Settle a small estate when there's no Will: Small Estate Affidavit

What is a Small Estate Affidavit?

A Small Estate Affidavit is a legal document that you can use to settle a small estate when there's no will. To shorten the time that a decedent's estate needs to be managed by the probate court, many states have separate procedures for small estates – which is where Small Estate Affidavits are useful.

The maximum value of a qualifying "small" estate in a Small Estate Affidavit is defined by state law. This value can range from $184,500 in California to $30,000 in Delaware. The majority of other states fall within this range, but it is best to ask a lawyer about your specific scenario.

Each Small Estate Affidavit form from Rocket Lawyer can be completely personalized to address your specific situation. Your Affidavit will be assembled piece by piece so you can feel confident that it has the correct details within.

When a person passes away, their assets typically need to go through probate (unless they were placed in a trust or held in joint ownership). Probate is the legal process where the court reviews the estate to ensure the correct distribution of assets. For large estates, probate can take six months or more. However, for smaller estates, many states offer a faster, simpler process using a Small Estate Affidavit.

When to use a Small Estate Affidavit:

- Your spouse or close relative has died without a will and you would like to finalize his or her estate matters.

- You were named the personal representative or executor of an estate that qualifies as a “small estate" under the law.

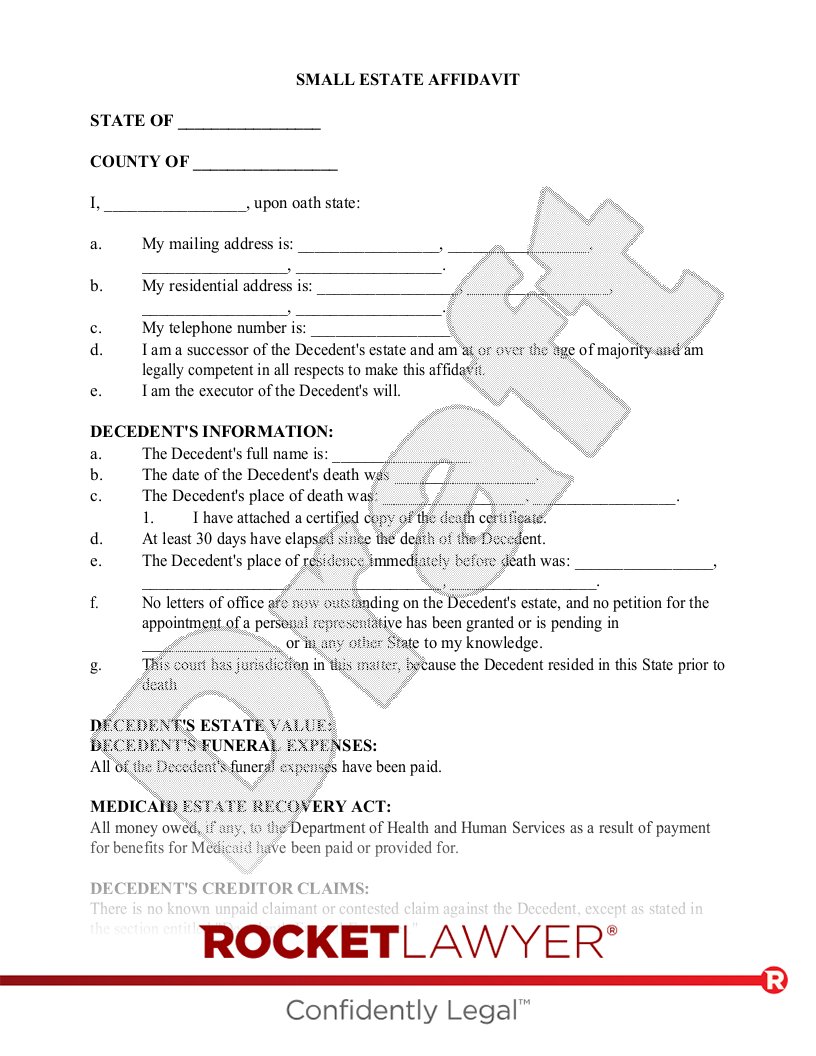

Sample Small Estate Affidavit

The terms in your document will update based on the information you provide

STATE OF

OF

| d. | I am a successor of the Decedent's estate and am at or over the age of majority and am legally competent in all respects to make this affidavit. |

