MAKE YOUR FREE Real Estate Purchase Agreement

What we’ll cover

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legal document that buyers and sellers use to confirm their intent to transact with each other. Real Estate Purchase Agreements, however, do not transfer any property title. Instead, they set out the parameters for doing so.

A Real Estate Purchase Agreement, sometimes referred to as a House Purchase Agreement or Home Purchase Agreement, sets forth the terms under which the sale of property will take place on a future date. It can be made between many types of parties, including individuals, married couples, businesses, or trusts.

If you are ready to buy or sell property, you can use a Real Estate Purchase Agreement to determine the obligations of both parties for the sale to occur on the closing date. It will help you determine the responsibilities of all parties involved before transferring the property in question. As a Rocket Lawyer member, you have the option to activate Document Defense®, which allows a lawyer to help you get paid or otherwise enforce your rights.

When to use a Real Estate Purchase Agreement:

- You are ready to sell your property to an interested buyer and would like to outline the process for the sale until the closing date.

- You would like to purchase a property and want to enter into a formal agreement with the seller regarding the terms of the sale.

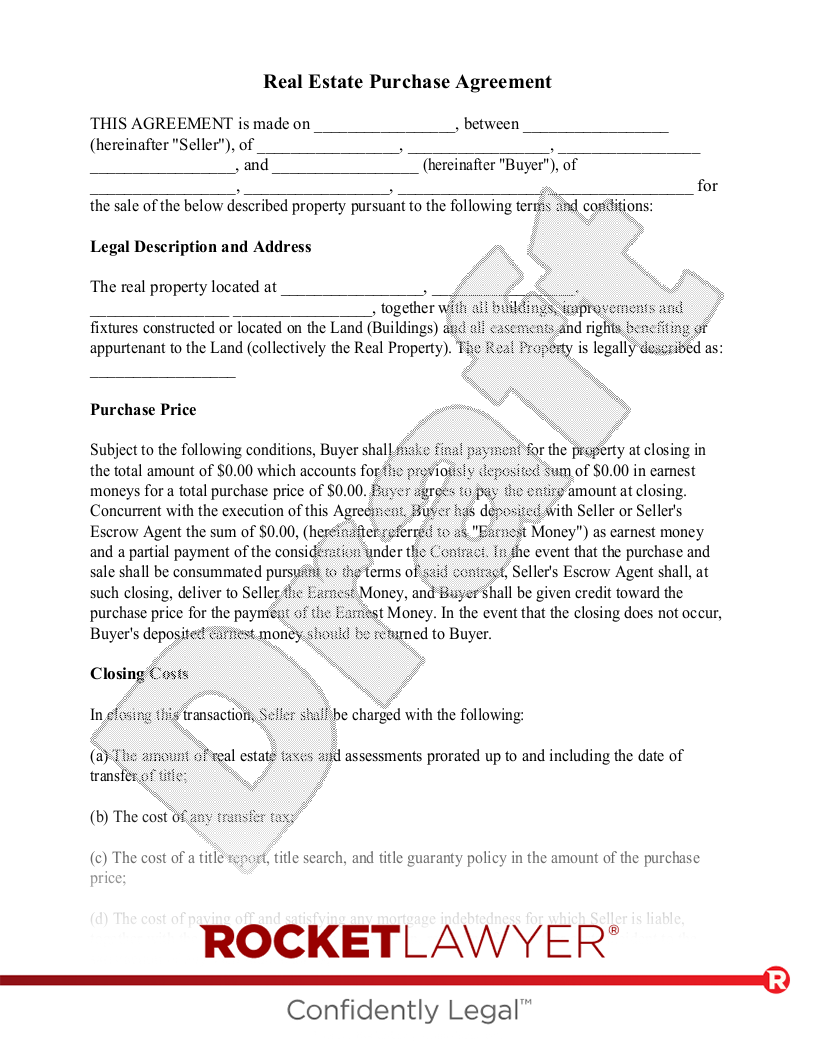

Sample Real Estate Purchase Agreement

The terms in your document will update based on the information you provide

Real Estate Purchase Agreement

THIS AGREEMENT is made on , between (hereinafter "Seller"), of , , , and (hereinafter "Buyer"), of , , for the sale of the below described property pursuant to the following terms and conditions:

Legal Description and Address

The real property located at , , , together with all buildings, improvements and fixtures constructed or located on the Land (Buildings) and all easements and rights benefiting or appurtenant to the Land (collectively the Real Property). The Real Property is legally described as:

Purchase Price

(b) The cost of any transfer ;

(b)

(c)

(c)

(d)

(d)

(e)

(e) One half of the escrow fee; and

(f) One half of the escrow fee; and

(f) All other charges properly borne by Seller consistent with the terms of this Agreement;

(g) All other charges properly borne by Seller consistent with the terms of this Agreement;

and immediately thereafter shall deliver to Seller the balance of the funds in its hands due, and all documents due Seller.

