What are the advantages and disadvantages of starting a business with personal savings?

Let's look at the advantages first. Because you are financially tied to your business's success, you are more likely to run a more efficient and more competent company when you self-fund. You are more likely to carefully measure the financial risk each step of the way. You will also have complete control of your business. You keep the profits without worrying about investors looking for returns on their investment.

Now let's look at some disadvantages. For starters, you may not have enough money to fund your business fully. For example, suppose you have enough money to create and manufacture a product to sell. Then, once your idea takes off, you get an order for 1,000 units. If you do not have enough money to self-fund the production side of such a large order, you may be stuck, and your business may suffer.

If you scramble to come up with the missing funds and take money out of your retirement account to fund your business, you may face penalties and additional taxes. Using your own money might also mean depleting your savings, which could cause personal challenges down the road.

How much should I have in savings before starting a business?

If you choose to self-finance your business, it might be best to save several months of expenses for both your personal and business costs. How many months to save depends on your monthly expenses and the type of business you are starting. Putting numbers on paper can help you see a clear financial picture for the short and long term.

For instance, when deciding how much money to save, consider how much it costs to pay your monthly personal expenses. It can be helpful to list out expenses on a Personal Financial Statement such as:

- Rent or mortgage.

- Utilities.

- Insurance.

- Groceries.

- Car and gas.

Next, consider your required business expenses and list the expected costs on a Business Financial Statement. Depending on your business, this may include:

- Rent.

- Employee salaries.

- Office supplies.

- Manufacturing.

- Distribution.

- Security.

- IT development costs.

- Quarterly income taxes.

- Taxes.

Finally, it might be a good idea to determine if you have additional income that can support the launch of your business. For example, perhaps your spouse's income can pay most or all your monthly expenses. Or you might consider continuing working a full-time or part-time job while starting your new business. This income can help offset some of your starting costs and impact how much you will need to save.

What are the benefits of borrowing money from friends or family to start a business?

If using your own money is not on the table, or you need more capital than what you can come up with, borrowing money from friends or family may be an option.

Borrowing from friends and family may be easier than getting a bank loan, but may still have some strings attached. You might not have to qualify for the loan or deal with mounds of paperwork, such as bank applications and loan documents. Additionally, you may get a lower interest rate and more flexibility with family and friends than with a lending institution. You might not have to offer any collateral, as you likely would with a bank loan.

There are downsides, however, to borrowing from family and friends. Mixing personal and business can lead to strained relationships. It is important to consider your relationship with whomever you take a loan from. If things do not work out, personal issues can develop, and legal battles can get emotionally heated and messy.

What are some ways to protect friends, family, and myself when borrowing money for my business?

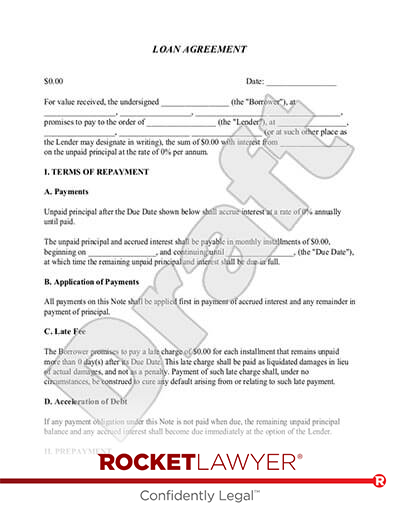

Although borrowing from family and friends might typically be an informal transaction, you should still make it official. You may want to make a Loan Agreement to put the terms in writing. The written document should include the amount borrowed, the interest rate, the length of the loan, and the repayment terms. It can also include provisions for what happens if there are missed payments. By having a written agreement, you establish expectations and responsibilities for everyone involved.

When asking friends or family for a loan, you may want to be prepared to show them your business's and your own financial situation. If your business is already running, preparing a Profit and Loss Form can be helpful to show the health of your business. Alongside your financials, you may want to show them a Business Plan that clearly explains how the business operates. If you are just starting up, show them what type of business you are starting, your marketing plan, sales plan, and other critical elements of launching a business.

Finally, as an alternative to taking a loan, or as an alternative to interest, you may consider offering your family and friends some ownership interest in your business. This can be accomplished through membership interests if your business is a limited liability company, or equity if it is a corporation. With this approach, your friends and family will share in the profits and losses of the business, and have a vested interest in your business's success.

To learn more about self-financing a new business, or borrowing money from family and friends, reach out to a Rocket Legal Pro™ for affordable legal advice.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.