Make your new hire official: Employment Contract

What we’ll cover

What is an Employment Contract?

An Employment Contract between employer and employee sets out important terms of employment, and ensures that both parties understand what is expected of them.

For an employer, having an Employment Contract is a crucial part of protecting your company – particularly because employee lawsuits are increasingly common. When there is no written contract, these lawsuits can be ambiguous and more costly. Although a written agreement will not eliminate the possibility of a lawsuit, it may help to reduce the risk and cost.

Also referred to as an Employment Agreement, it protects employees too, as it clearly lays out the conditions, rights and obligations for each party. Whether you’re an employer or employee, get started on yours now with Rocket Lawyer!

When to use an Employment Contract:

- You are hiring a new employee and wish to specify the employee's compensation and summarize the terms of the employment agreement.

- You are becoming an employee of an employer who will not otherwise be providing a written employment agreement.

- You are an employer and wish to formalize a verbal employment agreement with your current employees.

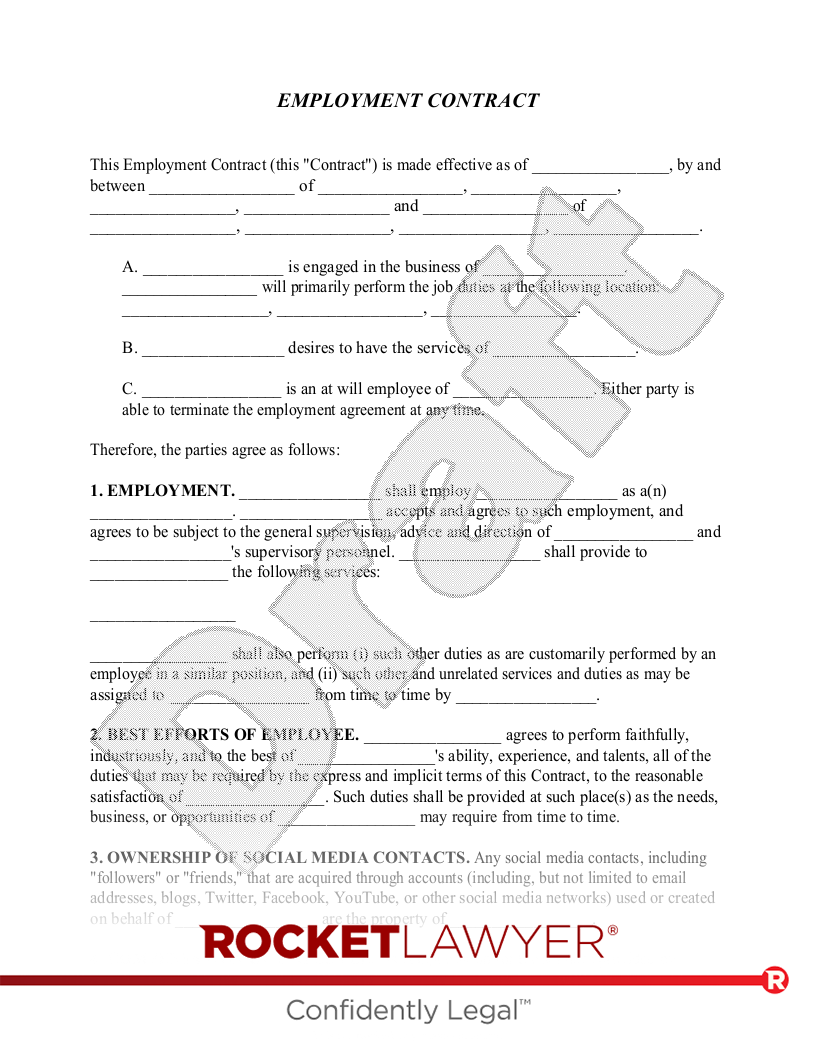

Sample Employment Contract

The terms in your document will update based on the information you provide

This (this "") is made effective as of , by and between of , , , and of , , , .

A. is engaged in the business of . will primarily perform the job duties at the following location: , , .

B. desires to have the services of .

C. is an at will employee of . Either party is able to terminate the employment agreement at any time.

Therefore, the parties agree as follows:

. EMPLOYMENT. shall employ as a(n) . shall provide to duties as needed. the services described on the attached Exhibit A, which is made a part of this by this reference. accepts and agrees to such employment, and agrees to be subject to the general supervision, advice and direction of and 's supervisory personnel. shall provide to the following services:

. BEST EFFORTS OF EMPLOYEE. agrees to perform faithfully, industriously, and to the best of 's ability, experience, and talents, all of the duties that may be required by the express and implicit terms of this , to the reasonable satisfaction of . Such duties shall be provided at such place(s) as the needs, business, or opportunities of may require from time to time.

