Document business income over a certain period: Profit and Loss Statement

What we’ll cover

What is a Profit and Loss Statement?

A Profit and Loss Statement will help you understand how profitable your business was for a specific time period. Profit and Loss Statements are beneficial as they aid you in knowing how much money your organization has so that you can prepare for the future.

A Profit and Loss Statement displays a company's income and expenses for a specific time period, typically a month, quarter, or fiscal year. In general, it is intended to provide insight regarding the company's current profitability.

If you run a business, it is in your best interest to track your finances at all times. Get started on your Profit and Loss Statement now with Rocket Lawyer!

When to use a Profit and Loss Statement:

- You own a business and you’d like to keep track of its finances over a specific time period, either for yourself or for investors.

- You’re an accountant who has to report to your client about their business’ profitability.

- You want to compare your business’ finances during this period to the previous one.

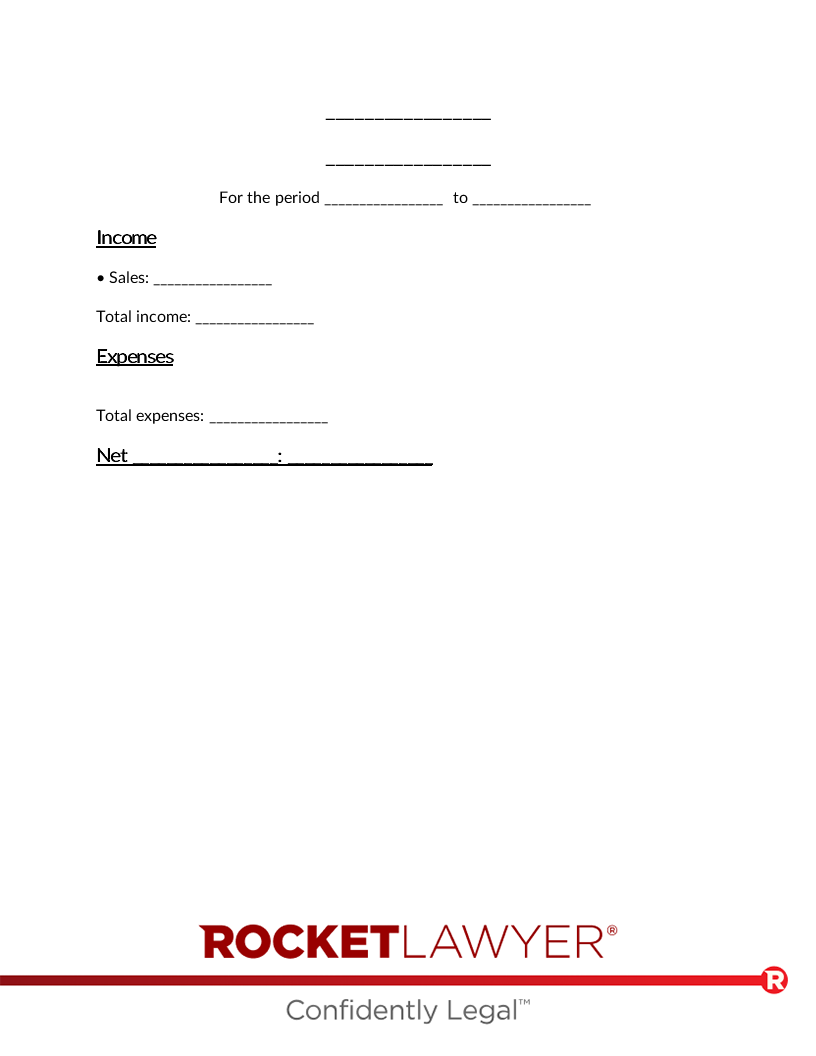

Sample Profit and Loss Statement

The terms in your document will update based on the information you provide

Profit and Loss Statement

For the period to

Income

• Sales:

Total income:

Expenses

Total expenses:

Net :

About Profit and Loss Statements

Learn about how to document business income over a certain period

-

The different types of Profit and Loss Statements

A Profit and Loss Statements is a fundamental aspect of financial accounting – and there are two primary methods for making one: the cash method and the accrual method. These methods differ in how they account for revenue and liabilities, and the choice can impact how a company assesses its financial health and makes strategic decisions.

Cash method

The cash method, also known as the cash accounting method, is a straightforward approach that records financial transactions solely when cash flows in or out of the business. In this method, revenue is recognized when cash is received, while liabilities are recorded when cash is used to pay bills or settle other financial obligations.

The simplicity of the cash method makes it popular among smaller companies and individuals managing their personal finances. However, it does not provide a comprehensive picture of a company's financial performance, as it may not reflect revenue expected to be received in the future.

Accrual method

In contrast, the accrual method captures revenue as it is earned, focusing on when the company becomes entitled to the income, regardless of actual cash receipts. This means that it records revenue in the Profit and Loss Statement as soon as it is earned, even if payment has not yet been received. Likewise, liabilities are recognized when they are incurred, not when they are paid.

This method is widely used by larger businesses and is considered to provide a more accurate representation of a company's financial health because it considers future income and obligations.

The choice between the cash and accrual methods has significant implications for financial reporting and decision-making. It's crucial that businesses select the method that aligns with their specific needs and apply it consistently for financial reporting.

-

Common terms when preparing a Profit and Loss Statement

The Profit and Loss Statement is a fundamental financial statement made up of various components that meticulously track the expenses and income of a business across different categories. Here are a few of the terms you may encounter if when making your own:

Revenue and income

Revenue and income encompass the business's overall income and are broadly categorized into two sections. The primary portion records revenue generated from the core business operations, representing income earned through standard business activities. The second portion captures more miscellaneous income, such as earnings from the company's investments, including interest and dividends. This distinction helps in assessing the diversified sources of income contributing to the company's overall revenue.

Cost of goods sold (COGS)

Cost of goods sold incorporates the direct expenses associated with the company's operations, such as labor costs, raw material expenses, and direct overheads related to the production or procurement of goods. Subtracting these costs from the revenue provides the business's gross margin, a pivotal metric for assessing profitability.

Operating expenses and profit

Operating expenses encompass indirect expenses that are essential for running a business. These costs include administrative expenses, depreciation expenses, marketing and distribution expenses, selling costs, research and development expenditures, and more.

Similarly, operating profit, or EBIT (Earnings Before Interest and Taxes), is determined by subtracting the operating expenses from the gross margin. This figure signifies the positive balance resulting from core operations, serving as a key indicator of a business's profitability and solvency.

A positive operating profit instills confidence in stakeholders and investors regarding the company's financial stability and success.

Net income

Net income represents the net profit generated by the business after accounting for both operating and non-operating expenses, interest payments, and taxes. This is the profit available for distribution to shareholders and is crucial in assessing the overall financial performance and health of the company. Furthermore, the earnings per share (EPS) is calculated based on the net profit.

A P&L Statement can provide a detailed insight into a business's income, expenses, and overall profitability. But you don’t have to worry about all the details – let us handle those for you! With Rocket Lawyer, all you have to do is answer a few questions and we build the document for you. Get started now!

Profit and Loss Statement FAQs

-

Why do I need a Profit and Loss Statement?

A Profit and Loss Statement will give you an in-depth understanding of your company's financial performance. With that understanding, you can make more informed business decisions. Additionally, a Profit and Loss Form can help you secure financing or investors.

-

Are all businesses required to have Profit and Loss Statements?

The answer varies depending on the type of business. In the U.S., the Securities and Exchange Commission (SEC) does require that publicly traded companies prepare Profit and Loss Statements and properly file them to be scrutinized by investors, regulators, and analysts. Smaller companies, however, may not even have to prepare formal financial statements at all.

If you’re wondering whether your business is required to have one, don’t hesitate to ask a lawyer.

-

How do I create a Profit and Loss Form?

Making a Profit and Loss Form is simple and easy with Rocket Lawyer. All you have to do is answer a few questions and our document builder will create a personalized Profit and Loss Form for you. The process will be made much faster if you prepare the following information in advance:

- Income received for the desired time period (e.g., sales, services, and other income).

- Expenses incurred (e.g., advertising costs, salaries and wages paid, etc.).

-

Should I compare Profit and Loss Statements from different periods?

This is considered a good business practice, as it helps you better understand the financial health of your business. But it is important to go beyond just the numbers to understand the different reasons behind any changes in revenues, operating costs, and net earnings. For instance, even if your revenue is growing at a steady rate, it can still be a concerning result if expenses are growing much faster.

Some may even opt to compare their Profit and Loss Statements to those of another similarly sized company in the same industry, as that can be a good way to show where you could improve and where you might be excelling.

-

What is the difference between a P&L Statement and a Balance Sheet?

Many people confuse these two forms because they are similar in concept, but they do serve different purposes.

A P&L Statement shows a company’s income, expenses, and overall profitability over a specific time period, like a fiscal quarter or a year. A Balance Sheet, on the other hand, is more of a snapshot of a company’s financial position at a particular point in time, providing an overview of the company’s financial strength and detailing its assets, liabilities, and shareholders’ equity. The former is mainly used to make decisions regarding operations and budgeting, while the latter is used to assess the company’s ability to meet its obligations and financial goals.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.