One significant difference between revocable and irrevocable trusts are that assets in a revocable trust are included in your estate for estate tax purposes, while assets that you transfer into an irrevocable trust are usually excluded from your estate for estate tax purposes. Thus, by giving up control over the assets with an irrevocable trust (or at least most of the control) you may gain an estate tax advantage. It's smart to Consult a Legal Pro to find out how to plan for any estate taxes.

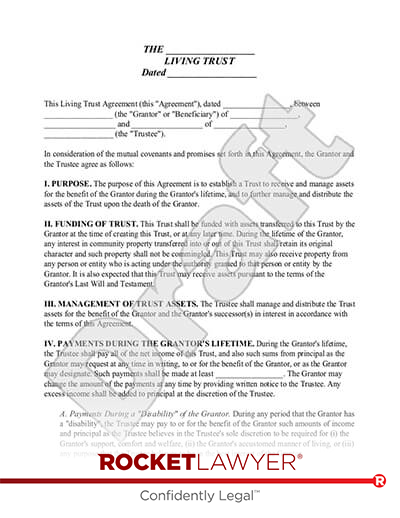

A revocable trust is also known as a Living Trust. Advantages of a revocable or Living Trust are that you can appoint someone to manage your affairs in case you are incompetent (your successor trustee), you can avoid the additional cost of probate proceedings, and you can keep your affairs more private.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.