying an employee as an independent contractor can lead to legal trouble, lawsuits, fines, and tax penalties. When hiring employees, it is important to learn about and meet your basic legal requirements as an employer.

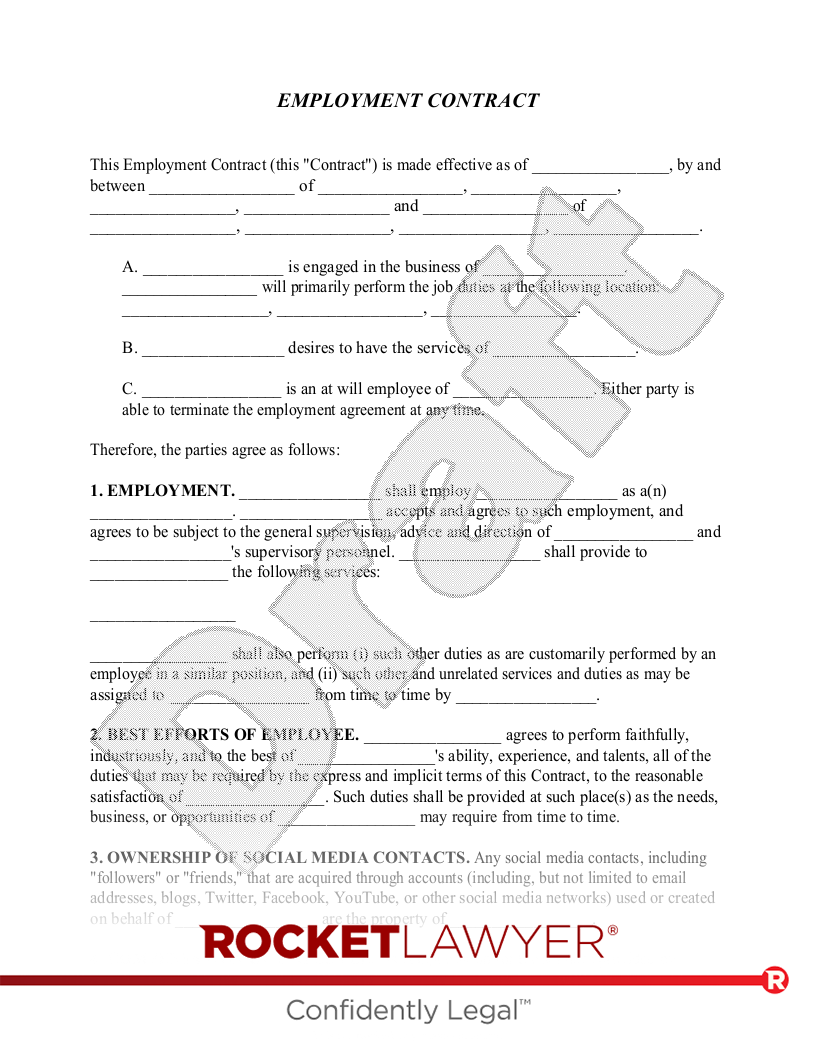

What goes in an Employment Agreement?

When hiring employees using an Employment Contract, or independent contractors with an Independent Contractor Agreement, you may want to carefully consider what goes into your agreements.

For employees, you may want to include the following terms, information, and additional documents, to your agreements:

- Starting date and possibly an end date.

- Title of the position being offered.

- Rate of pay.

- Length of any probationary period.

- Details about eligibility for benefits.

- Confidentiality.

- Noncompete or Non-Disclosure Agreements.

- Statement explaining that employment is "at-will" or for a limited duration of time.

It can help to include any other state, industry-specific, or company required information, such as requiring employees to follow company policies and procedures in an Employee Handbook.

For independent contractors, you may want to make sure your agreement includes:

- Scope of services.

- Upfront pricing and payment information.

- Clear deadlines or timeframes for services.

- Non-disclosure and confidentiality.

- Insurance or tax requirements.

When making agreements that may have an ongoing impact on your business, having your customized document reviewed by a Rocket Lawyer network attorney can help you identify areas that may require more of your attention.

How do I offer employee benefits?

To offer benefits like health insurance, vision and dental, or other valuable services that you cannot provide or administer yourself, third party benefits providers are available. There are several different optional benefits that can be provided to employees. In some places, these benefits may even be required to be offered during an open enrollment period. Some required benefits may include:

- Health insurance coverage.

- Sick leave.

- Parental leave.

In addition, you may consider giving the option of adding other, non-listed benefits, such as vacation time, holidays, flex-time, additional maternal and paternal leave, and more. Typically, Employment Contracts explain that employee benefits may change from time to time. This allows the employer to be free to change the amount of benefits (for example, the number of vacation days) from time to time without violating the agreement. Benefits may also be spelled out in detail in your Employee Handbook.

What the law requires varies from location to location, and often depends on the size of an employer. If you need help evaluating benefits plans, or figuring out what you are legally required to provide, talking to a lawyer can provide you a clear and direct answer.

How do I determine compensation and pay workers?

Wages and commission payments to employees must comply with the requirements of the Fair Labor Standards Act (FLSA). The FLSA is a federal law covering wages, working hours, and other employer-employee matters. For example, some types of employees must be paid at least twice per month. In addition, many states also have their own state laws regulating minimum wage and overtime pay. In some cases, state law is more restrictive than federal law.

Additionally, employers are required to withhold employee taxes as well as pay employment taxes, withhold and pay for benefits and other insurance. While these extra steps may sound complicated, small business owners are frequently able to manage these with ease, after some practice. Additionally, payroll processing companies can often help automate the process.

If you are unsure on how to set up your compensation structure and policies, or how to do withholdings or pay employment taxes, talking to a Legal Pro can help.

How do I make sure employees don't give away my business secrets?

The Employment Contract offers a confidentiality paragraph that obligates the employee to protect and not disclose the employer's proprietary or confidential information. Confidential information is unique to your company and disclosure of it can cause harm to the business.

Some employers may want a separate agreement to protect their trade secrets, while others may include it as part of an Employment Contract. The confidentiality paragraph includes an option that describes the employer's rights to take action against actual or potential disclosures. Another option allows for the continuation of the confidentiality provisions after termination of employment. Some states may impose a maximum time limit for how long the employer's information must be kept confidential. The confidentiality limitations must be reasonable in light of the needs and practices of the business and in the industry. Whether you need a Confidentiality Agreement, Non-Disclosure Agreement, a Noncompete, or all three, varies based on your business's needs and how you plan to enforce those agreements if violated.

If you have more questions about hiring employees, reach out to a Rocket Legal Pro for affordable legal advice.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.