Am I an employer if I only hire contractors?

The distinction between when a worker is an employee or contractor is not always clear. You may not want to assume that you have nothing to worry about simply because you only hire independent contractors. If those contractors are legally required to be treated and paid as employees, it could lead to costly fines and penalties. Typically, for one-off repairs or seasonal maintenance, hiring independent contractors or service providers will not lead to a landlord becoming an employer in the traditional sense.

There are different legal and practical implications when you are considered an employer. Things to consider include:

- Withholding federal and state taxes.

- Paying for workers' compensation and unemployment insurance.

- Your liability to an injured worker.

- Your liability to a tenant for the actions of a worker.

- Your legal obligation to verify an employee's authorization to work.

- Your overall relationship with a worker.

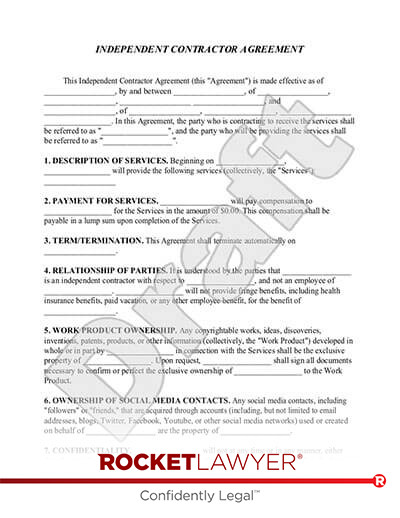

If you choose to use contractors, you may wish to have an Independent Contractor Agreement that outlines the scope of their work and payments. If you are hiring an individual to provide ongoing services, it may be worthwhile to ask a lawyer whether you need to classify that worker as an employee or independent contractor.

Are rental property managers employees?

There are generally two types of rental property managers. One works directly for an individual landlord as an employee and the other works for a property management company that a landlord hires.

This may be a fairly easy distinction in many states due to real estate licensing laws. Some states require someone handling renting and leasing to either have a real estate license or to be an employee of the landlord. Licensed real estate agents are often recognized as independent contractors by the IRS and many states.

Employee Property Managers

A property manager who works for a specific landlord is likely to be considered an employee based on the landlord controlling their work and hours. Even if the property manager has a high degree of flexibility, their jobs are similar to managers in other types of businesses who are unquestionably employees. In some states, like California, there are clear legal requirements that employee property managers be available for larger multifamily buildings.

In states where a property manager does not need to be classified as an employee by law, a landlord could still be considered an employer if they exercise a lot of control over the property manager's work.

Another thing to keep in mind is that providing a rent-free unit to a tenant in exchange for property management services may be a form of payment. This may make the tenant an employee and could mean that a landlord may need to pay employment taxes and have other obligations.

Documents such as an Employment Offer Letter, Employment Contract, or Employment Agreement Amendment can help clarify your expectations of employees and what they should expect from you.

Property Management Companies

Real estate agents and property management companies are generally outside vendors, or independent contractors. They often have many clients and are paid based on the services provided. Property management companies that offer other regular services, such as rent collection and maintenance, generally control the services they offer and who they can hire to do the work. If a property management company, however, is violating labor laws, in some circumstances, a landlord may be considered a joint employer.

If you are unsure whether a worker should be classified as an employee, ask a lawyer. These determinations can be complicated and the consequences of getting it wrong can be costly.

Are rental property maintenance workers employees?

Maintenance workers can be employees or independent contractors. It depends on what they do and how much control you have over their work.

A full-time or regular part-time worker that you hire to work on your property may be your employee. If you hire out specific jobs to established companies or sole proprietors doing the same work for others, they are likely not employees. If you use a property management company, it is possible that they could have regular workers who are their employees, but not your employees.

What tax and liability risks do I face as a landlord and employer?

Many employers incorrectly believe that they can classify a worker as a contractor just because it is easier. You might think you can skip tax withholdings or extra tax forms if you hire a worker as a contractor. The truth is that whether someone is an employee or a contractor depends on what they do and how much control you have over them.

The IRS, state taxing authorities, the U.S. Department of Labor, state labor departments, and other government agencies may use different standards to determine when someone is an employee. If you are unsure if your worker is an employee, you may want to ask a lawyer.

If you incorrectly classify an employee as a contractor, there are two things you need to know:

- First, a misclassified worker generally has all of the rights that an employee is entitled to by law.

- Second, you may face fines or have to pay extra taxes for misclassifying someone as a contractor.

If a misclassified employee complains to a state or federal agency, or sues you, they may be entitled to back pay, unpaid overtime, breaks, vacation pay, and more.

Finally, you can still be liable to or for a properly classified contractor. For example, they might not qualify for workers' compensation, but they may be able to file a personal injury claim against you if they are injured while working for you. If a contractor injures your tenant, steals from a tenant, or causes a tenant some other harm, that tenant may be able to sue you since you hired the contractor.

To learn more about whether you are an employer or how to handle a situation with a worker, reach out to a Rocket Lawyer network attorney for affordable legal advice. If you need tax help, Rocket Lawyer can now match you with a tax pro for affordable and convenient tax filing services. Don't do your taxes™ – Let us do them for you.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.