Is it legal for an independent contractor to work an hourly shift?

The answer to this question is a bit complicated as it really depends on the work being performed. Business owners should be careful when assigning independent contractors to work regular hourly shifts that employees would typically work because doing so could lead to big problems for employers. If an employer misclassifies a worker, there can be legal and tax consequences, such as fines, penalties, and back pay. For employers, it is critical to understand the difference between independent contractors and employees from a legal perspective, and how these differences impact the way workers are classified in the eyes of the law.

The classification of workers as employees or independent contractors is less about the label and more about the worker's relationship with the employer. Classification is further complicated by laws that differ from state to state, and state laws that differ from federal laws.

In general, the more control the business owner has over the worker and their work, the more likely a worker is an employee instead of an independent contractor. Consider the following questions when thinking through your relationships with your workers:

- Who decides when, where, and how the work gets done?

Employees tend to have a set number of hours (a shift) that they must work in a set location (such as an office or factory), as determined by management, who supervises the employees as they work. Independent contractors, on the other hand, are generally free to work on their assigned tasks whenever, wherever, and however they choose so long as they meet the business owner's deadline and expectations for work product.

- Who determines how much the worker gets paid?

Employees work for wages set by the business owner and receive a regular paycheck. Independent contractors set their own rates and receive payment when the work is completed, or as called for in their contract.

- Who owns the tools and resources?

Business owners typically provide employees with the tools and resources necessary to do their work, and those tools and resources remain the property of the business owner. Independent contractors normally bring their own tools to the job.

- Is the work time-limited or a discrete task?

Businesses usually hire employees to perform their assigned duties indefinitely, until either the business owner or the employee decides to part ways. Independent contractors are hired for definite time periods or for discrete tasks, such as managing a social media account for one week or writing one contract.

Assigning an independent contractor to work an hourly shift each day gives the business owner control over when the contractor performs their work, so it increases the likelihood that the IRS or a court will classify the contractor as an employee if somehow the worker's classification ever came up. Depending on a number of different factors, this could lead to you, the employer, being on the hook for unpaid taxes and other liabilities if the worker was determined to be an employee but was being treated as an independent contractor. You can connect with a Rocket Lawyer On Call® attorney to help you properly classify your workers.

Can a business hire a contractor as an employee for temporary coverage?

Sometimes business owners know they are only going to need an extra worker for a temporary period. An essential employee might go on paternity leave or take care of a sick parent, or the summer season might bring a high volume of customers into a store before traffic drops off again in the autumn.

Business owners should be careful about classifying workers hired for such temporary periods as contractors instead of employees. Even though a work contract is time-limited, it may not justify classifying the worker as a contractor instead of an employee. If the replaced worker was an employee, the contractor replacing them may be as well. It's important to note that businesses may hire temporary employees using an Employment Contract that sets a specific duration.

There are creative solutions that you may consider if you do not want to hire a temporary employee. One potential solution is a temp. Staffing agencies act as employers of record for their workers, allowing you to fill a gap without hiring a new employee, while still allowing you the control needed over the work being done.

Another potential solution is to break down the work into discrete tasks. What work does the employee you are replacing do on a daily basis? Could they be divided and assigned to multiple contractors, at least temporarily? Or could assigning some of those tasks to contractors reduce the workload so you or an employee could pick up the slack? Instead of hiring a temporary employee to replace your administrative assistant, for example, perhaps you could hire an off-site contractor to monitor and respond to emails while you answer the office phone.

What can a business do if a contractor does not want to be paid as an employee?

Whether a worker is an independent contractor or an employee is determined by federal and state law. How workers want to be classified is as irrelevant as how business owners want to classify them.

If a worker you suspect should be classified as an employee wants to be paid as a contractor, you may explain the consequences of misclassification. These can include owing state and federal income taxes, unpaid worker's compensation premiums, penalties and interest.

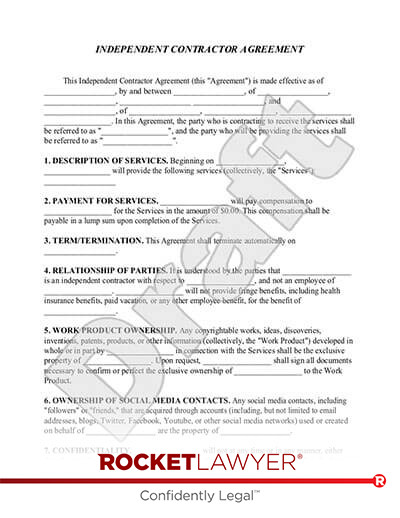

If the worker persists, consider renegotiating so the relationship is structured for an independent contractor, rather than an employee. Remember that the primary factor in this determination is control. The less control you have as a manager over the employee's work, the less likely it is that a court or the IRS will classify them as an employee. Regardless of the terms you eventually come to with the worker, be sure to memorialize it in an Independent Contractor Agreement that explicitly outlines the relationship.

Can a business hire a former employee as an independent contractor?

Yes, businesses may hire former employees as independent contractors if the relationship can support that classification.

For example, you can hire a former employee as a contractor to train new staff, or complete a project or two independently. You cannot, however, hire a former employee as a contractor and treat them exactly the same as you did when they were an employee. Rather, the work relationship must change to reflect the change in classification. In practice, this means you should have less control over when, how, and where your former employee completes their work.

A Rocket Lawyer network attorney can help give you peace of mind about your business's relationships with its workers. Get the legal help you need anywhere and on any device using the Rocket Lawyer Mobile App.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.