Why is a lease a good idea for a multigenerational household?

The primary function of a Lease Agreement is to document and clarify financial obligations and other expectations related to living in the home. At a minimum, a lease ensures that each adult family member is legally responsible for their fair share of the cost of keeping the household running, such as rent, mortgage payments, and utilities. Granting each family member a financial stake in the maintenance of the household can make them more prudent in using family resources, thereby reducing the overall living expenses of the household.

A lease can also be a way to set boundaries and expectations for family members. For example, a lease can designate specific areas of the home as private spaces for certain family members. It can also set limits regarding noise levels at specified times and assign responsibilities for keeping common areas clean and tidy.

In extreme cases, a Lease Agreement provides a legal mechanism for evicting family members who consistently fail to fulfill their financial obligations, violate family rules, or become toxic or abusive.

How does signing a lease benefit the parents in a multigenerational living arrangement?

Parents or grandparents are usually the homeowners or primary lessees in a multigenerational living arrangement. Therefore, it can be prudent to sign a lease with their adult children to alleviate the financial burden of maintaining the home. Specifically, a lease makes it clear who is responsible for what part of the rent, mortgage payment, or utilities, along with the consequences for any family member who consistently fails to pay their portion.

A lease can also help parents navigate the difficult transition from relating to their children as minors for whom they have financial responsibility to relating to their children as independent adults with their own resources. By granting adult children a financial stake in the household, a lease lessens the impact of money issues on their parent-child relationship.

How does signing the lease benefit the adult children?

A lease provides adult children with peace of mind by eliminating ambiguity about their rights and responsibilities while residing in their parents’ home. If something happens to the parents or grandparents, a lease may provide adult children with some rights to remain in the home if they do not inherit it or if there are probate issues. It can also alleviate any tensions or guilt they might feel about burdening their parents by living in their home.

Signing and abiding by a lease may help adult children learn to live as adults, even while continuing to live in their parents’ home. Sharing living expenses with adult children can help get them accustomed to the responsibilities of living on their own. At the same time, adult children who help pay the family’s expenses often find that parents begin to respect the independence and privacy appropriate to their age and responsibilities.

What are some of the perks of sharing a living space with extended family?

Sharing a home with extended family has several benefits. Financially, it is cheaper to share a home than it would be for each adult family member to live on their own. Even when parents charge below market rates, the money saved by sharing living expenses can be spent on other things to improve the family’s quality of life. The savings also extend to time: Splitting home care tasks among family members frees up time for other aspects of family life.

A lease may end up doing more than just providing clear expectations about finances and boundaries. Oftentimes, sharing a home with family members can strengthen family bonds. Intergenerational homes allow children and older family members to spend more time together. Caregiving tasks, both for young children and elderly family members, may be more easily shared among loved ones because multiple caregivers can live in the same home.

What type of lease is recommended for my adult children?

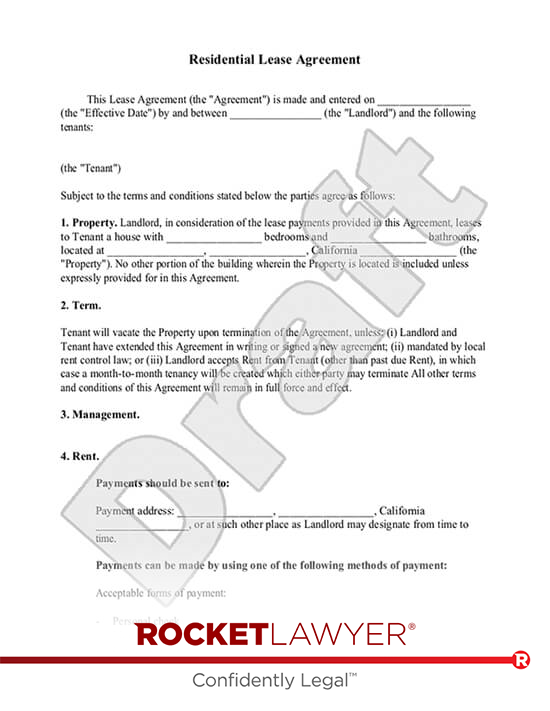

The best type of lease for a multigenerational home varies depending on the circumstances of each family. If the parents are homeowners and the adult child plans to stay for an extended or indefinite period of time, or has their own family that is moving in with them, a standard Lease Agreement or Room Rental Agreement may be most appropriate.

Parents who are renters themselves may either use a Sublease Agreement, or request that their landlord add their adult children to their existing lease using a Lease Amendment. For smaller details, rules, duties, or particular living arrangements, a Roommate Agreement can be helpful. If the adult child only plans to stay for a short time but is not sure how long, a Month-to-Month Rental Agreement may make the most sense.

Finally, parent-homeowners may grant their adult children a permanent stake in the family home using a Rent to Own Agreement. Under a Rent to Own Agreement, some or all of the adult children’s rent payments go toward actually purchasing the property. Such an agreement allows parents to pass the home to their adult children without worrying about inheritance issues. There are, however, other estate planning options available to pass on the family home.

If you have more questions, or want help identifying which type of agreement is best for your unique situation, reach out to a Rocket Lawyer network attorney for affordable legal advice.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.