The amount by which the cost of furnishing the title insurance exceeds the cost of furnishing a title guaranty policy, if Buyer elects to be furnished with title insurance;The cost of a title search, title report and title insurance; andOne half of the escrow fee; and All other charges properly borne by Buyer consistent with the terms of this Agreement.

(e) All other charges properly borne by Buyer consistent with the terms of this Agreement;

and immediately thereafter, the escrow agent shall deliver to Buyer the title guaranty or title insurance, as the case may be, the record deed or Recorders' receipt, any prorations to which Buyer is entitled, and all other funds or documents due Buyer.

Seller shall accompany Seller's deed with a title guaranty policy in the amount of the purchase price issued by a general title company ("title company") in its customary form, guaranteeing record title to the Property to be good in Buyer subject only to the exceptions to be contained in the deed. However, Buyer may elect to be furnished with an Owner's Fee Policy of title insurance ("title insurance"), in the amount of the purchase price, insuring marketable title to be good in Buyer, subject only to the exceptions to be contained in the deed. In such event, in lieu of a title guaranty policy, Seller shall furnish Buyer with title insurance. Seller shall pay that portion of the costs which would have been incurred had a title guaranty policy been issued, and Buyer shall pay the remaining costs. Seller shall accompany Seller's deed with an owner's title insurance policy insuring over all mortgages being satisfied for which releases are not available at Closing.Seller Buyer Buyer. Seller. On the closing date, the escrow agent shall notify the parties whether the title company can issue its title guaranty or title insurance, showing as exceptions only those items in the title report to which Buyer did not object. If the escrow agent notifies the parties that (a) the title company will issue such title guaranty or title insurance, this transaction shall be consummated in accordance with the terms and provisions of this Agreement, or (b) the title company will not issue such title guaranty or title insurance, and if Buyer does not immediately waive the title defects claimed by the escrow agent to prevent such issuance or Seller does not cure the defects within the permitted period, this Agreement shall be null and void, the escrow agent shall return to the parties all funds and documents previously deposited by them into escrow, and the parties shall be fully released from any liability or obligation hereunder, except that Seller shall pay the full cost of the escrow and the title company's charges.On the closing date, Seller's Attorney shall notify the parties whether the title company can issue its title insurance, showing as exceptions only those items in the title report to which Buyer did not object. If Seller's Attorney notifies the parties that (a) the title company will issue such title insurance, this transaction shall be consummated in accordance with the terms and provisions of this Agreement, or (b) the title company will not issue such title insurance, and if Buyer does not immediately waive the title defects claimed by Seller's Attorney to prevent such issuance or Seller does not cure the defects within the permitted period, this Agreement shall be null and void, Seller's Attorney shall return to the parties all funds and documents previously deposited by them into escrow, and the parties shall be fully released from any liability or obligation hereunder, except that Seller shall pay the full cost of the escrow and the title company's charges. title guaranty or title insurance title insurance the escrow agentSeller's AttorneyAll general and special real estate taxes and assessments shall be prorated by the escrow agent as of the date the deed is filed for record, using the rate and valuation shown on the last available tax duplicate. If the proration does not fully reimburse Buyer for all real estate taxes and assessments accrued and unpaid with respect to the Property as of the record date of transfer of title, Seller shall promptly reimburse Buyer that amount accrued in excess of the proration credit upon the official certification of the real estate tax duplicate for the year in which transfer of title occurs. The escrow agent shall prorate any rents as of the date the deed is filed for record. All general and special real estate taxes and assessments shall be prorated by Seller's Attorney as of the date the deed is filed for record, using the rate and valuation shown on the last available tax duplicate. If the proration does not fully reimburse Buyer for all real estate taxes and assessments accrued and unpaid with respect to the Property as of the record date of transfer of title, Seller shall promptly reimburse Buyer that amount accrued in excess of the proration credit upon the official certification of the real estate tax duplicate for the year in which transfer of title occurs. Seller's Attorney shall prorate any rents as of the date the deed is filed for record.