. OWNERSHIP OF SOCIAL MEDIA CONTACTS. Any social media contacts, including "followers" or "friends," that are acquired through accounts (including, but not limited to email addresses, blogs, Twitter, Facebook, YouTube, or other social media networks) used or created on behalf of are the property of . .

. COMPENSATION OF EMPLOYEE. As compensation for the services provided by under this , will pay an annual salary of payable per . This amount shall be paid in accordance with 's usual payroll procedures and subject to applicable federal, state, and local withholding. monthly on the day of each month and subject to applicable federal, state, and local withholding. of the following month and subject to applicable federal, state, and local withholding. semi-monthly on the day and the day of the month and subject to applicable federal, state, and local withholding. on of every other week and subject to applicable federal, state, and local withholding. every two weeks, no later than days after the payroll period that ended on the preceding and subject to applicable federal, state, and local withholding. weekly, no later than days after the payroll period that ended on the preceding and subject to applicable federal, state, and local withholding. Upon termination of this , payments under this paragraph shall cease; provided, however, that shall be entitled to payments for periods or partial periods that occurred prior to the date of termination and for which has not yet been paid, and for any commission earned in accordance with 's customary procedures, if applicable. If this terminates due to discharging from service, payments due shall be paid within seven working days or the end of the next regular pay period, whichever is sooner. If termination is due to quitting the service of , payments due shall be paid no later than the regular payday for the pay period during which the termination occurred. Accrued vacation will be paid in accordance with state law and 's customary procedures. This section of the is included only for accounting and payroll purposes and should not be construed as establishing a minimum or definite term of employment.

. COMMISSION PAYMENTS. In addition to the payments under the preceding paragraph, As an alternative to the payments under the preceding paragraph, may receive commission payments in lieu of regular compensation for any particular pay. will make commission payments to based on of . This commission will be paid monthly on the day of the following month. semi-monthly on the day and the day of the month, each payment corresponding to the semi-monthly period that ended approximately fifteen days prior to the payment date. weekly, no later than days after the payroll period that ended on the preceding . every two weeks, no later than days after the payroll period that ended on the preceding . Upon request by , will make advances against expected commissions in accordance with 's usual policies.

. EXPENSE REIMBURSEMENT. will reimburse for "out-of-pocket" expenses incurred by in accordance with 's policies in effect from time to time. the following "out-of-pocket" expenses in accordance with policies in effect from time to time:

-

. RECOMMENDATIONS FOR IMPROVING OPERATIONS. shall provide with all information, suggestions, and recommendations regarding 's business, of which has knowledge, that will be of benefit to .

. CONFIDENTIALITY. recognizes that has and will have information regarding the following:

-

and other vital information items (collectively, "Information") which are valuable, special and unique assets of . agrees that will not at any time or in any manner, either directly or indirectly, divulge, disclose, or communicate any Information to any third party without the prior written consent of . will protect the Information and treat it as strictly confidential. A violation by of this paragraph shall be a material violation of this and will justify legal and/or equitable relief.

. NON-COMPETE AGREEMENT. recognizes that the various items of Information are special and unique assets of the company and need to be protected from improper disclosure. In consideration of the disclosure of the Information to , agrees and covenants that during his or her employment by and for a period of following the termination of 's employment, whether such termination is voluntary or involuntary, will not directly or indirectly engage in any business competitive with . or do business with the following competitor(s):

-

This covenant shall apply to the geographical area that includes anywhere in the United States. all of the State of Commonwealth of . the area within a -mile radius of . . Directly or indirectly engaging in any competitive business includes, but is not limited to: (i) engaging in a business as owner, partner, or agent, (ii) becoming an employee of any third party that is engaged in such business, (iii) becoming interested directly or indirectly in any such business, or (iv) soliciting any customer of for the benefit of a third party that is engaged in such business. agrees that this non-compete provision will not adversely affect 's livelihood.

. EMPLOYEE'S INABILITY TO CONTRACT FOR EMPLOYER. shall not have the right to make any contracts or commitments for or on behalf of without first obtaining the express written consent of .

