Is there a trusted relationship between the parties or family members?

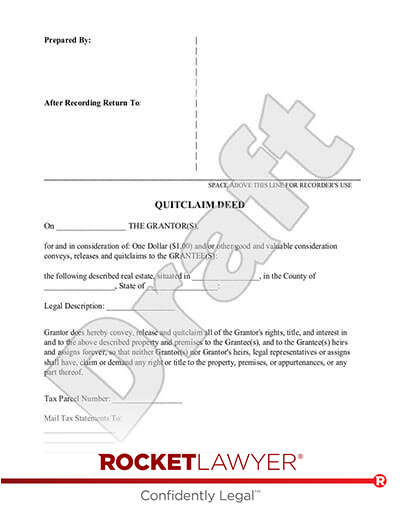

A Quitclaim Deed is often used to transfer property between parties who are familiar with one another and have an established relationship. Unlike a Warranty Deed, a Quitclaim Deed does not provide the new owner with any guarantees or warranties that the seller owns the property or has authority to sell the property, nor does this type of deed guarantee that a buyer is receiving the property free of mortgages.

Due to the lack of warranties with signing a Quitclaim Deed, it is typically only used to transfer title between family members, spouses or ex-spouses after a divorce, between a trust owner and the trust, or between other individuals who have a long standing and trusting relationship.

Do you want to correct a previously recorded deed?

A Quitclaim Deed is often used to correct mistakes or to clarify information in previously recorded deeds. Unless a deed is drafted that clarifies or corrects the conflicting information, minor disparities that aren't fixed can cause problems when a property owner attempts to sell the property.

Do you want to clarify how the property is owned?

Another common reason for using a Quitclaim Deed is to clarify tenancy (how the property is owned by the parties) amongst the property owners. Clarifying tenancy using a Quitclaim Deed can save time and money in the event of death of one of the property owners. For example, a husband and wife who realize the current deed does not specify tenancy may want to update the deed to make sure the other spouse automatically owns the entire property should one spouse die. In most states, if no specific statement is made, it is assumed the property is owned as tenants in common. Most spouses or family members prefer to hold property as joint tenants with the right of survivorship. Doing so allows the property to pass to the remaining property owners without the necessity of an expensive probate after the death of one of the property owners.

Do state laws differ in their treatment of Quitclaim Deeds?

There are some state differences regarding transfer of an after-acquired title. Some states allow transfer of an after-acquired title using a Quitclaim Deed. However, in most states, a Quitclaim Deed only transfers the interest owned by the seller at the time they executed the deed. Usually, any interest in the property acquired after the signing of the Quitclaim Deed does not pass to the buyer.

Are there tax consequences for gifting property?

There can be tax consequences for gifting property. If the fair market value of the property exceeds the annual gift tax exclusion amount, the person making the gift may be required to file a gift tax return and may be liable for gift tax. Additionally, the person receiving the gift may be responsible for paying any applicable state or local transfer taxes. It's a good idea to work with a tax pro to make sure your tax return is compliant with current tax laws.

Ask a Lawyer

If you have questions about Quitclaim Deeds and whether you should consider using one to transfer property to a family member or friend, reach out to a Rocket Lawyer network attorney for affordable legal advice. If you need tax help, you can get matched with a tax pro via Rocket Tax™ to save time and money filling your tax returns.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.