Escrow Agent

This transaction shall be closed in escrow with an escrow agent of Buyer's choice ("escrow agent"). Buyer shall deposit with the escrow agent an executed counterpart of this Agreement, which shall serve as the escrow instructions. The escrow agent may attach its standard conditions of acceptance, but if they are inconsistent or conflict with the terms of this Agreement, this Agreement shall control.

If on the closing date (1) the escrow agent then has on hand all necessary funds and documents to complete the transaction, and (2) the title company has stated that it shall be in a position to and will issue and deliver, upon the filing of the deed for record, the required title guaranty policy or title insurance, the escrow agent shall thereupon record the deed and all other required instruments and shall deliver to each party the funds and documents to which it is entitled, together with the agent's escrow statement. If on the closing date (1) Seller's Attorney then has on hand all necessary funds and documents to complete the transaction, and (2) the title company has stated that it shall be in a position to and will issue and deliver, upon the filing of the deed for record, the required title insurance, Seller's Attorney shall thereupon record the deed and all other required instruments and shall deliver to each party the funds and documents to which it is entitled, together with the attorney's escrow statement. the escrow agent Seller's Attorney the escrow agent Seller's Attorney

Statutory and Other Disclosures

(a) Seller shall deliver to Buyer, if required by law, Federal Lead Based Paint Disclosures and pamphlet.

(b) Unless exempt, Seller shall deliver to Buyer fully completed disclosures of notices required by sections 1102 et seq. and 1103 et seq. of the California Civil Code (Statutory Disclosures). Statutory Disclosures include, but are not limited to a Real Estate Transfer Disclosure Statement ("TDS"), a Natural Hazard Disclosure Statement ("NHD"), notice or actual knowledge of a release of illegally controlled substances, a notice of special tax and/or assessments (or if allowed, a substantially equivalent notice regarding the Mello-Roos Community Facilities Act of 1882 and Improvement Bond Act of 1915) and Seller must let Buyer know if he or she has actual knowledge of industrial use and military ordinance at the location of the property.

(c) Notice to Buyer and Seller: Waiver of Statutory and Lead Disclosures is prohibited by Law.

(d) Natural and Environmental Hazard Disclosures and Other Booklets: If required by law, Seller shall deliver to Buyer earthquake guides and an earthquake questionnaire, an environmental hazards booklet and a home energy rating pamphlet. Seller shall also disclose if the Property is located in a Special Flood Hazard Area, a potential Flooding Area (Inundation Area), a Very High Fire Hazard Zone, a State Fire Responsibility Area, an Earthquake Fault Zone, a Seismic Hazard Zone, and disclose any other zone as required by law and provide any other information required for those zones.

(e) Megan's Law Database Disclosure: Pursuant to Section 290.46 of the Penal Code., information about specified registered sex offenders is made available to the public via an internet website maintained by the Department of Justice at www.meganslaw.ca.gov.

(f) Notice Regarding Gas and Hazardous Liquid Transmission Pipelines: This notice is being provided to inform Seller and Buyer that information about the general location of gas and hazardous liquid transmission pipelines is available to the public via the National Pipeline Mapping System (NPMS) internet web site maintained by the United States Department of Transportation at www.npms.phmsa.dot.gov/.

Disclosure of Oil and Gas Activity

THE SURFACE ESTATE OF THE PROPERTY MAY BE OWNED SEPARATELY FROM THE UNDERLYING MINERAL ESTATE, AND TRANSFER OF THE SURFACE ESTATE MAY NOT INCLUDE TRANSFER OF THE MINERAL ESTATE. THIRD PARTIES MAY OWN OR LEASE INTERESTS IN OIL, GAS, OR OTHER MINERALS UNDER THE SURFACE, AND THEY MAY ENTER AND USE THE SURFACE ESTATE TO ACCESS THE MINERAL ESTATE.

THE USE OF THE SURFACE ESTATE TO ACCESS THE MINERALS MAY BE GOVERNED BY A SURFACE USE AGREEMENT, A MEMORANDUM OR OTHER NOTICE OF WHICH MAY BE RECORDED WITH THE COUNTY CLERK AND RECORDER.

THE OIL AND GAS ACTIVITY THAT MAY OCCUR ON OR ADJACENT TO THIS PROPERTY MAY INCLUDE, BUT IS NOT LIMITED TO, SURVEYING, DRILLING, WELL COMPLETION OPERATIONS, STORAGE, OIL AND GAS, OR PRODUCTION FACILITIES, PRODUCING WELLS, REWORKING OF CURRENT WELLS, AND GAS GATHERING AND PROCESSING FACILITIES.

