What are common problems landlords face after a flood?

Flooding causes numerous safety, legal, and financial issues for landlords. Whether floodwaters originate inside or outside your rental property, the actual damage may not occur until days later when wood and drywall begin to rot and mold. Therefore, a quick response is vital to contain and minimize flood damage. The longer things stay wet, the more difficult it becomes to repair.

Landlords are typically responsible for completing any property repairs to make the dwelling habitable for tenants again. After a flood caused by mother nature, securing contractors to make the repairs quickly can be very difficult and costly due to high demand. If tenants cannot stay in their rentals during the repairs, waiving rent for that time period, or other accommodations, may be required. Landlords are not usually responsible, however, for any of a tenant's furniture or personal items that may be water damaged. Most renters insurance, as explained below, may cover the damages to personal belongings.

Handling insurance claims and tenant requests for access after a flood can cause several headaches for landlords. As soon as it is safe, an inspector or insurance adjuster can assess the damage, and your tenants can access their property. Sometimes, keeping tenants away after a major flood can be tricky, but care should be taken to make sure the property is safe to access when you do allow it. Additionally, depending on the location and severity of the damage, you may have furniture, personal items, walls, carpets, and insulation removed in order to inspect. This will help you inspect the extent of the water damage and for mold inside walls, floors, and ceilings. Waiting too long to inspect for water intrusion and mold can lead to more extensive damage and more expensive repairs.

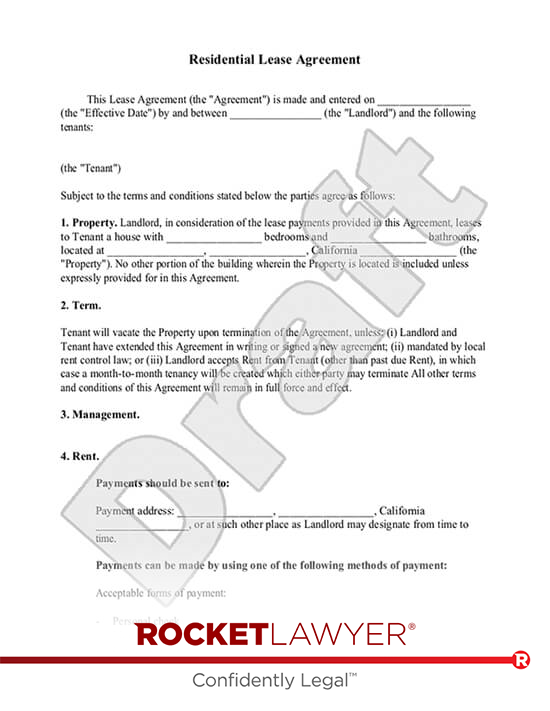

For floods caused by a tenant, the legal and financial issues are a little different. Landlords will still be required to fix the property, but may charge tenants for the damage they caused. These responsibilities and duties should be described in the Lease Agreement.

Are landlords liable for flood damage to a tenant's personal property?

Generally, landlords are not liable for flood water damage from a weather event or natural disaster to a tenant's personal property. While the landlord is responsible for property repairs, such as replacing drywall or flooring, after a flood, it is the tenant's responsibility to repair or replace any damaged personal property. Notably, however, if a tenant can show that a landlord's negligence caused the flood or water damage, then the landlord could be liable for personal property damage.

In multifamily buildings, flood and water damage can be rather complicated as a flood in one unit can impact several others, and cause damage for tenants who had no hand in causing the problem. When these instances arise, landlords may want to contact an attorney to discuss how to proceed and respond to impacted tenants.

How can landlords help tenants prepare for flooding?

Preparation is essential. When flooding is expected, acting fast to get barriers in place, prepare the property, evacuate tenants, or to quickly get things dried up after a flood, can make a world of difference. Making sure the right emergency supplies are on hand can help ensure the property is ready if you, your maintenance worker, or your tenants, need to take immediate action.

To help your tenants are prepared for a flood caused by a weather event or disaster, be sure they know what to do in case of an emergency and:

- Keep flashlights, buckets, and bottled water on hand.

- Sandbag the perimeter of the property or board up windows.

- Shut off the main power or utilities to the property.

- Secure outdoor furniture in case of a storm or hurricane.

- Provide a map of evacuation routes.

- List emergency numbers, such as the local fire or police departments.

To prevent plumbing, non-natural disaster, or weather-related flooding, you may ask your tenants to keep an eye on sinks, toilets, showers, windows, dishwashers, washing machines, and hot water heaters for leaks or potential problems, notifying you as soon as they see any issues. Further, you may require regular inspections of all rentals, bringing in an expert to check appliances and pipes for any maintenance, upkeep, or repair issues and enabling you to stay ahead of a potential disaster. The sooner you identify and fix a faulty appliance or pipe, the better for both you and your tenant.

Since flooding is often unpredictable, insurance coverage can make a big difference when it comes to paying to fix the problems flooding can cause. Since a landlord's property insurance may not necessarily cover a renter's personal property, tenants may need their own policies. Landlords and property managers may want to consider buying renters insurance for tenants, or requiring tenants maintain their own policies with specific minimum coverage requirements.

What can a landlord do if a tenant will not evacuate when ordered?

Whether tenants remain in a rental after a major flood will depend on the extent of the damage. If the property is no longer habitable, it may not be legal for a tenant to remain there if the property has been deemed uninhabitable by local authorities. In these situations, you may need to contact local law enforcement. If a tenant refuses to evacuate during an ongoing disaster, a landlord's only option may be contacting the authorities.

After a flood, whether a tenant can stay in the rental during the repairs depends on the level of damage. It may not be safe to be present. Depending on your lease, and on local or state law, several issues may arise that you should be prepared to address, such as:

- Will the tenant have to continue paying rent during the repairs?

- Who will pay for temporary housing?

- If the property is uninhabitable, can the lease be broken?

If your lease does not address these issues, then you may want to amend it, protecting both you and your tenants. If you need help with amending your lease, contact a qualified attorney to determine what provisions are permitted and can be added. In most jurisdictions, if a tenant refuses to vacate the premises for major repairs, the landlord may need to provide an Eviction Notice and pursue an eviction through the court.

Does insurance cover flood damage?

Most landlords' property insurance is similar to a typical homeowners policy in that it covers the rented dwelling against liability for injuries and particular damage caused by hail, fire, water, flood, and many other common dangers. These insurance policies, however, are written to protect landlords—meaning certain protections are excluded, such as a tenant's personal property coverage. Also, in certain regions, the standard property insurance policy will exclude common disasters, like floods, fires, or earthquakes. In this scenario, a separate policy will need to be obtained to cover the specifically excluded hazard.

If your policy is issued by either a private insurer or the National Flood Insurance Program, it will generally cover damage to the building structure, electrical and plumbing systems, foundation walls, staircases, furnaces, water heaters, appliances, well water tanks and pumps, and carpets. Flood insurance does not cover damage caused by something other than flooding. What is covered and what is not covered in a flood is determined by the policy language. To understand if you are covered for water damage or flooding, actually review the insurance policies to identify the gaps in coverage.

Understanding your legal responsibilities during a flood or other disaster is critical to keeping tenants and property safe. If you have more questions, don't hesitate to ask a lawyer for help.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.