Confirm and transfer ownership of a property: Bargain and Sale Deed

What we’ll cover

What is a Bargain and Sale Deed?

A Bargain and Sale Deed is a legal document that a seller of real estate can use to confirm their right to transfer a property title. Bargain and Sale Deeds are often used in relation to foreclosures and tax sales, and they do not indicate that a property is free of liens or debts.

Like a Quitclaim Deed, a Bargain and Sale Deed can be used when transferring ownership between family members, placing property into a family trust, or purchasing property at a tax or foreclosure sale.

A Bargain and Sale Deed, sometimes called a Deed of Bargain and Sale, can be drafted to provide a guarantee to the buyer that the seller owns the property free and clear of any debt (unless the debt is disclosed in the deed). If this sounds like what you might need, get started now – making your Bargain and Sale Deed with Rocket Lawyer is as easy as answering a few questions!

When to use a Bargain and Sale Deed:

You are transferring property with a person you are familiar with such as a family member.

You own a business and you want to buy or sell real property.

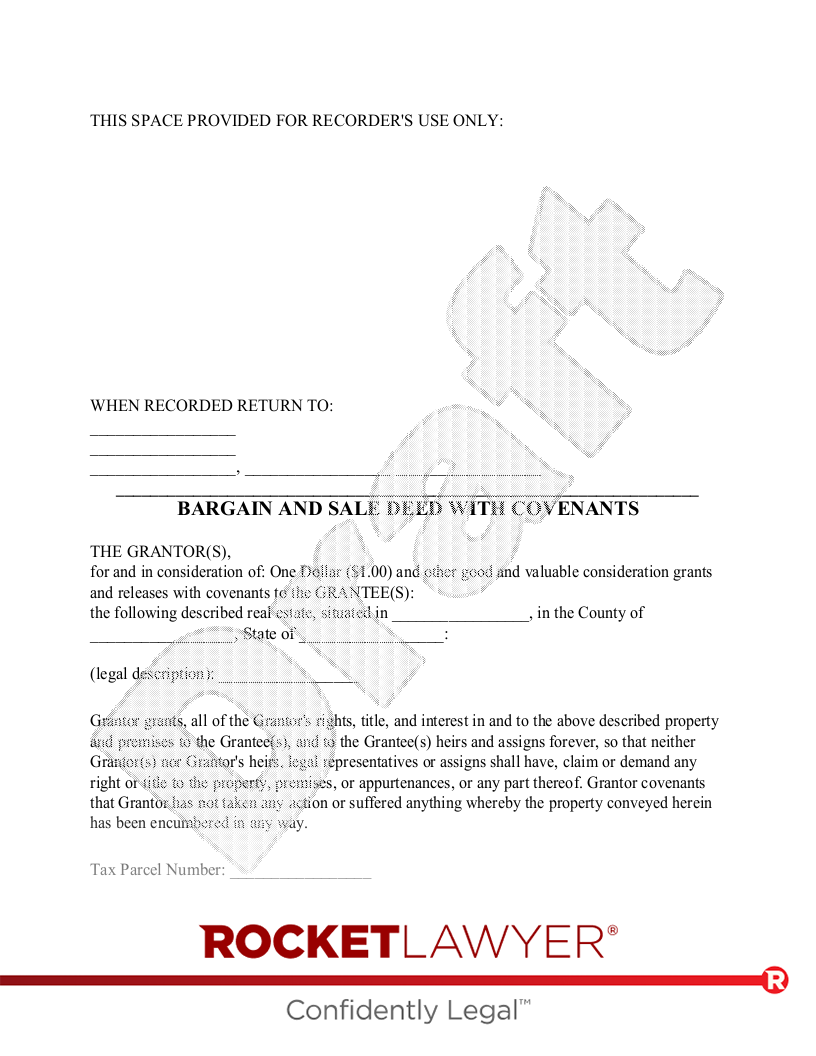

Sample Bargain and Sale Deed

The terms in your document will update based on the information you provide

THIS SPACE PROVIDED FOR RECORDER'S USE ONLY:

WHEN RECORDED RETURN TO:

,

____________________________________________________________________

BARGAIN AND SALE DEED WITH COVENANTS

THE GRANTOR(S),

| - | of , , , by the in docket number |

for and in consideration of:

| - | , , , , , a single person, a married couple, |

the following described real estate, situated in at , , , State of

(legal description):

Grantor grants, all of the Grantor's rights, title, and interest in and to the above described property and premises to the Grantee(s), and to the Grantee(s) heirs and assigns forever, so that neither Grantor(s) nor Grantor's heirs, legal representatives or assigns shall have, claim or demand any right or title to the property, premises, or appurtenances, or any part thereof. Grantor covenants that Grantor has not taken any action or suffered anything whereby the property conveyed herein has been encumbered in any way.

Tax Parcel Number:

| DATED:___________________________ |

| __________________________________ |

STATE OF ss:, ss:STATE OF , ss:

, COUNTY OF PARISH OF

On this _____ day of ____________________, _____, before me, ______________________________, the undersigned officer, personally appeared, known to me (or proved to me on the oath of ______________________________) to be the persons who are described in and who executed the within and foregoing instrument, and acknowledged to me that they executed the same.

Before me, a Notary Public (or justice of the peace) in and for said county, personally appeared the above named , who acknowledged that they did sign the foregoing instrument, and that the same is their free act and deed. In testimony whereof, I have hereunto subscribed my name at ________________________________, this _____ day of ____________________, _____.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by .

The foregoing instrument was acknowledged before me, by means of ☐ physical presence or ☐ online notarization, this _____ day of ____________________, _____ by , who are personally known to me or who have produced ________________________________ as identification.

This instrument was acknowledged before me on this _____ day of ____________________, _____ by .

On this _____ day of ____________________, _____, before me personally appeared , to me known to be the persons described in and who executed the foregoing instrument, and acknowledged that they executed same as their free act and deed.

On this _____ day of ____________________, _____, before me, ________________________________, personally appeared , known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument and acknowledged that they executed the same as for the purposes therein contained.

On this _____ day of ____________________, _____, before me, the undersigned, Notary Public for the State of Vermont, personally appeared , to me known (or to me proved) to be the identical persons named in and who executed the above Bargain and Sale Deed, and acknowledged that such persons executed it as such persons' voluntary act and deed.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by .

In witness whereof I hereunto set my hand and official seal.

_________________________________

Notary Public

Signature of person taking acknowledgment

_________________________________

Name typed, printed, or stamped

Title (and Rank)

_________________________________

Title or rank

My commission expires _____________

_________________________________

Serial number (if applicable)

Serial number, if any

Notary Address:

_________________________________

_________________________________

_________________________________

_________________________________

A notary public or other officer completing this certificate verifies only the identity of the individual(s) who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF

On ____________________ before me, ________________________________, personally appeared , who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

________________________________________ (Notary Seal)

Signature of Notary Public

CountyParish

Prior to filing your deed you will needed to complete Real Estate Transfer Tax Form PT-61. To electronically file this form you can visit http://www.gsccca.org/efiling/pt61/

Oregon state law requires that all deeds be recorded no more than 15 days after being signed.As a number of counties in Arkansas have two county seats you should make certain you are recording the deed in the correct office.

Most counties will not accept your deed for recording until proof all transfer taxes have been paid. Some towns will affix a town stamp to the deed when you have paid the required taxes.

A cover sheet must be created through ACRIS (Automated City Register Information System) www. nyc.gov before the deed can be recorded.

Cattaraugus County and Chautaugua County require a carbon copy of the information contained in the deed, not the deed, for each of the townships affected by the deed. The information needed in this information sheet includes: Date of conveyance, Consideration given, Name of Grantor(s) and Grantee(s), Mailing Address of the Grantee(s) and the Legal Description of the property conveyed.

