Put information together as executor of an estate: Trust Administration Worksheet

What is a Trust Administration Worksheet?

You probably don't think much about handling an estate until you have to, but even so, a Trust Administration Worksheet can help when you ever need to. Make sure all the paperwork is handled; what documents do you need to organize and who's responsible for what? Your top priorities are probably beneficiaries and finances, but where do you start? Using a worksheet can help you compile and organize the important information in a single place. Our worksheet can be used as a trust administration checklist, which can provide a helpful tool during this tough time.

When to use a Trust Administration Worksheet:

- You're the executor of an estate.

- You need to get beneficiaries and finances in order.

- You want to make sure you have the right documents.

Sample Trust Administration Worksheet

The terms in your document will update based on the information you provide

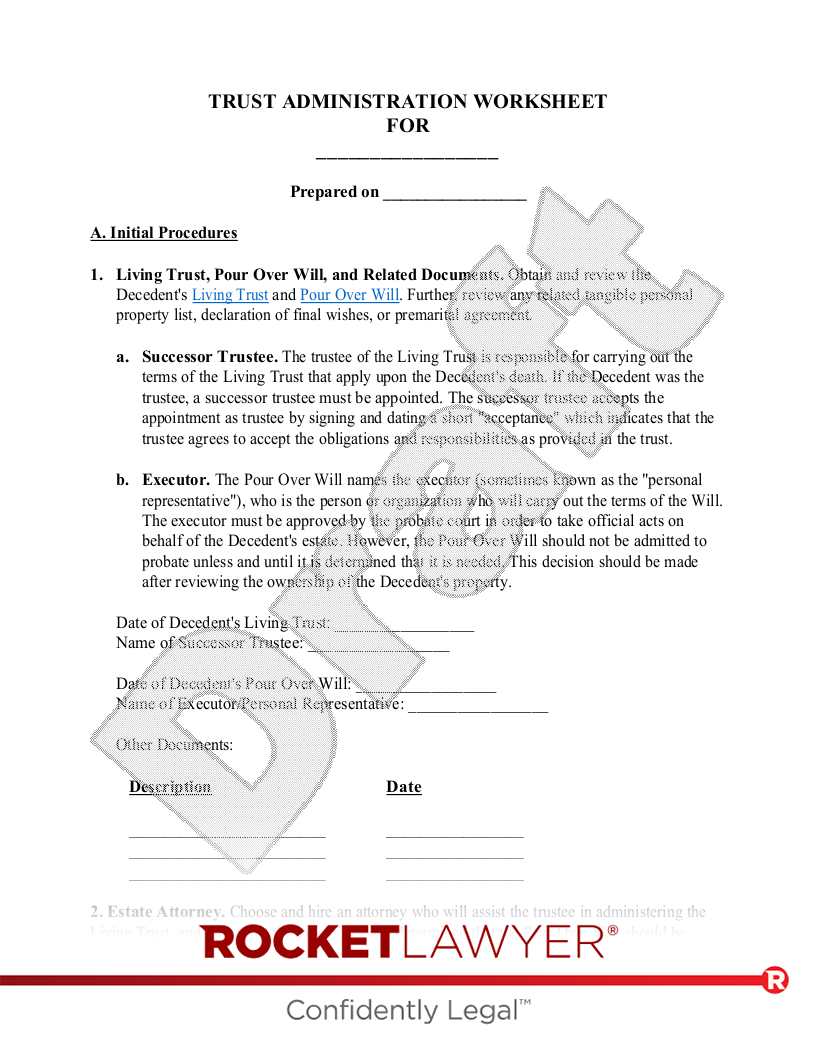

TRUST ADMINISTRATION WORKSHEET

FOR

Prepared on

A. Initial Procedures

| 1. | Living Trust, Pour Over Will, and Related Documents. Obtain and review the Decedent's Living Trust and Pour Over Will. Further, review any related tangible personal property list, declaration of final wishes, or premarital agreement. |

| a. | Successor Trustee. The trustee of the Living Trust is responsible for carrying out the terms of the Living Trust that apply upon the Decedent's death. If the Decedent was the trustee, a successor trustee must be appointed. The successor trustee accepts the appointment as trustee by signing and dating a short "acceptance" which indicates that the trustee agrees to accept the obligations and responsibilities as provided in the trust. |

| b. | Executor. The Pour Over Will names the executor (sometimes known as the "personal representative"), who is the person or organization who will carry out the terms of the Will. The executor must be approved by the probate court in order to take official acts on behalf of the Decedent's estate. However, the Pour Over Will should not be admitted to probate unless and until it is determined that it is needed. This decision should be made after reviewing the ownership of the Decedent's property. |

Date of Decedent's Living Trust:

Name of Successor Trustee:

Date of Decedent's Pour Over Will:

Name of Executor/Personal Representative:

Other Documents:

| Description | Date |

2. Estate Attorney. Choose and hire an attorney who will assist the trustee in administering the Living Trust, and also assist the executor if it is determined that the Pour Over Will should be admitted to probate. The choice does not need to be the attorney who drafted the Trust and Will. However, the attorney should be a lawyer who regularly handles trusts and estates.

| Name of Attorney: |

| Address: |

,

| Phone Number: |

| E-mail: |

3. Immediate Needs.

a.Family Needs. Provide for the Decedent's surviving spouse and/or minor children, if any. Make sure that there are liquid funds in the trust to provide adequate support.

b. Safeguard Assets. Where necessary, safeguard the Decedent's real estate, vehicles and personal property, and establish a system to pay bills.

c. Insurance Protection. Verify the existence and adequacy of property and liability insurance for the assets of the trust and the Decedent's other assets.

d. Change of Address. Arrange for mail to be forwarded to the appropriate party. Complete and mail change of address forms, as appropriate.

| 4. | Gather Information. Obtain general and financial information about the Decedent and the Decedent's family and beneficiaries that will be useful in administering the trust. |

. Sources of Information. The following sources will help provide the needed information.

Decedent's Family and Friends. The Decedent's family and perhaps close friends will know much of the personal information that is needed.

Death Certificate. Obtain a copy of the Decedent's death certificate from the funeral service provider or directly from the appropriate local government office. Several copies should be obtained.

| Issuing Authority: |

| Certificate Number: |

Personal Papers and Effects. The Decedent's residence will usually contain personal records that include financial information. If the Decedent's financial affairs were being handled by a third party (perhaps an agent under a power of attorney), you will need to contact that third party.

Insurance Policies. Obtain copies of policies covering property (real estate, vehicles, contents of residence) liability, and health.

Income Tax Returns. Obtain copies of the Decedent's most recent income tax returns (perhaps the last three years).

| Types of Tax Return | Year |

The Mail. Bank statements, insurance premiums, utility bills, and other incoming mail items will contain important financial information.

Safe Deposit Box. Find out if the Decedent rented a safe deposit box, and if so, obtain the location of the box, the box number, and the location of the keys to the box. Safe deposit boxes often contain personal property, stock certificates, insurance policies, real estate documents, and other helpful information.

| Box Number | Location |

Advisors of the Decedent. The Decedent's various advisors may be able to provide very important information and assistance. Obtain the names, addresses and contact information of the Decedent's advisors, which may include an attorney, accountant or tax return preparer, insurance agent, financial planner, investment broker, and banker.

. Decedent's Personal Information. Obtain the following information about the Decedent.

| Decedent's Name: |

| Address: |

,

| Date of birth: |

| Date of death: |

| Age at death: |

| Marital Status: |

| State of residence: |

| Year residence established: |

. Employment Information. Contact the Decedent's employer, or a past employer for a retired Decedent, who may have very important insurance or employee benefits information.

Decedent's Occupation:

. Family and Beneficiary Information. Obtain the names, addresses, phone numbers, and birth dates for the Decedent's spouse and children (to the extent applicable) and the beneficiaries under the Decedent's trust.

. Fiduciaries Under the Decedent's Living Trust and Pour Over Will. Obtain the names and contact information for any executors (personal representatives), trustees, or guardians that are named in the Decedent's Living Trust and Pour Over Will.

. Financial Information. Obtain detailed information regarding the Decedent's property and debts. The values of the Decedent's various assets as of the date of death will need to be determined. In some cases, appraisals from third party experts may be needed to determine the values. At a minimum, usually the Decedent's real estate and investments will be titled in the name of the Living Trust. It is also likely, or at least possible, that some assets will be titled in the Decedent's name.

Cash, bank accounts and certificates of deposit. Prepare a listing of all cash related items. Determine the named owner of each account, the manner in which title is held, date-of-death balance, and accrued interest to date of death. The banking institution can be contacted to obtain this information, which should be compared with the Decedent's personal information.

Savings bonds. Make a listing of the bonds, including the date of purchase, face amount, named owner, and the manner in which title is held.

Stocks, mutual funds and other securities investments. List the various investments of the Decedent in securities. The list should include the named owners, the manner in which title is held, and the value as of the date of death. If an item is in certificate form make a copy of the certificate so that you have a record of the number of shares, the name of the investment and the "CUSIP" number. Obtain date-of-death market quotations for each security. A broker's expertise may be needed to help value securities that are not regularly traded in the stock market.

If the investment is held in a brokerage account, make a copy of a recent account statement that shows the name of brokerage firm, the name of the broker agent (if any), the account number, and each investment in the account. Contact the broker to help you determine the values of each investment as of the date of death, and whether there were any dividends or interest that were payable to the account as of the date of death.

Real estate. Make a listing of all real estate owned by the Decedent and the Living Trust. Obtain values. Include street addresses and legal descriptions for each property. Obtain copies of deeds, abstract of title and/or title insurance policy, and recent real estate tax statements. Determine whether any of the real estate is subject to a mortgage. If so, determine the balance of the mortgage, name of lender, loan number, and names of the borrowers.

Obtain copies of property insurance policies and other information which shows the name of the company, account number, amount of coverage, expiration date, premium payment date, and agent's name, address, and phone number. Determine whether environmental problems may exist for any of the real estate. A real estate appraisal may be needed to determine the value of the real estate.

Vehicles. List each vehicle and obtain copies of vehicle titles and registrations which will show the named owners and the manner in which title is held. Obtain date-of-death retail values for each vehicle from a dealer or a recently-published "blue book" that lists vehicle values.

Personal Property. Make a list of household goods, furniture, personal effects, and miscellaneous property owned by the Decedent. In many cases, the listing can be summary in form. For example, if the Decedent owned very little furniture of a reasonably small value, the list may include "furniture - $500," rather than showing each individual item of furniture. In valuing personal property, use the "garage-sale value" for items of limited value. The appraisal of a jeweler or coin dealer may be needed for jewelry or a coin collection.

Life Insurance. Make a listing of each life insurance policy owned by the Decedent. Although life insurance proceeds will not be controlled by the Living Trust (unless the Living Trust is the designated beneficiary), the life insurance information will be needed to properly prepare and file the federal estate tax return and any required state death tax return. The list should include policies on the Decedent's life, as well as policies owned by the Decedent on other individuals.

In each case, the list should include the insurance company, a phone number or address for contacting the company, the face amount of the policy, the policy number, and the name(s) and address(es) of the beneficiaries. In addition, obtain the cash surrender value of the policy, particularly if the policy insures the life of someone other than the Decedent.

If the Decedent created a life insurance trust at any time, obtain a copy of the trust agreement, and make a list of all insurance policies owned by the trust. Determine the dates that each policy was obtained or transferred into the trust.

Retirement Plans / Annuities. Make a list of all pensions, annuities, retirement plans, individual retirement accounts, and other retirement benefits that the Decedent may have had. In each case, the remaining values of these accounts will need to be determined.

Government and Employment Benefits. Determine whether the Decedent was receiving any government benefits, and whether the Decedent's survivors are entitled to any continuing benefits. Such benefits may include social security benefits, veteran's benefits, and railroad retirement benefits.

Determine whether the Decedent was entitled to any unpaid employee benefits, including accrued salary, accrued vacation pay, accumulated sick pay, group life insurance, workers compensation benefits, company death benefits, retirement plan benefits, deferred compensation benefits, and stock options. Make a list of each item and its date of death value.

Other Property. Determine whether the Decedent or Living Trust owned any other property. If so, obtain information on such property so that it can be described and valued as of the date of death. Other property may include tax refunds, recently inherited property, and refunds of insurance, subscriptions and other items.

Debts and Expenses. Make lists of any unpaid bills owed by the Decedent or the Living Trust as of the date of death. Such bills may arrive in the mail for up to several months following the death. Typical expenses include utilities, final medical expenses, and funeral expenses.

. Fiduciary Roles of the Decedent. Make a list of all fiduciary obligations of the Decedent, if any, as of the date of death. Such responsibilities will need to be transferred to others. Such fiduciary obligations could include the Decedent as trustee of a trust, executor of an estate, conservator or guardian for someone else, custodian for a minor, agent under a power of attorney, registered agent for a company.

. Guardianship / Conservatorship. If the Decedent was the "ward," whose affairs were being handled by a conservator or guardian for the Decedent's benefit, such guardianship and/or conservatorship proceedings will need to be concluded and terminated.

| 5. | Determination of Whether to Use the Pour Over Will. If the Decedent continued to own many assets individually (instead of in the name of the Living Trust), it may be necessary to use the Decedent's Pour Over Will in order to transfer such assets into the Living Trust. However, in most cases, the Decedent's important assets will be owned by the Living Trust, and there will not be concerns about creditors and challenges to the Living Trust. In such cases, it will not be necessary to use the Pour Over Will. |

| 6. | Court Procedures - If Necessary. If it is decided that the Pour Over Will should be admitted to probate, certain procedures will need to be followed. These procedures vary from one state to another, but can include the following. |

a. Pour Over Will. Apply to the court that handles probate matters to have the Decedent's Pour Over Will "admitted" to probate. If the Pour Over Will appears to be legitimate and if it appears to have been signed following all of the necessary formalities, the court will accept the Will, subject to possible objections by potential heirs and beneficiaries.

b. Self-Proving Affidavit. A "self-proving affidavit" may have been attached to the Pour Over Will. This affidavit is a sworn statement signed by the Decedent and the witnesses to the Will in the presence of a notary public, swearing that all of the formalities in signing the Will were followed. If no such affidavit is attached to the Will, or if state law does not recognize the self-proving affidavit, it may be necessary to locate one or more of the witnesses and obtain from them a sworn statement to the same effect.

c. Appointment of Executor/Personal Representative. Apply to the court to appoint an executor/personal representative who will have the authority to collect, manage and distribute the assets of the Decedent that are subject to probate. Depending on the circumstances, there may be only a few assets that are actually subject to probate. The executor will be required to provide the court with a sworn promise to act honestly and use his/her best abilities in carrying out the duties in that role.

d. Executor Bond. If necessary, obtain a fiduciary bond on the executor/personal representative to protect the beneficiaries against misappropriation of assets by the executor. The court may agree not to require a bond, depending upon the provisions of state law, whether the Decedent requested that no bond be required, and/or if the beneficiaries collectively agree not to require a bond.

e. Notice to Creditors, Heirs and Beneficiaries. Notify all of the Decedent's creditors, beneficiaries and heirs of the admission of the Pour Over Will to probate and the appointment of the executor/personal representative. This is done to provide the heirs and beneficiaries with a limited period of time during which they can object, for example on grounds that the Will was not properly witnessed and signed, that the Decedent signed the Will under the improper influence of a beneficiary, or that a more recent Will exists. The notice is provided to creditors to give them an opportunity to state that the Decedent owed some amount to them.

Date that Notice Is Given: _______________________

f. Will Challenges. If any heirs or beneficiaries file a challenge to the Pour Over Will, such challenges will be handled by the executor in accordance with state law procedures.

g. Probate - Other States. If the Decedent owned real estate or other property in other states, it may be necessary to initiate probate procedures in those states. This step should not be necessary if the "out of state" property was owned by the Living Trust (instead of individually by the Decedent).

| 7. | Non-Court Procedures. The following procedures should be followed as part of the trust/estate administration process. |

a. Checking Account. In most cases, it is appropriate and desirable to have a checking account in the Living Trust, which can be used to facilitate collection of assets and payment of expenses. It is also an integral part of the trust's record-keeping system. If the Pour Over Will must be admitted to probate it may also be useful to have an estate checking account.

Account Number: ____________________________________

Name of Bank: ____________________________________

| Contact Information: ____________________________________ |

| ____________________________________ |

b. Obtain a Federal Identification Number. It will be necessary to obtain a federal identification number for the Living Trust. This number is obtained from the IRS using Form SS-4. If the Pour Over Will must be admitted to probate, it may also be necessary to obtain a federal identification number for the estate, and advise the Internal Revenue Service of the authority of the executor/personal representative to act for the Decedent using Form 54.

Federal Identification Number - Trust: _______________________

Federal Identification Number - Estate: _______________________

c.Obtain Benefits. Apply for social security, veterans, employee, and other survivor's benefits.

| Description of Benefit | Amount | Date Obtained | Other Information |

| ___________________ | ______ | _____________ | ________________ |

| ___________________ | ______ | _____________ | ________________ |

| ___________________ | ______ | _____________ | ________________ |

d.Life Insurance. Send requests to insurance companies to obtain death benefits. Obtain IRS "Form 712" from insurance companies, including forms for policies on the lives of others; this form confirms the value of the insurance and the identity of the beneficiaries.

| Insurance Co. | Policy No. | Amount | Date Obtained | Other Information |

| _________________ | _________ | ______ | ____________ | ________________ |

| _________________ | _________ | ______ | ____________ | ________________ |

| _________________ | _________ | ______ | ____________ | ________________ |

e.Insurance Claims. If necessary, submit, pay or settle hospitalization and medical insurance claims.

| Medical Claim | Amount | Date Paid | Other Information |

| ____________ | _______ | _________ | ________________ |

| ____________ | _______ | _________ | ________________ |

| ____________ | _______ | _________ | ________________ |

| ____________ | _______ | _________ | ________________ |

| ____________ | _______ | _________ | ________________ |

f. Liability and Property Insurance. Notify liability and casualty insurers of the estate administration process.

| Insurance Company | Type of Insurance | Date Notified | Other Information |

| _________________ | _______________ | ___________ | ________________ |

| _________________ | _______________ | ___________ | ________________ |

| _________________ | _______________ | ___________ | ________________ |

g. Credit Cards. Terminate charge accounts and credit cards.

| Credit Card Company | Outstanding Balance | Date Terminated |

| ___________________ | __________________ | _______________ |

| ___________________ | __________________ | _______________ |

| ___________________ | __________________ | _______________ |

| ___________________ | __________________ | _______________ |

| ___________________ | __________________ | _______________ |

h.Refund Requests. Request cancellations and refunds for subscriptions, memberships, health insurance, and similar items.

| Type of Refund | Amount | Date Received | Other Information |

| _____________ | _______ | _____________ | ________________ |

| _____________ | _______ | _____________ | ________________ |

| _____________ | _______ | _____________ | ________________ |

| _____________ | _______ | _____________ | ________________ |

| _____________ | _______ | _____________ | ________________ |

i. Business Property. Make sure that businesses of the Decedent have continued management. For example, if the Decedent was a landlord or creditor, notify the tenants and/or debtors of the place and method for payment.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

j.Surviving Spouse - Planning. If applicable, consider whether or not changes should be made to the surviving spouse's will, living trust, power of attorney, or health care power of attorney.

| Type of Planning | Date Action Taken | Other Information |

| _____________________ | _________________ | ________________ |

| _____________________ | _________________ | ________________ |

| _____________________ | _________________ | ________________ |

k.Disclaimers / Post-Death Estate Planning. Consider whether steps should or could be taken to reduce or eliminate taxes. For example, "disclaimers" are sometimes filed by beneficiaries who elect not to accept a bequest in order to reduce taxes.

| Type of Planning | Date Action Taken | Other Information |

| _____________________ | _________________ | ________________ |

| _____________________ | _________________ | ________________ |

| _____________________ | _________________ | ________________ |

8. Rights of Surviving Spouse and Minor Children. In most states, a surviving spouse and minor children have certain rights to protect them.

a.Election of Spouse. Determine whether the surviving spouse will accept the provisions of the Living Trust and/or Pour Over Will, or alternatively, demand a share of the estate as may be provided by law. A premarital agreement may specify how this issue should be handled.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

b.Support Allowance for Spouse. If appropriate and necessary, apply to the court for a support allowance for the spouse and/or minor children to be paid from the Decedent's assets until the assets can be distributed.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

c.Other Spousal Rights. Determine whether the surviving spouse will elect to exercise certain rights, such as occupying the residence and/or protecting certain property as exempt from creditors.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

B. Gathering Assets. The trustee will need to take control of the Living Trust assets and any assets to be transferred to the trust in accordance with the Pour Over Will. If the Pour Over Will is not needed, the trustee should assume full authority to act. If the Pour Over Will is being used, the trustee's authority will need to be coordinated with the executor's authority over the assets (perhaps just a few) that are subject to the probate process.

1. Financial Information Review. Review the financial information already gathered and complete the information, contacting various third parties for additional information as needed.

2. Probate Assets. Determine which assets are already owned by the Living Trust, which assets are "subject to probate" (pass to the beneficiaries pursuant to the Will), and which assets will pass automatically to the survivor or named beneficiary. For example, real estate may be held by two persons "jointly, with rights of survivorship" so that upon the death of one, the survivor immediately becomes the sole owner, regardless of what the Living Trust or Will may state. Life insurance and retirement plan benefits are paid directly to the designated beneficiaries. Finally, bank or brokerage accounts and savings bonds may be "payable-on-death to" a named beneficiary.

3. Possession of Assets. The trustee should take physical custody or control of the Living Trust assets, and the executor (personal representative) of the Pour Over Will should take physical custody or control of the probate assets, as appropriate.

a.Real estate. Inform the utility companies, insurance company, and tenants of the authority and responsibility of the trustee and/or executor. Consider ordering a real estate title search to determine the extent of the Decedent's holdings and the state of title (liens, joint owners, etc.).

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

b.Business Operations. Assume responsibility and oversight of business operations, as appropriate.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

c.Personal Property. Secure and insure the Decedent's household contents, collectibles, vehicles, equipment, jewelry, and other personal property, as appropriate.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

d.Cash and Investment Accounts. Change the title of brokerage, bank, and other financial accounts into ownership of the trust, if appropriate.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | _______________ |

| ____________________ | _________________ | _______________ |

| ____________________ | _________________ | _______________ |

e.Securities Certificates. Take possession of the certificates of stocks and bonds held in certificate form, and consider depositing them into a brokerage account to safeguard them and for ease in later distribution or liquidation.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | _______________ |

| ____________________ | _________________ | _______________ |

| ____________________ | _________________ | _______________ |

4. Valuation of Assets. Review the initial efforts in obtaining financial information. Obtain valuations and appraisals as necessary.

a.Independent Appraisals. Arrange for independent appraisals of real estate, collectibles, jewelry, and business interests. It is necessary to obtain accurate values of the property for death tax returns and/or to establish a new cost "basis" for the recipient beneficiaries. The "basis" information becomes important in determining taxable gain (profit) to the recipient beneficiary upon that beneficiary's subsequent sale of the inherited property.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

b.Published Sources of Values. Consult published valuation guides for publicly-traded securities and vehicles.

c.Confirmations from Third Parties. The confirmations from banks, brokers, insurance companies and other third parties will help establish the values of cash accounts, securities, life insurance and similar items.

d.Valuation Date. Asset values should be determined as of the date of death. If federal estate taxes are payable, the asset values should also be determined as of the "alternate valuation date" (six months after the date of death).

C. Payment of Debts and Expenses. In addition to gathering and valuing the trust and estate property, the trustee and executor / personal representative must also determine what debts and expenses should be paid before making distributions to the beneficiaries.

1. Debts. The debts of the Decedent and Living Trust as of the date of death must be paid. Typically, these debts are paid from the trust or estate checking account as assets are collected and liquidated. Debts can include utilities, medical expenses, and credit card balances.

| Description of Debt | Date Paid or Other Action Taken |

| ___________________________ | ________________________________ |

| ___________________________ | ________________________________ |

| ___________________________ | ________________________________ |

| ___________________________ | ________________________________ |

| ___________________________ | ________________________________ |

2. Contested Debts. If the Pour Over Will was admitted to probate, any claims filed in the probate court proceedings must be evaluated. Some claims may not be legitimate and should be denied by the executor, which may result in a court hearing to decide the matter.

| Type of Action | Date Action Taken | Other Information |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

| ____________________ | _________________ | ________________ |

3. Administration Expenses. The expenses incurred in administering the trust (and estate) must also be paid. These expenses may include storage fees, maintenance costs, appraisal fees, commissions, insurance premiums, fees of brokers, agents, and accountants, safe deposit box rent, utilities, court costs, trustee fees, executor fees, and attorney fees. An accounting of expenses paid should be maintained.

4. Tax Returns. Tax returns must be filed and any taxes owed must be paid. These returns may include a federal estate tax return, a state inheritance or estate tax return, final individual income tax returns (federal form 1040 and applicable state return) for the Decedent, a gift tax return (if the Decedent made substantial gifts) during the year before death, fiduciary income tax returns (federal and state) for the estate's income, fiduciary income tax returns (federal and state) for the income of the trust, and business and/or employment tax returns for business interests. Maintain a list of tax returns to be filed, the due dates for filing the returns, the amount of tax owed, and the actual dates of filing. Consult with an appropriate tax professional.

D. Sale or Distribution of Assets. After the debts and expenses, including taxes, have been paid, the trustee and executor / personal representative need to make proper distribution of the remaining assets. Such distributions should be made in accordance with required provisions of the Living Trust and Pour Over Will.

1. Specific Bequests. Pay/distribute any specific bequests of cash or items of property. Obtain a receipt for each distribution.

| Description of Bequest | Date Paid or Distribution |

| ___________________________ | ________________________________ |

| ___________________________ | ________________________________ |

| ___________________________ | ________________________________ |

2. Liquidation of Assets. Sell property which will not be distributed "in kind," including property which must be sold in order to pay debts and expenses. Maintain a list of property sold, the date of sale, and the amount of the proceeds. This information will be needed to file income tax returns.

3. Establish Trusts Shares. Establish any trust shares that are required by the provisions of the Living Trust. For example, a children's trust for minor children or a bypass trust for the benefit of a spouse may cause the Living Trust to continue for a period of time.

4. Distribution of Remaining Assets. Distribute the remaining assets of the trust and estate to the "residuary beneficiaries," subject to payment of any final administrative expenses. Obtain a receipt from each beneficiary. Maintain an accounting record of the distributions.

E. Closing the Trust/Estate. The following steps must be followed to close the trust and estate.

1. Tax Clearances. In many cases, approvals (sometime known as "clearances") must be obtained from the appropriate government agencies. For example, if a federal estate tax return is required to be filed, a "federal estate tax closing letter" must be obtained from the IRS before closing the estate. In many states, similar clearances must be obtained for state death taxes and state income taxes.

| Type of Clearance | Date Received | Other Information |

| ___________________________ | ________________ | _________________ |

| ___________________________ | ________________ | _________________ |

| ___________________________ | ________________ | _________________ |

2. Accounting. The trustee should provide accountings to the trust beneficiaries in accordance with the terms of the trust. This accounting should explain all receipts, disbursements and activities of the trust and the trustee.

3. Court Procedures. If the Pour Over Will has been admitted to probate, the executor/personal representative will also need to prepare an accounting and final report with respect to the probate estate. Usually, the beneficiaries are given the opportunity to file objections to the final report and accounting if they have questions. In such cases, the probate court must resolve any disputes after giving both sides an opportunity to be heard. Approval of the accounting and final report (as may have been adjusted by objections) is obtained from the court, and the executor is released from his/her official duties. If the executor was required to be bonded, the bond can be terminated.Approval of the accounting and final report (as may have been adjusted by objections) is obtained from the court, and the executor / personal representative is released from his/her official duties.

4. Payment of Final Expenses. Any final expenses should be paid. Any remaining insurance and utilities can be canceled.

5. Close Accounts. Any remaining balance in the trust and estate checking accounts can be distributed and the accounts closed.

Date Closed: ___________________

6. Continued Trust. If the Living Trust provides for continued trust provisions, perhaps a children's trust or a bypass trust for a spouse, the trust will continue in accordance with the Living Trust agreement. The trustee will manage the continued trust assets, make distributions to the beneficiaries, file annual tax returns, and then eventually terminate the trust in accordance with the trust agreement.