. BENEFITS. shall be entitled to employment benefits, as provided by 's policies in effect during the term of employment. These benefits include:

-

. VACATION. shall be entitled to of paid vacation for each completed year of employment. Such vacation must be taken at a time mutually convenient to and , and must be approved by . Requests for vacation shall be submitted to 's immediate supervisor prior to of each year. days in advance of the requested beginning date.

The provisions of this Vacation section are subject to change in accordance with policies in effect from time to time.

. SICK LEAVE. After completion of of employment, shall be entitled to shall be entitled to paid time, due to illness unpaid time, due to illness or for personal business, for each calendar year beginning January 1, . for each year of employment, with the year to be measured using 's starting date as the point of beginning. Unused sick leave benefits as of of each year Up to of any unused sick leave benefits as of of each year may be converted into cash compensation at a rate of per . Sick leave benefits may not be converted into cash compensation. 's rights to unused sick leave benefits shall be forfeited upon termination of employment. Sick leave may be accumulated from year to year up to a total of ; excess amounts shall be forfeited. Sick leave may not be accumulated from year to year; unused benefits shall be forfeited.

All requests for sick days off shall be made by in accordance with policies in effect from time to time.

The provisions of this Sick Leave section are subject to change in accordance with policies in effect from time to time.

. PERSONAL LEAVE. After completion of of employment, shall be entitled to shall be entitled to paid time, for personal business unpaid time, for personal business or due to illness, for each calendar year beginning January 1, . for each year of employment, with the year to be measured using 's starting date as the point of beginning. Unused personal leave benefits as of of each year Up to of unused personal leave benefits as of of each year may be converted into cash compensation at a rate of per . Personal leave benefits may not be converted into cash compensation. 's rights to unused personal leave benefits shall be forfeited upon termination of employment. Personal leave may be accumulated from year to year up to a total of ; excess amounts shall be forfeited. Personal leave may not be accumulated from year to year; unused benefits shall be forfeited.

All requests for personal days off shall be made by in accordance with policies in effect from time to time.

The provisions of this Personal Leave section are subject to change in accordance with policies in effect from time to time.

. HOLIDAYS. shall be entitled to holidays with pay during each calendar year. All requests for holidays off shall be made by in accordance with policies in effect from time to time. shall be entitled to the following holidays with pay during each calendar year:

-

The provisions of this Holidays section are subject to change in accordance with policies in effect from time to time.

. INSURANCE BENEFITS. shall be entitled to insurance benefits, in accordance with 's applicable insurance contract(s) and policies, and applicable state law. These benefits shall include:

The provisions of this Insurance Benefits section are subject to change in accordance with policies in effect from time to time.

. BENEFITS. shall be entitled to the following benefits:

-

. TERM/TERMINATION. 's employment under this shall be for an unspecified term on an "at will" basis. , beginning on . This may be terminated by upon written notice, and by upon written notice. If shall so terminate this , shall be entitled to compensation for beyond the termination date of such termination, unless is in violation of this . If is in violation of this , may terminate employment without notice and with compensation to only to the date of such termination. The compensation paid under this shall be 's exclusive remedy.

. TERMINATION FOR DISABILITY. shall have the option to terminate this , if becomes permanently disabled and is no longer able to perform the essential functions of the position with reasonable accommodation. shall exercise this option by giving written notice to .

. COMPLIANCE WITH EMPLOYER'S RULES. agrees to comply with all of the rules and regulations of .

. RETURN OF PROPERTY. Upon termination of this , shall deliver to all property which is 's property or related to 's business (including keys, records, notes, data, memoranda, models, and equipment) that is in 's possession or under 's control. Such obligation shall be governed by any separate confidentiality or proprietary rights agreement signed by .

. NOTICES. All notices required or permitted under this shall be in writing and shall be deemed delivered when delivered in person or on the third day after being deposited in the United States mail, postage paid, addressed as follows:

Employer:

,

Employee:

,

Such addresses may be changed from time to time by either party by providing written notice in the manner set forth above.

. ENTIRE AGREEMENT. This contains the entire agreement of the parties and there are no other promises or conditions in any other agreement whether oral or written. This supersedes any prior written or oral agreements between the parties.

. AMENDMENT. This may be modified or amended, if the amendment is made in writing and is signed by both parties.

