Make the tenant responsible for property expenses: Triple Net Lease

What we’ll cover

What is a Triple Net Lease?

A Triple Net Lease is a commercial lease agreement where the tenant is responsible for the property taxes, building insurance, and common area maintenance costs related to the property being leased. Triple Net Leases are typically used for free standing commercial buildings with common areas (such as parking areas) as a way to make sure that your tenants cover all the expenses associated with use of an entire property.

A Triple Net Lease can benefit the tenant because they may be able to negotiate a lower base rent with the landlord if the tenant is willing to assume these expenses. The Triple Net Lease can also provide the tenant with more control over the property, as they may be able to make decisions about how the property is maintained and managed.

When to use a Triple Net Lease:

- You are leasing a commercial property and want to ensure all property costs are covered in the agreement.

- You want to lease commercial rental property and want to negotiate the terms of the lease using net expenses.

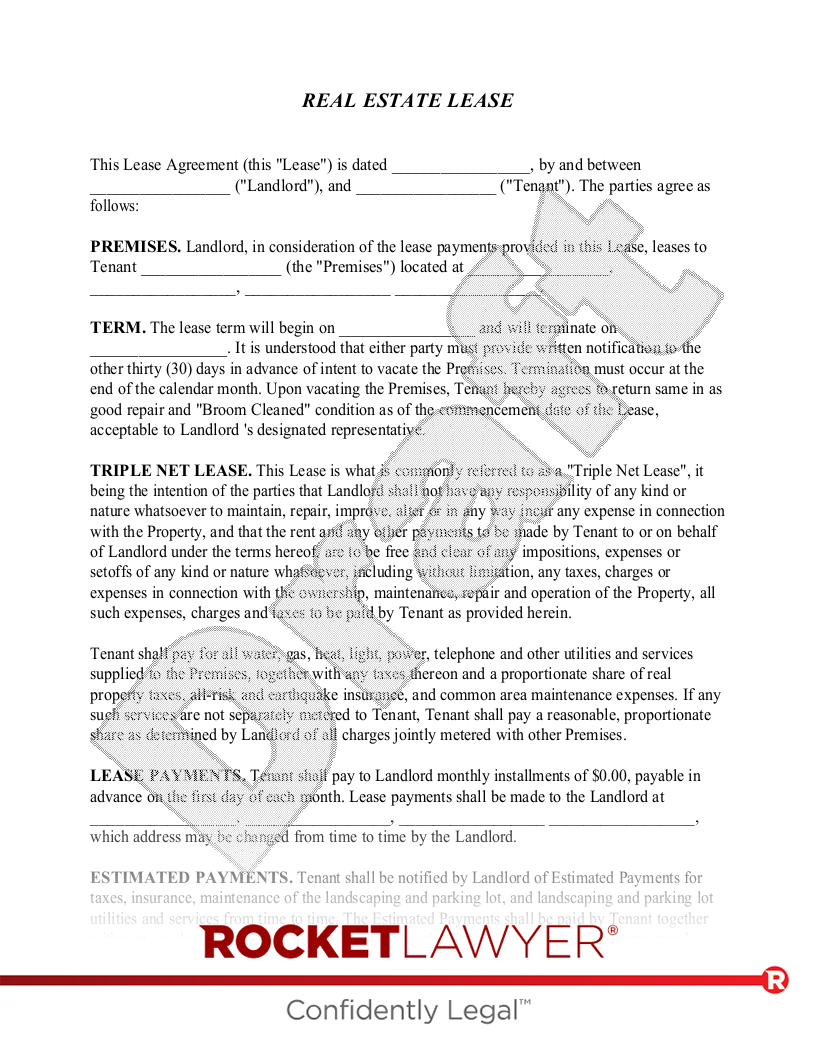

Sample Triple Net Lease

The terms in your document will update based on the information you provide

REAL ESTATE LEASE

This Lease Agreement (this "Lease") is dated , by and between ("Landlord"), and ("Tenant"). The parties agree as follows:

PREMISES. Landlord, in consideration of the lease payments provided in this Lease, leases to Tenant (the "Premises") located at , , .

TERM. The lease term will begin on and will terminate on . It is understood that either party must provide written notification to the other thirty (30) days in advance of intent to vacate the Premises. Termination must occur at the end of the calendar month. Upon vacating the Premises, Tenant hereby agrees to return same in as good repair and "Broom Cleaned" condition as of the commencement date of the Lease, acceptable to Landlord 's designated representative.

TRIPLE NET LEASE. This Lease is what is commonly referred to as a "Triple Net Lease", it being the intention of the parties that Landlord shall not have any responsibility of any kind or nature whatsoever to maintain, repair, improve, alter or in any way incur any expense in connection with the Property, and that the rent and any other payments to be made by Tenant to or on behalf of Landlord under the terms hereof, are to be free and clear of any impositions, expenses or setoffs of any kind or nature whatsoever, including without limitation, any taxes, charges or expenses in connection with the ownership, maintenance, repair and operation of the Property, all such expenses, charges and taxes to be paid by Tenant as provided herein.

Tenant shall pay for all water, gas, heat, light, power, telephone and other utilities and services supplied to the Premises, together with any taxes thereon and a proportionate share of real property taxes, all-risk and earthquake insurance, and common area maintenance expenses. If any such services are not separately metered to Tenant, Tenant shall pay a reasonable, proportionate share as determined by Landlord of all charges jointly metered with other Premises.

LEASE PAYMENTS. Tenant shall pay to Landlord Lease payments shall be made to the Landlord at , , , which address may be changed from time to time by the Landlord.

ESTIMATED PAYMENTS. Tenant shall be notified by Landlord of Estimated Payments for taxes, insurance, maintenance of the landscaping and parking lot, and landscaping and parking lot utilities and services from time to time. The Estimated Payments shall be paid by Tenant together with rent, on the first day of each month throughout the Term. The Estimated Payments may be increased or decreased by Landlord upon written notice to Tenant based upon statements received or charges incurred by Landlord, information available to Landlord as to the probable cost of expected charges and expenses, or the reasonable estimate of Landlord as to the probable amount of expected charges or expenses. Landlord shall be entitled to retain the monies received from such payments in its general fund pending payment of all such costs and charges. No more frequently than once each calendar quarter, the actual costs shall be determined by Landlord, and Tenant shall remit to Landlord on demand its unpaid pro rata share of the actual expense. In the event Tenant paid more than the actual expenses for such period of time, Landlord shall apply such overpayment towards the next Estimated Payments owing by Tenant. At the termination of this Lease, an accounting for such charges and expenses shall be made to the nearest practical accounting period, and Tenant shall pay to Landlord any balance due, or the Landlord shall refund to Tenant any excess amount paid.

POSSESSION. Tenant shall be entitled to possession on the first day of the term of this Lease, and shall yield possession to Landlord on the last day of the term of this Lease, unless otherwise agreed by both parties in writing. At the expiration of the term, Tenant shall remove its goods and effects and peaceably yield up the Premises to Landlord in as good a condition as when delivered to Tenant, ordinary wear and tear excepted.

ALTERATIONS. Tenant covenants and agrees that all Alterations constructed on the Property or work performed or caused to be performed by Tenant shall be in full compliance with all laws, rules, orders, ordinances, directions, codes, regulations and requirements of all governmental agencies, offices, departments, bureaus and boards having jurisdiction over the Property. Tenant shall provide Landlord with at least days notice prior to having any construction materials delivered to the Property or commencing construction of any improvements, and shall reasonably cooperate with Landlord in the posting of a notice of non-responsibility.

COST OF ALTERATIONS. Tenant shall pay all costs of constructing any such Alterations approved by Landlord including but not limited to fees and costs charged by architects, engineers, the general contractor, subcontractors, and laborers and material men, and shall not permit any mechanic's or materialmen's lien to be filed against the Property in connection therewith.

PROPERTY INSURANCE. Tenant shall maintain casualty property insurance on the Premises and all improvements against loss or damage by fire and lightning and against loss or damage by other risks in an amount not less than Landlord shall be named as an additional insured in such policies. Tenant shall deliver appropriate evidence to Landlord as proof that adequate insurance is in force issued by companies reasonably satisfactory to Landlord. Landlord shall receive advance written notice from the insurer prior to any termination of such insurance policies. All insurance proceeds payable by the occurrence of any covered loss shall be payable to Landlord, and Tenant shall have no right or claim to any such insurance proceeds payable with respect to the Improvements, excluding, however, any such proceeds that may be payable with respect to Tenant's personal property or trade fixtures.

Tenant shall also maintain any other insurance which Landlord may reasonably require for the protection of Landlord's interest in the Premises. Tenant is responsible for maintaining casualty insurance on its own property.

MAINTENANCE. Tenant shall have the responsibility to maintain the Premises in good repair at all times during the term of this Lease.

UTILITIES AND SERVICES. Tenant shall be responsible for all utilities and services incurred in connection with the Premises.

Tenant acknowledges that Landlord has fully explained to Tenant the utility rates, charges and services for which Tenant will be required to pay to Landlord (if any), other than those to be paid directly to the third-party provider.

TAXES. Taxes attributable to the Premises or the use of the Premises shall be allocated as follows:

REAL ESTATE TAXES. Tenant shall pay all real estate taxes and assessments which are assessed against the Premises during the time of this Lease. Real Property Taxes" shall include any form of assessment, license, fee, rent, tax, levy, penalty or tax imposed by any authority having the direct or indirect power to tax, including any improvement district, as against any legal or equitable interest of Landlord in the Premises or as against Landlord 's business of renting the Premises. Tenant 's share of Real Property Taxes shall be equitably prorated to cover only the period of time within the fiscal tax year during which this Lease is in effect. With respect to any assessments which may be levied against or upon the Premises, and which may be paid in annual installments, only the amount of such annual installments (with appropriate proration for any partial year) and interest due thereon shall be included within the computation of the annual Real Property Taxes. Landlord represents that, to the best of his knowledge, there are no assessment or improvement districts being planned which would affect the Premises other than as in effect as of the date of this Lease.

PERSONAL TAXES. Tenant shall pay all personal taxes and any other charges which may be levied against the Premises and which are attributable to Tenant's use of the Premises, along with all sales and/or use taxes (if any) that may be due in connection with lease payments. Accordingly, Tenant shall pay before delinquency all taxes levied or assessed on Tenant 's fixtures, improvements, furnishings, merchandise, equipment and personal property in and on the Premises, whether or not affixed to the real property. If Tenant in good faith contests the validity of any such personal property taxes, then Tenant shall at its sole expense defend itself and Landlord against the same and shall pay and satisfy any adverse determination or judgment that may be rendered thereon and shall furnish Landlord with a surety bond satisfactory to Landlord in an amount equal to 150% of such contested taxes. Tenant shall indemnify Landlord against liability for any such taxes and/or any liens placed on the Premises in connection with such taxes. If at any time after any tax or assessment has become due or payable Tenant or its legal representative neglects to pay such tax or assessment, Landlord shall be entitled, but not obligated, to pay the same at any time thereafter and such amount so paid by Landlord shall be repaid by Tenant to Landlord with Tenant 's next rent installment together with interest at the highest rate allowable by law.

TERMINATION CLAUSE. Tenant may, upon days' written notice to Landlord, terminate this lease provided that the Tenant pays a termination charge equal to months' rent or the maximum allowable by law, whichever is less. Termination will be effective as of the last day of the calendar month following the end of the day notice period. Termination charge will be in addition to all rent due up to the termination day.

MILITARY TERMINATION CLAUSE. In the event, the Tenant is, or hereafter becomes, a member of the United States Armed Forces on extended active duty and hereafter the Tenant receives permanent change of station orders to depart from the area where the Premises are located, or is relieved from active duty, retires or separates from the military, or is ordered into military housing, then in any of these events, the Tenant may terminate this lease upon giving thirty (30) days written notice to the Landlord. The Tenant shall also provide to the Landlord a copy of the official orders or a letter signed by the tenant's commanding officer, reflecting the change, which warrants termination under this clause. The Tenant will pay prorated rent for any days (he/she) occupy the dwelling past the first day of the month. Any security deposit will be promptly returned to the tenant, provided there are no damages to the premises.

CUMULATIVE RIGHTS. The rights of the parties under this Lease are cumulative, and shall not be construed as exclusive unless otherwise required by law.

REMODELING OR STRUCTURAL IMPROVEMENTS. Tenant shall have the obligation to conduct any construction or remodeling (at Tenant's expense) that may be required to use the Premises as specified above. Tenant may also construct such fixtures on the Premises (at Tenant's expense) that appropriately facilitate its use for such purposes. Such construction shall be undertaken and such fixtures may be erected only with the prior written consent of the Landlord which shall not be unreasonably withheld. Tenant shall not install awnings or advertisements on any part of the Premises without Landlord's prior written consent. At the end of the lease term, Tenant shall be entitled to remove (or at the request of Landlord shall remove) such fixtures, and shall restore the Premises to substantially the same condition of the Premises at the commencement of this Lease.

ACCESS BY LANDLORD TO PREMISES. Subject to Tenant's consent (which shall not be unreasonably withheld), Landlord shall have the right to enter the Premises to make inspections, provide necessary services, or show the unit to prospective buyers, mortgagees, tenants or workers. However, Landlord does not assume any liability for the care or supervision of the Premises. As provided by law, in the case of an emergency, Landlord may enter the Premises without Tenant's consent. During the last three months of this Lease, or any extension of this Lease, Landlord shall be allowed to display the usual "To Let" signs and show the Premises to prospective tenants.

INDEMNITY REGARDING USE OF PREMISES. To the extent permitted by law, Tenant agrees to indemnify, hold harmless, and defend Landlord from and against any and all losses, claims, liabilities, and expenses, including reasonable attorney fees, if any, which Landlord may suffer or incur in connection with Tenant's possession, use or misuse of the Premises, except Landlord's act or negligence.

DANGEROUS MATERIALS. Tenant shall not keep or have on the Premises any article or thing of a dangerous, flammable, or explosive character that might substantially increase the danger of fire on the Premises, or that might be considered hazardous by a responsible insurance company, unless the prior written consent of Landlord is obtained and proof of adequate insurance protection is provided by Tenant to Landlord. However, Tenant shall be entitled to use and store only those Hazardous Materials, that are necessary for Tenant 's business, provided that such usage and storage is in full compliance with all applicable local, state and federal statutes, orders, ordinances, rules and regulations (as interpreted by judicial and administrative decisions). Tenant shall not keep or store on the Premises chemicals in quantities, amounts, concentrations or type which are in excess of those permitted by local, state or federal laws, regulations or ordinances.

Tenant shall give to Landlord immediate verbal and follow-up written notice of any spills, releases or discharges of Hazardous Materials on the Premises, or in any common areas or parking lots (if not considered part of the Premises), caused by the acts or omissions of Tenant, or its agents, employees, representatives, invitees, licensees, subtenants, customers or contractors. Tenant covenants to investigate, clean up and otherwise remediate any spill, release or discharge of Hazardous Materials caused by the acts or omissions of Tenant, or its agents, employees, representatives, invitees, licensees, subtenants, customers or contractors at Tenant 's cost and expense; such investigation, clean up and remediation to be performed after Tenant has obtained Landlord 's written consent, which shall not be unreasonably withheld; provided, however, that Tenant shall be entitled to respond immediately to an emergency without first obtaining Landlord 's written consent. Tenant shall indemnify, defend and hold Landlord harmless from and against any and all claims, judgments, damages, penalties, fines, liabilities, losses, suits, administrative proceedings and costs (including, but not limited to, attorneys' and consultant fees) arising from or related to the use, presence, transportation, storage, disposal, spill, release or discharge of Hazardous Materials on or about the Premises caused by the acts or omissions of Tenant, its agents, employees, representatives, invitees, licensees, subtenants, customers or contractors. Tenant shall not be entitled to install any tanks under, on or about the Premises for the storage of Hazardous Materials without the express written consent of Landlord, which may be given or withheld in Landlords sole discretion.

COMPLIANCE WITH REGULATIONS. Tenant shall promptly comply with all laws, ordinances, requirements and regulations of the federal, state, county, municipal and other authorities, and the fire insurance underwriters. However, Tenant shall not by this provision be required to make alterations to the exterior of the building or alterations of a structural nature.

MECHANICS LIENS. Neither the Tenant nor anyone claiming through the Tenant shall have the right to file mechanics liens or any other kind of lien on the Premises and the filing of this Lease constitutes notice that such liens are invalid. Further, Tenant agrees to (1) give actual advance notice to any contractors, subcontractors or suppliers of goods, labor, or services that such liens will not be valid, and (2) take whatever additional steps that are necessary in order to keep the premises free of all liens resulting from construction done by or for the Tenant.

SUBORDINATION OF LEASE. This Lease is subordinate to any mortgage that now exists, or may be given later by Landlord, with respect to the Premises.

ASSIGNABILITY/SUBLETTING. Tenant may not assign or sublease any interest in the Premises, nor effect a change in the majority ownership of the Tenant (from the ownership existing at the inception of this lease), nor assign, mortgage or pledge this Lease, without the prior written consent of Landlord, which shall not be unreasonably withheld.

Such addresses may be changed from time to time by either party by providing notice as set forth above. Notices mailed in accordance with the above provisions shall be deemed received on the third day after posting.

GOVERNING LAW. This Lease shall be construed in accordance with the laws of the State of .

ENTIRE AGREEMENT/AMENDMENT. This Lease Agreement contains the entire agreement of the parties and there are no other promises, conditions, understandings or other agreements, whether oral or written, relating to the subject matter of this Lease. This Lease may be modified or amended in writing, if the writing is signed by the party obligated under the amendment.

SEVERABILITY. If any portion of this Lease shall be held to be invalid or unenforceable for any reason, the remaining provisions shall continue to be valid and enforceable. If a court finds that any provision of this Lease is invalid or unenforceable, but that by limiting such provision, it would become valid and enforceable, then such provision shall be deemed to be written, construed, and enforced as so limited.

WAIVER. The failure of either party to enforce any provisions of this Lease shall not be construed as a waiver or limitation of that party's right to subsequently enforce and compel strict compliance with every provision of this Lease.

BINDING EFFECT. The provisions of this Lease shall be binding upon and inure to the benefit of both parties and their respective legal representatives, successors and assigns.

SIGNATURES AND NOTICE. This Lease shall be signed by the following parties. No notice under this Lease shall be deemed valid unless given or served in writing and forwarded by mail, postage prepaid, addressed to the parties below:

LANDLORD:

,

TENANT:

LANDLORD:

| By: | Date: |

TENANT:

| By: | Date: |

| _____ |

| _____ |

| _____ |

| _____ |

When to Consult a Lawyer

| * | State laws vary on the amount that may be charged as a late payment fee. Consult an attorney to determine whether limits apply in your state. |

| * | Consult an attorney to determine whether the laws of your state limit the amount that may be charged for checks returned due to non-sufficient funds. |

About Triple Net Leases

Learn about how to make the tenant responsible for property expenses

-

How To Write a Triple Net Lease

A Triple Net Lease is a type of commercial lease agreement that transfers the responsibility of certain costs from the landlord to the tenant. In a Triple Net Lease, the tenant agrees to pay for property taxes, insurance, and maintenance expenses in addition to the base rent. This arrangement can be beneficial for both parties, as it provides the landlord with predictable income while shifting some of the financial burden to the tenant. Here are some key provisions to consider including when writing a Triple Net Lease:

Maintenance

The tenant is responsible for all maintenance items in a Triple Net Lease. It is important to check county and city ordinances for specific duties that may be imposed on landlords. A lawyer should be consulted if you have questions.

Casualty Insurance

In a Triple Net Lease, the responsibility to obtain and pay for casualty insurance on the property is usually that of the tenant. In a lease where the tenant occupies only part of the space in the building, it is common for the landlord to insure the building and the tenant will be responsible for paying the appropriate portion of the insurance premium based on the portion of the premises occupied by the tenant. The tenant may also desire to insure their belongings. If the tenant occupies an entire building, the tenant may be required to maintain the insurance coverage at levels specified by the landlord and to name the landlord as an "additional insured." In any event where the tenant must supply the insurance, the landlord may be provided with proof of insurance and a commitment from the insurance company to notify the landlord prior to any lapse of coverage.

Remodeling and Improvements

It is important for the landlord to retain control over any remodeling or alterations to the property. If the tenant redesigns the property in a manner that is impractical or unattractive to other potential tenants, it may be difficult to re-rent the property when the tenant moves out. Therefore, if remodeling or improvements will be permitted at all, the lease may require pre-approval by the landlord. Further, the tenant should be required to restore the property to its original condition before leaving.

Allowing a tenant to make improvements to the property may also result in "liens" against the property. For example, if a tenant hires a contractor to install a new furnace and then fails to pay the contractor, most states authorize the contractor to file a "mechanic's lien" or "contractor's lien" against the property. A "lien" is similar to a mortgage in that the lienholder (here, the contractor) can force the sale of the property, if necessary, in order to get paid.

Therefore, if the tenant will be allowed to make improvements, the landlord may want to take appropriate steps to make sure that the contractor is paid in full. In some states, some protection can be obtained by including language in the Lease which prohibits liens caused by the tenant, and then filing the Lease with the appropriate government office. Contact an attorney for further assistance.

Triple Net Lease Payments

In Triple Net Leases, there is usually no restriction on the amount of rent charged. These leases are usually unaffected by rent control laws.

Defaults

Each state has specific requirements to properly terminate the Lease when one of the parties violates the terms of the lease, or is "in default." Perhaps the most frequent example of default is the tenant's failure to promptly pay the rent. In order to terminate the lease for nonpayment of rent, the landlord must strictly comply with state-specific procedures, including the content and timing of required notice to the tenant. Failure to do so may result in a delay in eviction. It may also jeopardize the landlord's right to recover rent or reimbursement for damages to the premises.

Landlords may also want to be careful that their actions in terminating a lease or evicting a tenant do not constitute retaliatory actions against the tenant for exercising their rights. For example, the landlord may not evict the tenant simply because the tenant called the authorities regarding a safety problem on the premises. Most states have specific laws that allow tenants to obtain money damages from landlords who engage in retaliatory actions or presume a retaliatory motive for a period of time after the tenant's act.

Alternative Dispute Resolution

Both mediation and arbitration are forms of Alternative Dispute Resolution (ADR) and offer an alternative to going to court. Both involve an unbiased third party (mediator/arbitrator) who helps to resolve the dispute. The main difference between the two is that an arbitrator makes a final and binding decision (just as if a judge had decided on the case), while a mediator structures negotiations in such a way that the parties can come to a compromise and settle the matter with one another.

Because the arbitrator's decision is final and legally binding on the parties, using arbitration means giving up the right to bring the dispute to court, which may or may not be desirable.

On the other hand, mediation provides that the dispute is not settled or concluded until the parties decide that it is. Thus, at any point in the mediation process, either party may determine that mediation will not be successful and pursue other avenues of resolution (arbitration if provided for in the document, lawsuit, etc.), as long as they have made a good faith effort and followed any statutory rules for mediation. Because mediation is more collaborative and less adversarial than arbitration, it is often the preferred option when the parties have a positive relationship that they would like to maintain.

Sublet

A "sublet" or "sublease" is a Lease by a tenant (lessee) to a third party of all or a part of the property that the tenant (lessee) is leasing from a landlord (lessor). Under the sublease, the original tenant becomes the "Sublessor" and the new tenant is referred to as the "Sublessee." The sublease does not release the tenant (sublessor) from the remaining obligations of the Lease, unless the landlord specifically releases such obligations in writing.

Obviously, the landlord will insist on retaining some control over the selection of any sublessee in order to prevent a complete stranger from occupying the property. Therefore, it is recommended that you include the optional Lease provision that prohibits subletting the property without the landlord's prior written approval. This gives the landlord the opportunity to screen and approve the prospective sublessee.

Subordination of Lease

A "subordination of lease" is a consent from the tenant that their rights to enjoy possession of the property are lower ("subordinate") in priority to the rights of a bank holding a mortgage on the leased property. The landlord's bank usually requires this arrangement for the bank's protection. Without it, the bank might be limited in enforcing its mortgage (upon the landlord's default) because of the tenant's superior right of possession.

Security Deposit

A security deposit is an amount of money given to the landlord by the tenant that can be used by the landlord to offset unpaid rental payments or some other default by the tenant. Most states do not limit the amount that can be collected as a security deposit when the lease is for commercial purposes (i.e. renting space to a printing business as compared to renting an apartment to the president of the printing business for his private living quarters). However, some states require that the security deposit be retained in a separate account, perhaps bearing interest. Check with an attorney if you have any questions about the collection of a security deposit.

Late Payments

Many states have laws limiting the amount of fees that can be charged for late rental payments, but they generally apply to residential, rather than Triple Net Leases. For Triple Net Leases, the landlord generally is allowed to charge whatever late charge that the parties agree upon, as long as that amount is reasonable in relation to the amount of rent and how long the payment has been overdue.

Automatic Renewal/Holdover

Triple Net Leases often provide for automatic renewal of the Lease at the end of each term unless either party gives written termination notice to the other party. Most renewal clauses provide that the terms of the renewed Lease will be the same as the old Lease except that the Lease payments may be adjusted.

The Lease can also include a "holdover" clause, which automatically characterizes the Lease as a month-to-month Lease after the term expires but before the tenant leaves. This characterization defines and limits the relationship so that the landlord can enforce its terms.

Holdover

If a tenant continues to occupy the premises after the Lease term, the landlord is entitled to rent for the period that the tenant unjustifiably remains in the rental property, usually at the same rate that applied during the Lease term. Some states allow the landlord to increase the rent during the holdover period.

If a landlord does not want to continue leasing the property to the holdover tenant, the landlord may immediately begin the state-specified eviction procedures. A delay could result in the creation of a new Lease for an implied term, such as month-to-month. Consult with a lawyer about the eviction process.

Termination on Sale

A "termination on sale" provision gives the landlord the right to prematurely terminate the Lease if the leased property is sold to a third party. The new buyer may want to occupy the property itself or lease the property to a different tenant. Therefore, without this provision, the property would be less valuable to the buyer because the tenant could not be forced to leave.

Destruction or Condemnation of the Property

It is possible that some casualty will occur during the lease term which will severely damage the property (for example, damage by fire, tornado, or flood). If it is possible to repair the damage within 60 days at a reasonable cost, the Lease can provide that the landlord is required to repair the property, and the Lease will not terminate. However, during this repair period, the rent will be reduced in proportion to the tenant's partial or full inability to use the property. The maximum amount that the landlord is required to spend to repair the property can be specified. If the loss is greater than the specified amount, or if the property cannot be repaired within 60 days, or if the property is condemned by a governmental agency, either party can terminate the lease. In that event, the tenant will receive a refund of any unused rent.

General Provisions

A Lease should include provisions that: 1) make it clear that the document contains the entire agreement of the parties, 2) require any changes to the agreement to be in writing and signed by both parties, 3) preserve the remainder of the agreement if one of its provisions is invalid, and 4) specify which state's laws will govern any dispute between the parties.

Triple Net Lease FAQs

-

Will my Triple Net Commercial Lease be legally binding?

As with any legal agreement, Triple Net Leases are not legally binding until everyone has signed. This isn't a run-of-the-mill Triple Net Lease template. Any Triple Net Commercial Lease under a Rocket Lawyer membership can be reinforced by optional Document Defense® support from an attorney.

-

Why should I write a Triple Net Commercial Lease?

Even if you are new to the industry, it is always valuable to record the details of every rental in a lease. Using a Triple Net Lease will most likely be a smart move for you because of these benefits:

- Payment-related information is well-defined

- Roles and responsibilities are understood by all

- There are no surprises about how long the rental period lasts

In the end, if you decide not to make a Triple Net Commercial Lease, you might not get to enjoy the benefits associated with having one.

-

How should the main contents of a Triple Net Lease template be organized?

The details that you may want to cover in the Triple Net Lease are:

- The address and legal description of your property (which can be found on the deed or mortgage documents)

- The contact information for all parties involved

- What the start date and duration of the lease will be

- What utilities or services will be provided

- How much the rent will be, when payment is due, and what payment methods are accepted

- How much of a security deposit will be paid

- What is the notice period for property alterations

- What is the protocol for lease renewal

As you probably expect, Triple Net Leases made with Rocket Lawyer also contain language related to late or overdue rent, smoking, acceptable usage of the property, and moving out before the lease ends. While building your document, you also can add more specifics related to insurance requirements, maintenance procedures, and furnishings. With the Rocket Lawyer document tool, you are able to add more custom modifications, if needed.

-

How can I create my own Triple Net Commercial Lease online?

Fortunately, you will not have to start from scratch when putting your contract in writing. When using Rocket Lawyer, any landlord is able to create Triple Net Leases online with relative ease. Your contract will be built step by step, so you can be sure that it contains the proper details that you'll need. Ordinarily, given the level of customization, you could ultimately pay a traditional attorney fees in the hundreds of dollars, if not more.

-

What needs to happen after a Triple Net Lease has been made?

To make your agreement legally binding, you must sign it, electronically using RocketSign®, or otherwise. The tenant should always receive a copy of your final agreement. With a Rocket Lawyer membership, you also will be able to make a copy of it, download it, and print it out as needed. You should also feel free to take a look at our larger repository of contracts and other legal documents for property owners and managers.

-

How will local rental laws affect my Triple Net Lease?

The law often changes over time. If you've got any particular hesitations or concerns about property rental laws, you can always ask an attorney. Hiring a legal professional to comment on contracts may be relatively time-intensive. Some attorneys will not even agree to review a document if they did not work on it. In the event that a lawyer does offer to give advice on your contract, they most likely would still charge their standard rate to do it. An easier and more cost-effective way to get a second pair of eyes on your document is to request help from a Rocket Lawyer network attorney. Whether you decide to produce additional copies of your Triple Net Commercial Lease or other documents for landlords, Rocket Lawyer is by your side.

Our quality guarantee

We guarantee our service is safe and secure, and that properly executed Rocket Lawyer legal documents are legally enforceable under applicable US laws.

Need help? No problem!

Ask a question for free or get affordable legal advice when you connect with a Rocket Lawyer network attorney.