THE BUYER IS ENCOURAGED TO SEEK ADDITIONAL INFORMATION REGARDING OIL AND GAS ACTIVITY ON OR ADJACENT TO THIS PROPERTY, INCLUDING DRILLING PERMIT APPLICATIONS. THIS INFORMATION MAY BE AVAILABLE FROM THE COLORADO OIL AND GAS CONSERVATION COMMISSION.

State of Commonwealth of ..

In witness of the mutual promises made above, Seller and Buyer have executed this contract.

SELLER:

| By: | Date: |

BUYER:

| By: | Date: |

(i) __X__ Known lead-based paint and/or lead-based paint hazards are present in the housing (explain):

(i) _____ Seller has provided the Buyer with all available records and reports pertaining to lead-based paint and/or lead-based paint hazards in the housing (list documents): ______________________________________________

(ii)__X__ Seller has no reports or records pertaining to lead-based paint and/or lead-based paint hazards in the housing.

| By: | Date: |

California Law requires sellers to provide additional disclosures and forms: a Transfer Disclosure Statement (TDS) found here: http://www.dre.ca.gov/files/pdf/re6.pdf and a Natural Hazards Disclosure (NHD) Statement if the property being sold lies within one or more state or locally mapped hazard areas. Exemptions may apply depending on the type of transaction.

If the property is in a Mello-Roos District, or subject to an assessment pursuant to the Improvement Bond Act of 1915, the seller must make a good faith effort to obtain a disclosure notice from the taxing authority and deliver the notice to the buyer.

The buyer is contractually obligated to return the statutory disclosure forms within a specified period of time.

Some areas have additional local requirements, so please check with your county recorder.

The Natural Hazards Disclosure Act requires that sellers of real property and their agents provide prospective buyers with a "Natural Hazard Disclosure Statement" when the property being sold lies within one or more state-mapped hazard areas, including a Seismic Hazard Zone. For more information please see:

http://www.conservation.ca.gov/cgs/shzp/Pages/shmprealdis.aspx

Natural Hazard Zones: California Law requires that the Seller disclose to the Buyer if the property is located in any of the following: (1) an Earthquake Fault Zone or Seismic Hazard Zone when the Seller has actual knowledge that the property is in an identified area; (2) a Special Flood Hazard Area (Zone A) as designated by the Federal Emergency Management Agency (FEMA). Flood insurance coverage is generally required on these properties. The Seller must also notify the Buyer that he or she must maintain flood insurance if the Seller has received Federal Disaster Assistance on the property; (3) in an Inundation zone that is subject to flooding in the event of a dam failure; (4) in a State Fire Responsibility Area (SRA); (5) A very high fire severity zone. The Seller must also disclose if the property has existing maintenance requirements.

Earthquake Safety: The Seller must provide a disclosure in the form of a booklet regarding earthquake safety or seismic deficiencies of structures of certain types of construction, depending on the year that the property was built. The Seller must disclose known structural deficiencies and earthquake hazards in general.

(a) "The Homeowner's Guide to Earthquake Safety" booklet should be used for conventional light frame construction structures built prior to 1960. The Seller is responsible for completing the questionnaire page and giving the entire booklet to the Buyer.

(b) The "Commercial Property Guide to Earthquake Safety" should be used for masonry or pre-cast concrete structures with wood frame floors and roofs built prior to 1975.

Environmental Hazard Booklet: This booklet discusses common environmental hazards: asbestos, lead, mold, hazardous waste, household hazardous waste, formaldehyde, and radon.

About Real Estate Purchase Agreements

Learn about how to outline and agree upon the terms of a sale

-

Common terms in a Real Estate Purchase Agreement

A Real Estate Purchase Agreement outlines the terms and conditions governing the sale of a property. These agreements can sometimes vary, but they typically include a set of common terms and provisions. Here are some terms you can expect to find in one and what they mean:

Title Requirements

In order to sell property, the seller must own "marketable title," meaning the seller must own and have full authority to sell the property. The seller, under this agreement, must provide proof of marketable title as well as a title report, which is used to document the history of title ownership on the property. The title report will help the buyer uncover any problems that could jeopardize the buyer's ability to purchase the property.

Under this agreement, the seller is given the opportunity to resolve any issues with the title, at the seller's cost. If the seller is unable or unwilling to resolve the issues to the satisfaction of the buyer, the buyer may have reasonable cause to terminate the agreement.

Inspection of Property

The buyer may have the property inspected based on local standards and have the seller fix any defects that fail to meet the standards set by ordinance by a local government authority. Depending on the type of loan the buyer receives, the buyer's financing may be contingent on the results of a property inspection, an appraisal, or both.