. SEVERABILITY. If any provisions of this shall be held to be invalid or unenforceable for any reason, the remaining provisions shall continue to be valid and enforceable. If a court finds that any provision of this Agreement is invalid or unenforceable, but that by limiting such provision it would become valid or enforceable, then such provision shall be deemed to be written, construed, and enforced as so limited.

. WAIVER OF CONTRACTUAL RIGHT. The failure of either party to enforce any provision of this shall not be construed as a waiver or limitation of that party's right to subsequently enforce and compel strict compliance with every provision of this .

. APPLICABLE LAW. This shall be governed by the laws of the State of Commonwealth of .

. SIGNATORIES. This shall be signed by , on behalf of and by in an individual capacity. This is effective as of the date first above written.

| By: | Date: |

,

| By: | Date: |

Checklist

Make It Legal™

Find out next steps for your document

___Sign this document. This document needs to be signed by:

The can be signed online. It becomes effective as of the date specified in the .

___Everyone gets a copy. Anyone named in the document should receive a copy of the signed document. If you sign this agreement online a copy will be securely stored in your account. You can share your document from your account.

Important Details

This document should not be used if the Employee is covered by a collective bargaining agreement, if the Employee is considered to be a consultant, or if the Employee is considered to be an independent contractor.

This document should be reviewed periodically to evaluate whether circumstances have changed enough to warrant changes to the .

About Employment Contracts

Learn about how to make your new hire official

-

7 common terms in an Employment Contract

An Employment Contract sets out the parameters of the employment relationship between an employee and their employer. To do so, it typically includes terms to make sure all provisions are clear to both parties. This includes:

1. Intellectual property

Employees often have helpful ideas on how to improve efficiency or make the workplace more enjoyable. Employers can benefit from these ideas by encouraging employees to share these ideas. Generally, employee-generated ideas become the property of the employer if generated during the employee's course of employment. However, this result can vary from state to state and also depends on how closely related the idea is to the employee's job duties.

2. Compensation

Wage payments and commission payments to employees must comply with the requirements of the Fair Labor Standards Act, a federal law regarding wages, working hours, and other employer/employee matters. For example, some types of employees must be paid at least twice per month.

In addition, many states also have their own state laws regulating minimum wage and overtime pay. In some cases, state law is more restrictive than federal law. For additional information, contact an attorney or the local office of the "wage and hour" division of the U.S. Department of Labor (or similar state agency).

3. Commissions

"Commissions" are compensation paid to an employee (e.g., a salesperson) or an independent contractor (perhaps also a salesperson). The commission is usually an amount based on the employee's results. For example, a salesperson's commission is often a percentage of the salesperson's sales volume. A commission plan should be in writing and should clearly describe any limitations on the amount of commissions that can be earned, as well as the circumstances under which commissions will be paid.

4. Expense reimbursement

Many employers reimburse their employees for various "out-of-pocket" expenses. For example, if the employee is required to use his or her car to carry out his or her responsibilities on behalf of the employer, the employer may reimburse the employee by making a fixed "per mile" payment. Other reimbursed expenses might include long distance phone calls, travel expenses, and education or seminar expenses.

5. Vacation, sick leave, holidays, and other benefits

An employee may be entitled to several benefits to their employees, such as paid vacation days, sick leave, holidays, and even personal days. If that is the case, it’s a good idea to make that clear in your Employment Contract.

6. Employment confidentiality

Employment Contracts most of the time offer a confidentiality paragraph that obligates the employee to protect and not disclose the employer's proprietary or confidential information. "Confidential information" is information that is unique to a particular company. The confidentiality paragraph usually includes language that describes the employer's rights to take action against actual or potential disclosures. Another option allows for the continuation of the confidentiality provisions after termination of employment.

Court decisions vary from state to state, but some may impose a maximum time limit regarding the time period for which the employer's information must be kept confidential. The confidentiality limitations must be "reasonable" in light of the needs and practices of the employer's business and industry.

7. Return of property

It is advisable to require an employee to return all employer property immediately upon termination of the employment. Any delay can lead to difficulties in recovering technology, cars, tools, keys and important records. Continued use of these items by the now "former" employee can cause significant damages for the employer. In some cases, employees could sign a confidentiality agreement which has specific provisions regarding the return of records and other information that belongs to the employer.