If you are a resident of Cook County and this Bargain and Sale Deed is for a transfer of residential real estate:

Grantor must sign the deed in front a notary. The notary is required by law to get the Grantor's right thumb print on their Notary Report.

Unless your notary is an employee of a principal, employee or agent of a Title Insurance Company, Title Insurance Agent, Financial Institution or attorney, the notary must deliver an original Notarial Record within 14 days of notarizing the document to the Recorder of Deeds of Cook County along with a filing fee of $5.00. If your notary is one of the above they may retain the record at their place of employment

Ask the Registry Employee prior to recording your deed to verify if you deed should be recorded or registered. The deed will be invalid if it is recorded or registered in the wrong place.

Additional Documents Required to File with Your Bargain and Sale Deed:

An Illinois Declaration of Value form must be filed with your deed. You will need to obtain this form from your County Recorder.

The Grantor must fill out a Declaration of Value, Ground Water Hazard Statement and pay transfer taxes on the property before the deed will be accepted for recording.

A Nevada Declaration of Value form must be filed with your deed. You will need to obtain this form from your County Recorder.

Real Estate Transfer Statement Form 521 will need to be completed and filed with your deed. You can obtain this form from your County Recorder or online at http://www.co.cheyenne.ne.us/Form521.pdf.

Within 30 days of recording your deed you will need to file a Declaration of Consideration statement with the Department of Revenue Administration. This form can be found on the New Hampshire Department of Revenue Administration Website.

Each County has its own transfer tax and property ownership forms, which must be filed and recorded with your deed. You can obtain these forms by contacting the County Registrars Office where the property being transferred is located.

A Certificate of Real Estate Value must be filed with your deed. You will need to contact your County Recorders Office to obtain this form.

Preliminary Change in Ownership Form must be completed and filed with your deed. You can complete this form at the County Assessor's Office when you file your Bargain and Sale Deed.

Affidavit of Consideration: Must be completed and filed with your deed if:

a) If the full consideration is not stated in the deed

b) When an exemption to Realty Transfer Fee is claimed

c) If the transfer involves Class 4 property (commercial, industrial or apartments)

d) If the transfer involves "new construction"

Click here if you would like to print this form:

www.state.nj.us/treasury/taxation/pdf/other_forms/lpt/rtf1ee.pdf

Statement of Value must be filed with your deed in duplicate-

www.revenue.state.pa.us/revenue/lib/revenue/rev-183.pdf

Real Estate Transfer Tax (From PT-61) form must be filed prior to recording your deed (This form should be completed and submitted online at http://www.gsccca.org/efiling/pt61/)

Real Estate Excise Tax Affidavit must be filed with your deed

http://dor.wa.gov/Docs/forms/RealEstExcsTx/RealEstExTxAffid_E.pdf.

If you are in Asotin, Clark, Pacific, Skamania or Whatcom County you will need to contact your County Treasurer or Recorder to get the correct Affidavit.

Real Estate Excise Tax Supplemental Affidavit must be filed in addition to the Real Estate Excise Tax Affidavit with your deed if you are claiming an exemption to the tax

http://dor.wa.gov/content/getaformorpublication/formbysubject/forms_reet.aspx

_____Affidavit of Property Value will be provided by your County Recorder if it is required

_____State of Maryland Land Instrument Intake Sheet must be filed with your deed

http://www.courts.state.md.us/courtforms/circuit/intakesheet.html

Well Disclosure Statement must be filed with your deed if wells are on the property being transferred and the number of wells has changed since the last Well Disclosure Statement was filed.

www.health.state.mn.us/divs/eh/wells/disclosures/certificateform.pdf

In the Parish of Orleans, the Clerk of Court and Ex-Officio Register of Conveyances and Records of Mortgages will need to provide you with a certificate that will be attached to your deed stating the Grantor owns the property free and clear of debt. Make sure you obtain this certificate prior to recording your deed.

