Is lending money legal?

Yes, it is. It is legal to lend money, and when you do, the debt becomes the borrower's legal obligation to repay. For smaller loans, you can take legal action against your borrower if they do not pay by taking them to small claims court. This may seem harsh, but it's important to understand up front. A loan between loved ones has the same legal weight as a bank loan.

If you are lending money to a friend or family member, you may want to get the details in writing and signed by all parties in case there's a conflict or misunderstanding. If all you have is a verbal understanding and a handshake, that may not be enough to prove the details of your agreement. A signed, written contract is far better than a handshake.

Can I lend money to a friend and charge interest?

Yes, you can, but the tax ramifications can be tricky and complicated. You would have made interest on the money if you had kept it in an interest-bearing account, and that's one good reason to charge interest. However, casual lenders could unwittingly cause themselves tax headaches down the road if they don't structure their loans wisely, get all of the details in writing, and have the written agreement signed. You may want to ask a lawyer for help if you'd like to set up a loan agreement with interest.

Should I avoid lending money because of potential legal trouble?

It all depends. Lending money to family or friends can quickly create friction in those relationships. Consider your financial situation, relationships, and goals:

- Can you afford to tie up this money?

- If other lenders have turned the borrower down, do you really want to take on the risk? What if the borrower runs into unexpected challenges?

- Are you and other members of your family prepared to take legal action in case of a default?

- Are you prepared to forgive your borrower's debt to keep the peace?

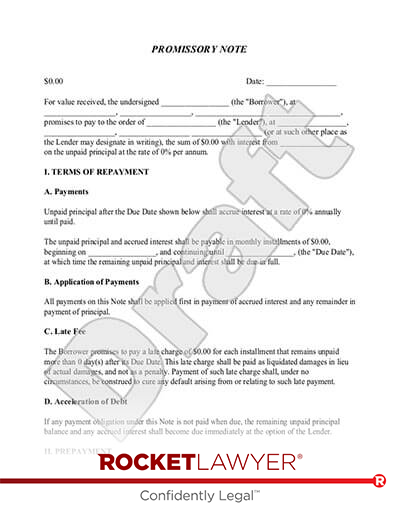

If losing this amount of money would cause serious financial harm to you, then you may well decide to say so and avoid making the loan. If you do move forward, you may want to make sure you set terms in a written and signed Promissory Note.

How can I make sure I will be paid back?

While there are few guarantees in life, here are some tips that may increase the odds that you will be paid back in full.

Tip 1: Put the terms in writing.

You can use a legally binding and easy to fill out Loan Agreement, or a Promissory Note, to capture the details of your loan. Of course, it is easier, and emotionally gentler, to have a spoken promise between friends, but the trouble comes when one or both of the parties cannot recall the terms a year or two in the future. A written agreement avoids an uncomfortable debate later. If a problem arises, the agreement may have a solution that has already been agreed to in advance. There are different types of personal loan agreements, so it may be worthwhile to review your options, or ask a lawyer for help figuring out which agreement to use.

Tip 2: Lay out all key loan agreement terms.

Making your loan terms as clear as possible can help to avoid confusion. Consider including:

- Names and addresses of the parties to the agreement.

- Loan amount (principal).

- Interest rate.

- Repayment terms, including dates, and any late fees or penalties.

- Signature lines.

The repayment terms may be geared to the borrower's circumstances. For example, two smaller payments each month might work better for some borrowers. Alternatively, if the borrower is expecting a major financial boost, such as a tax refund, a lump-sum repayment might make sense. In any case, you may want to clearly specify the due date or payment terms.

You might also specify the collateral for the loan, and, if applicable, specify that the loan obligation is transferable to a third party.

Tip 3: Spell out your recourse if the borrower defaults.

If the borrower defaults, or fails to pay what they owe, you may:

- Modify the terms of the agreement to account for changes in circumstances.

- Take collateral, if any was given to secure the loan.

- Go to court to get a judgment.

Do I really need a written agreement for a loan?

While there may be limited legal recourse if a loan that was not in writing does not get paid back, it can be costly and difficult to enforce. With the Rocket Lawyer Promissory Note, you can cover the legal basics, including the loan amount, repayment terms, and default provisions. You and your borrower can even sign electronically.

Should you have trouble with your borrower, you will have a better chance of being able to get paid back if your loan agreement is in writing. With a written agreement you may be able to avoid court by renegotiating the loan terms, recouping a portion of the debt in a settlement agreement, or helping the borrower obtain a debt consolidation loan.

Need case-specific advice? Reach out to a Rocket Lawyer network attorney for affordable legal advice.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.