Seems complicated? Don’t be overwhelmed. With Rocket Lawyer, making your Employment Contract is as easy as answering a few questions. Get started now!

-

What is the difference between an employee and an independent contractor?

If you’re an employer trying to figure out if a person should be an employee tied to your business with a contract or an Independent Contractor Agreement, you should know that the IRS has very strict guidelines concerning whether a person providing services is an employee or an independent contractor.

Businesses may attempt to make their workers "independent contractors" so that they are not obligated to provide employee benefits or to withhold employee payroll taxes.

However, the IRS often views such relationships as "employer/employee" relationships in order to assess payroll taxes against the employer, which may lead to unexpected tax bills or even penalties. In such cases, it is advisable to consult a tax expert to determine whether the Employment Contract (for employees) should be used instead of an Independent Contractor Agreement or Work for Hire Contract.

If one or more of the following factors apply, there is a possibility that the IRS will view the worker as an employee:

- The worker will work only for the company that is hiring the worker, the relationship between the worker and the company is continuous, or the company integrates the worker into its business operations.

- The worker will be paid an hourly, weekly, or monthly wage, or the worker does not bear the risk of realizing a profit or loss.

- The company will control or significantly influence the worker's working hours or work environment, or the worker works on the company's premises.

- The company will control or significantly influence the worker's work methods, and is not merely interested in the results of the worker's services.

- The company furnishes tools and equipment required by the worker to perform the services, the company pays for business or traveling expenses, or the worker has little or no investment in his or her independent business.

- The company requires that the worker must render services personally, the company hires, supervises, or pays assistants, or the company determines the sequence of work to be performed.

- The relationship of the worker to the company includes other factors that are similar to factors that characterize the relationship of employees to employers.

The existence of one of the above factors by itself may not be determinative, but it will be considered along with other factors by the IRS in deciding which relationship is more dominant. The primary issue in determining the distinction between an employee and independent contractor is whether the company maintains the right to control the manner and means by which the worker accomplishes the desired result.

Having this clear from the start is important for more than just tax-related issues. It also impacts employer liability. Generally, an employer can be held liable for the actions of an employee that were committed during the course and within the scope of the employment relationship. On the other hand, a business is less likely to be held liable for the actions of independent contractors.

If you have additional questions about the type of relationship created, or if you have any doubt whether a worker is an employee or independent contractor, ask a lawyer.

-

Termination of the Employment Contract: what happens when the employment comes to an end?

The termination paragraph of an Employment Contract specifies the amount of notice that must be given if either party wishes to terminate the agreement. In addition, the amount of compensation to which the employee will be entitled (if terminated) can be stated.

What about employment at will?

Our contract, for example, allows the selection of employment "at will," which means that either the employer or employee can terminate the employment relationship at any time, with or without notice. Traditionally, in the absence of a written agreement governing the duration of a person's employment, an employer could terminate the employment relationship at any time, for any reason (other than a discriminatory or illegal reason) with or without notice.

While many states have severely limited or restricted the employment-at-will doctrine, this doctrine is still the law in some states. In these states, employment-at-will is still presumed unless there is an agreement establishing the duration of the employment relationship. In most states, any such agreement (for a fixed duration) must be in writing if the term of the agreement exceeds one year. If an employer wishes to have the option of terminating the employee at any time, it is essential that the employment agreement be of indefinite duration.

For more information regarding the implications of an employer's failure to clearly maintain an employee's "at will" status, talk to a lawyer. A termination by an employer should be conducted under the advice of a lawyer familiar with the facts. A termination that is handled inappropriately can provide the basis for a discrimination or other employment lawsuit.

-

Am I allowed to include a non-compete provision in my Employment Contract?

The non-compete provision is intended to provide additional protection against the possibility that the knowledge gained by the employee regarding the employer will be used in the future to compete against the employer.

However, the courts in many states view non-compete provisions as a "restraint of trade," and therefore are reluctant to enforce them. Some states, including Alabama, Colorado, Hawaii, Louisiana, Nevada, North Carolina, South Dakota, Oregon, Texas, and Wisconsin have significant restrictions on the enforceability of non-compete provisions, while California, Montana, North Dakota, and Oklahoma do not even permit non-compete provisions.

Non-compete provisions are enforceable in many states only when they are "reasonable" in terms of their effect on the parties and the general public, and where the restraint imposed is not greater than necessary to protect the company's valid business interests. Generally, for a non-compete provision to be enforceable, the employer must have a protectable business interest in specific customer or trade information.