It will be necessary for either a Grantor or Grantee to execute the consideration statement at the end of this deed verifying the amount of the consideration paid.

About Bargain and Sale Deeds

Learn about how to confirm and transfer ownership of a property

-

Is a Bargain and Sale Deed the right deed for me?

Understanding the type of deed associated with a property is crucial. For an investor looking to purchase a property with the purpose of renovating and reselling, potential unresolved title issues could introduce risk into the transaction and impact their financial outcome. This is why it is so important to know whether a Bargain and Sale Deed is the right deed for you – or if another one might be a better fit.

The distinctions between deed types revolve around the guarantees, also known as warranties or covenants, made by the grantor concerning the quality of the title being transferred. The most commonly used deeds across states include:

- Warranty Deed: This is frequently used in property sales and provides comprehensive assurances. It states that the grantor is the rightful owner of the property, affirms the absence of any legal claims against the property, and pledges to shield the grantee from any future claims.

- Special Warranty Deed: This deed covers claims incurred during the grantor's ownership, but not those arising before their ownership. Special Warranty Deeds are commonly used in situations where the grantor is selling a property acquired through foreclosure.

- Quitclaim Deed: In this type of deed, the seller refrains from offering any warranties. Essentially, it transfers all rights in a property with no guarantees. Quitclaim Deeds are frequently used for transfers between family members, trusts, or to rectify document errors, such as name misspellings.

- Bargain and Sale Deed: A Bargain and Sale Deed indicates that only the seller holds the title and the right to convey ownership. This deed does not provide guarantees to the buyer against potential liens or other claims to the property, which means the buyer might be responsible for addressing such issues.

If you know a Bargain and Sale Deed is the right fit for you, get started on yours now. If you are unsure what type of deed to prepare, you can always ask a lawyer.

Bargain and Sale Deed FAQs

-

How do I get a Bargain and Sale Deed?

It is very simple to prepare a free Bargain and Sale Deed with Rocket Lawyer:

- Make the document - Answer a few general questions and we will do the rest.

- Send and share it - Discuss any legal questions with a lawyer.

- Sign and make it legal - This document must be signed in the presence of a notary public.

This method is, in most cases, notably less expensive and less time-consuming than meeting and hiring a conventional provider to draft the entire document on your behalf.

-

Where is a Bargain and Sale Deed commonly used?

A Bargain and Sale Deed will commonly be used in New York, Washington, Wyoming, Colorado, Oregon, and Vermont when transferring residential property.

-

When to use a Bargain and Sale Deed, a Warranty Deed, a Special Warranty Deed or a Quitclaim Deed?

If the seller wants to provide a guarantee against problems with the title regardless of when or under whose ownership they occurred, a Warranty Deed is more appropriate. If they only want to guarantee against problems with the title to the property through the time the seller owned the property, a Special Warranty Deed is needed. If they do not want to provide any guarantees regarding title or the seller's authority to sell the property free and clear of debt, then a Quitclaim Deed is best. A Bargain and Sale Deed can be used in very similar cases to a Quitclaim Deed, but it does have warranties.

-

Then what is the difference between a Bargain and Sale Deed and a Quitclaim Deed?

A grantee possesses more protections with a Bargain and Sale Deed than a Quitclaim Deed. A Quitclaim Deed makes no warranties while Bargain and Sale Deed warrants that the grantor has title to the property.

-

What is a Bargain and Sale Deed in real estate?

In real estate, Bargain and Sale Deeds are typically used to transfer property ownership to a family member, into a trust, or buying real estate from a foreclosure sale.

-

What is a Bargain and Sale Deed in Oregon?

Bargain and Sale Deeds are a type of statutory deed in Oregon and can be used to transfer interest in a property from a grantor to a grantee.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.

Bargain and Sale Deed checklist

Complete your free Bargain and Sale Deed with our Make it Legal™ checklist

States with more specific Bargain and Sale Deeds

Learn more about states with more specific Bargain and Sale Deed requirements

Pick a state: