Irrevocable Definition

When an irrevocable trust is set up, the grantor gives up all right, interest, and title to the assets that are held in the trust. Grantors also give up the right to terminate the trust. To give you a simple irrevocable definition, once the terms of the trust agreement have been written, they cannot be amended for any reason in the future (except by court order).

Property held within the trust will be used for the sole benefit of the named beneficiaries. Remainder interests may also be named in the trust instrument. These are the individuals who would receive what's left of the property, if any, when the trust terminates.

Any person, aside from the grantor, can be named the beneficiary of the trust. Once the assets have been transferred to the trust, the grantor cannot benefit or use them in any way. Just about any asset can be transferred to a trust as well. This includes business interests, cash, real estate, life insurance policies, and stock portfolios.

Up to $14,000 can be transferred into an irrevocable trust or multiple trusts each year tax free. However, in order to receive these tax benefits, it must be considered a "present interest gift." What this means is that the beneficiary must be able to access all or at least part of the assets immediately. Gifts that do not qualify under the annual exclusion will be subject to the federal gift tax.

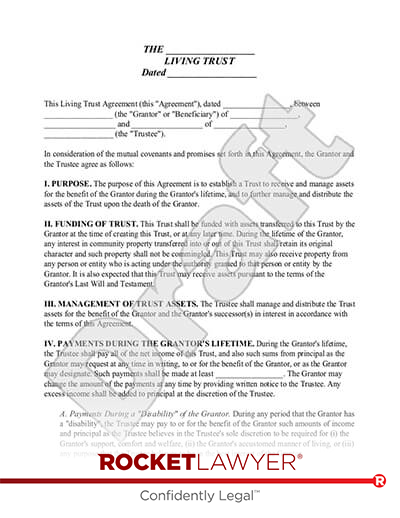

Creating an Irrevocable Trust Agreement

To create an irrevocable trust, a written trust document should be created that defines the terms and the conditions of the trust. As mentioned in the irrevocable definition above, any terms and conditions defined in the agreement cannot be amended in the future unless by court order.

To simplify the process, you can use our Living Trust template and customize it to your own personal needs.

Within the agreement, the trustee must be named who will hold the property in accordance to the terms of the agreement. The beneficiaries of the trust are also named within this document along with the conditions in which the trustee will distribute the assets to the beneficiaries.

The trust document should also include some contingencies. For example, you may want to include guidelines on what to do if the beneficiary dies before the trust can be distributed.

The Advantages of an Irrevocable Trust

An irrevocable trust comes with several advantages. For starters, the grantor who creates and funds the trust creates the terms and conditions of the agreement, and determines the use of the trust's assets before giving up their rights.

Assets that are gifted to the estate are generally not included in your taxable estate upon your death. As a grantor, you also have the ability to control when and under what terms the assets are distributed.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.