The legality of restrictions in the agreement will be determined on a case by case basis in court. If you have any questions, do not hesitate to ask a lawyer.

-

How to address the Americans With Disabilities Act in my Employment Contract?

The Americans With Disabilities Act prohibits all public entities and private businesses from discriminating in their employment practices. Employers must reasonably modify their policies, practices, and procedures to avoid discrimination against qualified individuals with disabilities. The application of the Act may vary depending on the number of employees working for the employer.

Employers must make "reasonable accommodation" for the known mental and physical limitations of otherwise qualified applicants or employees with disabilities. "Reasonable accommodation" means any change or adjustment to a job or work environment that permits a qualified applicant or employee with a disability to (i) participate in the job application process, (ii) perform the essential functions of the job, or (iii) enjoy benefits and privileges of employment equal to those enjoyed by employees without disabilities. Examples include:

- Buying or modifying equipment.

- Changing the job.

- Modifying work schedules.

- Making the workplace accessible.

There are exceptions if the employer can show that the accommodation would impose an "undue hardship." This term means significant difficulty or expense relative to the operation of the employer's business. If a particular accommodation might constitute an "undue hardship," other alternatives must still be considered.

But keep in mind that before concluding that a particular accommodation would create an undue hardship, a lawyer should be consulted to determine whether the denial of the accommodation might violate the law.

The purpose of the Act is to protect qualified individuals from discrimination on the basis of a disability. Whether a particular individual is covered by the Act requires a careful analysis of whether the person is "an individual with a disability" and whether the person is "qualified." Before any action is taken by an employer with respect to a disabled individual requesting accommodation, a lawyer should be consulted to avoid any violation of the Act or similar state laws which apply to disabled persons.

Employment Contract FAQs

-

What should be included in an Employment Contract?

What should be included in your employment contract will depend on the nature of the employment. Although some companies will include the foregoing information in separate documents, here are some of the most common terms that a good employment contract template will likely include:

- Wage information - The contract should include specific wage information including hourly rate or salary, commission information, etc. It will likely also include payroll schedule information.

- Benefits - The agreement should discuss whether the employee will be eligible to receive benefits such as health insurance, dental insurance, vision insurance, life insurance, and disability insurance, and it should contain information regarding paid time off, sick leave, and vacation.

- Good faith clause - Sometimes called "best efforts," this clause requires that the employee works to their best ability. It may also include information regarding severance.

- At-will and termination - An at-will clause explains whether the employer is required to have a reason for dismissing the employee. It also contains information regarding policies for termination, such as returning company property, etc.

- Confidentiality and non-disclosure - The contract should specify which information is to be treated as confidential. It may cover information such as products, inventions, designs, processes, customer lists, pricing, trade secrets, and more. Typically, there is a mention of how long the confidentiality is expected.

-

What is contract employment?

A contract employee is typically a temporary type of employment classification. Contract employment usually refers to an individual retained by a company for a specific job at a specific wage for a specific amount of time—for example, a landscaping professional being hired for the summer season.

-

Should you have a contract of employment?

As a general matter, if you are giving or receiving money for any completed work, you should have a contract of employment. Rocket Lawyer's free and highly-customizable Employment Contract template is easy to use, and you can edit, save, and share it in your account. A contract of employment is a legally enforceable document.

Common scenarios under which you'll want a contract of employment include:

- You are hiring a new employee and want to ensure that they understand the employment relationship.

- You are hiring a new employee and you need them to sign a confidentiality agreement.

- You need to communicate to your new employee that they are an "at-will" employee.

- Thus far you've only had verbal employment agreements and need a formal agreement for your current employees.

-

What are the 4 types of employment?

There are a number of different types of hiring arrangements. Here are some examples:

Employees - An employee can either be a part-time or full-time relationship where a person is hired by a company. An employee can be paid by the hour or with a salary.

If you hire employees for the holidays or other peak times for your business, these might be classified as seasonal or temporary employees.

Independent Contractors - Independent contractors provide goods or services to a company under terms specified in a contract. Individual freelancers or businesses can be hired as independent contractors.

Interns or Apprentices - These individuals work under the direction of a master or highly skilled mentor who either teach skills necessary for licensing, or in the case of an intern, typically provide training for white collar careers.

If you have further questions about making an Employment Contract, ask a lawyer.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.