| d. | The affiant or declarant is the successor of the decedent (as defined in Section 13006 of the California Probate Code) to the decedent's interest in the described property. |

| f. | No letters of office are now outstanding on the Decedent's estate, and no petition for the appointment of a personal representative has been granted or is pending in or in any other State to my knowledge. |

| f. | No proceeding is now being or has been conducted in California for administration of the decedent's estate. |

| h. | The decedent's Social Security Number is |

The Total value of the decedent's property subject to administration in Wisconsin at the date of death did not exceed $50,000.

The gross value of the Decedent's entire estate including real property, wherever located and including contents of a safe deposit box but excluding liens and encumbrances, does not exceed .

The gross value of the Decedent's entire estate including real property, wherever located, excluding liens and encumbrances, does not exceed .

The current gross fair market value of the decedent's real and personal property in California, excluding the property described in Section 13050 of the California Probate Code, does not exceed one hundred sixty six thousand two hundred and fifty dollars ($166,250).

The Decedent's estate does not include real property. The gross value of the Decedent's entire estate wherever located and including any contents of a safe deposit box, excluding liens and encumbrances, is , which does not exceed the state limit of $50,000.

The value of a decedent's gross probate estate, less liens and encumbrances, does not exceed $50,000.

The gross value the entire estate including real property less liens and encumbrances of a decedent does not exceed $50,000.

To be eligible for voluntary administration, the decedent must have been a resident of Massachusetts and left an estate consisting entirely of personal property valued at $25,000 or less (excluding the value of a car) and 30 days or more have passed from the date of the decedent's death.

In the State of Oklahoma, a petition for summary administration may be filed by any person interested in an estate that meets the conditions, the value of the estate is less than or equal to Two Hundred Thousand Dollars ($200,000.00).

. Minor's Age:

The surviving spouse is the natural or adoptive parent of

, Minors Age: and codicil(s) dated| 1. | The Decedent has no surviving spouse, domestic partner or minor children. |

Minors Age: and codicil(s)

The following property is to be transferred under §867.03(1g), Wisconsin Statutes.

No other person has a superior right to the interest of the decedent in the described property. The affiant or declarant requests that the described property be paid, delivered, or transferred to those persons named below.

The Decedent has no personal property to distribute.

| Property Description | Fair Market Value |

The Decedent has no personal property to distribute.

| Property Description | Fair Market Value |

| Make | Model | Year | Fair Market Value |

| Total Fair Market Value of Decedent's Personal Property: |

| Total Fair Market Value of Decedent's Personal Property: |

The Decedent has no real property to distribute.

| Real Property Description | Fair Market Value |

The Decedent has no motor vehicles to distribute.

| Make | Model | Year | Fair Market Value |

| Total Fair Market Value of Decedent's Motor Vehicles: |

, , ; None.None.None.

, COUNTY OF PARISH OF

On this _____ day of ____________________, _____, before me, ______________________________, the undersigned officer, personally appeared , known to me (or proved to me on the oath of ______________________________) to be the person who is described in and who executed the within and foregoing Affidavit, and being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

Before me, a Notary Public (or justice of the peace) in and for said county, personally appeared the above named , who acknowledged that he/she did sign the foregoing Affidavit, and being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief. In testimony whereof, I have hereunto subscribed my name at ________________________________, this _____ day of ____________________, _____.

The foregoing Affidavit was acknowledged before me this _____ day of ____________________, _____, by , who, being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

The foregoing Affidavit was acknowledged before me, by means of ☐ physical presence or ☐ online notarization, this _____ day of ____________________, ______ by , who is personally known to me or who has produced ________________________________ as identification, and being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

This Affidavit was acknowledged before me on this _____ day of ____________________, _____ by , who, being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

On this _____ day of ____________________, _____, before me personally appeared , to me known to be the person described in and who executed the foregoing Affidavit, and, being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

On this _____ day of ____________________, _____, before me, ________________________________, personally appeared , known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within Affidavit, and, being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

On this _____ day of ____________________, _____, before me, the undersigned, Notary Public for the State of Vermont, personally appeared , to me known (or to me proved) to be the identical person named in and who executed the above Affidavit, who, being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

The foregoing instrument was acknowledged before me this _____ day of ____________________, _____, by , who, being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

In witness whereof I hereunto set my hand and official seal.

_________________________________

Notary Public

Signature of person taking acknowledgment

_________________________________

Name typed, printed, or stamped

Title (and Rank)

_________________________________

Title or rank

My commission expires _____________

_________________________________

Serial number (if applicable)

Serial number, if any

Notary Address:

_________________________________

_________________________________

_________________________________

| _________________________________ |

A notary public or other officer completing this certificate verifies only the identity of the individual(s) who signed the document to which this certificate is attached, and not the truthfulness, accuracy, or validity of that document.

STATE OF CALIFORNIA

COUNTY OF

On ____________________ before me, ________________________________, personally appeared , who proved to me on the basis of satisfactory evidence to be the person(s) whose name is subscribed to the within Affidavit and acknowledged to me that he/she executed the same in his/her authorized capacity, and who, being first duly sworn on oath according to law, deposes and says that he/she has read the foregoing Affidavit subscribed by him/her, and that the matters stated herein are true to the best of his/her information, knowledge and belief.

I certify under PENALTY OF PERJURY under the laws of the State of California that the foregoing paragraph is true and correct.

WITNESS my hand and official seal.

________________________________________ (Notary Seal)

Signature of Notary Public

notary public and two disinterested witnesses who should also sign the AffidavitClerk of the Probate Court in the county where it will be filednotarizedcertified30 40 45 At least 14 days before filing this Affidavit, you should send notice by personal service or certified mail to anyone whose right to the decedent's property is equal to yours or greater (generally, any other heirs). This notice should describe the property and note the portion that you are claiming.

The Texas Rule of Civil Procedure 78a requires that all Small Estate Affidavits include a Civil Case Information Sheet when filed with the Clerk of the Court. The sheet is obtainable online, at https://texaslawhelp.org/sites/default/files/pr-gen-116_civil_case_information_sheet.pdf.

Additionally, the county where this Small Estate Affidavit is being filed may require an additional cover sheet, such as a Probate Court Information Sheet. Call the Clerk of the Court to ask if your county requires such forms.

About Small Estate Affidavits

Learn how to settle a small estate when there's no Will

-

How to make a Small Estate Affidavit

What Is Considered a Small Estate?

Each state sets its own value limit for what qualifies as a small estate. The limits range from $5,000 in Ohio to $200,000 in Wyoming. Some states have no special process for small estates, while others have specific rules about which assets qualify.

The following is a list of each state and a link where you can locate the law or statute that governs small estate proceedings. Also, because the maximum value of the estate may change and also because of the varying rules around what qualifies as a small estate, it’s always best to consult with a lawyer to ensure your situation meets your state’s small estate guidelines.

Maximum Value of Small Estates

State Max Small Estate Value State definitions Alabama $25,000 43-2-692 Alaska $150,000 AS 13.16.680 Arkansas $100,000 A.C.A. Sec. 28-41-101-102 Arizona $175,000 14-3971 California $184,500 Cal. Probate Code Section 13100 Colorado $30,000 Sec. 15-12-1201 Connecticut $40,000 Chapter 802(b), Sec. 451a-273 Delaware $30,000 Title 12, Chap. 23, 2306-2307 District of Columbia (D.C.) $40,000 D.C. Code Ann. § 20-357 Florida Title XLII, Chap. 735, Sec. 201 Georgia $75,000 Hawaii Georgia does not allow small estate affidavits. Part 12. Sec. 560:3-1201 Idaho $100,000 Title 15, Chap. 3, Sec. 1201-1204 Illinois $100,000 Title 25, 755 ILCS 5 Indiana $100,000 IC 29-1-8-1 Iowa $50,000 - Personal property only (persons with real estate can't bypass the probate process with a small estate affidavit). Title XV, Subtitle 4, Chap. 636, Sec. 1 et seq. Kansas $75,000 Chap. 59-1507b Kentucky Kentucky does not allow small estate affidavits. Louisiana $125,000 Title V, Chap. 1, Art. 3421 et seq Maine $40,000 Title 18-A, sec. 3-1201 et. seq Maryland $50,000 - If a spouse is the only applicant, $100,000. Maryland Code, Estates and Trusts, § 5-601 Massachusetts $25,000 Mass. Gen. Laws Ann. §§ 3-1201 Michigan $15,000 - The estate's value is calculated after funeral expenses. Act. 386 of 1998, Sect. 700.3982 Minnesota $75,000 524:3-1201 Mississippi $75,000 - Personal property only. Sec, 81-14-383, Miss. Code of 1972 Missouri $40,000 Chap. 473, Sect. 097.1 Montana $50,000 72-3-1101 Nebraska $100,000 Rev. Statute 30-24,125 Nevada $25,000 - If spouse is sole applicant, $100,000. NRS 146.070 and NRS 146.080 New Hampshire There is no small estate affidavit available in New Hampshire (except by court order). Small estates can be found in judicial proceedings to speed up the probate process at a court's discretion (see State - Specific Resources for more information). New Mexico $50,000 Art. 3, 45-3-1201-1206 New York $50,000 - Personal property only. Art. 13, Sec. 1301-1311 New Jersey $20,000 - If spouse or domestic/civil partner is sole applicant, $50,000. Title 3B:10-3 and Title 3B:10-4 North Carolina $20,000 - If spouse is sole applicant, $30,000. North Dakota $50,000 Chap. 30.1.23 Ohio $5,000 Title 21, Chap. 2113, Sec. 03 et seq Oklahoma $50,000 Oregon $275,000 - $75,000 in personal property; $200,000 in real property. Sec. 114.515 et. seq. Pennsylvania $50,000 Title 20, sec. 3102 Rhode Island $15,000 - Personal property only. Chap. 33, sec. 24-1 South Carolina $25,000 Title 62, Chap. 3, 1201 et. seq. South Dakota $100,000 29A-3-1201 Tennessee $50,000 Title 30, Chap. 4, Secs. 101-105 Texas $75,000 - If the decedent died with a valid Will, Texas law prohibits the decedent's heirs, beneficiaries or creditors from using an Affidavit of Small Estate. Estates Code, Chap. 205 Utah $100,000 Title 75, Chap. 3, Sec. 1201 et seq. Vermont $45,000 - Personal property only. Title 14, Part 3, Chap. 81, Sec. 1901 et. seq. Virginia $50,000 Virginia Code, §64.2-601 & 602 Washington $100,000 Title 11. Chap., 11.62, Sec. 010 West Virginia $150,000 - $50,000 in personal property; $100,000 in real property. Wisconsin $50,000 Wyoming $200,000 Title 2, Chap. Sec. 201, et. seq. Important: This process cannot be used by residents of Florida, Georgia, Kentucky, New Hampshire, or West Virginia.

-

How to Make and Use a Small Estate Affidavit

1. Wait the required time

Most states require that you wait 30-45 days after the decedent’s death before filing a Small Estate Affidavit.

2. Identify the decedent

The person who has passed is referred to as a “decedent”. When completing the Affidavit of Small Estate, the court will generally need to know the following information about them:

- Date and place of death.

- Their last permanent address.

- Whether they died with or without a Will.

- A list of their surviving heirs or beneficiaries, including information about the decedent's spouse or domestic partner.

3. Inventory the assets in the estate

Make a detailed list of the decedent’s assets, such as real estate, personal property, and bank accounts, and assign a fair market value to each item to confirm that the estate qualifies as "small" under your state’s laws.

-

Real Property: Includes land and permanent structures (e.g., houses, garages, barns). Mobile homes may be considered real or personal property, depending on state law.

-

Personal Property: Includes jewelry, artwork, furniture, bank accounts, stock certificates, etc.

-

Vehicles: Most states require the inclusion of cars, trucks, or motorcycles. You can determine the value using online estimators or by having the vehicle appraised.

Note: Do not include assets in certain types of trust accounts, jointly titled accounts, payable-on-death accounts, or jointly-owned property with the right of survivorship, as these typically pass to the designated beneficiary or co-owner outside the estate.

4. Document all debts and expenses

You must pay any outstanding debts before distributing assets. Document any outstanding debts and obligations of the estate, such as funeral expenses, medical bills, and other liabilities. These may include:

-

Funeral Expenses: In many states, all funeral expenses must be paid prior to filing an Affidavit of Small Estate. Funeral expenses may include the cost of the burial or cremation, cemetery plot, flowers, services, obituary publication, death certificates, memorial services, and reception.

-

Creditor Claims: Creditors (e.g., utility companies, landlords, doctors) must be paid before the estate is settled. Many states require public notice to creditors, giving them time to submit claims. It is advisable to check with your local probate court to determine what laws pertain to creditor claims as well as when and where these claims are to be published.

-

Taxes and Fees: While a small estate may not be subject to estate taxes under Internal Revenue Service guidelines, the affiant should review IRS guidelines to insure the estate will not owe taxes. You may also want to consult your local probate court for any filing fees associated with the Affidavit of Small Estate.

5. Provide Will and Codicils

If the decedent left a Will, it must be submitted along with the Small Estate Affidavit. Codicils (amendments to the Will) should also be included. If there is no Will, the state's intestacy laws will determine how the estate is distributed. This helps establish the validity of the claims and distributions outlined in the affidavit.

-

Wills: If a decedent died having written a Will (known as dying "testate"), the matter of who will receive gifts from the Will, or items from the decedent's estate, will be dictated by the Will.

-

Codicils: A Codicil is a document prepared by the decedent or the decedent's attorney which modifies one or more provisions of the original Will. The court will carefully review the original Will and any Codicils together to determine how the decedent wanted to gift their assets.

-

Intestate Estates: When a decedent dies without a Will, the decedent has died “intestate”. In this case, if there are any assets that the decedent had, and if there are any living heirs, the state's intestacy laws will dictate which heirs will inherit, and how much each heir will share in the decedent's estate.

Note: If there are any disputes about the decedent's Will, a small estate procedure cannot be used. In this case, the court will need to review and determine the outcome of these disputes, or the parties to the dispute will need to mediate or to settle the matters.

6. List all possible heirs and beneficiaries

Whether the decedent had a Will or not, list all possible heirs, including those who may have been left out of the Will. This ensures everyone is accounted for and notified.

If the decedent died without a Will, the decedent's surviving spouse and children may be entitled to inherit the decedent's property, depending on state law.

7. Provide information about yourself

The affiant is the person responsible for filing the Affidavit of Small Estate. This is usually the executor named in the Will or, if there is no Will, the closest relative. The affiant must provide their information, including their relationship to the decedent and their contact information.

This individual may be responsible for managing and distributing the estate as outlined in the affidavit.

It is best to check state law before developing an Affidavit of Small Estate to ensure that the proper person is completing the Affidavit.

8. Sign the affidavit

The affiant must sign the Small Estate Affidavit, affirming that all information provided is true and accurate to the best of their knowledge.

Many states require that the affidavit be signed in the presence of a notary public, while some states may also require additional witnesses. Verify your state’s specific requirements to ensure compliance.

You should also attach a certificated copy of the decedent's death certificate and a copy of the Will and/or any Codicils to the Affidavit. Be sure to keep a copy of the Affidavit of Small Estate for your records.

9. File the affidavit

File the completed small estate affidavit with the probate court or county clerk in the county where the decedent resided at the time of death. This is typically where the estate matters are handled, but may be different depending on the state or county.

Upon filing, the court or clerk will review the affidavit to ensure it meets all legal requirements. They may provide a certificate or other documentation confirming that the affidavit has been accepted.

Once accepted, the affidavit enables the affiant to proceed with the distribution of the estate’s assets according to the instructions outlined in the affidavit, minus any outstanding debts and obligations.

10. Consult a Lawyer

If you have any questions about your Small Estate Affidavit or the process, it's always a good idea to ask a lawyer.

-

Important Terms Related to Small Estate Affidavits

- Affiant: The person who files the Small Estate Affidavit.

- Codicil: A legal document that changes or modifies a Will.

- Community Property: Property automatically owned by the surviving spouse without the need for probate. In some states, property is considered community property by default.

- Decedent: A person who has died, whose estate will be distributed according to a Will or state law.

- Distribution: The division of the decedent's assets after all debts are paid.

- Escheat: When the state becomes the heir to an estate because the decedent died without a Will and has no heirs.

- Estate: The collection of real property, personal property, household items, and other assets, as well as debts and other unresolved matters, left after a person’s death.

- Executor: Also known as a personal representative, this person is named in the Will to handle the final matters of the estate, including distributing assets and settling debts.

- Heir: A person entitled to inherit assets under state law.

- Fair Market Value: The price a buyer would pay for property at the time of the decedent’s death, in a standard market transaction.

- Joint Tenancy: A form of property ownership where two or more people share ownership. When one joint tenant dies, their share passes to the surviving joint tenant(s) without going through probate.

- Intestate: When a person dies without leaving a Will, their estate is distributed according to state law.

- Tenants-in-Common: A type of property ownership where each owner has an individual share of the property. When one owner dies, their share becomes part of their estate and is distributed to their heirs.

- Testate: When a person dies with a valid Will in place.

Small Estate Affidavit FAQs

-

How do I get a Small Estate Affidavit?

It is very easy to get what you need with a free Small Estate Affidavit template from Rocket Lawyer:

- Make the document - Provide a few simple details and we will do the rest.

- Send and share it - Look over it with an attorney, if desired

- Sign it - Sign your Affidavit and make it legal

This solution, in many cases, would be notably less time-consuming than finding and working with a conventional law firm to draft the entire document. When making the document it will be important to have important details on hand, such as a list of the property that will be distributed and its fair market value.

-

Do I need to work with a lawyer for my Small Estate Affidavit?

Making a Small Estate Affidavit is usually easy to do; however, you may still need advice. The answer will vary depending on whom you approach, but often some lawyers will not even agree to review a document that they did not work on. An easier approach worth consideration is to go through Rocket Lawyer network of attorneys. By signing up for a Premium membership, you have the ability to request advice from an attorney with relevant experience or pose additional questions about your Affidavit. We're always here to help.

-

How much does a Small Estate Affidavit cost?

The cost of finding and working with a traditional legal provider to make a Small Estate Affidavit might total anywhere between two hundred and one thousand dollars, depending on where you are and how complicated it is. Different from most other Affidavit template providers that you might find elsewhere, Rocket Lawyer gives members up to 40% in savings when hiring a lawyer, so an attorney can review the situation and take action if you ever need help.

-

Is anything else required once I make a Small Estate Affidavit?

After completing your customized Affidavit with Rocket Lawyer, you will be able to see it on any device, anytime. With a membership, you may make edits, print it out, and/or sign it. Attached to each Small Estate Affidavit Form, there also is a checklist of helpful tips to follow while finalizing the document.

-

Does a Small Estate Affidavit need to be notarized?

It depends. Certain states require that a Small Estate Affidavit be notarized, but others may only require that it be signed "under penalty of perjury." Ask a lawyer or check with the probate court in the county where the deceased was a resident for more information regarding your state's notary requirements.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.