How does debt affect your ability to buy a house?

If you have a large amount of debt, you may have more challenges when buying a house than someone who is debt-free, but homeownership could still be within your reach. The amount of debt that you currently have may factor in significantly when determining how much house you can afford. Mortgage lenders generally look at your total outstanding debt, but they are more interested in your debt-to-income ratio (DTI).

The DTI ratio measures how much of your gross monthly income currently goes toward debt payments. Lenders are trying to determine if you will be able to make a monthly mortgage payment on top of your other debts. A seemingly large amount of debt might not be as big of a deal if your income is also quite large. Similarly, any debt amount is a big deal if it takes a large chunk of your paycheck to make payments. The loan documents and financing agreements that you may sign with the lender, such as the Mortgage Agreement and Mortgage Deed, give them the right to foreclose on the property if you stop making payments, but lenders generally prefer that it not come to that.

If you have a monthly income of $4,000, and your typical monthly debt payments are $1,500, your DTI ratio is 37.5% ($1,500 divided by $4,000). Mortgage lenders want to see a debt-to-income (DTI) ratio of 43% or less. Anything above that could lead to the rejection of your application. The closer your DTI ratio is to that percentage, the less favorable your mortgage terms are likely to be.

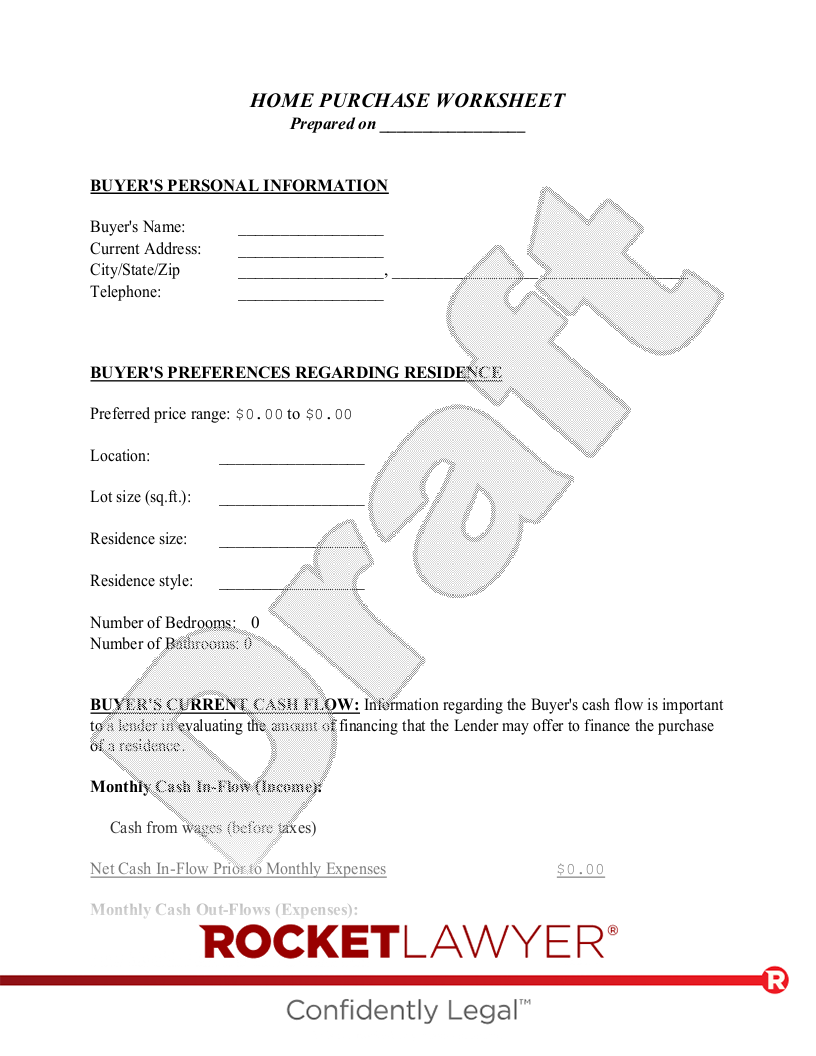

A Home Purchase Worksheet can help you determine your DTI ratio. When you are ready to start house hunting, a Home Evaluation Worksheet can give you an idea of whether a particular house is within your budget.

How can homebuyers lower their DTI ratio?

There are several ways to lower your DTI ratio:

- Pay down or consolidate debt: The less total debt you have, the lower your monthly debt payments will be. A Debt Settlement Agreement can ensure that you are paying a debt in full.

- Add a co-borrower to the loan: If you have a co-signer on a loan or other debt, your liability for the debt may appear lower.

- Get a second source of income: A side job or home-based business can increase your gross monthly income.

- Increase the down payment on your home loan: Paying more upfront on a home purchase means borrowing less. A mortgage lender could offer better terms for a smaller loan.

How much money is required for a down payment?

Many borrowers who are struggling with debt think that mortgage lenders always require at least 20% of the purchase price as a down payment. While lenders are more than happy to accept larger down payments, many loan programs allow homebuyers to pay smaller amounts. FHA loans, which have the backing of the Federal Housing Administration, often require 3.5% down payments. Loans offered through the U.S. Department of Veterans Affairs (VA) or the Department of Agriculture (USDA) may be available to eligible borrowers with no down payment.

Even conventional loans may only require 5% of the purchase price, although this often comes at a cost:

- Smaller down payments result in larger monthly payments.

- The less you pay toward the purchase price at closing, the more money you may have to borrow, which means paying more interest over time.

- A lender may require you to purchase private mortgage insurance (PMI) to buy a new home with a down payment of less than 20%. In this case, PMI may be required to be paid alongside other closing costs, such as property taxes and homeowners insurance.

What impact does your credit score have on your ability to borrow?

In addition to your DTI ratio, mortgage lenders want to look at your credit utilization. Information about credit utilization found on your credit report includes:

- Your credit score, also known as your FICO score: This provides a snapshot of the condition of your personal finances.

- The types of debts you have: Credit card debt, student loans, car loans, and other kinds of debts each present their own challenges.

- Your payment history: Lenders are mainly looking for late payments, defaults, and other issues.

- Your total amount of debt compared to your available credit: Are you only borrowing a small part of what you could be borrowing, or are you almost maxed out?

The information on your credit report impacts how much a lender may be willing to let you borrow, as well as the interest rate on your loan. A higher credit score tends to lead to a lower interest rate.

If you are concerned about your ability to buy a new home because of debt or credit history issues, or if you have questions about the homebuying process, reach out to a Rocket Lawyer network attorney for affordable legal advice.

Please note: This page offers general legal information, not but not legal advice tailored for your specific legal situation. Rocket Lawyer Incorporated isn't a law firm or a substitute for one. For further information on this topic, you can Ask a Legal Pro.