☑ Make sure you have enough cash for a down payment

Ideally, you've decided to buy a home having already saved enough cash to make a modest down payment. The more you're able to put down (i.e., pay the seller in cash), the less you'll need to borrow. The rate that most experts suggest is 20%, which would be $50,000 for a home listed at $250,000. Also, making a down payment of less than 20% means you'll also have to purchase private mortgage insurance.

☑ Check your credit report

When you apply for a mortgage loan, the bank will check your credit score to determine your creditworthiness, which is your ability to repay a loan based on your financial track record. Your credit report, which contains your FICO Score (the most commonly used credit score), also lists your credit accounts, public records, late payments on loans, defaults, and other information that may shed light on your potential risk to lenders.

Look for any errors or inaccuracies in your report and get them resolved right away. If your credit score is lower than you'd like, it may be worthwhile to put some effort into improving your score first before you apply for financing. Likewise, be sure you pay your bills on time and avoid making other large purchases, such as a car, prior to buying a home, as it could temporarily hurt your credit.

☑ Get pre-approved for a mortgage

If you're pre-approved for a mortgage, your offer is much more likely to be accepted by the seller. In fact, depending on how competitive the market is or whether a house has multiple offers, your application may not even be considered without pre-approval. The lender will consider your credit report, debt-to-income ratio, employment, assets, and other factors to determine how much they're willing to lend and at what rate.

Although it may seem tedious, going through the pre-approval process with a few different lenders will help you get the best rate possible. This process also has the added benefit of helping you narrow down your search to only those homes that fit your budget.

☑ Find the right real estate agent

You're not required to hire an agent, but it's often worth it, especially if you're also selling a home. Most sellers have agents and it's their job to represent the interests of their clients, which is why having an agent in your corner could help you get a thorough understanding of what's at stake and make the right choices. The standard commission for agents is 6%, usually split between the buyer's agent and seller's agent. This amount is usually worked into the sales price of the home.

☑ Check proximity to entertainment, parks, shopping, and the "walk score"

Make sure the neighborhoods you're considering are reasonably close to the activities and amenities you desire. Can you walk, bike, or easily drive to restaurants, parks, museums, and other likely destinations? One metric for this is the "walk score," a numerical score that measures a location's walkability. Likewise, you may also want to check out the "bike score" or "transit score" for access to public transportation.

☑ Quality of schools matters, even if you don't have kids

If you have, or plan to have, children, you'll want to know whether the local schools are up to your standards. Even if you don't have children, however, homes in top-rated school districts are more likely to increase in value when it comes time to sell. Your agent should provide you with this information. Look for a high-functioning school district with excellent opportunities for student growth and learning, high parent engagement, and lower student-to-teacher ratios.

If you're checking a particular school or district, you may want to start with the National Center for Educational Statistics. Alternatively, you can enter addresses or search the interactive map at GreatSchools.org, which will give you school ratings. If you are serious about a particular house or neighborhood, don't be shy about contacting the school principals for the schools in the neighborhood. Ask questions about the school staff, teachers, students, and families, and ask for the contact information for parents who have volunteered to speak to prospective parents.

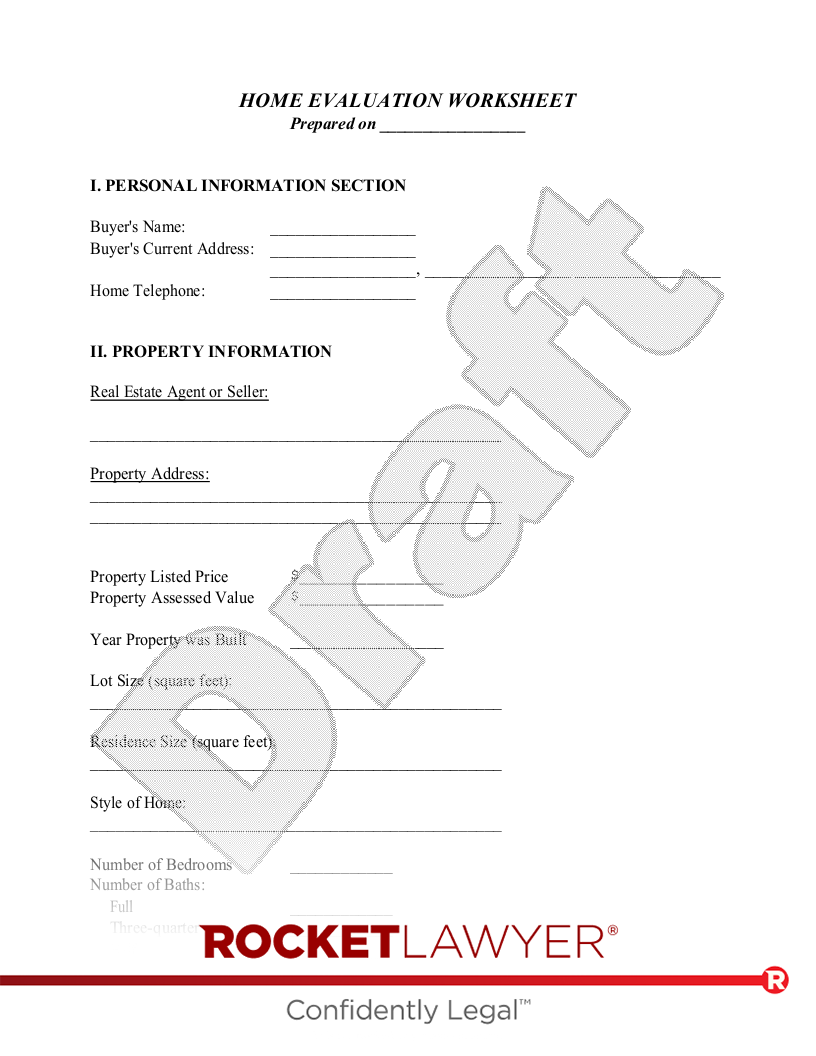

☑ Perform a thorough home evaluation

You won't find an absolutely flawless home, but taking the time to thoroughly evaluate your target homes will help you narrow down your search to just those that best fit your needs. The Rocket Lawyer free Home Evaluation Worksheet can help you list the main features and pertinent details of each home listing so you're better able to compare apples to apples.

At a minimum, your evaluation should cover the price, square footage, number of bedrooms and bathrooms, shared living spaces, amenities, appliances, proximity to shops or entertainment, cost of ownership (i.e., utilities, taxes, upkeep), and the quality of schools.

☑ Conduct a property title search

Once you've decided to make an offer on a home, you'll want to first conduct a property title search to ensure that the property is free from defects. In this context, a "defect" is anything that could adversely affect your usage of the land or its value. This could include liens on the property, easements, or any deed restrictions that may limit things like running a home business or obstructing a neighbor's view.

While you can hire someone for this purpose, you may choose to do it yourself. You'll want to visit the state courthouse in the property's district and look for chains of title and deed. Depending on where the property is, you may also be able to search for this information through the corresponding county assessor's website.

Make sure you're prepared before you buy a house

While searching for a new house should be exciting and uplifting, it's an all-consuming process that can be tedious at times. The best way to ensure success is to prepare yourself through careful research, smart financial planning, and having the right information at your fingertips. Your home will most likely be the most important purchase you'll ever make, so do it with care and be sure to ask an attorney if you have any legal questions.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.