What is an HOA scoring system?

An HOA scoring system helps potential homebuyers, current owners, and other interested parties assess a homeowner's association or condo association. It evaluates, among other things, the association's financial health and property maintenance.

One promising recently designed HOA scoring system is the FiPHO score. FiPHO stands for Financial, Physical, and Operational Health. A high FiPHO score demonstrates the association is strong in all areas. A low FiPHO score may indicate potential problems.

For an association to receive a FiPHO score, the HOA board of directors needs to join a database called the Association Insights & Marketplace. The board can then permit potential buyers and others to download a copy of the FiPHO report. An association is allowed to pass the cost of the report on to potential buyers and can even receive a portion of the fee to offset administrative expenses.

If you are a board member or seller, you may be required under state law to provide buyers with copies of association documents after the purchase offer is accepted or upon signing an Intent to Purchase Real Estate. You may check your local requirements to see if a FiPHO score is included in the required disclosures.

Why is the FiPHO score important?

Not all community associations operate the same. Some work very hard to limit HOA fees while keeping up with landscaping and important maintenance. Others may have poor financial reserves and surprise owners with special assessments. This often occurs when maintenance or repairs are delayed, or the HOA suffers from ineffective financial planning.

The purpose of the FiPHO score is to show whether the bylaws, HOA rules, and other regulations protect the people and the real estate within the community. FiPHO scores can indicate problems such as mismanaged funds or delayed maintenance.

In addition to potential safety lapses or assessments, an HOA's health can also impact property values. Potential buyers may not want to buy into a struggling HOA community unless they receive a discount. Rental property values can also be affected both because the owner may face additional expenses and because disruptions in the community may make it difficult to attract or keep renters.

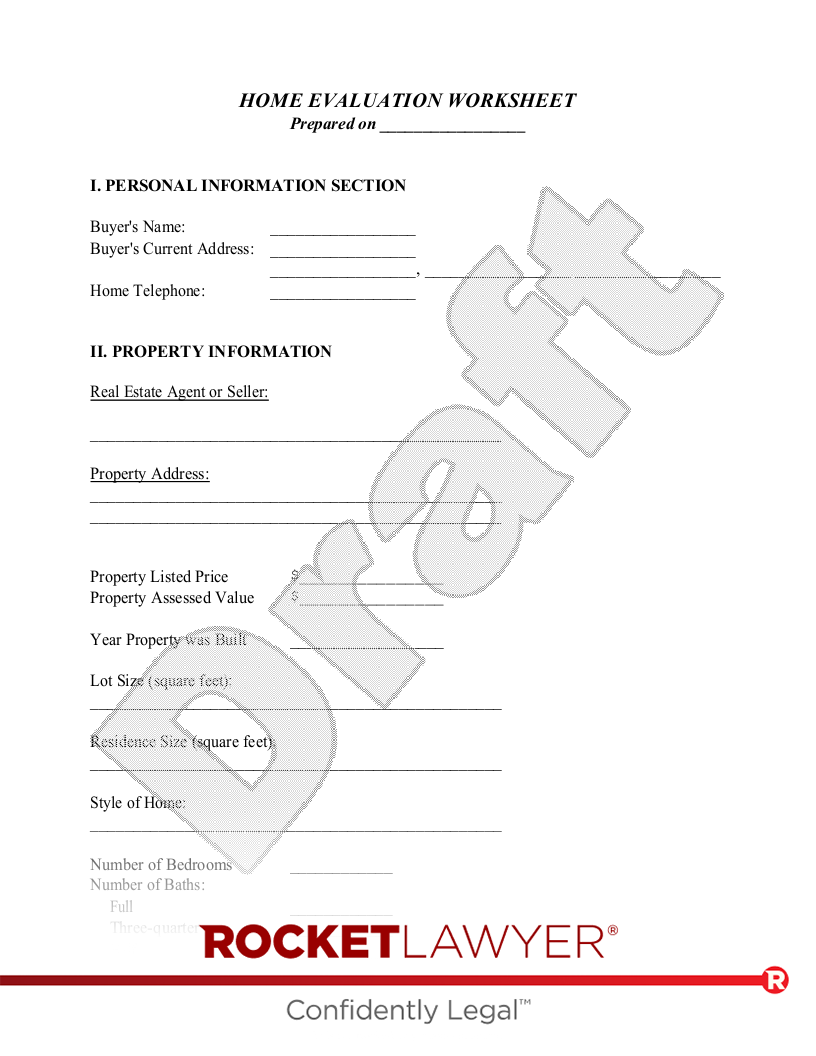

Some HOA's do not participate in the FiPHO scoring system since it is not generally required. Still, it's important to review the types of information covered by HOA scores. You may want to use a Home Evaluation Worksheet for each property you consider.

How is the FiPHO score calculated?

FiPHO scores range from 1 to 100 with 100 being the best. Each association also receives a letter grade similar to school report cards. Scores are also color-coded into green for healthy, yellow for caution, and red for unhealthy.

To obtain a FiPHO score, the HOA board has to upload financial reports, maintenance records, covenants, CC&R's, and other information. Like a credit score, the FiPHO score may drop due to one major issue or several minor issues.

One additional item to consider is the role of the HOA in your potential community. If you buy a single-family home where the HOA only maintains a few common areas, an HOA with a lower FiPHO score may be less risky than one responsible for an apartment building.

How does the score help sellers and landlords?

When you buy a property that's part of an HOA, it can be difficult to know how your HOA is doing. Even when you have the governing documents, it's hard to figure out whether your association has enough reserves and whether it properly budgets for less visible upkeep like roof replacements.

When you pay HOA dues, you may expect the HOA and its board members to properly maintain the common areas while being fiscally responsible. Knowing whether the HOA is following its rules and regulations only tells part of the story, since many things require judgment calls or more complex analysis. The FiPHO score gives a more complete look at an HOA's health and also provides a way to compare different HOAs.

Sellers can obtain a copy of their HOA's FiPHO score and use it to show potential buyers that the property is a good investment. Landlords can also use the FiPHO score to evaluate a potential investment or to anticipate when issues at an existing HOA property might pose problems for tenants. Even though renters don't usually deal directly with the HOA management, a smoothly operating HOA increases the chance that tenants will have a positive experience.

If you have more questions about HOA's, FiPHO scores, or more, reach out to a Rocket Lawyer network attorney for affordable legal advice.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.