Business and contracts

Make professional business contracts and more. We can help.

- Greg L.

- Rocket Lawyer member since 2014

Business and contract FAQs

-

I'm ready to start a business. What should I do first?

Small business consultants often have the same, unglamorous but practical, answer of "get your own finances in order." You can easily and affordably start your business by using our incorporation services. We can help you form your LLC, obtain your tax ID number (EIN) and designate a registered agent, but it is up to you to manage your finances. Your personal credit may matter if you are intending to apply for small business loans, business credit cards, commercial lease space, or investment funding.

In addition to forming a legal business entity, here are a few more actions to consider when starting a business:

- Separate your personal and business checking and savings accounts

- Improve your personal credit score

- Settle issues you may have with the IRS or state tax agency

- Avoid additional debt, if possible

- Separate your personal and business properties

- Consult with an accountant about how best to prepare for filing business taxes

-

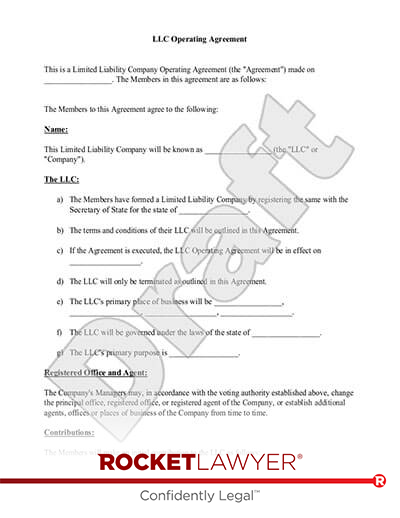

Do I need an Operating Agreement and a Business Plan?

Even if you are not required by your state to have an Operating Agreement, it is a good idea to have both an Operating Agreement and a Business Plan. While most businesses start with an idea, an idea cannot run your business. A well-thought-out Operating Agreement can help you prepare for difficult situations, and a solid Business Plan can help you outline the strategic vision for your company's growth and success.

An Operating Agreement generally includes details about:

- Member contributions

- Accounting

- Dissolution

And a good Business Plan generally includes:

- A clear description of your product or service

- Who the stakeholders are and their roles

- A researched marketing plan

- A financial plan

-

What is an Executive Summary?

An Executive Summary is often included in your Business Plan. It is your "elevator speech" or "pitch" that quickly and clearly describes your business. It should be well-thought-out and tested. And, like your Business Plan, you can change it when needed. Your entire team should fully understand what the Executive Summary is and they should be able to communicate it to others, such as potential investors or customers, easily.

Ask a lawyer

Legal guides

-

- Business Lessons From the Great White Shark

- 4 min read

-

- When Should a Small Business Change Its Legal Structure?

- 2 min read

-

- Top 10 Contracts for Every Small Business

- 5 min read

-

- Do I Need a Corporate Lawyer?

- 2 min read

-

- Small Business Lawsuits: What Are My Chances of Getting Sued?

- 5 min read

-

- Types of Business Forms

- 2 min read

-

- Corporate Law: What Is Fiduciary Duty?

- 3 min read

-

- Five Things Small Businesses Should Do at Year-End

- 3 min read

-

- What Kind of Lawyer Do I Need?

- 2 min read