Fixtures

Fixtures are items that are permanently affixed to the property and, when the property is sold, may be considered part of the property itself. These can include something as simple as light fixtures to something as complex as heating and cooling systems and major appliances. To avoid any confusion or dispute in the future, it is usually a good idea to specifically spell out which fixtures are part of the sale and, if applicable, which items the seller plans to take with them.

Closing

The closing is the final step in the property sale. Upon closing, the title of the property will be transferred from the seller to the buyer and the seller will receive the purchase price. The buyer and seller have to submit all the documentation and other information requested by the title company or escrow agent. After the documentation is in order, it is then necessary to pay the closing costs and fees in order to close the transaction.

Closing Costs

Closing fees and costs typically include deed recording fees, payment of realtor and closing or escrow agent fees, title insurance, taxes, and other miscellaneous costs involved with selling the property. The parties may elect to share and divide these costs differently. There are no rules against either party paying all of the fees and costs or one party paying a portion toward the other party's fees and costs.

Sounds complicated? It doesn’t have to be – with Rocket Lawyer, making your own Real Estate Purchase Agreement is as simple as answering a few questions. Get started now!

-

How to get the disclosure of lead paint right on your Real Estate Purchase Agreement

Federal regulations require that sellers who are selling residential property built prior to 1978 must disclose to the buyer any information known to the seller about lead paint hazards on the property, including any inspection reports.

The seller must also give the buyer the Environmental Protection Agency's (EPA) pamphlet entitled "Protect Your Family From Lead In Your Home." Most private housing, public housing, federally owned housing, and housing receiving federal assistance are affected by this rule.

This is a crucial part of your Real Estate Business Agreement and can be a little tricky to get right. Here are some things to keep in mind to ensure this happens:

- Sellers are required to give buyers a 10-day opportunity to conduct an inspection of the property, at the buyer's option and cost.

- The Rocket Lawyer Purchase Agreement already provides the required disclosure form at the end of this document regarding the seller's knowledge of lead paint hazards on the property.

- In addition to this disclosure form, the seller must provide a potential buyer with the EPA pamphlet described above. This pamphlet may be obtained by contacting the National Lead Information Clearinghouse (NLIC).

- The disclosure statement and EPA pamphlet must be provided to each potential buyer. Sellers who fail to comply with this regulation can face civil and criminal penalties including, potentially, triple damages.

- The seller, buyer, and any agent involved in the purchase agreement are required to sign the acknowledgment at the end of the disclosure form.

- The Federal regulations require that the seller must keep the signed acknowledgment form for at least three (3) years as proof of compliance with the rules.

If you have any questions regarding this or any other section in your Real Estate Purchase Agreement, reach out to a Rocket Lawyer network attorney for affordable legal advice.

Real Estate Purchase Agreement FAQs

-

How do I write a Real Estate Purchase Agreement?

It is very simple to outline the details of a real estate sale using a free Real Estate Purchase Agreement template from Rocket Lawyer. If you already have a legal description of the property and you know the purchase price and the earnest money to be paid upfront, move on to the steps below:

- Make your document – Provide a few simple details and we will do the rest.

- Send or share – Discuss it with the other party or get legal help.

- Sign it – Sign the agreement online with RocketSign®.

This route is, in most cases, much more affordable than working with a conventional lawyer.

-

What should be in a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement should include the following information:

- Buyer and seller information.

- Legal description and address of the property.

- Details regarding closing costs, warranties, and title requirements.

- Closing and possession dates.

-

Is a Real Estate Purchase Agreement legally binding?

Yes, a Real Estate Purchase Agreement is a binding agreement made between a buyer and seller to transfer a home or other property.

-

What happens if either party fails to complete the transaction agreed upon in a Real Estate Purchase Agreement?

When signing a Real Estate Purchase Agreement, each party assumes an obligation, which might seem obvious: One party (the buyer) is obligated to purchase and the other party (the seller) is obligated to sell the property at the sale price agreed upon by both parties. But what happens when this doesn’t happen?

There may be penalties for either party for failing to complete the transaction, unless a valid reason to terminate the sale is outlined in the agreement. After signing this agreement, the buyer should deposit an amount of earnest money and a partial payment of the purchase price under the agreement. Typically, the seller will be entitled to the earnest money deposited by the buyer if the buyer backs out of the sale without proper cause. However, if the agreement is terminated with reasonable cause, the earnest money and accumulated interest, if any, may be returned to the buyer.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.